It seems like only yesterday that I wrote about Gable’s $12 million Series A, but it was, in fact, two days ago. The company is building an interesting product in the world of remote work, and I was curious how the founders were able to convince investors to part with a big pile of dough.

Gable takes all the administrative work out of finding and booking nearby workspaces, both for employees and employers. It operates in 26 different countries, and the company says that more than 5,000 employees are using the platform.

Slides in this deck

At 21 slides, Gable’s deck is longer than average. Here’s what it included:

- Cover slide

- Team slide

- Market context slide (“The revolution of remote work”)

- Problem slide No. 1 (“Going remote-first is hard”)

- How people solve it now (“How it’s done today”)

- Problem slide No. 2 (“Main Issues”)

- Solution slide

- Traction slide (“Where we are”)

- Product slide No.1 (“Employee view”)

- Product slide No. 2 (“Management and insights”)

- Product slide No. 3 (“Host view”)

- Traction slide (“Partnership with over 800 spaces”)

- Value proposition slide (“Why they choose Gable”)

- Case study slide No. 1

- Case study slide No. 2

- Business model slide

- Market-size slide (“TAM”)

- Go-to-market slide (“Scalable process”)

- Marketing slide (“Massive channel opportunity)

- Product road map slide

- Thank you slide

Three things to love

Making the business of shared workspaces easier for startups certainly has its challenges, but it’s also a large and growing market. Gable weaves its story together with ease.

