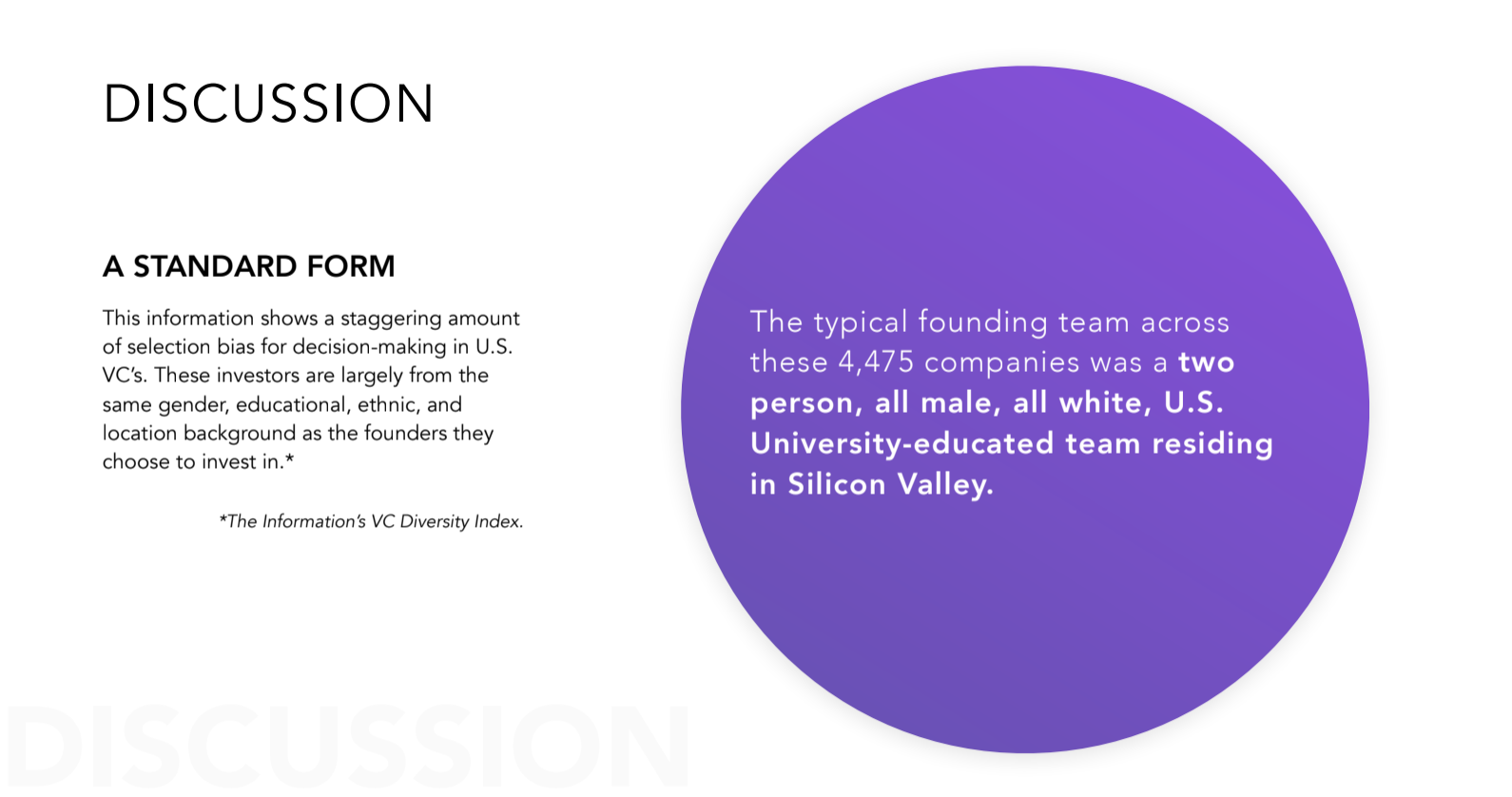

The large majority of venture dollars are invested in companies run by white men with a university degree, according to a new report by RateMyInvestor and Diversity VC.

This new data reveals that despite the lip service investors have paid to backing founders from diverse backgrounds, much, much, more work needs to be done to actually achieve the industry’s stated goals. It also shows the vast gulf that separates the meritocratic myth that Silicon Valley has created for itself from the hard truths of its natural nepotistic state.

