There’s a growing trend, fed by everything from IP concerns to Suez Canal traffic jams, to bring manufacturing back to North America.

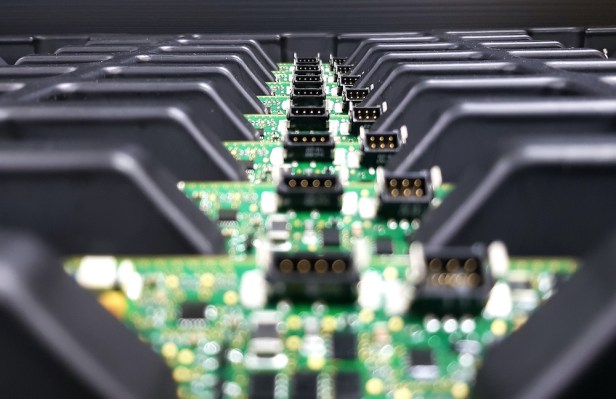

This is more than just a commercial idea: The U.S.’s lack of manufacturing capabilities when it comes to semiconductors and other chips has been touted quite often as a national security risk. If factories in China stop or suffer disruptions, all of the manufacturing that involves or requires PCBs would, too. That includes pretty much everything you could possibly imagine: If it has a battery or runs on electricity, it probably has a PCB and a microprocessor in it.

Companies such as MacroFab are helping enable this nearshoring effort. TechCrunch+ spoke with MacroFab CEO Misha Govshteyn to learn more about the drive to manufacture in North America and how MacroFab is helping to facilitate it.

“MacroFab is an electronics manufacturing platform, very similar in spirit to what Fictiv does, for example, but we’re focused on anything with a printed circuit board,” Govshteyn said, referring to the supply chain company.

MacroFab says it operates the largest digital platform for electronics manufacturing in the country and has a network of more than 75 factories across North America. In April this year, it added six new component vendors to its platform, expanding its flexibility further.

“Imagine any device with a circuit board in it,” Govshteyn said. “Our customers can upload a design to us directly from their CAD files, get an instant price quote, place an order, [pay] either with a credit card … [or place] purchase orders with us and get their order in as little as 10 days.”

This makes MacroFab perfect for anyone who wants to make a prototype and prove a concept, but what about going beyond that? Can MacroFab support the production of millions of units of a particular build?

“We don’t stop necessarily at early-stage prototypes, and we’re not limited by volume,” Govshteyn said, noting that customers can go from prototype to full production within MacroFab’s setup. “We have customers who place orders as small as single-digit units — those can be $1,000 apiece — and then we have the largest customers, who spend millions of dollars on our platform.”

End-to-end manufacturing

MacroFab doesn’t just provide production capacity to its customers; it can support them throughout the entire manufacturing process, as well. “Factories in our network will build the entire product for the customer. They’ll do full product assembly, and they’ll do full testing, full packaging. In fact, we even inventory finished goods for customers and deliver them on their behalf to their customers,” Govshteyn said.

By providing the full spectrum of manufacturing support, MacroFab’s goal is to make it easier for startups to navigate their production process and encourage companies that have previously manufactured abroad to bring their production back to North America.

“On our platform, customers can upload their design, but they can also do part selection,” Govshteyn said. “We have API links to all the major distributors and you can define substitute parts.”

This is great for maintaining both cost and supply stability, especially at the beginning of the production process or for smaller runs. For larger production runs, MacroFab has more to offer.

“When it gets into large production deals, our supply chain team will actually source all the materials for our customers, including plastics and metals and all of the rubber materials. We will help them set up all of the testing infrastructure,” Govshteyn said. “So to that end, we really become their supply chain team.”

Following several years of supply chain instability, these distributor options and supply chain facilitation is something that MacroFab believes makes it especially attractive to anyone trying to manufacture products with PCBs, as having flexibility is crucial for anyone who wishes to engage in manufacturing. “Despite what you see in the headlines, the supply chain crisis is not even remotely over,” Govshteyn said. “We still see parts coming on, becoming available and then disappearing very quickly again.”