A problem worth solving

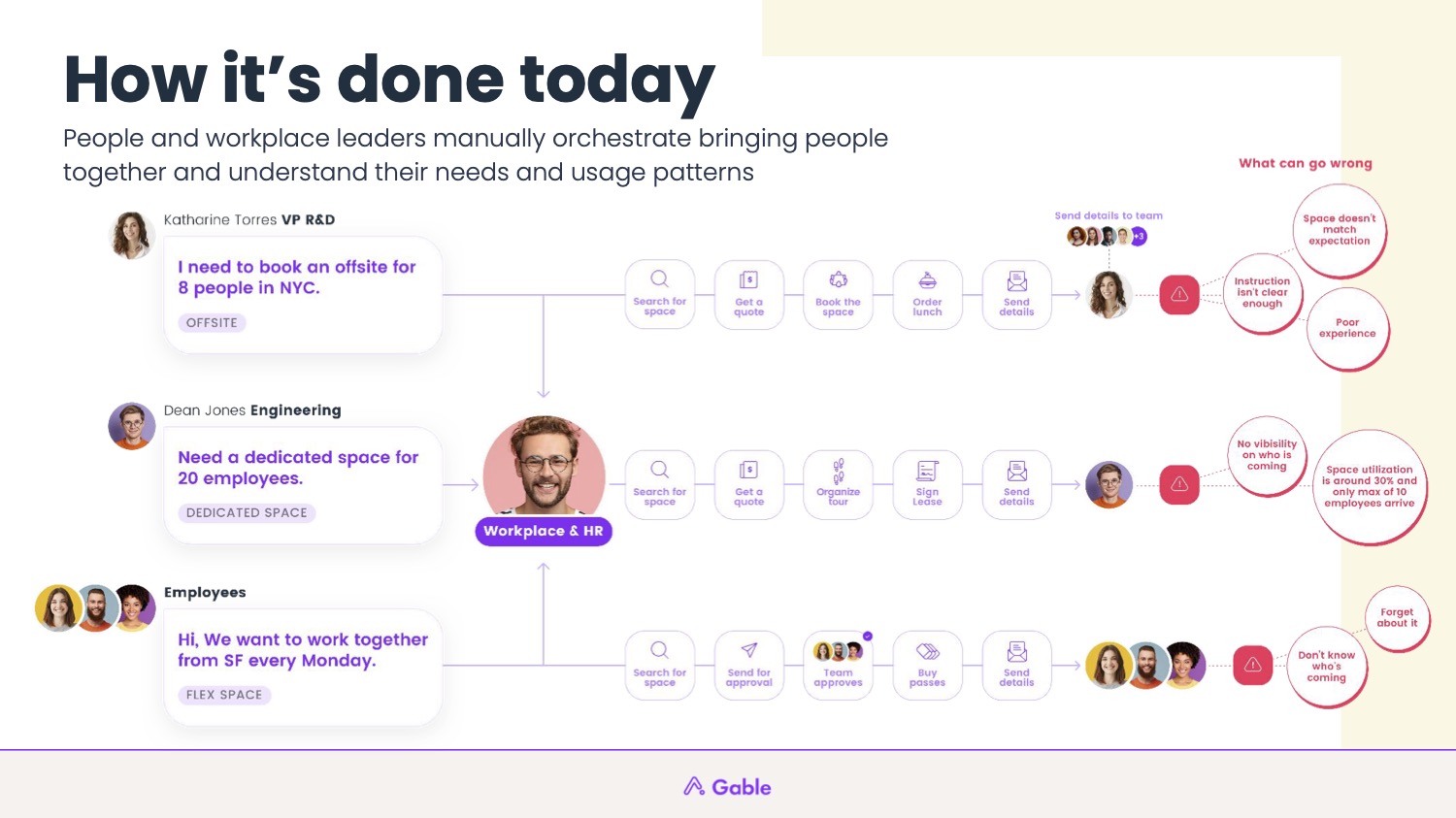

[Slide 5] I’m getting PTSD just looking at this. Image Credits: Gable

All of these are important metrics in a company that’s running on marketplace economics, but it’s crucial for the investors to understand the shape of the growth.

One of the big issues with telling a fundraising story is to illustrate that you have a problem that is truly worth solving. Gable does a good job here, illustrating all the potential hurdles companies might come up against when planning events.

In particular, the thing that works well on this slide is that it breaks down how different user groups all have similar issues that have different effects. The “what can go wrong” bubbles on the right are particularly well done: I’d hazard that most investors have come across each of these issues and felt the pain of something not going as planned.

The company explains the problem in this slide, and on Slide 6, Gable shows the potential impacts: “Hours spent on operational time,” “multiple invoices,” “an average of 50% overspent” and “no track on feedback” are among the things listed. This does a good job of explaining an almost universal problem that can affect time, efficiency and cost.

