It’s been more than a decade since I first starting covering Bitcoin, and I feel like I’ve seen the ups and downs of crypto. From the Mt. Gox days through the ICO boom and the later NFT cycle, it’s been a fascinating ride. The web3 world that Bitcoin kicked off back in 2009 has been a tumultuous and absorbing financial and technological story.

My optimism for blockchain-based tech has also gone through ups and downs. Just as I worried for the viability of my index funds every time crypto prices went vertical, I’ve also wondered whether it was the final straw for Bitcoin and friends every time the web3 hype cycle imploded. But no matter how high the high, how low the low or how fast the transition between the two, crypto has managed to come back in one form or another.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

At some point you give up trying to predict what will happen and when, and you must simply watch.

Investors are not playing the same game. The venture market by its nature is a wager-placing activity. VCs think up a thesis, find what they consider to be outstanding startups that fit their market hypothesis, fund them, and then try to help those startups become big. So long as some of the companies that they pick do well, they can earn back all the capital they invested and share in the profits.

The thesis portion of the venture game is sometimes hard to parse from the outside. Many investors are low key when it comes to speaking publicly, so we have to watch their deal flow to get a taste of where they see the future going. Some investors, in contrast, like to make a bit more noise.

The thesis portion of the venture game is sometimes hard to parse from the outside. Many investors are low key when it comes to speaking publicly, so we have to watch their deal flow to get a taste of where they see the future going. Some investors, in contrast, like to make a bit more noise.

It’s often useful. Bessemer’s regular cloud reports discuss a portion of that firm’s investing thesis. Since the Bessemer documents are chock-full of useful data and are often unsparing in their market diagnosis they are worth reading. It was with that vibe that I dug into the most recent a16z crypto market update.

Investors often compile funds based on a unified thesis. At a16z, this manifests in the form of crypto-focused funds. The well-known investing shop has raised a number of crypto-focused venture funds, including a most recent $4.5 billion “Crypto Fund IV” that it announced last year.

So what can we learn from the a16z report? Is it full of useful data to help us understand its thesis and why it decided that $4.5 billion was the right number to raise? Somewhat!

But more importantly, it underscored a key weakness in the crypto market as it relates to speculation. Let’s talk about it and how what we’re hearing from some of crypto’s most vociferous backers sounds more like a historical echo at times than a roadmap for the future.

Inherently financial

There’s a flavor of hope in high-level discussions of crypto that I am sympathetic to. Here’s how a16z’s crypto crew described the opportunity for its problem space (emphasis added):

We believe recent setbacks underscore the failure of opaque, centralized systems in contrast to the resilience of decentralized infrastructure. We believe decentralized computing platforms can counter the trend of power consolidating into the hands of a few giant tech corporations. The internet needs web3. Those who understand this will fight for the future of this technology.

It is worrying that a handful of major tech companies have managed to become so central to how the digital economy operates; that Amazon and Microsoft and Alphabet are only accreting more and more power to themselves is worrying. And incredibly centralized. These three companies control two-thirds of the global public cloud market.

Throw in the fact that Microsoft has seemingly scooped the leading player in new AI tech, and that we’re again seeing other major companies work like hell to earn, and hold onto, a lead in a new and exciting market. The idea that web3 is heading in the precisely opposite direction — toward decentralization, in other words — sits well on the tongue.