In 2017, venture capital investment reached $84.24 billion, a height not seen since the dot-com bubble of the early 2000s. The data from RateMyInvestor and Diversity VC covers a survey of the seed to Series D investments made during that year from what the two organizations selected as the top 135 firms by deal activity. Those firms invested in 4,475 companies, which collectively included 9,874 co-founders, according to the report.

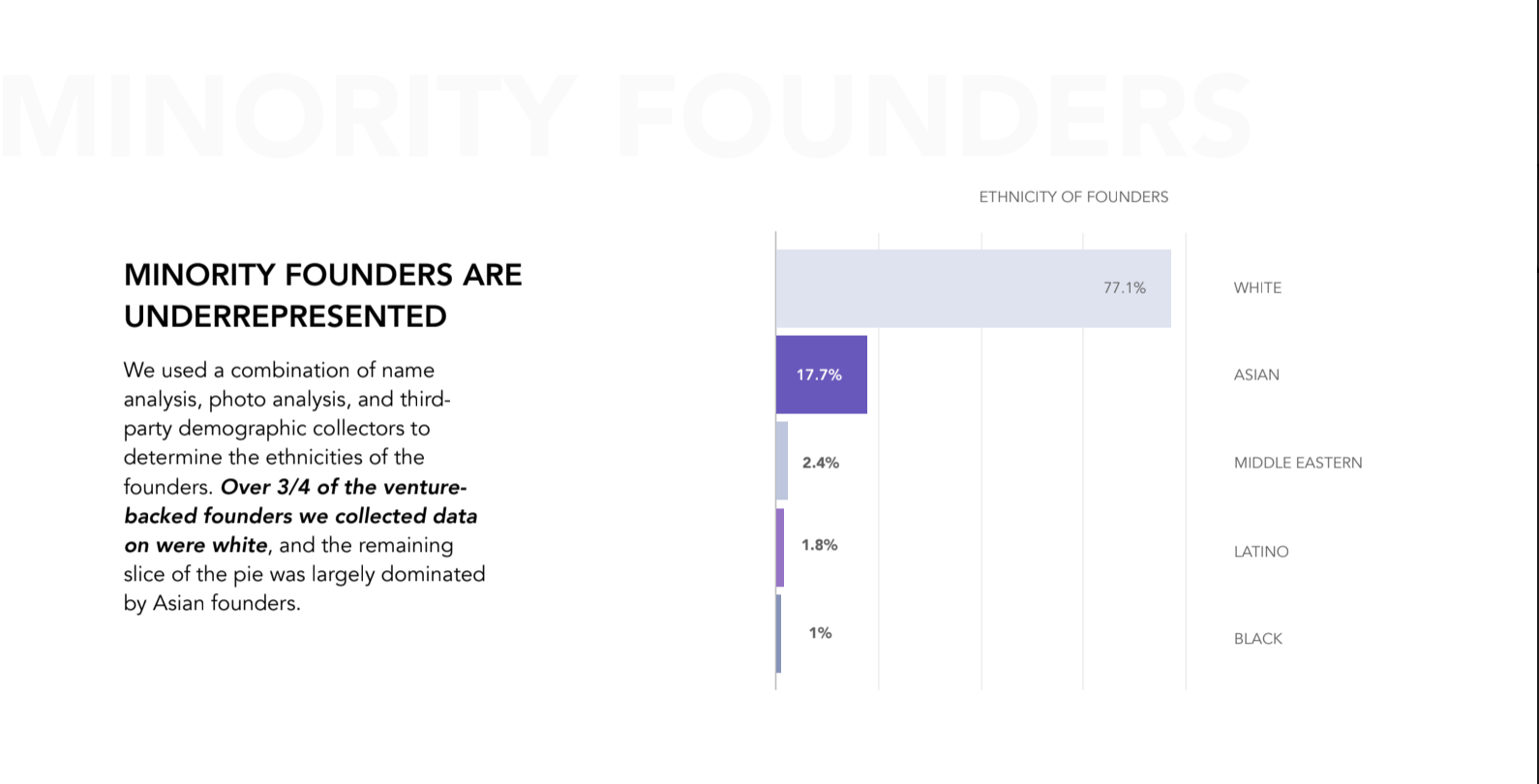

Of those co-founders only 9 percent were women, while 17 percent identified as Asian American, 2.4 percent identified as Middle Eastern, 1.9 percent identified as Latinx and 1 percent identified as black.

