From the people who brought you credit monitoring services now comes Credit Karma Net Worth, a new product to help people know, grow and protect their wealth.

The new feature brings the 16-year-old company closer to becoming an end-to-end personal finance management platform, also offering debt, credit building and checking and savings products, Credit Karma founder and CEO Kenneth Lin said in an interview.

As Credit Karma members moved through their credit journey of establishing credit and getting their credit score in check, they are now thinking about the next stage of their life: financial goals and outcomes, he said.

“This is really part of the natural progression of helping that group of users understand their financial lives,” Lin said. “This is one of those things that everyone tells us is important, but no one has done it well, and more importantly, no one has done it with the ease of access that we believe we have at Credit Karma.”

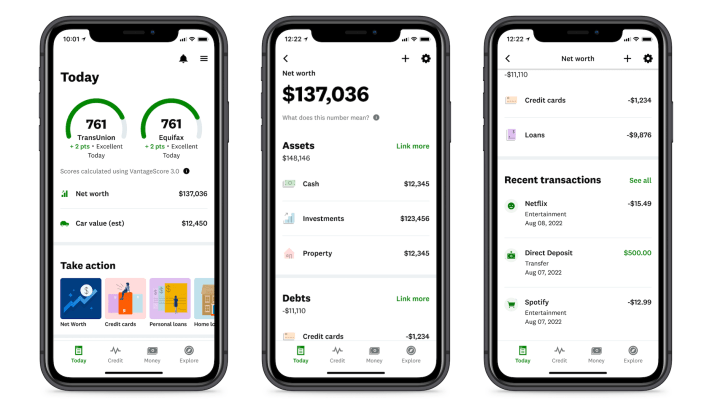

The overall goal of Net Worth is to guide members to grow and protect their wealth, but at product launch, it is focused first on helping members understand the various components of their net worth, including assets, loans, retirement savings and credit card debt, so that they can monitor it and track progress over time.

Here’s how it works: Members can link their financial accounts, such as a 401(k), brokerage account and outstanding liabilities, like a mortgage. All of those combined will give them some insights into their total net worth. From then on, members can see their transaction history and can monitor how money is coming in and going out each month, Ryan Steckler, general manager of Mint and Net Worth, said in an interview.

Steckler, who has been with Intuit for 17 years, joined the Credit Karma team six months ago when Intuit’s Mint business combined with Credit Karma to build Net Worth. Intuit acquired Credit Karma in 2021.

Credit Karma has more than 120 million members in the U.S., but Net Worth is being rolled out to initially target U.S. consumers with a credit score of 720 or above, with the goal to expand to a larger population over time.

These members are described as “prime,” or those who largely have the first leg of their financial journey under control, are paying off their bills on time and getting out of credit card debt. As such, they have some money left over at the end of the month, yet still lack the confidence to maximize their money and plan for the future, Steckler said.

“We’ve helped people in those middle credit score bands for years, but we weren’t helping them with this, and so we had people outgrowing our app,” Steckler said. “That was the impetus to create Net Worth. By bringing Mint into Credit Karma, we’re now leveraging that team and all the experience they’ve had around helping those ‘prime’ members with their finances.”