Back in August, our own Ron Miller covered the $6 million seed round of Spinach, a company that’s building out its meeting tool designed specifically for engineers using agile methodology to run stand-up meetings online.

It caught my eye at the time: There is no shortage of meeting tools, and I was curious about what made the company stand out. Today, our itch gets scratched: Spinach shared its pitch deck with TechCrunch for a closer look.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

If your team isn’t the best it can possibly be, then throw the team slide somewhere in the back of the deck and let your traction do the talking.

Spinach raised its round with a tight 10-slide deck that’s missing some important information (we’ll get back to that in the “Three things that could be improved” section), but the included info is extraordinarily well laid out and organized. The team says it submitted the deck exactly as it was used in its investor pitches.

- Cover slide

- Team slide

- Problem slide

- Mission slide

- Product slide

- Traction slide

- Customers slide

- Investors slide

- 18-month plan slide

- Thank you slide

Three things to love

I love the 10-slide deck’s brevity; I think they could have raised money with just two or three slides, so let’s start with the strongest one:

Traction, traction, traction

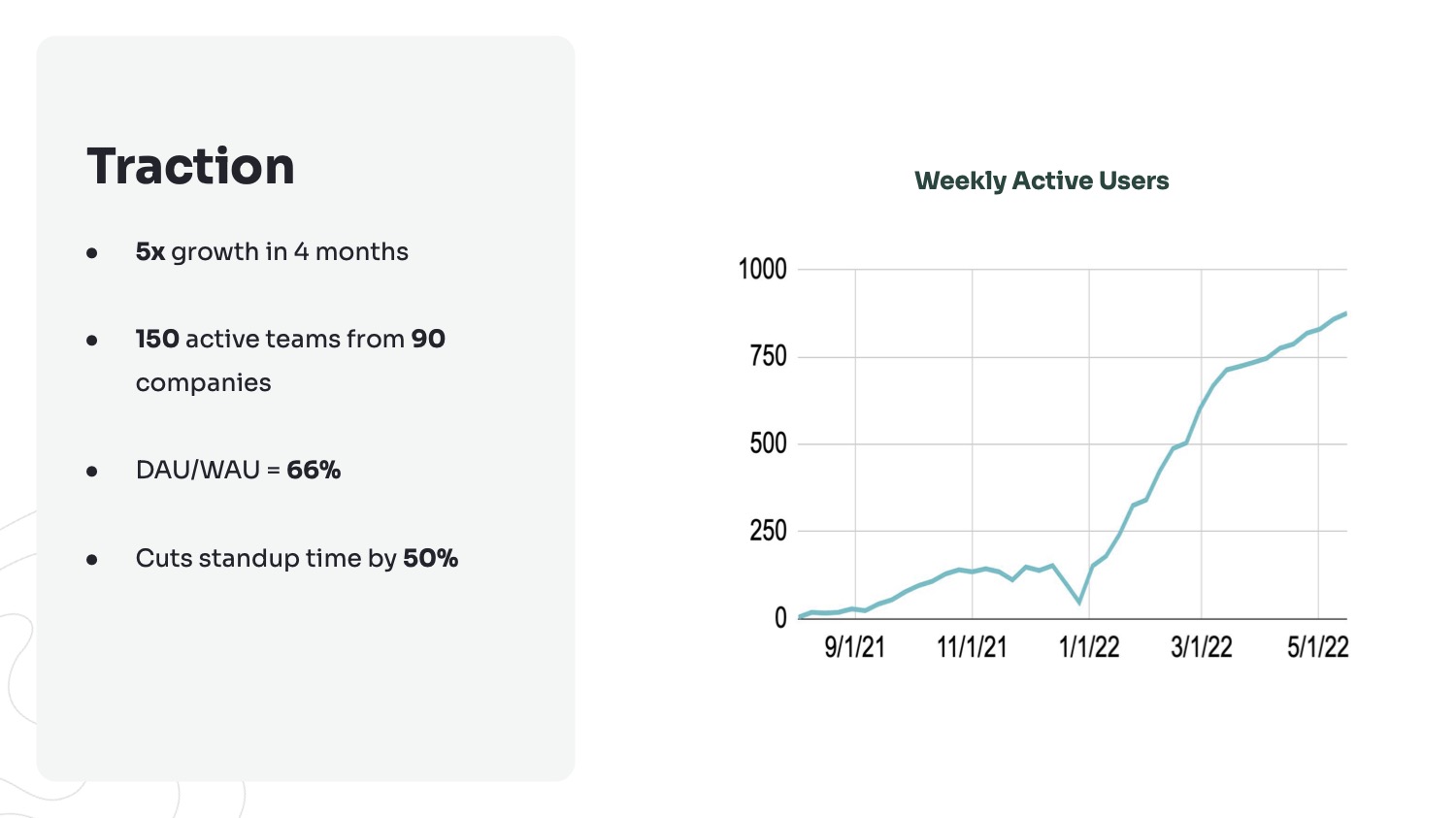

[Slide 6] The Spinach traction slide is a beast. Image Credits: Spinach.io

Now, the growth is impressive, but it isn’t exponential. Beginning in early March 2022, it flattened out a little, and as an investor, I would want to dig into why that might be.

The other potential gotcha here is that the company is graphing weekly active users. That’s an important graph, of course, but the company fails to tell the story of its business model. In other words, from the deck alone, it isn’t clear whether active user numbers are directly tied to revenue (checking out the company’s pricing page, however, it seems that it is, which makes me wonder why it doesn’t just graph revenue here).