“VCs should make more of a deliberate effort to spend quality time with communities of color that are otherwise unfamiliar,” said Suzy Ryoo, a venture partner and vice president of technology at Cross Culture Ventures. “Another tactical suggestion would be to co-host salon dinners community events with the growing group of early-stage venture funds managed by diverse investors, such as Cross Culture Ventures, Backstage Capital, Precursor Ventures, etc.”

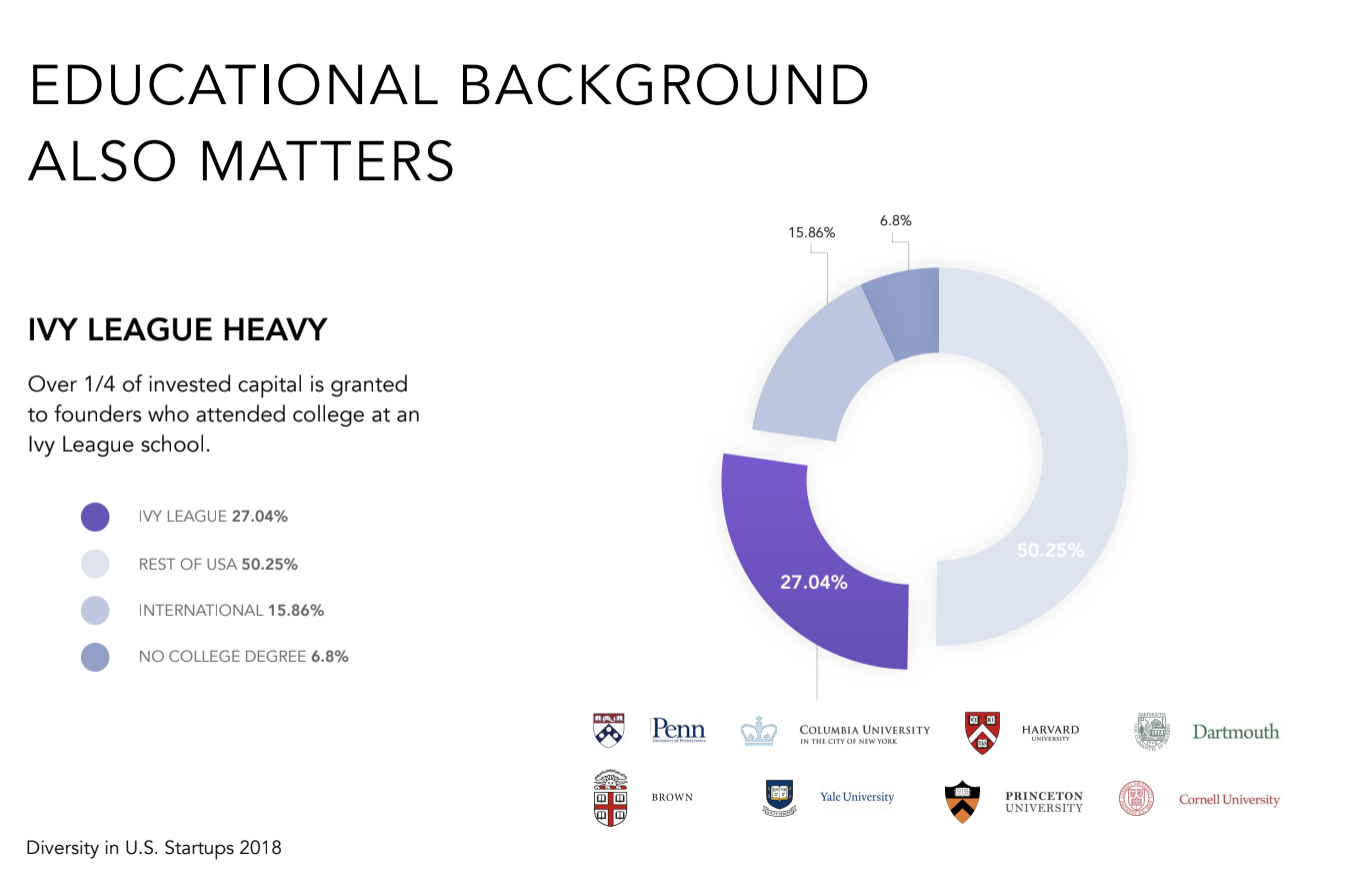

The data compiled by Diversity VC and RateMyInvestor contains some other staggering statistics. Ivy League-educated founders captured 27 percent of all the dollars invested in venture capital startups, while all graduates from all other universities across the U.S. represented 50 percent of venture funding. Founders who graduated from international institutions had nearly 16 percent of venture funding. Founders without a university degree accounted for around 6 percent of the total capital invested.

