AeroCloud, a cloud-native airport management software startup used by dozens of airports across the world, has raised $12.6 million in a Series A round of funding.

Founded out of Chester, U.K., in 2019, AeroCloud says that it’s already working with Manchester and Eindhoven airports in Europe, while in the U.S. it counts Tampa International and John Wayne Airport as customers, processing some 150 million passengers each year across the board.

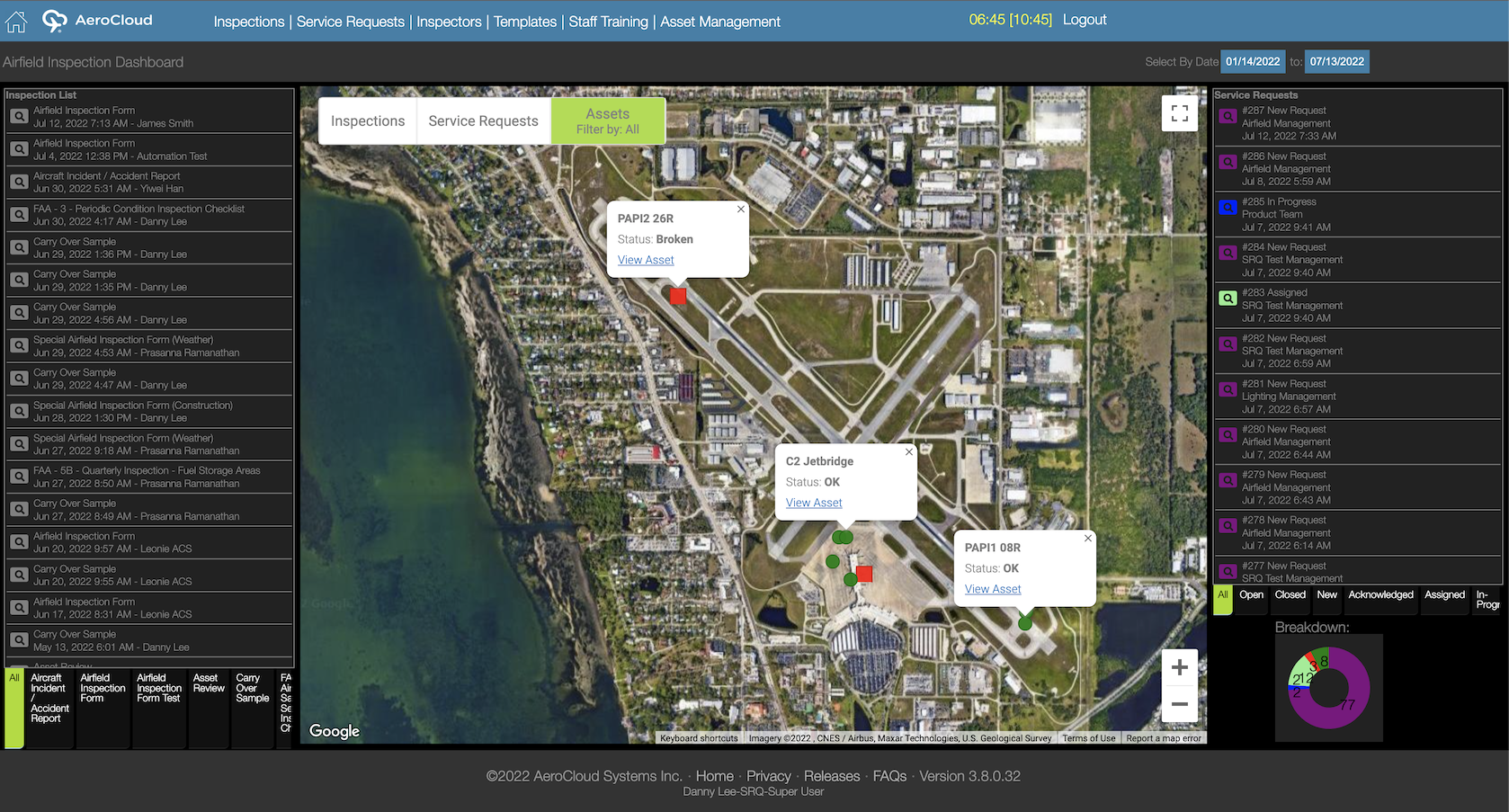

At its core, AeroCloud promises all stakeholders access to data via the cloud, with features that support common airport use cases such as automated gate allocation for flights and optimizing spare gate capacity to increase revenue.

