As a marketing veteran, you’re likely familiar with the concept of LTV (lifetime value) and its importance in determining the success of your acquisition strategies. But, are you utilizing predictive LTV in your day-to-day decision-making? If not, you’re missing out on a powerful tool that can give you a competitive edge and an opportunity drive growth for your business.

Predictive LTV is a method of precisely estimating the future value of a customer, based on their historical behavior and other relevant data. By combining this prediction with traditional metrics such as CAC (customer acquisition cost), you gain a new dimension of knowledge that was previously inaccessible to you. This allows you to make more informed decisions that balance the cost of acquisition with your predicted return on investment.

In a sense, not using predictive LTV to inform decisions is like going on a hike, not knowing where it will end and how hard it will be. You may have a general idea of where you’re going, but without advanced tools and technology, you could easily get lost, sidetracked or miss your destination altogether.

Identifying high-value customers early in their life cycle is one of the biggest benefits of predictive LTV. You can use this to build more targeted, effective acquisition strategies, that focus on acquiring and retaining customers. In addition, you can decide how much to invest in acquisition and retention efforts based on your customers’ predicted lifetime value.

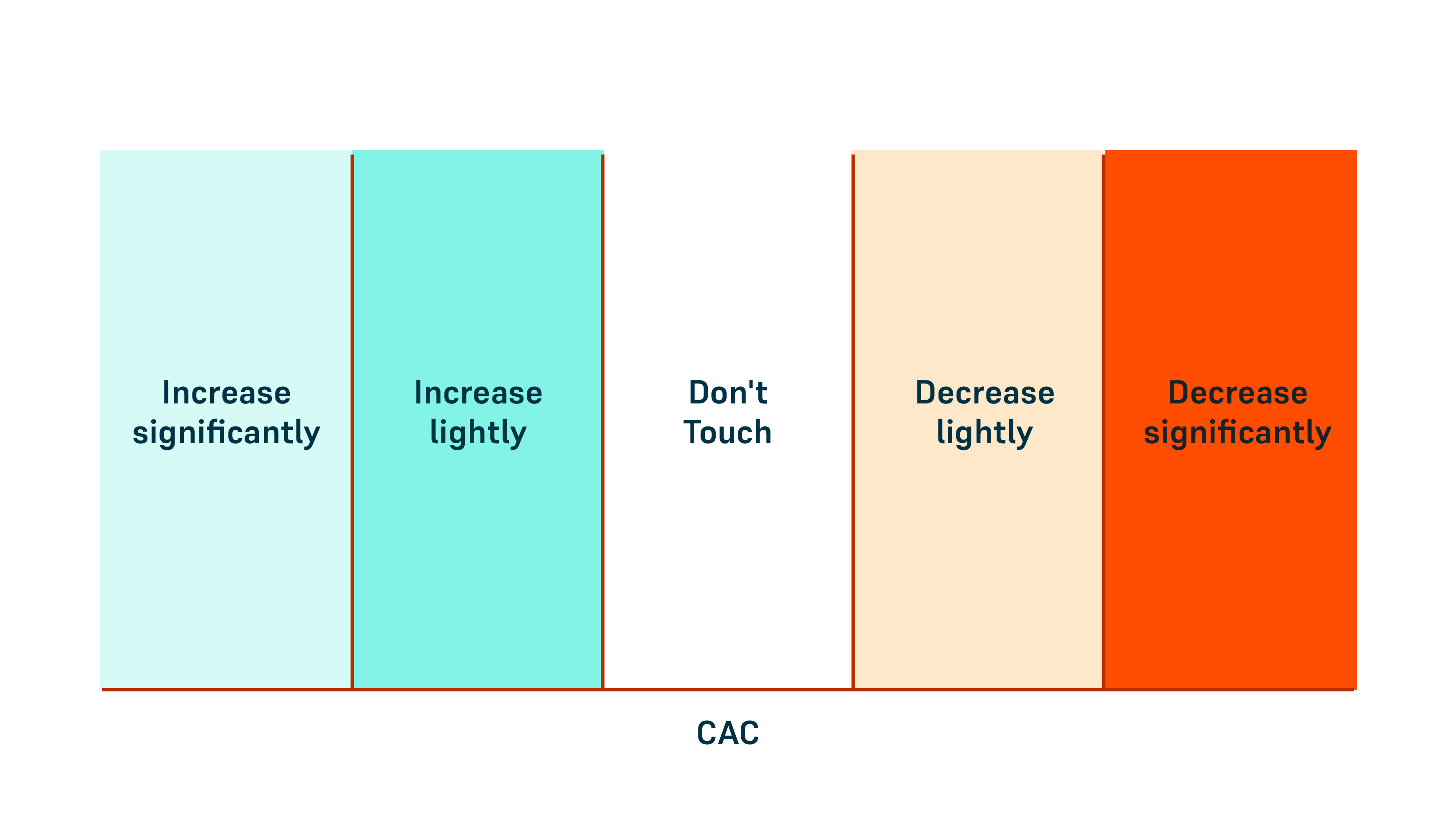

CAC-only optimization

CAC-only optimization. Image Credits: Voyantis

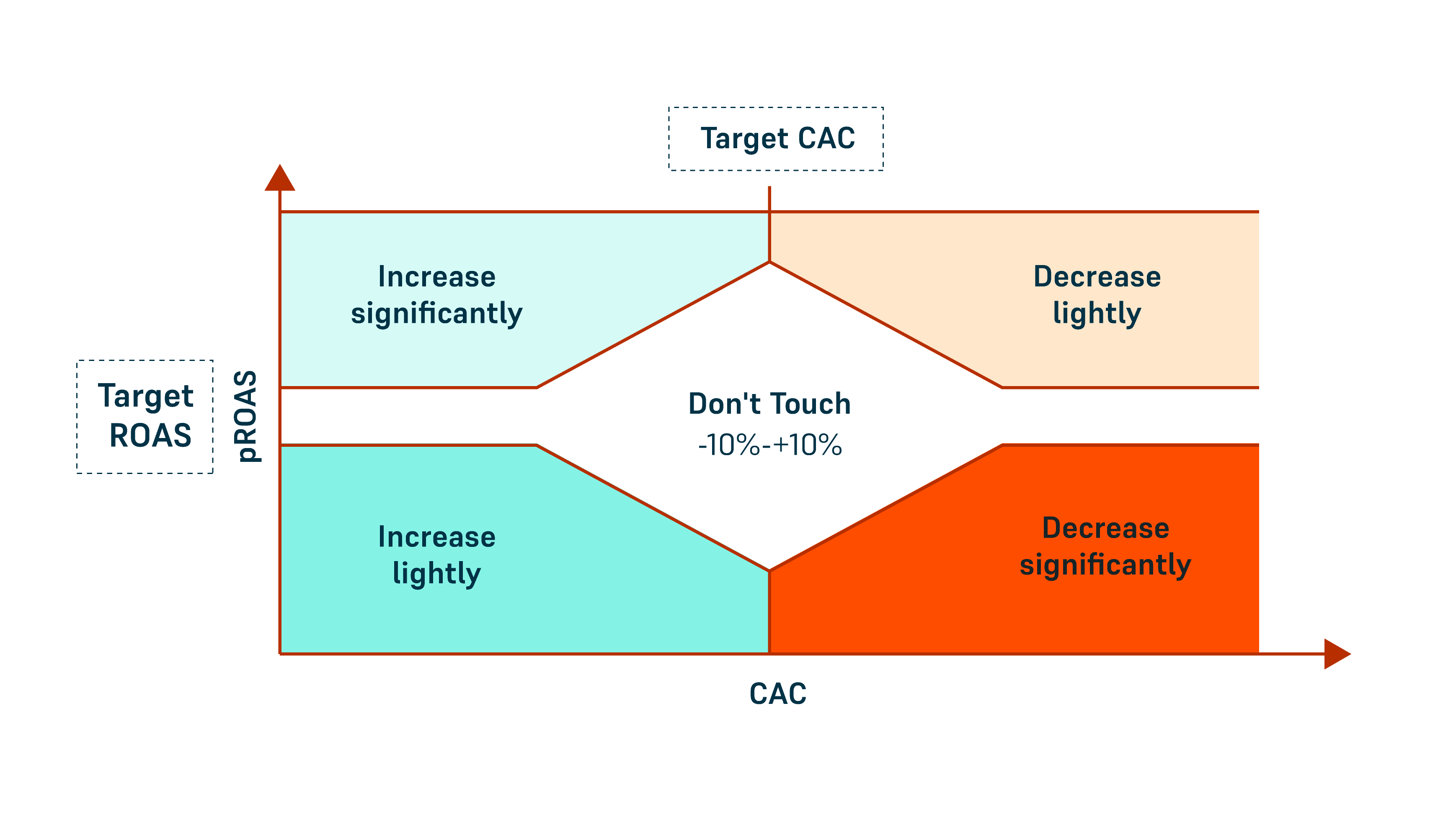

CAC and predictive LTV optimization