Excellent traction

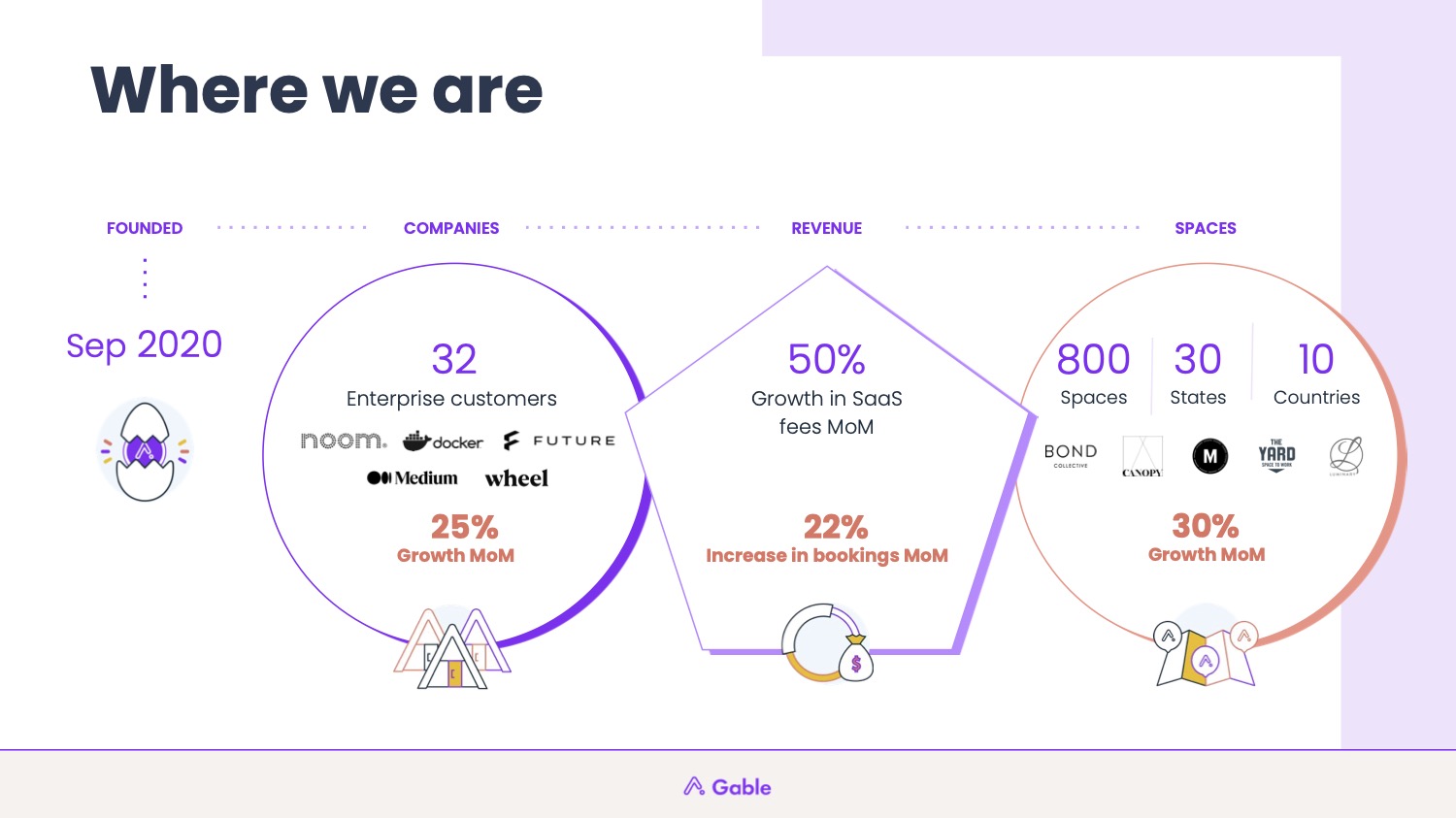

[Slide 8] Great traction trumps everything. Image Credits: Gable

The slide isn’t perfect, though: Presenting growth as a chart instead of numbers might’ve been even more impactful. It better illustrates how things are accelerating or slowing and offers more clarity around a company’s trajectory.

Reporting what is presumably a monthly recurring revenue as “Growth in SaaS fees” is unclear. As an investor, I’d probably want to dig in there a bit more, especially when the company reports 50% fee growth but 22% bookings growth, 30% spaces growth and 25% companies growth.

All of these are important metrics for a company that’s running on marketplace economics, but it’s crucial for the investors to understand the shape of the growth. In other words: Is it accelerating? Stable? Slowing? Is it different on each leg of the stool? How is the company shaping its growth?

Top level, these figures are great, but adding an appendix that digs into the metrics a bit further would’ve gone a long way.