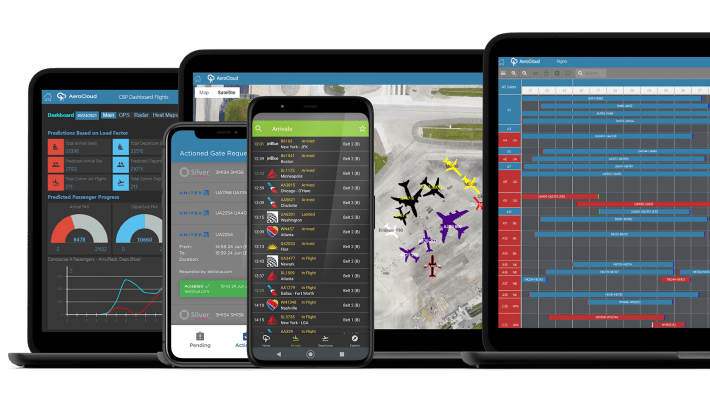

The AeroCloud platform. Image Credits: AeroCloud

The company also says that it taps machine learning smarts to serve its customers with forecasts using historical data, such as estimating passenger numbers for a specific time of year.

“By introducing AI and machine learning into our intelligent airport management system, we are allowing airport operations teams to plan less and action more,” AeroCloud co-founder and CEO George Richardson explained to TechCrunch. “Airports have a set of tasks requiring varying degrees of human interaction on a day-to-day basis. With AI, we can reduce that cognitive load on individuals and teams, and assist with freeing up an airport’s time to focus on other priority challenges.”

The AeroCloud platform also meshes key data such as what percentage of passengers are currently boarded on a specific plane and when it’s due to depart, allowing it to predict whether the plane is likely to leave on time. Additionally, it can automatically reassign gates to inbound planes if its scheduled arrival gate has a delayed plane still sitting there.

“These scenarios are happening 100 times a day for customers of ours, and the AI can always beat the human head to a solution,” Richardson added.

On the surface, the airport management software market might seem a somewhat niche vertical, but Richardson points to the data to highlight the potential for a new player in the space.

“You may see a niche in terms of the number of airports there are in the world, but the potential of the niche is significant — we see a market worth $20 billion,” Richardson said, citing figures garnered through internal competitor data analysis. “For example, in the U.S. alone there are 508 commercial service airports and 3,500-plus non-commercial service airports. We have products to fit most of these customers. However, that’s not even the exciting part — the really exciting part is when we reach a critical mass of customers on our system we will have created a network of airports to communicate and share valuable information with one another.”

Cloud-native

The airport management software space includes legacy incumbents such as Amadeus and SITA, but as with just about every young upstart looking to supplant the long-established status quo, AeroCloud touts its cloud-native credentials as a major selling point for would-be new customers.

“Large airports currently rely on systems from our competitors, originally built in the late 80s,” Richardson said. “This software has barely changed since then — they are static and not in the cloud. Like with many overlooked and underserved industries, airports are extremely challenging environments to enact change, with lots of layers of management and perceived risk at the board level, which is why they’re still relying on old-school software.”

The problem, according to Richardson, is that many of the on-premises legacy solutions don’t make it easy to access data, instead promoting data siloes through homegrown tech stacks. This is problematic in an airport environment that often needs to act quickly to support any number of fluid scenarios. With diverted planes, for example, where an aircraft in the vicinity needs somewhere to land quickly to due to an emergency, this involves multiple players from different departments spanning gates, customs, passport control, baggage handlers and all the rest.

Getting everyone on the same page, with access to all the same data and insights, saves a lot of manual spade work.

“Previously this would have been done by the operations team calling around the airport and getting everyone in line,” Richardson said. “Yet with AeroCloud, we know and inform all stakeholders the second the FAA marks the flight as an inbound diversion. The platform can let all teams know exactly what is taking place and remind them of the protocol automatically. This is not just powerful because it means everyone knows what’s happening, it’s powerful because now your operations team can concentrate on their job, instead of being the informer and chasing everyone around to get ready.”

If any evidence was needed that the public cloud is very much where it’s at in 2023, Amadeus, a $25 billion AeroCloud competitor, recently announced plans to take itself to the cloud as part of a three-year modernization effort.

Prior to now, AeroCloud had raised around $3.4 million, and with another $12.6 million in the bank the company said that it will use the new funding to expedite its expansion plans and continue its push to “displace lethargic incumbents.” More specifically, AeroCloud is gearing up to double its headcount to 80 through 2023 across its hubs in the U.K. and U.S., and is aiming to grow its customer base to more than 100 — up from 42 today — by the end of the year.

“We may deal mainly with passenger airplanes now, but we believe the addition of booming cargo air traffic post-COVID and the introduction of drones in the next 5-10 years time will also benefit from our network and this data,” Richardson said.

AeroCloud’s Series A round was led by U.S. VC firm Stage 2 Capital, with participation from Triple Point Ventures, I2BF Global Ventures, Praetura Ventures, Playfair Capital, Haatch, and Starburst Ventures.