When it comes to cloud growth, it’s probably safe to say that the sky isn’t falling, even though revenue growth rates have been. We’ve seen the aggregate public cloud revenue growth decline from 32% in Q1 last year to 19% this year. That’s a pretty steep drop-off, and it shows that the cloud has run into some headwinds.

As a result, we have seen folks talking about a great repatriation where cloud workloads will move back on-prem, but the evidence doesn’t suggest that’s happening. Instead, companies may be slowing cloud migration as they look at the most efficient way to distribute their workloads.

Clearly, companies have learned that not every workload is well suited to the cloud. Some that can’t deal with even a little bit of latency to get to the cloud and back, for example, need to be hosted on the edge to be closer to the compute source. But it doesn’t look like many IT departments long to go back to the days of racking and stacking new servers.

So why is public cloud growth slowing down? Customers have started to look at their hefty cloud bills, with budgets coming under ever more intensive review this year, looking for ways to cut costs, which Amazon CFO Brian Olsavsky acknowledged in the company’s earnings call with analysts this week.

“Enterprise customers continued their multidecade shift to the cloud while working closely with our AWS teams to thoughtfully identify opportunities to reduce costs and optimize their work,” he said during the call. In CFO speak, that means that they aren’t abandoning the cloud, but they are taking a hard look at expenses, which is having a pretty significant impact on the company’s cloud growth numbers.

He added that the slowing growth could continue for a couple more quarters, but that overall customers are still high on the cloud. “So far in the first month of the year, AWS year-over-year revenue growth is in the midteens. That said, stepping back, our new customer pipeline remains healthy and robust, and there are many customers continuing to put plans in place to migrate to the cloud and commit to AWS over the long term.”

By now, the value proposition of the cloud, regardless of the vendor, is clear. It allows a level of flexibility that just isn’t possible when you run your own data center, and running your own data center is expensive and requires an entirely different set of skills from running cloud workloads.

So what does all this mean for the cloud infrastructure market revenue growth? If the data is right, it’s going to be fine. It just looks a little dicey in the short term.

Positive trends

Goldman Sachs regularly surveys CIOs about spending priorities, and while IT spending in general is down this year (the cloud growth numbers bear that out) Goldman sees a bright future for the cloud.

