SoftBank Vision Fund lost $32 billion in the financial year ending March as the Japanese investment giant, the most prolific global investor in tech startups, continues to suffer from valuation corrections across its portfolio of private and public tech companies amid a weakening global economy.

The loss surged about 70% from the same period a year prior, when SoftBank had reported $19 billion in losses at the Vision Fund unit. The losses come even as SoftBank has grown very cautious about deploying new capital to startups in recent quarters.

Among the losses, the Japanese conglomerate said its Vision Fund 1 made an unrealized loss of $1.6 billion each in SenseTime Group and GoTo and nearly $800 million in DoorDash.

The fair value of SoftBank’s portfolio was marked down over the quarter by $2.3 billion to $138 billion.

“For private portfolio companies, the fair value decreased in a wide range of investments, mainly reflecting markdowns of weaker-performing companies and share price declines among market comparable companies,” SoftBank Group said in earnings report Thursday.

SoftBank chief finance officer Yoshimitsu Goto said earlier this year that the firm had entered “defence mode” and was preparing for three different scenarios. SoftBank anticipates that the market may either start to show recovery linearly this year, or by the second half of this year, or in a worst-case scenario stumble through until early 2024.

The tumultuous times at SoftBank Vision Fund means a tough time for many of its portfolio startups, many of whom themselves are loss-making. SoftBank has served as a high-conviction growth investor for its portfolio startups, often leading or co-leading later, and often large, financing rounds.

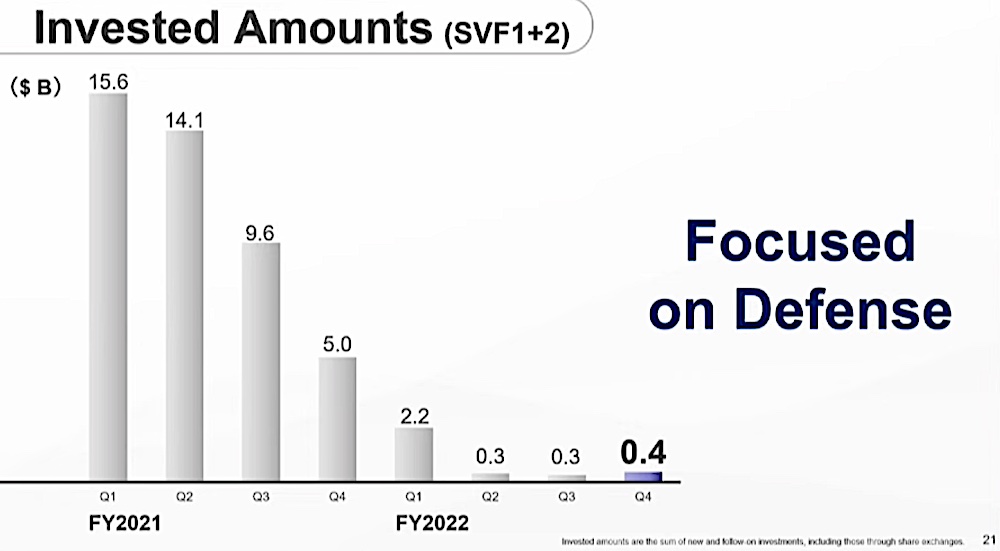

It’s logical that SoftBank is now going to be considerably more selective and judicious about investing going forward. The firm closed 25 deals in the last 12 months, and did an investment of about $400 million in the quarter ending March — but compare that to over 40 in its heyday in 2018, with total invested reaching well into the billions, sometimes even for single startups like WeWork and Grab.

SoftBank Vision Funds’ investments over the past two years. Image Credits: SoftBank Group

In the meantime, it is attempting to paint a picture of stability across its existing portfolio, estimating that 94% of the companies across all funds currently have a cash runway of more than 12 months.

SoftBank Vision Fund and Tiger Global escalated the pace of their dealmaking in 2021 as many investors believed that the rally in public stock markets would continue for the foreseeable future. But a sharp decline in the markets — accentuated by the Fed increasing interest rates and the unfolding of geopolitical events such as Russia invading Ukraine — has left many tech companies exposed with drops in business and shadows over their earnings forecasts, devaluing the businesses themselves, and leaving many investors scrambling to find ways to cut losses.

Invesco has cut the valuation of Swiggy in its holdings to $5.5 billion, just a year after leading a financing round in the Indian food delivery startup that valued the firm at $10.7 billion. Ola, the leading ride-hailing giant service in India, saw its valuation slashed by Vanguard to below the startup’s 2019 value. Both the startups are SoftBank Vision Fund’s star portfolio firms in India.

On a more positive note, SoftBank Group said the initial public offering of Arm was progressing “smoothly.” If and when it goes ahead, it could be a milestone that could generate considerable returns for the Japanese conglomerate. ARM’s $40 billion sale to Nvidia, first announced in 2020, was ultimately scuppered by regulators; now reports estimate that it could fetch a market cap of between $30 billion and $80 billion, although the IPO window has been shut for some time now, and tech stocks have been floundering.

SoftBank Group also estimated that 94% of its startup holdings maintain a financial runway of no less than 12 months.

The firm did not offer an update on whether it’s kickstarting the process to raise money for Vision Fund 3. It has said in the past that it will consider raising Vision Fund 3 after it has exhausted deploying the Vision Fund 2’s capital.