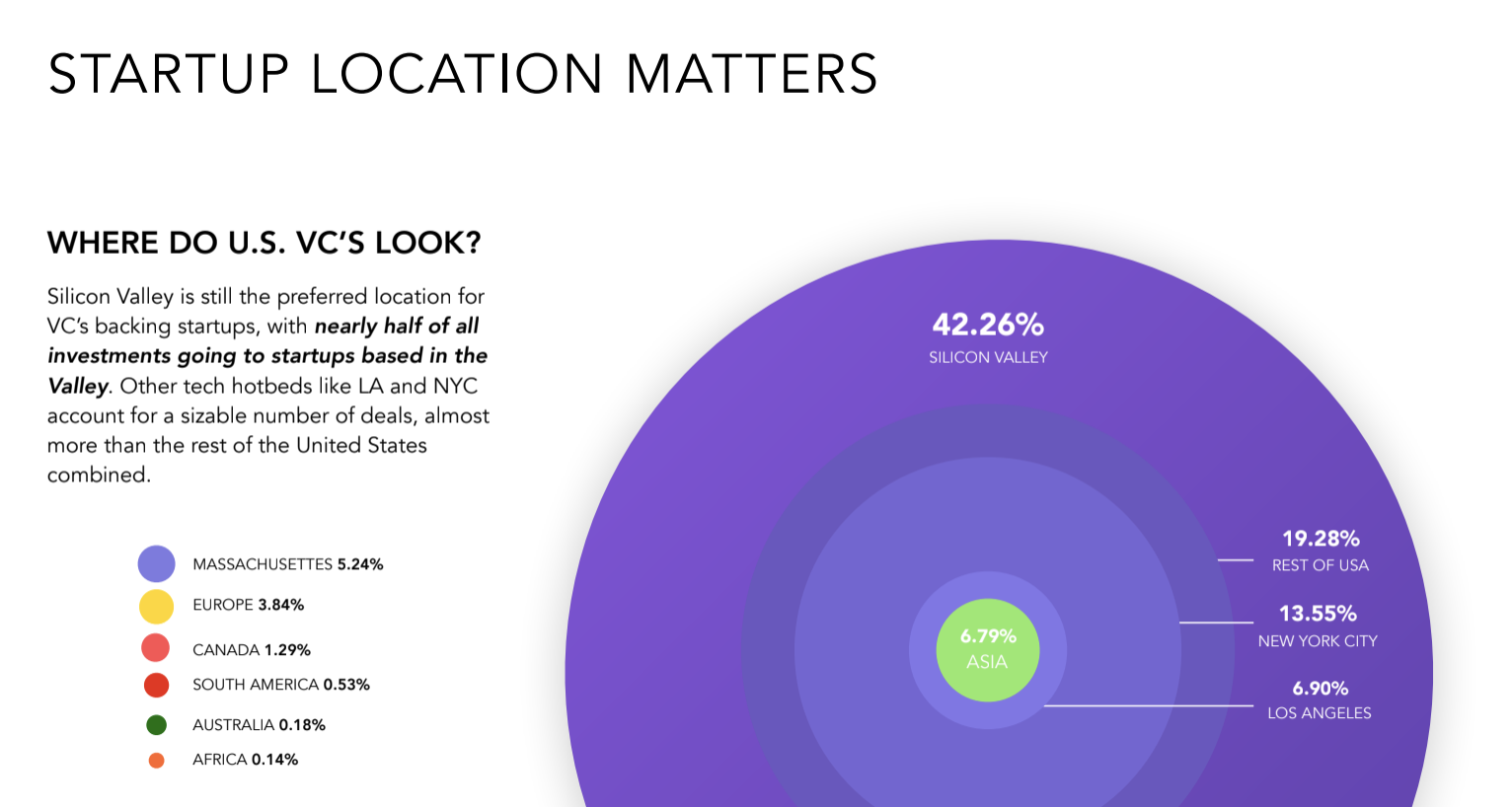

Finally, investors are still wildly reluctant to leave Silicon Valley to look for new deals, according to the survey. This despite skyrocketing prices for real estate and talent and the emergence of big technology ecosystems in cities across the U.S.

“Silicon Valley has done a poor job of fostering diversity of all forms, especially diversity of thought,” said DCM partner Kyle Lui. “VCs and founders tend to back/hire people who are in their existing network who most likely share the same views as them, went to the same school as them, and shared similar life experiences as them.”