U.K. regulator Ofcom is preparing to refer the local cloud infrastructure market for an in-depth investigation, with the practices of Amazon and Microsoft in particular firmly in focus.

The news comes some six months after Ofcom first revealed it was kickstarting a market study into the £15 billion U.K. cloud market.

It’s worth noting that Ofcom’s consultation, which involves soliciting stakeholder feedback from across the cloud industry, is only at its halfway point. But Ofcom said that it has “provisionally identified” practices that make it more difficult for businesses to switch between cloud providers, or even use multiple providers, which is why it is “proposing” to refer the U.K. cloud services market to the Competition and Markets Authority (CMA) for a formal investigation.

“We’ve done a deep dive into the digital backbone of our economy, and uncovered some concerning practices, including by some of the biggest tech firms in the world,” Fergal Farragher, Ofcom’s director responsible for the market study, said in a press release. “High barriers to switching are already harming competition in what is a fast-growing market. We think more in-depth scrutiny is needed, to make sure it’s working well for people and businesses who rely on these services.”

Friction

The crux of the problem, according to Ofcom, is that Amazon, Microsoft and Google collectively account for more than 80% of cloud revenues in the U.K., and they may enforce policies, fees and other restrictions that make it difficult for other smaller providers to gain traction. These include so-called “egress fees,” which are often opaque fees that cloud companies charge whenever a company transfers data out of the cloud and moves it elsewhere — this is often seen as an unscrupulous means to lock customers in, as the costs are typically higher than what it costs to transfer data into, or within, a single provider’s cloud.

Elsewhere, Ofcom also points to issues around interoperability, whereby the big cloud firms create their products so that they don’t play nicely with competing providers — this can put a considerable resource-drain on companies looking to adopt a hybrid cloud approach. Related to this, Ofcom also says that the big cloud vendors often offer “committed spend discounts,” which while reducing the customers’ costs, also encourages them to stick with a single vendor even if better alternatives may exist.

Ofcom notes in its initial findings:

These market features can make it difficult for some existing customers to bargain for a good deal with their provider. There are indications this is already causing harm, with evidence of cloud customers facing significant price increases when they come to renew their contracts.

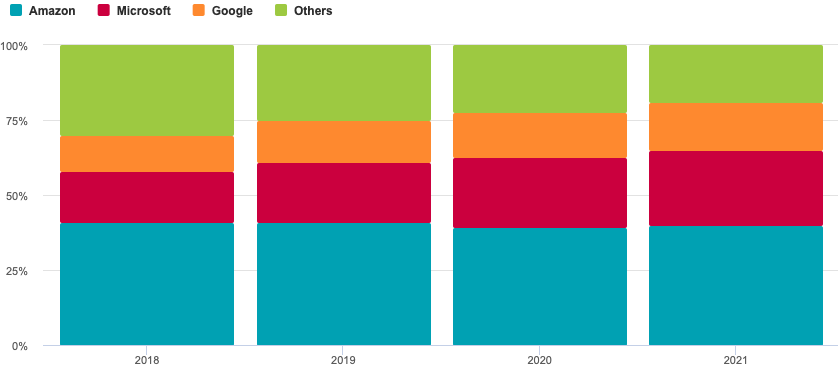

From 2018 to 2021, the “others” category in the U.K. cloud market fell from 30% to 19%, while in tandem the so-called big-three “hyperscalers” gained significant market share, or remained around the same. Microsoft has actually seen the biggest growth, rising from 17% to 25% over the four-year period, while Google jumped from 12% to 16% market share. AWS, meanwhile, has fallen marginally from 41% to 40%, but remains by far the single biggest cloud provider.

Market share of supply by revenue in U.K. public cloud infrastructure services market. Image Credits: Ofcom / Synergy Research Group

While all three of the big-name cloud players are part of its focus, Ofcom’s report seems to pinpoint AWS and Microsoft specifically, given that they reportedly account for cloud revenue spend of between 60% and 70% between them.

Moreover, Ofcom is quick to stress that its focus lies not so much on competition at the signing-up stage, it’s more about how difficult things become to switch after a company has signed up. The report notes:

We provisionally find that there is evidence of active competition for new customers, and that some customers are likely to have some bargaining power when first migrating to the cloud. However, once a customer makes its initial choice of cloud provider, their bargaining power is reduced, and the balance of power shifts to the initial cloud provider – most often AWS or Microsoft.

Dark cloud

Across the water in mainland Europe, a similar episode has also been unfolding. Cloud Infrastructure Services Providers in Europe (CISPE), a not-for-profit trade association, filed an antitrust complaint against Microsoft back in November, alleging that Microsoft was using its dominance in business software to tether its customers to Azure. It’s worth noting that Amazon’s AWS is a member of CISPE, and AWS has a clear interest in trying to stymie any gains Microsoft makes on its lucrative cloud business.

However, other smaller players in the cloud space, including France’s OVHcloud, have also been making noises about Microsoft’s practices to European regulators, with reports emerging last week that Microsoft was close to agreeing to a deal to placate them — prompting Google, of all companies, to accuse Microsoft of anti-competitive practices.

In response to today’s announcement from Ofcom, CISPE Secretary General Francisco Mingorance said that it’s “clear that Ofcom recognises the potential for Microsoft’s unfair software licensing practices to distort competition in the cloud market,” a statement that conveniently ignores CISPE-member AWS’s involvement in Ofcom’s initial market study.

“More and more customers, competitors and regulators are waking up to the ways in which Microsoft continues to distort fair competition in the cloud,” Mingorance said. “Private deals are unlikely to solve these sector-wide issues. Based on the mounting evidence, it is important that both national and EU authorities open formal investigations into Microsoft’s unfair software licensing practices as an urgent competition issue.”

Ofcom’s market study is still at its halfway point, and is subject to additional feedback based on Ofcom’s provisional findings, with stakeholders given a firm May 17, 2023 date to submit responses. The final report and recommendations is expected “no later than” October 5.