Apple Card customers in the U.S. can open a savings account and earn interest through an Apple saving account. To learn the specifics about Apple’s new offering, click here. When the company originally announced the new financial product back in October, Apple said that it couldn’t share what interest rate would be paid out on these accounts because rates are fluctuating so much these days.

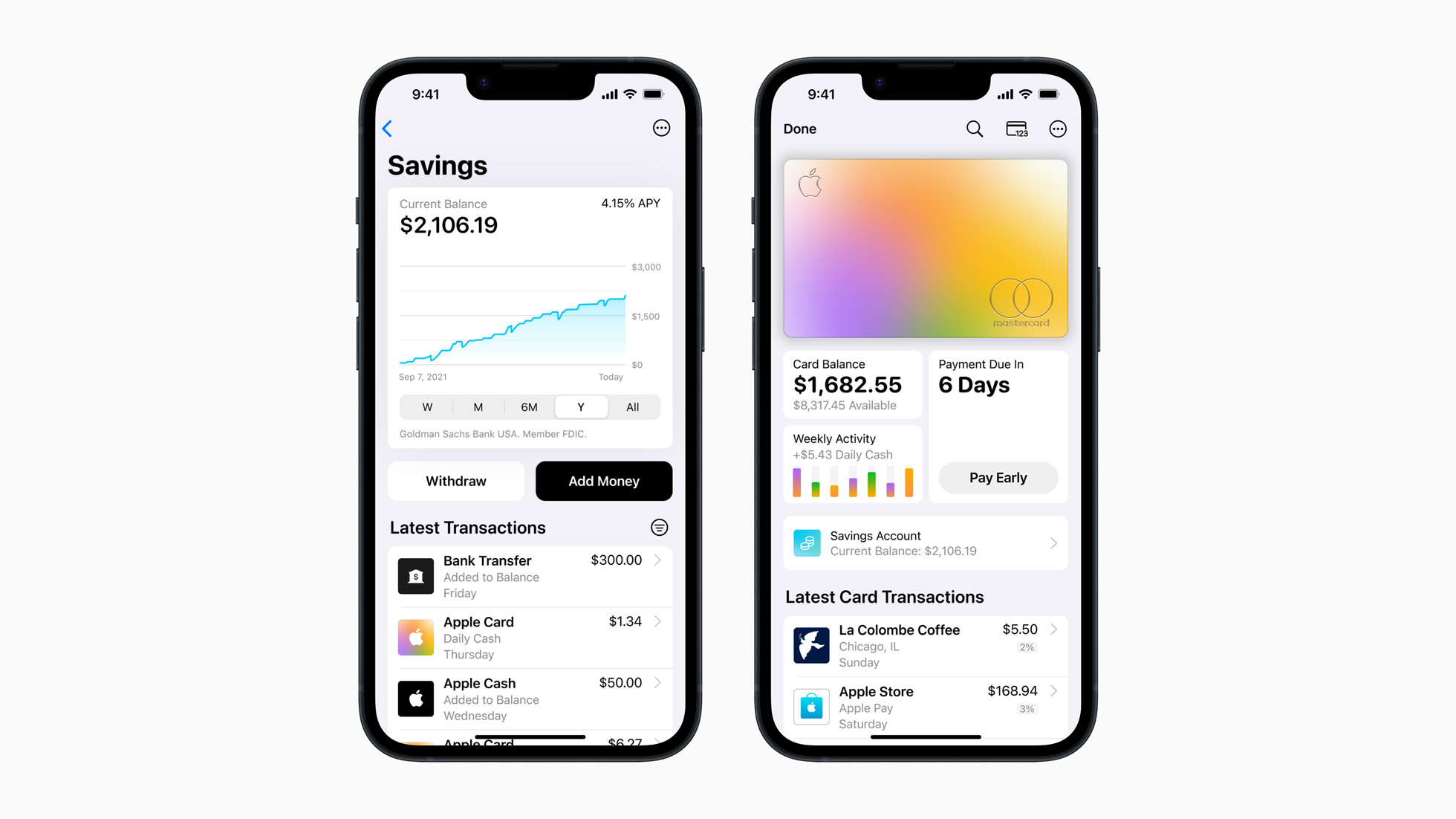

As of today, Apple is going to offer an APY of 4.15%. It looks like a competitive offering when you look at data from Bankrate — you can currently find savings accounts that offer an APY of 3.5% to 4.75%. The company isn’t making any promise when it comes to future interest rates. It could go up and down at any time.

Apple has partnered with Goldman Sachs once again for the banking feature. Savings accounts are technically managed by Goldman Sachs, which means that balances are covered by the Federal Deposit Insurance Corporation (FDIC).

This high-yield savings account has been created specifically for Apple Card customers. When customers pay with their Apple Card, they get cash back on all purchases. By default, all purchases grant you 1% in cash rewards and 2% for all purchases made using Apple Pay. Purchases with select merchants unlock 3% in rewards.

By default, customers receive cash rewards every day into Apple Cash, a pocket of money that appears in the Wallet app and that works more or less like a checking account. Your Apple Cash balance can be used to pay for things using Apple Pay, for your credit card balance or to send money to friends and family members. You also can transfer this balance to a regular bank account.

Starting today, Apple Card users can choose to deposit their daily rewards into their savings accounts. It’s a way to save money without having to think too much about it.

Your savings account is accessible from the Wallet app as well. You can see your current balance, the current interest rate and your most recent transactions. From this screen, users can also manually add or withdraw money. The balance can be transferred to Apple Cash or a regular bank account.

“Savings helps our users get even more value out of their favorite Apple Card benefit — Daily Cash — while providing them with an easy way to save money every day,” Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, said in a statement. “Our goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly — all from one place.”

There are no fees associated with Apple’s savings account. However, there is a maximum balance limit of $250,000. The APY of 4.15% applies to any sized balance and there is no minimum balance required.

Image Credits: Apple

Apple Card savings account, explained:

What are the requirements to open an Apple savings account?

You must first meet the following credentials in order to open an account:

- You are the owner or co-owner of an active Apple Card account.

- You have an Apple Card added to your iPhone or iOS device.

- You are at least 18 years old.

- You have either a social security number or an individual taxpayer ID number.

- You are a U.S. resident with a physical U.S. address.

- You have set up two-factor authentication for your Apple ID with the latest version of iOS.

How can I sign up for an Apple Card saving account?

- Open the Wallet app on your iPhone or iOS device and tap on “Apple Card.”

- Tap the More button, then tap “Daily Cash.”

- Tap “Set Up” next to “Savings,” and follow the onscreen instructions to the savings account application.

You can either transfer funds from your Apple Cash balance into your new savings account, or transfer funds from another bank account.

Is the Apple Card savings account FDIC insured?

Yes, balances are covered by FDIC. Apple’s Savings Deposit Account Agreement reads:

The Federal Deposit Insurance Corporation insures deposits up to the standard maximum deposit insurance amount per depositor, per FDIC-insured bank, and per ownership category. In determining how much insurance is applicable to your Account, you need to consider all accounts that you hold with us. For more information, visit the FDIC’s website or call the FDIC directly at 1-877-ASKFDIC (1-877-275-3342). You can also refer to the FDIC’s Electronic Deposit Insurance Estimator (EDIE).

Are there monthly fees associated with an Apple savings account?

No, there are no fees associated with an Apple savings account.

Is there a minimum balance for an Apple Card saving account?

No, there is no minimum deposit required to open an account or to earn the stated APY.

Do you need an Apple Card to have an Apple Card savings account?

Yes, you must be an owner or co-owner of an Apple Card, as defined in the Apple Card Customer Agreement.