Gotta love a simple business model

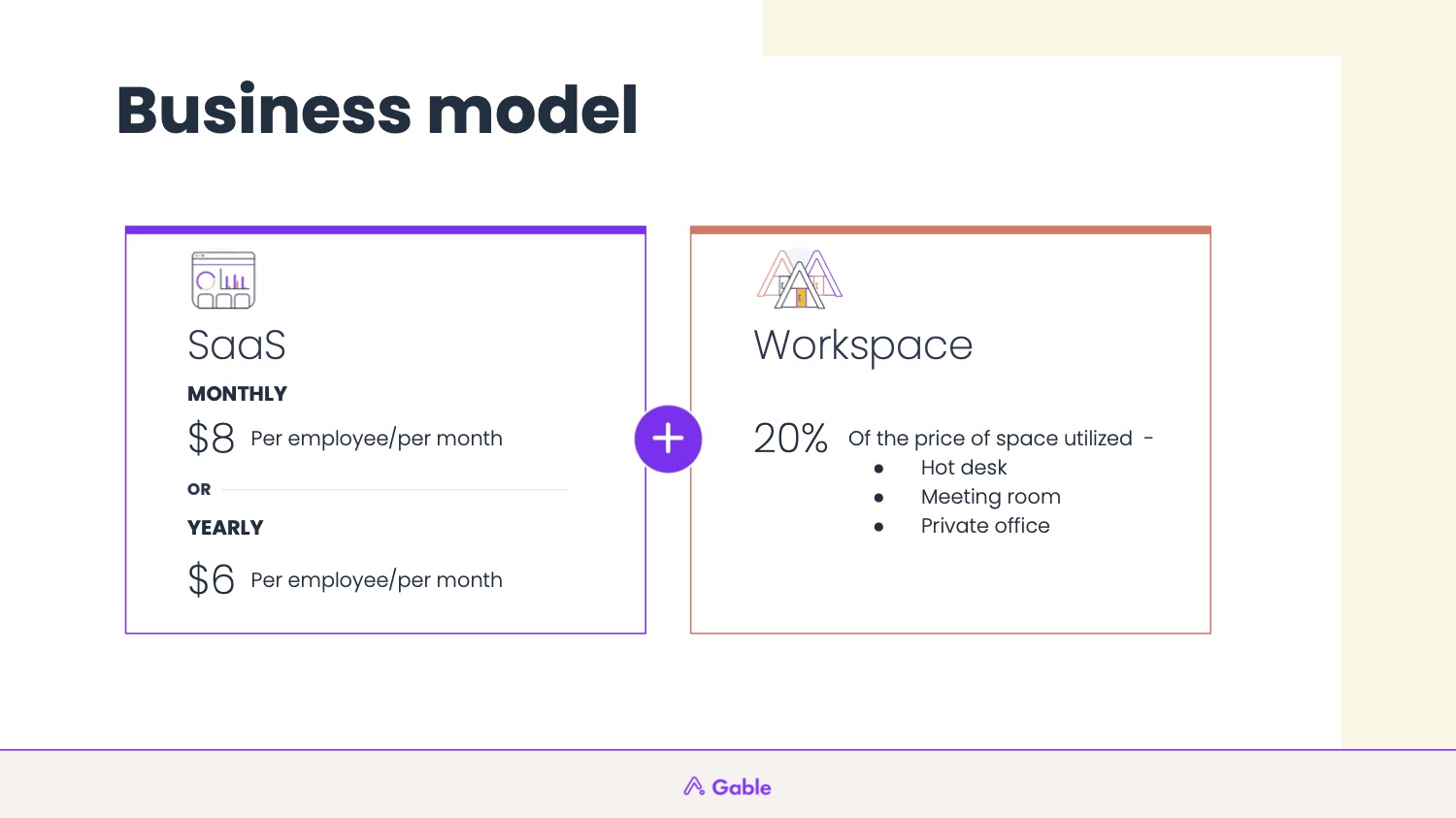

[Slide 16] Simplicity for the win. Image Credits: Gable

Gable is a deceptively complex business. If you squint, it looks like a three-sided marketplace, where the users (i.e., employees) are one part of it, the customers (i.e., the companies using the platform) and the workspaces all have an interest in its success. I’m very happy I’m not in charge of growth for this company is what I’m saying.

But the business model is poetically simple: $8 per month per employee. Get a 25% discount if you pay annually. Charge the workspaces a 20% finder’s fee for the business you refer its way. It’s visually interesting and quickly explains that Gable’s figured it out and is innovating.

Three things that could be improved

There are a lot of things worth celebrating about Gable’s deck, and it does a good job of walking through the challenges. But the deck isn’t perfect.

Why is this the right team for the job?

[Slide 2] Why are these the right people for the job? Image Credits: Gable

Opening with your team slide is a bold move: The team is one of the most important parts of your deck, and investors are going to want to see that you have collected the best bunch of humans to take this company to the next level.

This slide, however, doesn’t do that. There’s no context given about who these people are. How long has the team been working together? Why are they uniquely positioned to run this company? What skills do they have that can de-risk the company in any way?

For the company’s founders in particular, highlight what makes them a good fit, whether that’s a technology fit, a market fit or that they have past experience that gives them an advantage over the competition.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

You don’t have to jam all this information onto the slide, of course. You can link everyone’s name to their LinkedIn profile or write a couple of bullet points to describe the person’s function and why they’re there.

Wait, what’s your market size?

