When Apple’s AirTag came onto the scene in 2021, competitors like Tile were quick to bash the tech giant for antitrust issues, saying smaller companies had no chance of competing with Apple’s massive network of a billion iPhones. As it turns out, that’s not how another rival sees the situation. Chipolo, the 10-year-old maker of similar lost item location devices, has remained self-funded all these years, having sold 3.5 million devices and growing its revenue to the double-digit millions.

Instead of fighting Apple, Chipolo has opted to work with the Cupertino tech giant — and even credits Apple for helping further grow the item tracker industry. The team also sees the opportunity to integrate with the Find My app as a better consumer experience compared with its much smaller first-party finding network, which today is around 1 million monthly active users.

Without a large network, explains the company, it may take much longer for a device to alert its owner to its location when it’s misplaced and outside of Bluetooth range.

“It just comes down to do you want the customer to be happier with the bigger network?… We decided this is better,” said Chipolo co-founder Domen Barovic, in a conversation with TechCrunch at the Consumer Electronics Show in Las Vegas. “It’s easier to replace this,” he said, referring to Chipolo’s original non-Find My-integrated product, “than to try to build a huge network. We’ve seen that, actually, it’s really hard to do,” he added.

Image Credits: Chipolo

Tile, for comparison, is going a different route — it teamed up with Life360 by way of an acquisition to combine their respective networks in order to compete more directly with Apple. Tile also sat down with the Department of Justice (DoJ) lawyers, who are now building an antitrust case against Apple, to register its complaints about Apple’s entry into this market.

Tile repeatedly stressed how Apple has the advantage of its sizable customer base and platform. Meanwhile, Tile would have to give up its direct relationship with its customers through its own app, as well as pay a commission on any subscription sales or other services made through in-app purchases. In addition, Apple hasn’t yet allowed third parties to access its U1 chip (ultra-wideband) chip for precision finding, giving AirTag a competitive advantage on that front.

Image Credits: Chipolo

Chipolo, however, feels much differently about this situation. Though the company has had ultra-wideband (UWB) prototypes on hand for a few years, it doesn’t feel it’s at a loss for the lack of support.

“We’re not seeing that ultra-wideband is actually needed for these use cases,” noted Chipolo co-founder Primož Zelenšek — Chipolo’s algorithm focuses on delivering quicker reminders when you leave an item behind; then customers can ring the device to see where their item is located. “The sound is much more important,” he said.

Image Credits: Chipolo

If anything, Chipolo sings Apple’s praises for creating more consumer awareness about the lost item finder market in general with the launch of AirTag. Plus, the company believes Apple has a shared mission.

“They’re solving the problem that we wanted to solve,” said Barovic. “We’re not building a company because we want to build a company, right? We’re building the company because we want to help people. And that’s what Apple is also doing. So actually, it’s good.”

Interestingly, Chipolo shared these same sentiments with the DoJ’s lawyers last year, the co-founders told TechCrunch. The company had a couple of meetings over Zoom about the matter of AirTag and its impact on Chipolo’s business. Its comments, seemingly, could complicate the DoJ’s ability to effectively prosecute Apple. After all, here is a competitor happy to be offered access to Apple’s Find My platform — and one that says its own sales have grown as a result.

The co-founders told TechCrunch that Chipolo’s 2022 revenue topped that of the revenue it generated in its pre-Find My days — though the company clarified it’s not what you’d call “hockey stick” growth.

Still, said Barovic, “it’s going up.”

