After facilitating more than 300 office hours for immigrant entrepreneurs entering the U.K. market, what have we learned about who these founders are and the challenges they face?

Introductions for a soft landing can be crucial, but the real value lies in gleaning substantive feedback from experienced investors.

It’s about what your network can teach you and help you obtain (e.g., an opportunity to pitch), not just the number of connections you have.

We ran the first version of the Blue Lake International Office Hours in 2022, which showed initial evidence that the trend of VCs offering office hours can deliver real value, especially to immigrant founders entering the U.K. ecosystem.

In the second edition, which ran in March 2023, we wanted to continue making helpful introductions, but we also wanted to more systematically understand just what, exactly, was so useful about office hours.

With this aim, we developed our application and post-meeting feedback forms to better identify two things: (1) ahead of the meeting, what do founders say they most want to get out of the office hours with investors and (2) after the meeting, what do they say they appreciate most? Said differently: Do founders ultimately value the aspects of the meeting as they think they will?

First, who are the founders who participated in the second round? The 125 applicants to office hours from February 2023 came from 39 countries across six continents and varied countries in terms of language, economic development and other factors.

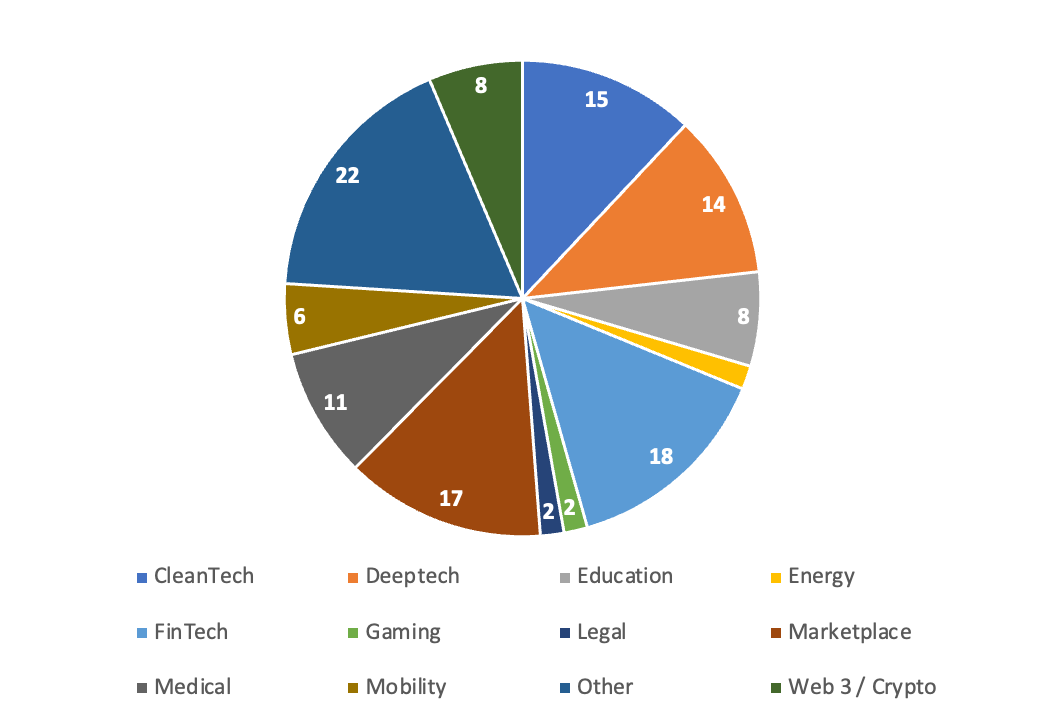

Countries of origin included places as diverse as Australia and Azerbaijan, as well as Ghana and Germany. The countries with the greatest numbers of applicants were Ukraine (33), India (11) and Turkey (10). There was also a mix of 12 different primary sectors identified by applicants. “Other” was the largest single category (22), followed by fintech (18) marketplace (17), clean tech (15) and deep tech (14).

Here’s an illustration of just how varied the primary sector mix was:

Image Credits: Blue Lake VC

Gender-wise, applicants were predominantly male, with 96 applicants identifying as male, 28 as female and one as nonbinary.

Back to our questions about what these diverse founders and what they say they want from office hours. Forty-five participants completed both the applications and post-office hours feedback form; we analyzed the answers for this subset to compare what they said they wanted to glean beforehand with what they covered and valued afterward.

In the application form, when asked about the aspects they would find most valuable, 60% answered “introductions/network.” Fundraising strategy received the second-highest number of responses, with just 13%. Sales and marketing, mentorship and team all received a small number of votes.

What our international founders were saying was clear: They applied for office hours with the primary aim of growing their network. Ostensibly this meant that they would connect with the VC they spoke to and perhaps they were hoping that this new contact would introduce them to others.

Yet, in our post-office hours feedback form, we found that the content of the call was not primarily about introductions. Fundraising strategy was said to be the most discussed (37%) topic during the meeting. Introductions/network ranked second, with 22% of respondents indicating this. Once the office hours meeting began, the conversation turned more to fundraising strategy rather than (further) introductions or networking being the dominant thrust of the conversation.

This is more or less consistent with what founders said they appreciated most. Thirty-seven percent said fundraising strategy was the most valuable aspect, while 28% said introductions/network and 13% sales/marketing.

This tells us two things:

1. Networking between startups and VCs — when the connection is actually made — quickly turns to substance. Networking for the sake of more nodes in your social graph is not the ultimate aim. Once international founders make the connection, then the conversation shifts to substance, such as fundraising strategy and sales and marketing tactics.

Saying that, some qualitative feedback underscored the importance of the new connection and feeling understood. For instance, one international founder remarked that:

[Investor] is full of warmth, with an immigrant story herself from her dad’s side, and thus she wants to give back. We talked the same language, given that [Investor] is actively looking at the [same] markets, and looking at potential investments. We will connect afterward, where she will share a list of potential investors.

2. Meetings with VCs, angels and others in the U.K. ecosystem can be crucial for international founders — they can help entrepreneurs glean feedback and better grapple the multiple obstacles they face when getting acquainted with the U.K. market. One founder’s feedback explained that after brief introductions, the investor “helped me better understand what angel investors are looking for and key metrics we need to work on.”

This calibrating expectation for fundraising in the U.K. market is a common theme. If the meeting is content rich, further introductions and connections can come.

For immigrant and international founders in the U.K., introductions for soft landings can be crucial. However, the real value lies in pursuing introductions for the sake of learning not just connecting. It’s about gleaning substantive feedback from experienced investors. Receiving this insight from U.K. investors is crucial and having this mindset is essential to founders new to the market.