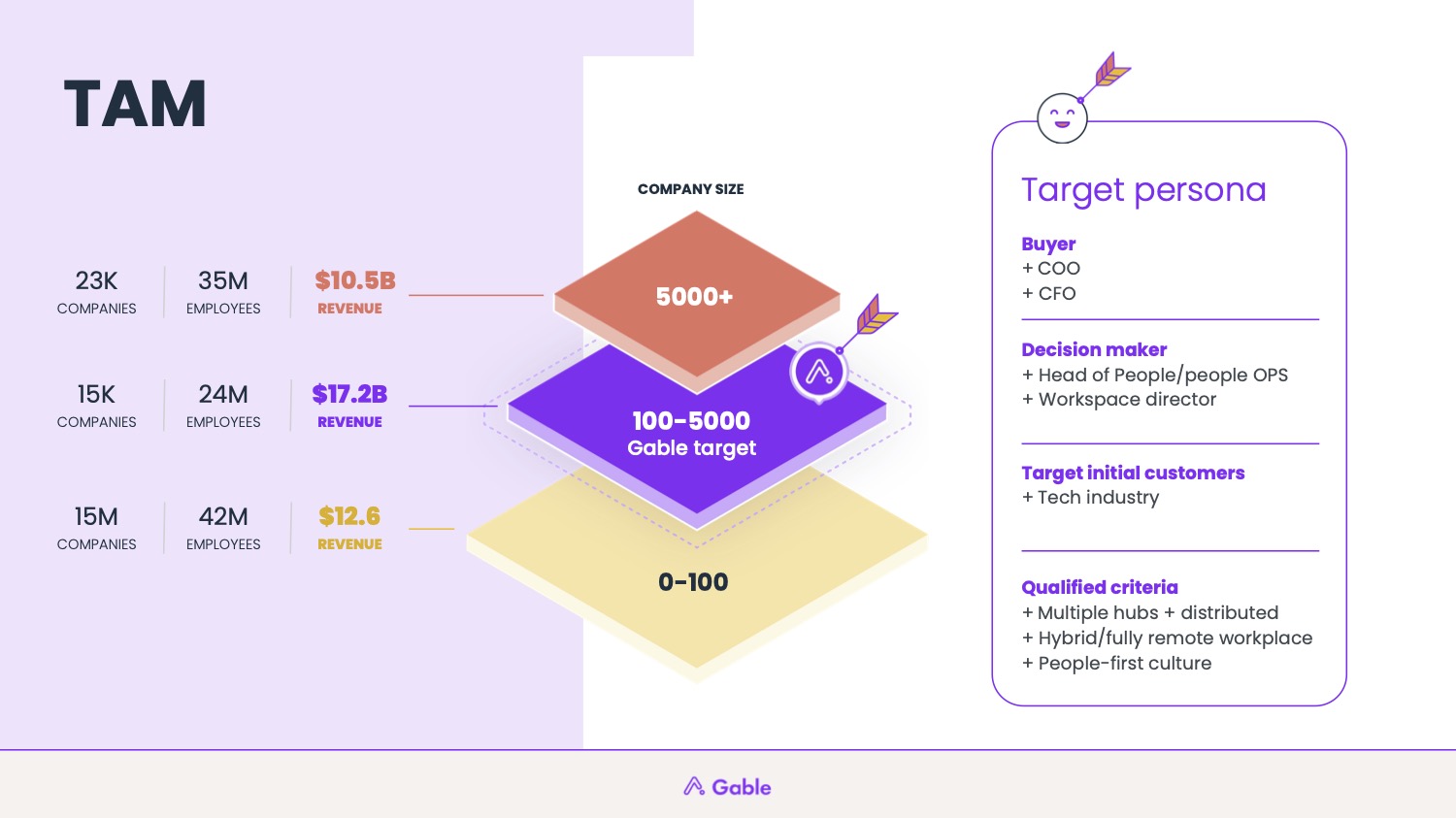

[Slide 17] This is a confusing slide. Image Credits: Gable

Showing just your total addressable market is confusing, especially if you’re not explaining what those numbers represent. There are 15,000 companies … where? Globally? In English-speaking countries? In the U.S.? In the target markets? If so, what are the target markets?

The other gotcha here is that the company is showing three different TAMs — which could easily be combined into one top-level TAM. Then you could break that down into a serviceable addressable market (for example, companies with 100 to 5,000 employees) and serviceable obtainable markets (a subset of the markets Gable serves).

Gable could have benefited from splitting this slide into two or three. That way, it could wrap a narrative around the TAM/SAM/SOM and its beachhead audience, together with go-to-market plans, in a more coherent way.

A good rule of thumb: Investors will usually only remember one or two points per slide, if you’re lucky. Be sure each slide highlights the exact point you want to make.

So, erm, whatcha gonna do with the money?