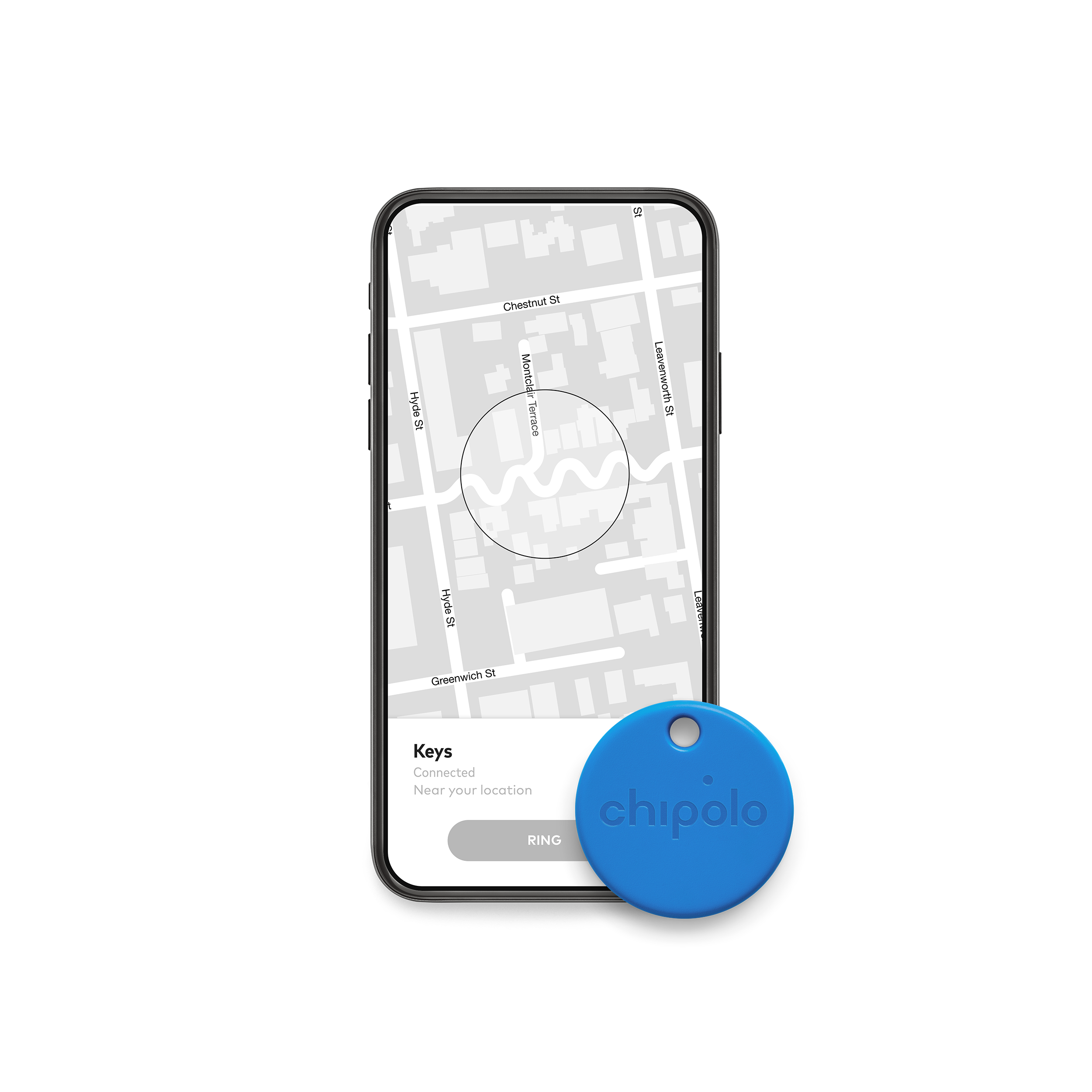

The device maker is at the Las Vegas trade show to promote its current line of lost item trackers and to celebrate its 10-year anniversary. Today, Chipolo sells two versions of a keychain dongle ($28) that work either with its own app or with Apple’s Find My Network, and a wallet card ($35) that is slim enough to fit into a credit card slot. Unlike AirTag, Chipolo fully supports Android phones.

Image Credits: Chipolo

The company differentiates its products by the nature of the form factor — it’s plastic, comes in many colors, and its keychain dongle has a hole in the top so you don’t have to buy a separate accessory. And it costs a little less. The device also has baseline functions — like beeping to help you find your lost item, if nearby, and finding a network of some sort when the item is out of Bluetooth range. (The non-Find My version, however, will not alert you if someone is trying to use the device for stalking purposes. But with its smaller network, its GPS updates are not as quick or as effective.)

Chipolo believes its feature set, along with what it believes are its better alerts, are what will help it to remain competitive with AirTag in the long-term.

The company is also not slowing down development, either, but rather sees Apple’s lack of variety with AirTag as a niche to exploit. In addition to the multiple form factors and colors, it has built prototypes for two more form factors, including a location tracker designed for luggage and a screw-on tracker for bikes. It’s hoping to launch those next year.

Chipolo funds its new products with sales from its existing trackers, despite offers of outside funding.

“We’ve had a few [investors approach], but we didn’t find anyone who actually fits our culture,” said Zelenšek. “But, of course, we are always open for new opportunities,” he added.