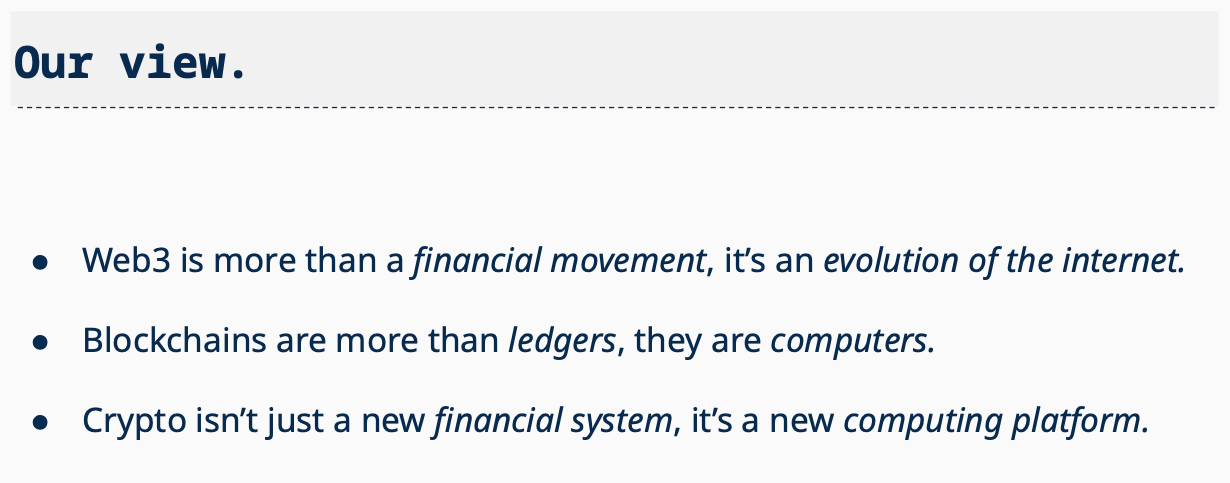

Back to the a16z report: How does web3 fight for a future of the internet where power doesn’t consolidate? Here’s the high-level argument from the venture group:

Image Credits: a16z 2023 State of Crypto report, Slide 3. Cropped.

This fits neatly into our worry that a few companies are slowly helping the world build toward a future in which they are host and vendor alike. It’s hard to not like the concept.

But the a16z presentation quickly pivots away from decentralized computing and toward things that we’re more familiar with: the argument that web3 “democratizes ownership,” and users in a web3 world will be able to “have more power and earn a greater share of revenue on web3 versus web2 platforms.”

In practice, this often means token-based rewards for participatory activity, tokens that are often exchangeable for other forms of currency, digital or otherwise.

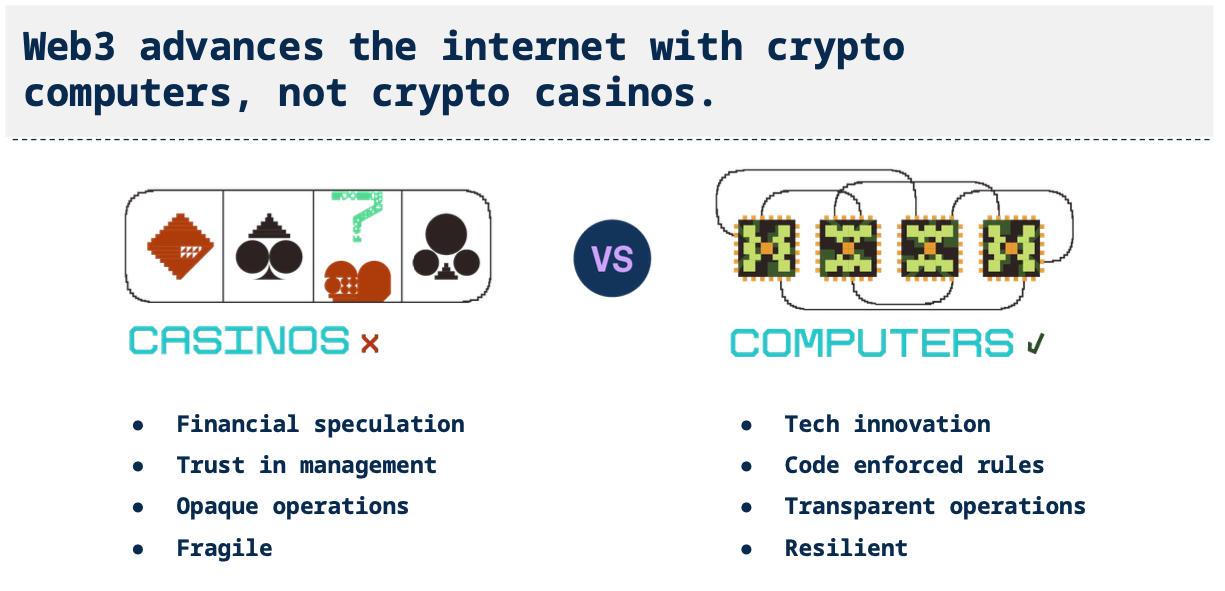

But after discussing the value accretion and ownership side of crypto, a16z shares the following breakdown of where it sees the future being built when we consider the web3 market:

Image Credits: a16z 2023 State of Crypto report, Slide 10. Cropped.