CAC and predictive LTV optimization. Image Credits: Voyantis

Balancing risk and growth with predictive LTV

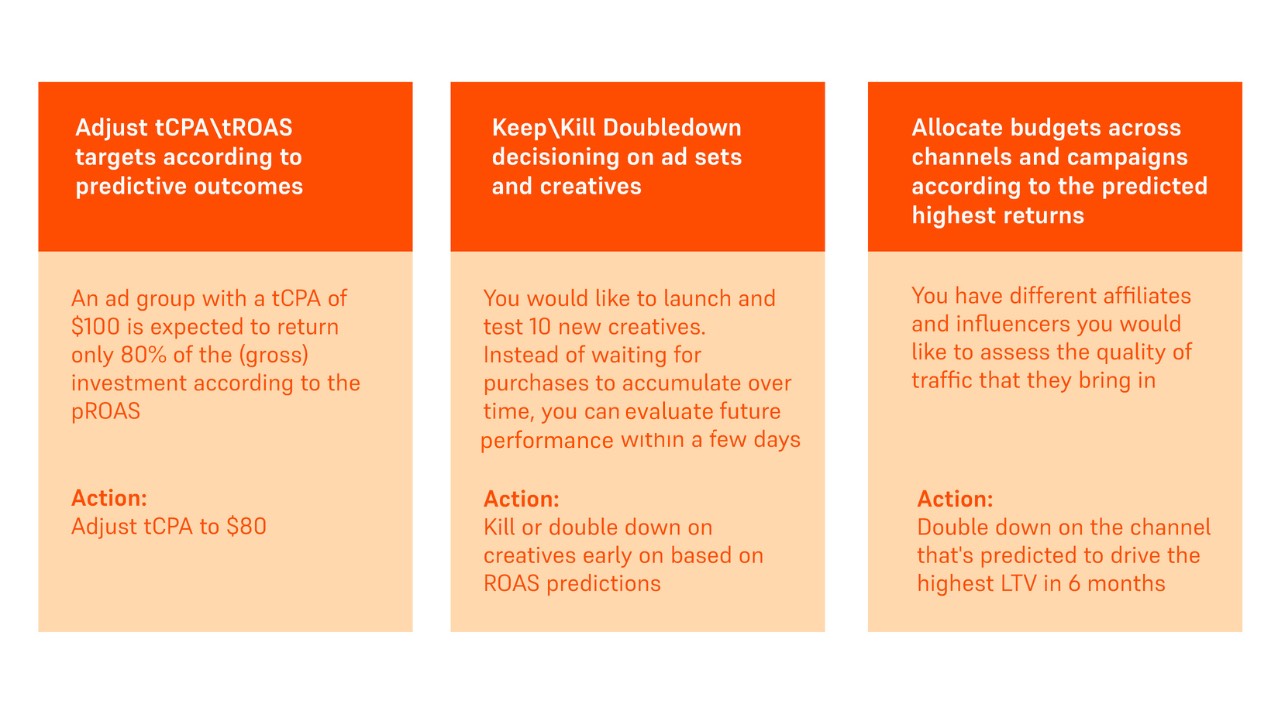

Before delving into the different approaches to predictive LTV, it’s important to understand the type of decisions that predictive LTV can inform. Predictive LTV can play a crucial role in shaping a business’s day-to-day decision-making. Here are some examples of how it can be incorporated:

Adjusting campaign budgets: Predictive LTV can help you adjust your campaign budgets, shifting more spend toward ads that are predicted to yield a higher ROAS. This allows you to maximize your return on investment and optimize your overall advertising strategy.

Setting performance targets: You can adjust your tCPA and tROAS targets based on predictions instead of relying on averages and assumptions. This helps you stay on track and meet your goals by making better-informed decisions.

Stopping nonperforming ads: Predictive LTV can also help you stop ads that are predicted not to underperform and miss your target. By doing so, you can avoid throwing ad dollars away spent on ineffective advertising and double down on the ads that will deliver the results you want.

Here are a few real-life examples of the type of decisions you can make when you involve predictive LTV in your analysis:

Real-life examples of predictive LTV decisions. Image Credits: Voyantis

With these examples in mind, let’s take a closer look at the two approaches to incorporating predictive LTV into your decision-making: the conservative and the less conservative approach.

