If you read the startup press, you might think that everyone in tech is still nursing a stiff hangover from the zenith of the 2021 boom. While there is much talk of cutting spending, conserving capital, trimming staff and hunkering down, there’s also quite a lot of good news out there.

New data from Battery, for example, details a corporate software spending climate that is far from moribund; for startups that sell software to other companies, this is great news.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Good news is not in short supply. As TechCrunch recently reported, Salesforce proved that SaaS growth could still come in above expectations, unicorns Instacart and Klarna are posting solid operating results, and software-focused corporate valuations are recovering. So much for a recession, yeah?

The latest data dump from Battery Ventures (which raised $3.8 billion to invest last year) buttresses our general impression that while many startups have had to retool their operations for today’s more conservative business climate, the business of selling software is still a good one to be in. The same dataset also tells us that it’s not equally good everywhere for every type of software vendor.

The latest data dump from Battery Ventures (which raised $3.8 billion to invest last year) buttresses our general impression that while many startups have had to retool their operations for today’s more conservative business climate, the business of selling software is still a good one to be in. The same dataset also tells us that it’s not equally good everywhere for every type of software vendor.

Let’s dig through the good news first and then discuss which software categories are lagging behind their peers. We’ll also touch on the bottoms-up sales approach and SaaS itself. If you are building a software startup, let’s orient you for the present day. To work!

The good

Let’s start with an overview statistic. Battery created a sentiment index for enterprise technology spending, indexed on a 100-point scale. Much like PMI, 50 is a “neutral” outlook measurement on the Battery scale. Despite dipping from its Q3 2022 reading of 55.4 to 50.2, the index remains in bullish (positive) territory.

No crying allowed, in other words.

Image Credits: Battery Ventures

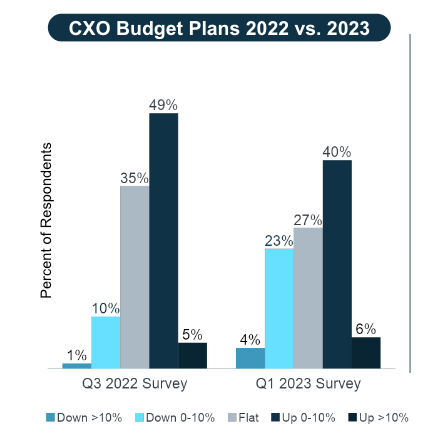

There has been some decline in anticipated technology budgets among the companies that the venture group surveyed. (The dataset is predicated on responses from 100 CXOs managing around $30 billion in spend, 85% of which are from companies with more than 1,000 full-time staff.)

Per the chart on the right, 46% of corporate respondents reported that their tech budgets for 2023 are heading up this year. Another 27% are flat. That leaves just 27% shrinking, with the vast majority of that group sticking to single-digit cuts.

The numbers were a bit better in Q3 2022 but are still not bad; after all, no matter the economic climate, some companies are going to cut tech spending for one reason or another, so we never expect those figures to read zero.

Even more, the larger budgets out there are even more robust than the aggregate Q1 2023 numbers. Per Battery, among companies with tech budgets of more than $500 million, 46% are heading up, 31% are flat and just 23% are expected to decline this year.

Battery investor Danel Dayan added in a call with TechCrunch that tech buyers “rarely actually see budgets shrink dramatically,” meaning that regardless of the macro environment, it’s never a bad time to sell software. Other companies need it to run.

Not every software buyer is the same, however, and breaking down the tech spending market by corporate budget size shows some interesting divergence. For example, tech buyers with budgets from $20 million to $99 million, per the Battery dataset, have the largest fraction of respondents saying that they are going to be more conservative this year (67%), while the same fraction of respondents with budgets in the $500 million to $1 billion range say that they are making no changes to their tech spend is this year.

For startups selling to larger customers, this is good news. If your upstart tech company is selling to the midmarket or below, the landscape is a bit less encouraging. (Perhaps this is why VCs have long said that selling to SMBs is hard.)

Among tech buyers, where is money flowing? When asked to rate their top five cloud software spending priorities, 79% of respondents included cloud infrastructure on their list. Data warehousing and enterprise security were next, with 64% and 56% of respondents including them in their top ranking. Enterprise apps came next, and automation picked up many more votes than it did as a category in the Q3 2022 Battery report. This implies that companies are looking to spend on tooling that will help conserve headcount costs. For startups that sell automation-like software, these are warm tidings.

Data operations and AI/ML tooling saw 44% and 43% of respondents include them as a top five priority. Toward the lower end of the list, we find collaboration software and developer security (22% of respondents put them in their top five). The developer tools category was only picked by 18% of respondents.

What does that all add up to? Sentiment in tech budgets has slipped some but remains net bullish, and most tech buyers are not cutting their spending, something that is especially true among larger purchasers of tech products. Big companies appear to have a slightly less conservative posture toward software spend, and a wide range of tech product types are in high demand from the current crop of tech buyers.

That’s the good news. Now let’s flip it.

The bad

Where are tech-buying leaders looking to cut? The two leading answers, per the survey, are vendor consolidation and SaaS license optimization. This means cutting down on duplicate products and trimming perhaps extraneous SaaS spend. Both of these could lead to increased churn among software startups (logo churn in the first case and reduced net retention in the second).

Trying to sneak your software into companies by selling to individual workers won’t always work. In Q3 2022, some 74% of execs surveyed by Battery let engineers pick their own tooling for development work. That figure fell to 46% in Q1 2023. We can infer here that startups hoping to land a few seats and then expand from there should expect a harder time doing so this year than the last.

Even more, given that only 46% of survey respondents said that they were consuming more than 20% of their software through bottoms-up sales motions, there’s only so much room in the market for startups to try and break into major budgets. Battery notes that “bottoms-up and PLG [sales motions] will experience headwinds as buyers become more conservative” this year.

That bad news came with a timer. Dayan told TechCrunch in a call that he expects consumption-based software sales models to show a “steeper acceleration” in time than what we’ll see from more traditional SaaS companies, though the latter group will also likely see less of a near-term decline.

Throw in the fact that only 36% of companies surveyed are willing to buy cloud software from early-stage startups, and the market looks a bit uphill. For tech startups past, say, the Series B mark, things are rosier. Then again, what else would we expect from a more conservative market? More demand for early-stage startup products?

It’s going to be harder to land and expand this year, which could mean startups with bottoms-up sales approaches will have a tough year. Bottoms-up early-stage software companies face buyer skepticism as well, putting them in a particularly tough spot. But because the bad news doesn’t seem to outweigh the good, we expect software companies to have a decent 2023, far better than we might have expected when the tech industry was busy chicken-littling its way into the new year.