Cloud costs remain a top concern for organizations. According to a recent Anodot survey, 50% of businesses are struggling to control them, in part because they lack visibility into their cloud usage. Unsurprisingly, reducing those costs has become a top priority. A report from Wanclouds finds that 81% of IT leaders have been directed by their C-suite to reduce or take on no additional cloud spending.

Surely that’s music to the ears of startups whose tech is designed to reduce cost spend. There’s several out there. But one of the more successful vendors is Cast AI, which today announced that it raised $20 million in an investment led by Creandum with participation from unnamed existing investors.

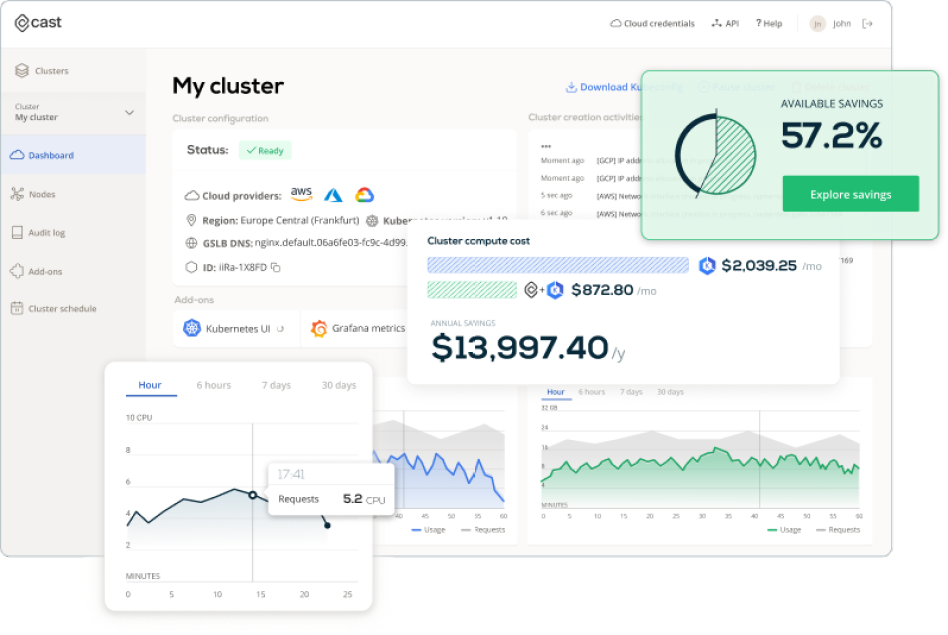

Founded by Yuri Frayman, Leon Kuperman and Laurent Gil in 2019, Cast AI — powered by AI, as the name implies — analyzes a company’s cloud usage to attempt to find the optimal cost-performance ratio. Cast AI customers can connect their cloud plans across AWS, Google Cloud and Azure to see recommendations and have the system implement them automatically.

“We decided to build a platform that would help companies automatically optimize and reduce their cloud costs — without manual intervention,” Frayman, who serves as Cast AI’s CEO, told TechCrunch in an email interview. “The need for such a platform became clear after we co-founded Zenedge, a cloud-based cybersecurity platform that was ultimately acquired by Oracle. As our application scaled up, we watched our cloud bill exponentially increase from thousands of dollars to millions of dollars … Our goal [with Cast AI] was to build the product we wished we had at Zenedge.”

According to Frayman, Cast leverages “many models” to drive its cloud usage optimization automation engine, which scales cloud resources up and down in real time while optimizing for cost. The models are trained on usage metadata from customers, public cloud pricing and inventory information, and undisclosed “other signals” that cloud providers make available. (Frayman notes that customers who don’t wish to submit their data for training can request that it be deleted.)

Cast AI’s optimization dashboard, showing real-time data across public cloud instances. Image Credits: Cast AI

Some of Cast’s models are responsible for determining how often public cloud jobs might be interrupted, while others predict spare compute capacity availability. Still others are trained to anticipate seasonal changes in workload requirements, like decreases in cloud usage during the winter months.

“We’re able to predict lower future compute prices to impact future batch workload scheduling, kind of like searching for a cheaper flight on Kayak and booking a future date that’s cheaper,” Frayman explained.

As we’ve written about before, several years ago, the market for cloud optimization software, while nascent, was consolidating as incumbents in adjacent sectors saw an opportunity to make a mark. In 2017, Microsoft acquired Cloudyn, which provided tools to analyze and forecast cloud spending. VMware and NetApp bought CloudHealth and Spot (formerly Spotinst), respectively, within the span of a few years. Somewhere in the midst of all that, Apptio snatched up cloud spending management vendor Cloudability, while Intel purchased Granulate for $650 million.

The consolidation isn’t necessarily over. But some vendors are prospering, judging by their successful fundraises. For example, ProsperOps, a Cast rival, landed $72 million in a venture round that closed in February.

To stay competitive, Cast recently launched a “zero-cost,” trial-like cloud cost monitoring and reporting product and its first cybersecurity offering: a tool that shows users security best practice violations as measured by the Center for Internet Security benchmarks and shows ways to fix those violations.

“Our goal is to have fewer people doing higher-order, more interesting work in cloud operations,” Frayman said. “The industry is faced with a challenged customer that needs to save cloud costs immediately and cannot afford to parse through reports and assign people to solve the problem manually.”

Frayman declined to disclose Cast’s revenue numbers. But he did say that Cast’s quarter-by-quarter revenue has grown by over 220% since the platform launched. Thousands of customers’ apps are being optimized by the platform, he claims, and Cast is actively managing over a million public cloud CPUs.

He thinks the Silicon Valley Bank scare could spur business, too, given the newfound tightness of capital. To that end — in light of the bank failures — Cast is offering onboarding services for free for a limited time. Customers will pay only once they start saving money.

Frayman says that Cast will put the newly secured funds, which bring the startup’s total raised to more than $38 million, toward growing its team and “working toward being cash-flow positive.”

“We currently have 75 employees and expect to grow the team as the business scales, and as we continue to hit our metrics driven milestones,” he added. “We will add automated security capabilities into the Cast AI platform. We will also invest in other features to help our customers with ‘day-two’ operations, like monitoring, testing and alerting. That way, we can help maintain the performance and reliability of our customers’ clusters with the ultimate goal of minimizing or completely eliminating human intervention.”