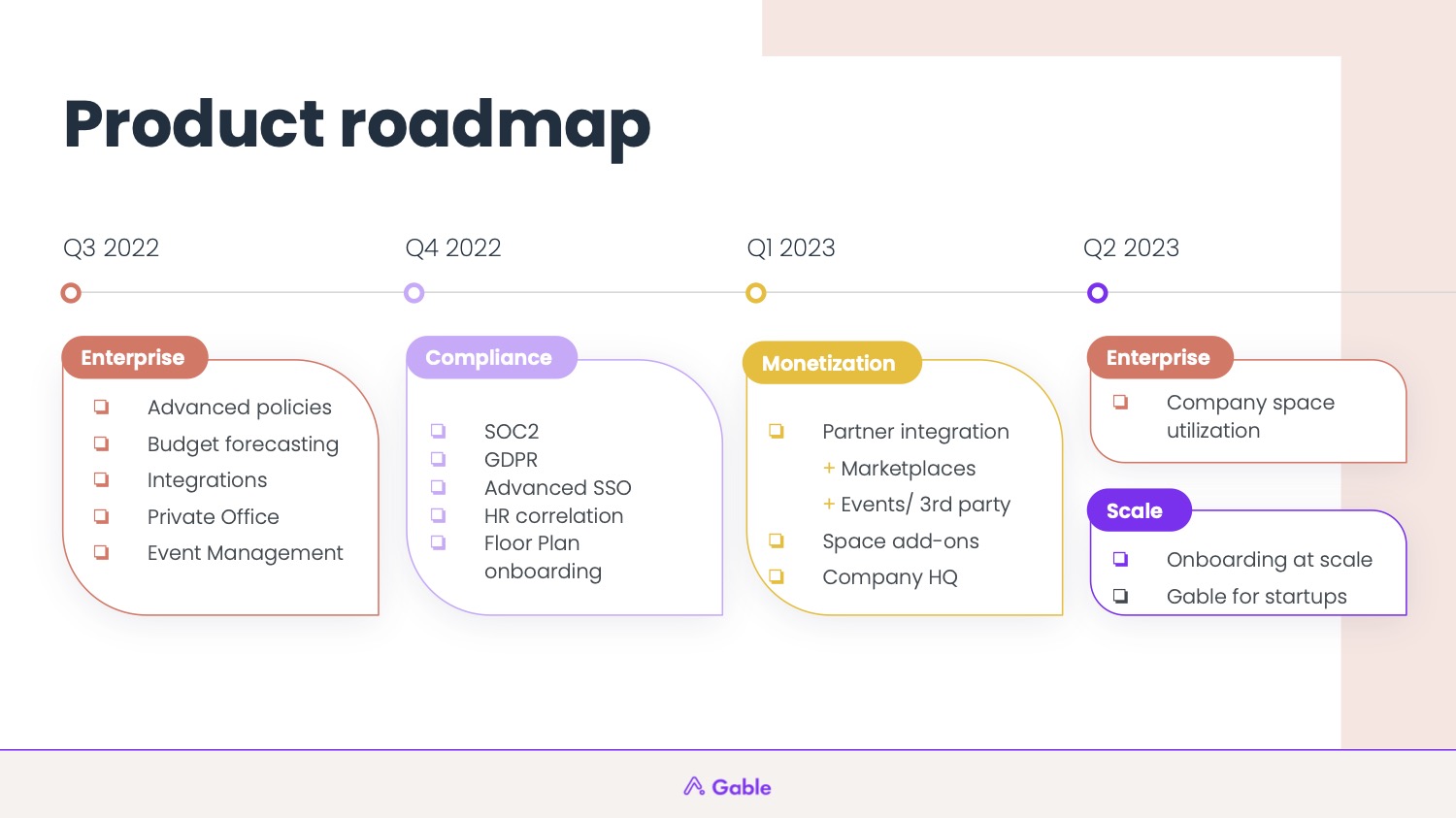

[Slide 20] This is the only forward-looking slide. Image Credits: Gable

Slide 20 is a product road map, and the product is a crucial aspect of the business. However, investors don’t invest in products; they invest in companies, and there’s very little here that explains how the founders see the future of the company and the market it’s operating in.

Gable could’ve included target milestones the company plans to hit over the next 18 months and perhaps tied those milestones to expenditure. An operating plan and a good “ask” slide are one way to go about that, but there are other storytelling techniques that could work well, too. It may feel a little risky to put projections on a slide deck, but great operators know how to mitigate risk, and investors at this stage understand that nobody can accurately predict the future.

A defendable plan is a great opportunity to shine. It shows that you have a firm grasp on what it will take to grow the company, and it shows off your skills as founder, with strong operational acumen to boot.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!