The conservative approach involves giving the CAC more weight and using prediction as an extra layer. The business may have to lower its budget or turn off certain acquisition strategies if the CAC rises too high. This is perfect for businesses that want to minimize risk and focus on short-term returns without investing too much of their budget on marketing assets that take will time to realize.

Despite being CAC conservative, this approach should still help you see your ROAS improve and your loss on inefficient ads reduce. This is also in line with the current state of direct-to-consumer (D2C) advertising, where the focus is on achieving immediate results and maximizing return on investment.

Conversely, a less conservative approach would give the prediction more weight, even while allowing the CAC to rise. You may decide to increase your budget or stay your course with your acquisition strategy, despite experiencing a high CAC, if the predicted ROAS is high. This approach is ideal for businesses that are less reliant on the immediate cash flow and can afford a longer return time. You’ll want to do this if you want to grow in a bolder, more long-term way, focusing on future potential instead of solely on immediate gains.

No matter which approach you choose, incorporating predictive LTV into your day-to-day decision-making is beneficial both in the short and the long term.

Off the bat, it will help you make more informed, data-driven decisions and improve your campaigns’ results. In the long term, it will enable your business to identify high-value customers, make better-targeted acquisition strategies and make smarter choices regarding how much (and where) to invest in acquisition and retention efforts in general.