India’s central bank has halted its plans for a high-profile project intended to rival the nation’s dominant payment system, Unified Payments Interface. The project had attracted significant interest from a variety of major conglomerates, tech giants and financial institutions, including Amazon, Reliance, Facebook, Tata Group, Google, HDFC and ICICI.

The Reserve Bank of India had initially invited bids in 2021 for licenses to operate new retail payment and settlement systems across India. The project was called New Umbrella Entity, or NUE.

However, according to RBI Deputy Governor T Rabi Sankar, the project’s potential participants failed to propose “any innovative or infrastructural solutions.” Sankar emphasized the central bank’s interest in exploring ideas that go beyond incremental improvements or substitutes for existing technologies.

UPI, which now processes over 8 billion transactions a month, was inching closer to the 1 billion milestone in 2021. The central bank sought to mitigate concentration risk as UPI’s importance in the economy continued to grow, aiming to develop an alternative protocol that would alleviate strain on the existing system.

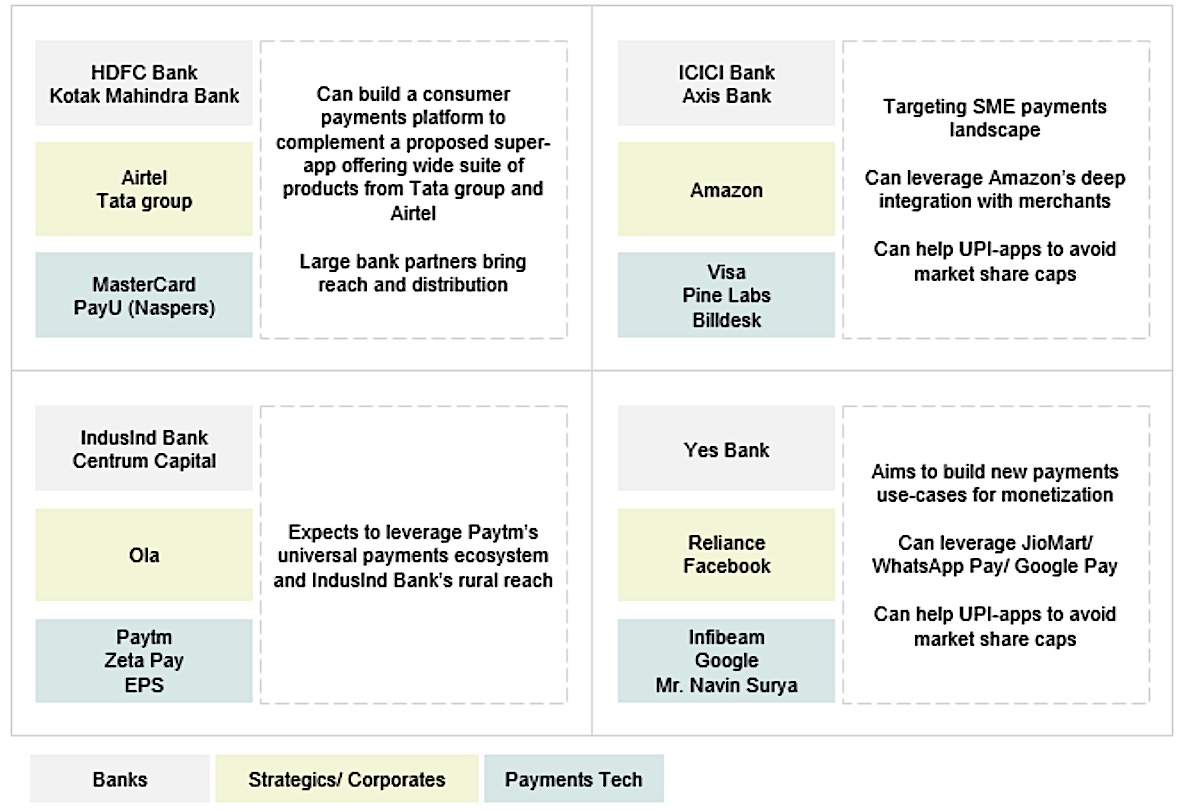

Industry players had formed four consortia and were planning to make a bid for the NUE license. Image Credits: Bernstein

PhonePe and Google Pay were commanding the most market share in UPI in 2021 — not much has changed — and many industry participants saw NUE as a way to be early and aggressive with a new payments system.

In an earlier proposal, RBI sought NUEs to be interoperable with each other.

“Thus, NUEs do not have any proprietary access. However, NUEs can customize the networks to their business model and distribution capabilities. If a conglomerate is strong in e-commerce, the NUE could customize to the specific needs of that use-case. UPI has market share caps/calibrated growth for new players (e.g. WhatsApp). NUEs would not have such restrictions and might help with accelerated network effects for private players. Thus, NUEs customized design and self-governance could provide stronger capabilities. Unlike UPI’s generic payment network, NUEs will have customized networks based on use-cases,” Bernstein wrote in a report in 2021.