Govshteyn says he’s seen companies falling into the design-and-redesign trap countless times as they try to work around shortages. “People fall into this cycle where they think they can design themselves out of a shortage,” he said. “It’s very expensive; they end up going into the tank for three to four months, come back and realize that a totally different set of components disappeared.”

It’s about flexibility, not rigidity. “We have a lot of customers that basically make their designs a lot more flexible,” he said. “So they may have one core design, but it’s designed to be flexible enough to be able to accommodate components from different suppliers; sometimes a different footprint helps.”

Govshteyn says companies are engaging with MacroFab because they can shore up their resilience to disruptions by having multiple suppliers, at least one of whom is not based in China. In turn, MacroFab production network enables this diversification. “We have facilities all across North America, including in the U.S., Canada and Mexico, and over 100 factories in our network. Some of these factories are massive, [spanning] hundreds of thousands of square feet, with dozens of lines,” he said.

Government incentives

Recent government initiatives are driving companies across the world to manufacture in the U.S. in particular. “In the last couple of quarters, we’ve definitely seen an influx of battery companies and clean tech companies — anything related to energy tech,” Govshteyn said.

The Inflation Reduction Act, for example, offers tax credits for wind, battery and solar components made in the U.S. “Some customers actually explicitly told us why that is: With the Inflation Reduction Act, there are a lot of incentives for the supply chain to be built 100% in the U.S.”

With the Biden administration committing $50 million to domestic and Canadian production of PCBs, there’s been a huge shift in the U.S. government’s stance toward manufacturing of semiconductors and similar equipment. The administration has been rolling out various initiatives to make it harder for chipmakers in China to manufacture semiconductor components.

Govshteyn thinks this is a symptom of a problem. “We simply don’t have enough domestic capacity even for defense purposes, much less aerospace, medical, industrial and commercial applications; this isn’t a solution. The amount of $50 million allocated for spending is both small and very specific [ … ] But $50 million is a Band-Aid at best. We still need that $3 billion bill to address domestic PCB fabrication capacity at a minimum.”

Govshteyn is referring to a bipartisan bill, co-sponsored by Rep. Anna Eshoo, Democrat of California, and Rep. Blake Moore, Republican of Utah, that would provide $3 billion for development of new PCB fabrication factories in the U.S. and a 25% credit for U.S.-built PCBs.

“This is one segment of the electronics supply chain that I am most worried about,” Govshteyn said. “We have allowed PCB fabrication plans to erode from over 2,500 to about 100 factories today. The urgency with the CHIPS Act escalated because our domestic semiconductor production dropped below 13%. But U.S. PCB fabrication is down to 4%.”

The problem may be obvious: Very little of the world has the capacity to manufacture PCBs at scale, and most of the manufacturing happens in China and Taiwan. “I think chips really captured the public awareness and provided the impetus for the CHIPS Act, but the PCB citation is much worse,” Govshteyn said. “If something were to happen between China and Taiwan, the supply chain crisis will make our COVID-19 challenges look minor in comparison.”

Finding its customers

Given MacroFab’s ability to take a company from startup to full production, does it have an ideal customer?

“Our sweet spot is really with industrial companies, a lot of startups, a lot of IoT devices,” Govshteyn said. “There’s a lot of robotics and drone development and production done on our platform, so it tends to be products that have high intellectual property value.”

It’s not all about high-value IP products, though. MacroFab does not see itself competing with the likes of Foxconn, but fulfilling a different need.

“When you look at what Flex and Foxconn do, they build for very large-scale companies. What they’re not really good at is building for diverse products and high-mix, low-volume [manufacturing],” Govshteyn said.

With MacroFab, though, he says it’s not a lot of volume; instead it’s a lot of permutations of different products. “That’s actually where our digital approach is really powerful. It’s not a lot of units per year, but there are high-value builds and there may be hundreds of thousands of them. That’s not usually a great fit for a tier-one manufacturer.”

Manufacturing is all about flexibility and diversification, but not just with raw materials and production supplies. It’s also about the who and the where, and MacroFab is one piece of that puzzle.