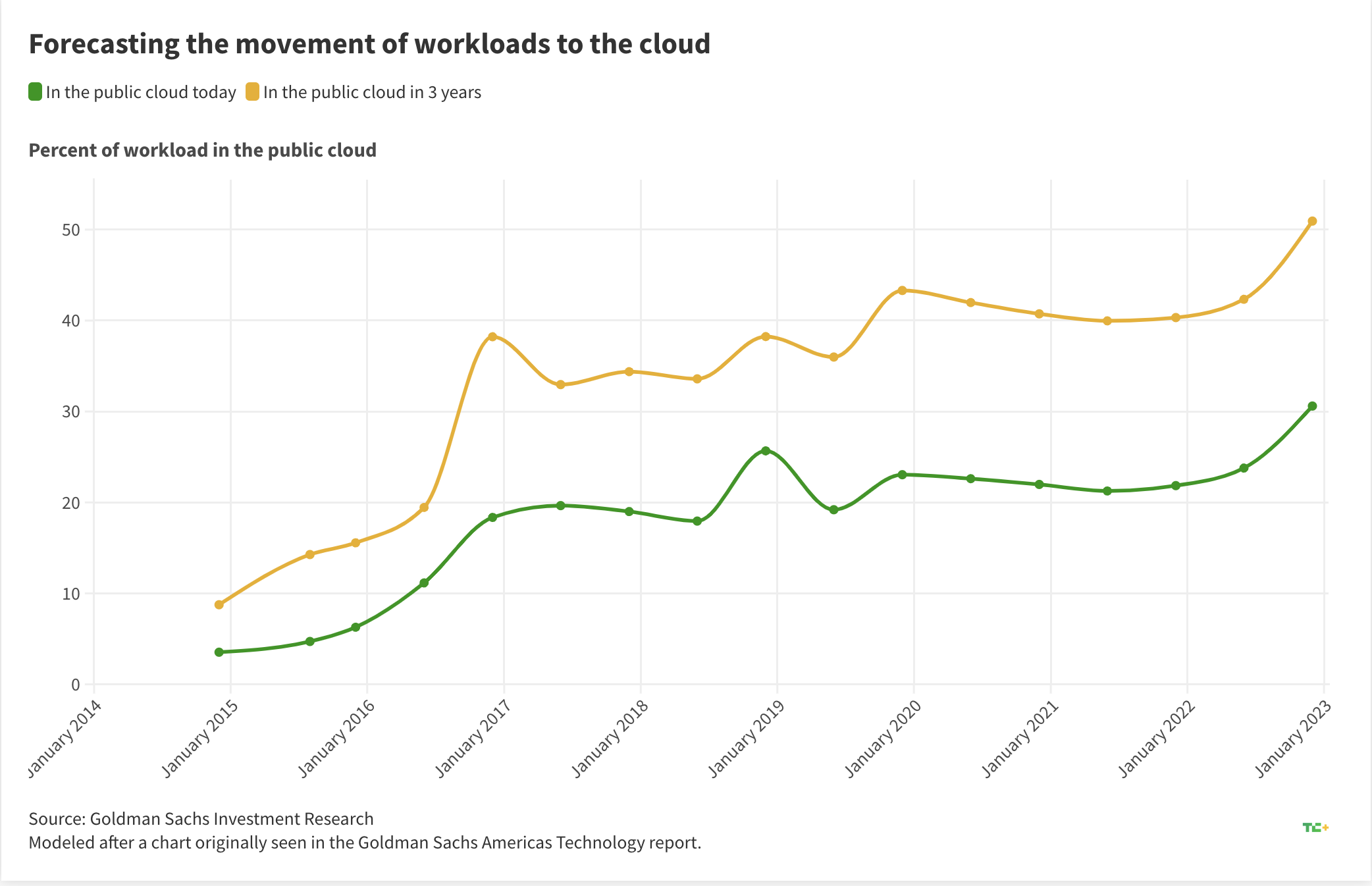

Today, the firm says that approximately 31% of workloads are in the cloud, meaning that there is still enormous room for growth when we consider future public cloud spend. As the chart below illustrates, using data from the Goldman Sachs survey, the next three years are trending in the right direction for cloud vendors.

Image Credits: Data visualization by Miranda Halpern, created with Flourish

That’s certainly good news for those vendors who are trying to convince investors that things are going to be just fine in time. This data proves that. As Goldman Sachs wrote in its report, the increased usage will also result in increased spending, even if the short-term outlook is not so great.

“We nonetheless see a long runway for continued cloud migrations, particularly in the wake of the COVID-19 pandemic as limitations and challenges in maintaining legacy, on-prem architectures have become more acute. While we also acknowledge that a more challenging macro backdrop may pressure near-term demand, we expect cloud demand to be largely recession-resistant, with some spend being pushed out, but not lost,” the firm wrote.

Ed Sim, founder and managing partner at Boldstart Ventures, says that the Goldman survey shows that some of the initial movement and the spend associated with migration has been done, but there is still a lot of future spend coming.

“So the point is that maybe all the early spend got spent and then now we’re going to the down cycle, but then maybe there’s an uptick starting back again, maybe in Q4 or January next year,” he told TechCrunch+. “So things have slowed down because they were going so fast, but if you look at this data, enterprises are still continuing to spend on the public cloud and moving [more workloads] over the next few years.”

Other key factors

If public cloud vendors were anticipating a secular stagnation in their future cloud growth rates, they would probably be cutting spending on capital expenditures. But that’s not happening. This relates to our notes above regarding legacy workloads continuing — if not accelerating — their movement to the cloud, continuing a long-running trend that TechCrunch+ has been tracking.

But there are new workloads being created — namely, AI — that have no real relation to the movement of historical on-prem compute needs moving to public cloud providers.

A quick perusal of recent earnings calls from the big three cloud vendors — Amazon, Microsoft and Google — indicate that AI is not only a key theme among the leaders of the world’s most valuable tech companies but also analysts and investors more generally. The companies themselves are investing to meet anticipated demand growth in AI services, adding another expected growth vector for overall public cloud spend, and therefore revenue expansion.

Here’s Microsoft CFO Amy Hood (emphasis added):

We will continue to invest in our cloud infrastructure, particularly AI-related spend as we scale with the growing demand, driven by customer transformation. And we expect the resulting revenue to grow over time.

Microsoft provided a look ahead to its current quarter, speaking to the results it expects. Tucked in that bit of prepared comment was a note on how AI-related cloud spend is already showing up in its numbers: “In Azure, we expect revenue growth to be 26% to 27% in constant currency, including roughly 1 point from AI services,” the company said.

Given that AI is already driving a point of growth for Microsoft’s public cloud, how are other majors discussing the same theme? This is how Alphabet CFO Ruth Porat spoke about similar matters, from both her prepared remarks (top paragraph) and a later answer to an analyst question (emphasis added):

As it relates to CapEx for 2023, we now expect total CapEx to be modestly higher than in 2022. As discussed last quarter, CapEx this year will include a meaningful increase in technical infrastructure versus a decline in office facilities. We expect the pace of investment in both data center construction and servers to step up in the second quarter and continue to increase throughout the year.

And in terms of CapEx, we do now expect that total CapEx for the year for 2023 will be modestly higher than in 2022. And I tried to point out that we’re expecting a step-up in the second quarter, and that will continue to increase throughout the year. And as we discussed last quarter, AI is a key component. It underlies everything that we do, and we’re continuing to invest in support of AI, support of our users, advertisers and our Cloud customers, since we are commenting on here. And then as we talked about last quarter, the increase in CapEx for the full year 2023 reflects the sizable increase in technical infrastructure investment, on the flip side, a decline in office facilities relative to last year.

Finally, here’s Amazon CFO Brian Olsavsky on the same theme in response to an analyst question (condensed by TechCrunch+ for clarity):

The increases in AWS and infrastructure [spend is] for Large Language Models and generative AI. So, we’re creating some space in our fulfillment and transportation [capex] number that has been repurposed over to AWS.

Each of the big three cloud companies are spending today in anticipation of greater future compute loads, hardly a bearish sign, and an indication that puts recent cloud growth numbers into more clear context. Yes, customers are working to squeeze value out of spend, but as those returns diminish, we could see growth pick back up absent of any other factor. Throw in market-anticipated growth in AI compute demands, and the road ahead for public cloud spend more generally is peachy indeed.