The real estate industry is a bit of a greenhouse gas powerhouse, responsible for 40% of all global emissions. A quarter of that comes from building materials, and Tangible has had enough. The company is building a tool for finding, managing and reporting on lower-carbon, more sustainable, building materials, and just closed a $3 million seed round to fulfill that mission.

Tangible today announced it has raised $3 million in seed funding. The round was led by early-stage construction tech investor Foundamental, and Fifty Years (which led the company’s previously undisclosed pre-seed round). Redstone Built World Fund, Pi Labs, Asymmetric and Deco Ventures participated in the round, as well.

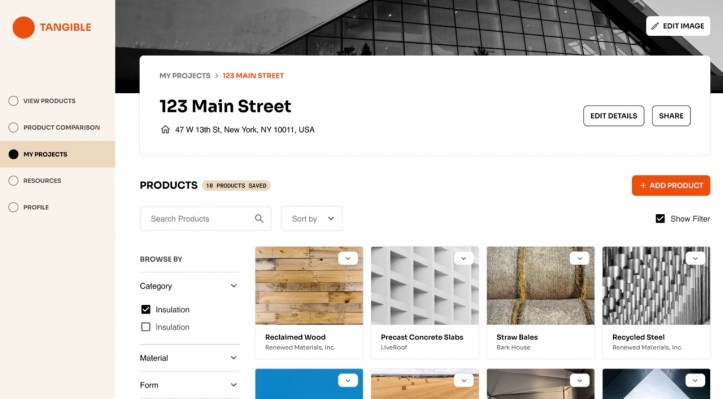

The Tangible platform has been designed to support sustainability and development managers who use it as a tool to find low-carbon materials, drawn primarily from global environmental product declarations, which the company says are all third-party verified. Materials can then be added to a project and the impact aggregated; the results are sharable, which gives developers a view of all their projects, the materials being used and the environmental and health impact. Tangible is also pushing for transparency: Users can share the information with their customers and investors to demonstrate the changes being made on the ground.

“We’re using the funding to grow the product team and continue developing the platform. We’ve been co-developing the platform with a select group of customers, so we’re scaling up for our full launch later this year,” says Anneli Tostar in an interview with TechCrunch. She co-founded the company alongside Nicole Granath. “We raised $3 million in this round, bringing the total we’ve raised to $4 million — all equity.”

The company declined to comment on the valuation for this round.

“We’re excited to develop Tangible and fully launch the platform into the North American market. This market alone is worth around $72 billion — with hundreds of thousands of developers and construction managers who would benefit from using Tangible to report embodied carbon for construction projects,” explains Tostar. “The long-term vision is a full-stack platform for sustainable construction. In the future, people will be able to use Tangible to track projects, see case studies from other organizations, order more sustainable materials, and provide the tools to decarbonize the construction industry at large.”

The industry already has LEED, but Tangible doesn’t believe that is enough to get to climate impact.

Anneli Tostar and Nicole Granath, founders at Tangible. Image credit: Tangible.

“When it comes to climate impact, LEED primarily focuses on energy consumption, with just a few points awarded for considering material sustainability,” says Tostar. “That’s a bit at-odds with how we need to think about carbon reduction. Studies show that the carbon emitted from upfront construction is equivalent to up to 10 years of operating the building, and additional carbon gets emitted every time there’s a retrofit or renovation. What’s more — when we emit carbon matters, the sooner we emit carbon, the more likely we are to kick-start climate cascades, which make the climate warm even faster. So addressing this upfront carbon is mission-critical for abating the worst effects of climate change.”

“We’ve been hearing from real estate investors and owners that they’re receiving pressure from investors, upcoming regulation and green building standards to decarbonize their developments. While many solutions exist to help them address the operational carbon of their properties, they don’t yet have a streamlined way to manage and reduce the embodied carbon of buildings,” says Granath. “While leading sustainability programs in-house and as consultants, Anneli and I saw the overwhelming need for a scalable solution to track, reduce and report on embodied carbon. Tangible is the embodied carbon management platform developers have been waiting for. We’re delighted to be launching Tangible for owners and developers who want a portfolio-wide view of their embodied carbon footprint and where they can decarbonize.”