It’s not every day that banking news is the big story in the startup world, but here we are. Yesterday the previously crypto-friendly Silvergate Bank announced that it would “wind down operations and voluntarily liquidate” itself.

The company’s stock had been under massive pressure in recent months, exacerbated by a note from the bank on March 1 that its earnings data would be delayed due to possible internal controls issues. It was also under regulatory inquiry.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

But that’s not the new big banking news making waves in startup circles.

Silicon Valley Bank (SVB), a well-known institution in the technology industry that works with venture capital firms and startups alike, announced that it was raising capital via a share sale (among other mechanisms), taking a $1.8 billion charge to divest itself of low-yield assets and double its term borrowing.

Per a letter from the company to its investors, its actions will “take advantage of the potential for higher short-term rates,” allowing it to “better protect” its interest-related incomes.

Per a letter from the company to its investors, its actions will “take advantage of the potential for higher short-term rates,” allowing it to “better protect” its interest-related incomes.

Investors did not like the implied dilution of the company’s share sale or the massive charge it will take on the sale of assets. Shares of SVB are off around 30% in pre-market trading today.

But that’s not the super juicy bit. Sure, it appears that SVB’s news is unsettling to some in the public investing world, but what we care more about is this slide from the company’s investor presentation concerning its midquarter performance:

Image Credits: SVB investor relations

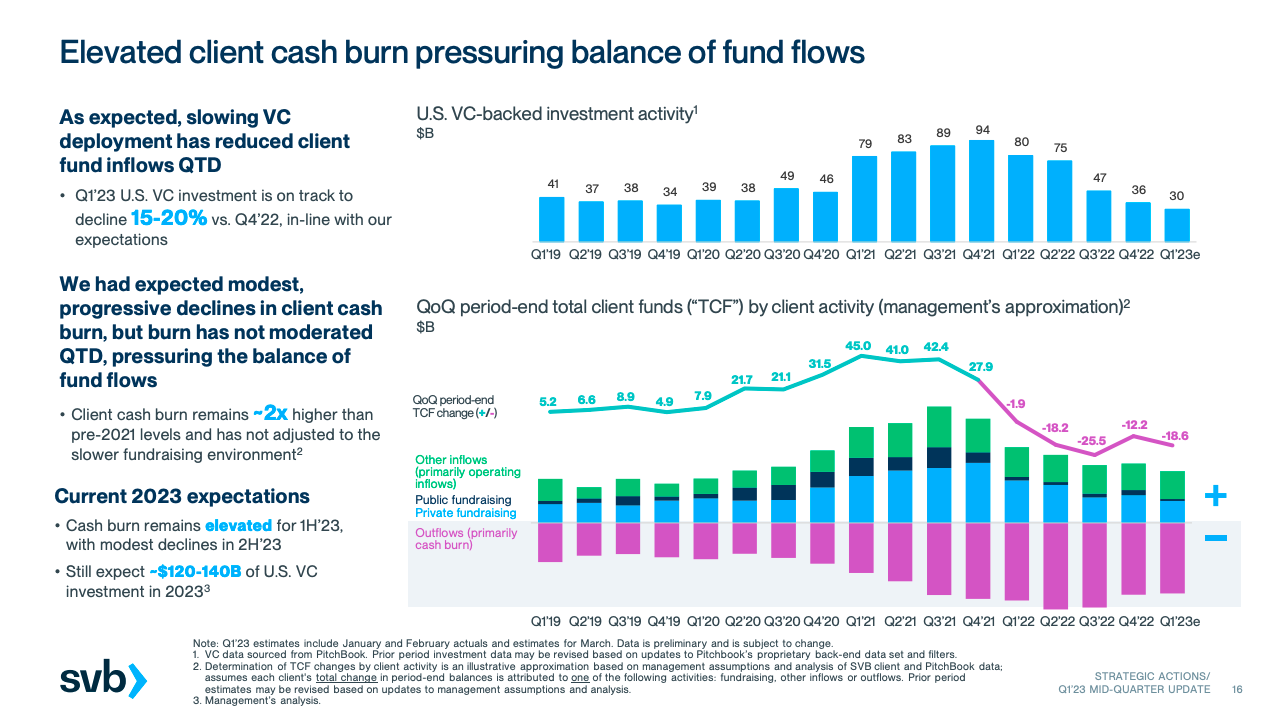

SVB expected venture capital investment to slow after the 2021 peak of the last private-market cycle. That happened, as you can see in the top chart, with U.S. venture capital activity falling from $94 billion in the fourth quarter of 2021 to an estimated $30 billion in the first quarter of this year. (That SVB expects a roughly 17% sequential decline in Q1 2023 U.S. venture deal volume compared to Q4 2022 would be news itself on a less busy morning!)

The bank expected that with fewer dollars flowing into their coffers, startups would cut their burn rates. That would reduce the impact on its deposit base of startups raising less capital. But even its self-described “modest, progressive” anticipated “declines in client cash burn” have not occurred. Or as SVB put it: Client cash “burn has not moderated [quarter-to-date].”

The lower chart shows capital in (positive columns) and burn (negative columns), as well as a pretty brutal pace of client fund outflows. (No bank likes to have a smaller deposit base, of course.)

Why do we care about this? Not because it appears to have put SVB into a bit of a situation — we’ll let the financial folks sort out how smart SVB’s actions are — but because cash burn among startups, a core client base of the bank, “remains ~2x higher than pre-2021 levels and has not adjusted to the slower fundraising environment.”

In plain language, startups are still burning huge amounts of cash. So much so that SVB felt compelled to highlight the extent of the cash depletion to its own investors. Sure, the bank expects burn to moderate in the back half of 2023, but it doesn’t appear that a return to pre-COVID levels of burn is in the cards any time soon.

Uh oh.

Cross that fact with the simple truth that venture capital investments are just a fraction of burn rates in Q1 2023 (compare the light blue column with the fuchsia column in the lower chart), and you have a recipe for a lot of startups imploding due to a lack of cash. They can’t keep burning forever, right?

All this combats the current venture narrative that cutting burn and extending fundraising dates is the right move for startups. We presumed that they had listened. Perhaps not, at least domestically.