Web3 can operate in a decentralized format because incentives are baked into its DNA. Tokens awarded for activity can be used as votes in a decentralized autonomous organization, or DAO, allowing market participants to not only have more say, but also to gain a share of upside from the platforms — protocols? — that they use.

The problem is that the incentive structure in crypto, tied to freely floating tokens that, thanks to often thin liquidity, is inherently speculative. Put more simply, I don’t know if you can have the right side of the above image without the left.

If blockchains, crypto projects and all the rest of what a16z enthuses about in its report are to self-manage, they must self-contain incentives for use and governance and maintenance. And those incentives are financial and therefore likely to devolve into speculative cycles.

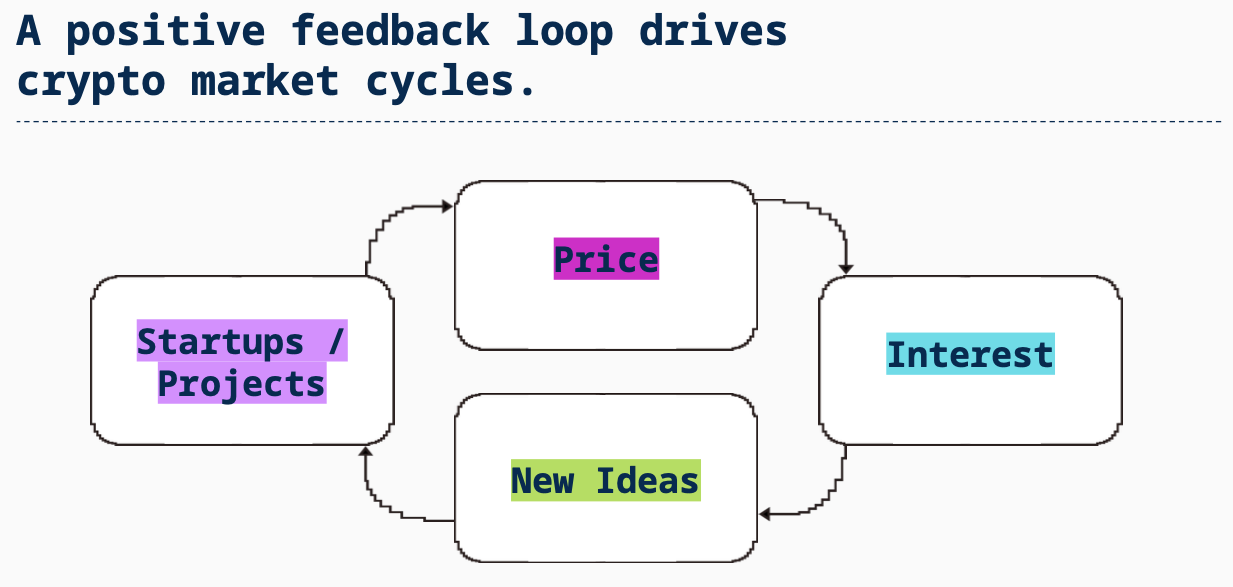

Indeed, the venture firm has several notes in its report concerning the impact of changing prices on web3 as a whole, framed as a positive:

Image Credits: a16z 2023 State of Crypto report, Slide 11. Cropped.

Perhaps crypto booms and busts are good for web3 over a long enough time horizon. Charts toward the back of the a16z report make that case to a degree. But the high-minded talk about building decentralized computing apart from a casino-like atmosphere is hard to believe in when price swings help drive the crypto market’s innovation cycles and liquid tokens form web3’s incentive structure.

At a very basic level, the fact that crypto is so financialized is one reason why I don’t have a big interest in using it today. I don’t want a second job as a day trader, and when I interact with entertainment mediums, stable prices are a boon instead of a bane. (Steam sales are the exception to this rule.)

All this is to say that I agree with the a16z vibe that we need to avoid a future where there are only a few big tech companies that matter, with everyone else eating the scraps off their datacenter footprint or AI models. But if the only way to get there is a series of booms and busts in the value of digital assets that are rife with fraud, a lack of consumer protection and insiders who are able to create their own short-term magic, I wonder if web3 can really live up to the potential that crypto investors foretell.

If crypto is inherently financial and swingy, we probably can’t get the world computer without a world casino, and that feels less like a solution to centralization than the creation of a related, if differentiated, problem set.