My heart sinks when I talk to a startup founder who proudly declares having a customer base that’s grown to 1,000 people organically. Being scrappy and frugal are great qualities to have as a startup, but your investors will want to see that you know how to scale rapidly when necessary.

If all of your growth so far has been organic, you might not know how to accelerate the business. After all, you wouldn’t even have a benchmark for what it costs to acquire new customers.

You don’t know how much money you need to raise. At best, that makes you look like an inexperienced founder. At worst, it’ll torpedo the fundraise altogether.

Startups typically raise money for at least one of three reasons: to hire a bigger and better team, to invest in development or to scale growth. Your “ask” slide will outline the milestones you need to hit for the company to reach its next phase, and your operating plan will lay out how much money you need to invest in order to achieve those goals.

Without knowing how much it costs to acquire customers, you can’t know how much money you’ll need to grow the company, which means you don’t know how much money you need to raise. At best, that makes you look like an inexperienced founder. At worst, it’ll torpedo the fundraise altogether.

But it doesn’t have to be this way. By being thoughtful about how you gather this data, you can prove to your investors that you know how to scale when the time comes.

There are cheap and even free ways of acquiring customers (press coverage, SEO, content marketing, word of mouth), but those acquisition channels are slow and unpredictable. The cost to acquire new customers will depend on your audience, your market, and whether you’re operating a direct-to-consumer or a business-to-business company. Figuring out which marketing channels work best for your business and your messaging is critical, and founders often underestimate how difficult it can be to get this right.

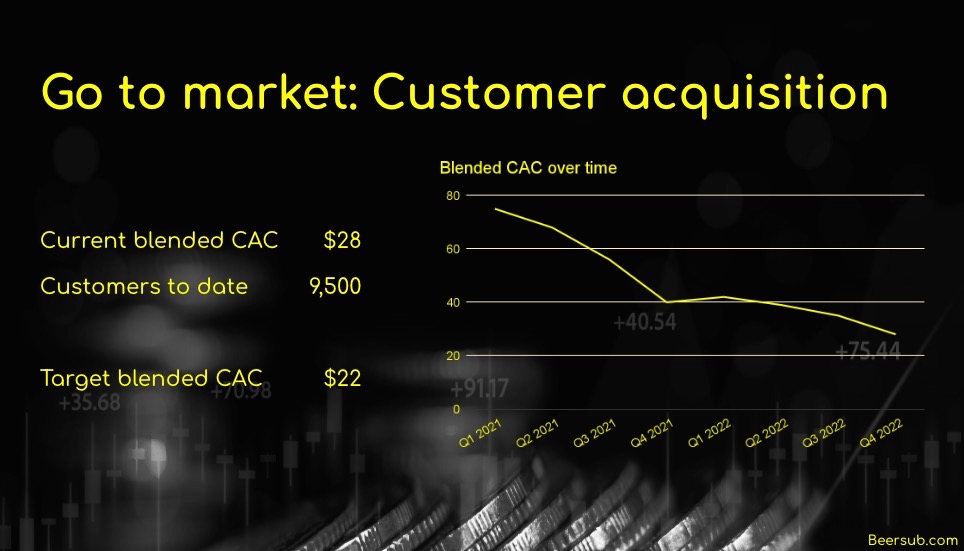

Investors will want to know that you have a solid go-to-market plan, including having a good grip on customer acquisition channels and per-channel customer acquisition costs (CAC). Not all channels are scalable and affordable, which over time can reduce acquisition costs, especially those channels that scale predictably.

Being able to show how your CAC evolves over time is a particularly useful indicator that you’re in the thick of your customer marketing experiments.

Our fake company BeerSub is showing its fake customer acquisition trends. Image Credits: Haje Kamps

Blended CAC is all your customers acquired divided by all your acquisition channel costs. Essentially, it’s cost per customer, but it includes all the word-of-mouth referrals and virality that are built into the product.

That’s a good top-level number to monitor, and it’s probably the most honest way of reporting your CAC overall, but it does hide some information as well, especially if you have bursts of press coverage that can lead to a large number of signups without a per-customer cost associated.

This level of detail is usually enough for your first pitch meetings, but another slide that is helpful to have handy — one for the appendix, perhaps — is a breakdown of your acquisition cost by channel:

Let’s see, how do we scale this thing? Image Credits: Haje Kamps

Getting to a benchmark

Having a benchmark is the first step to knowing how much it costs to acquire new customers. You can do that easily by running some experiments — for example, very targeted Facebook ads — to at least give you some idea as to what your benchmark CAC might be.

One tried-and-true version of running an experiment is the $5,000 in five weeks experiment. It goes as follows:

- Come up with three simple display ads.

- Target them at three super-specific Facebook audiences.

- Let the campaign spend $1,000 over the course of a week.

- Take the best-performing ad and create three new versions of it.

- Take the best-performing targeting and tweak it into three new versions (new locales, new target demographics, etc.).

- Repeat the experiment five weeks in a row.

It isn’t perfect, but at least it gives you a rough idea of where your starting point is. The more you spend per week, the less “noisy” the data will be, and the better your benchmark will be.

Of course, the above only applies if you are running a company where advertising directly to your customers makes sense. If you’re doing B2B sales, you’ll probably need a sales team to make sales, and the numbers will flow from that. Your sales team will come at a cost, and you can use that cost to calculate a cost-per-sale.

It’s up to you if you include the sales team’s salaries or only their commissions as a direct cost of customer acquisitions (there are arguments for doing either). Remember that when it comes to B2B sales, the revenue per customer tends to be much higher as well. On the bright side, as long as you can explain to your potential investors where you will get your sales leads and how those convert into paying customers, there is likely to be a lot less focus on the exact CAC figures than for a B2C company.

In any case, you’ll want to think through what your sales funnel looks like before you start thinking of raising money. It’s a critical part of your overall business plan, and investors will want to know that you have a handle on it.