Still, traction is traction, and if the revenue growth is in the same general ballpark as the daily and weekly active users, I’m unsurprised to see the company raised money.

The thing you can learn from this slide as a startup is to really lean into your metrics. If you’ve got ’em, flaunt ’em.

Great mission and solution

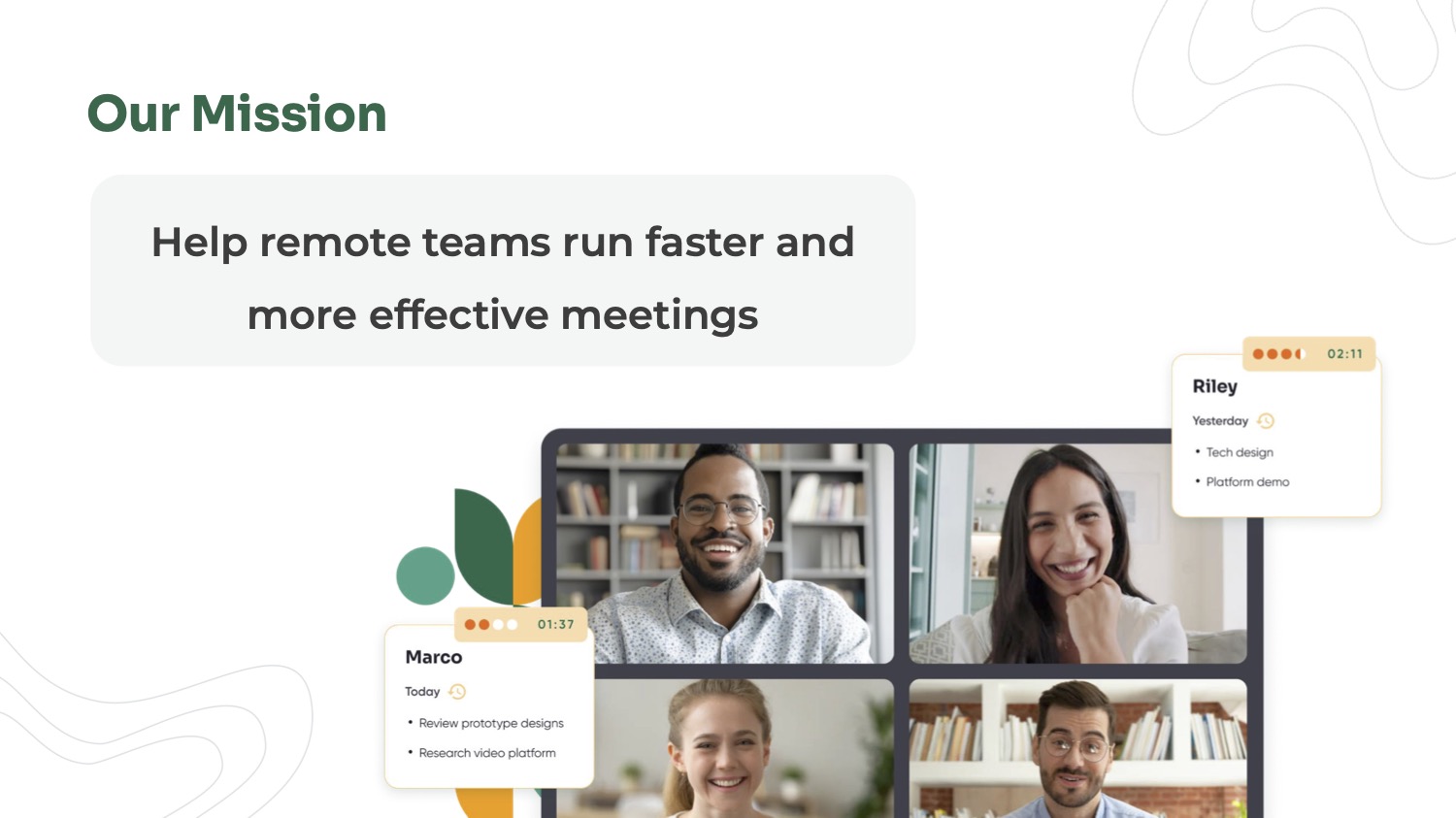

[Slide 4] That’s how you set a mission. Image Credits: Spinach.io

It’s not hard to imagine that Zoom might make changes to its platform that put Spinach’s business model at risk.

Spinach’s mission slide is basically its “solution” slide as well, and it very clearly states the reason for the company’s existence: helping “remote teams run faster and more effective meetings.”

I’d nitpick a little here, because the product (for now) is focused on integrated design and development teams running the scrum process — there are many other teams that work remotely for whom this product may be a less perfect fit — but I love the clarity of this.

As an investor, I’d be curious as to what the company is planning: Will it be broadening its focus to serve all remote meetings, or will it further narrow its goals to be an even better tool for scrum teams? What I wouldn’t have given to have a tool like this when I became a certified scrum master back in 2007.

This slide shows that it’s OK to simplify. Yes, it might be a little vague, but that might be necessary to make the story flow more easily and to help potential investors understand the direction you’re going.

Interesting take on the product slide

[Slide 5] Spinach embedded a video in its presentation rather than doing a live demo. Image Credits: Spinach.io

If you’re going to raise $6 million, you should spend the extra few hours to cut a video that speaks directly to the investors. It’s a small but important thing.

Finally, there’s a red flag built into the core of the company. It is essentially an extension for Zoom, which is an inherent risk. Now, it’s unlikely that Zoom will build Spinach’s features into its core platform, but it’s not hard to imagine that Zoom might make changes to its platform that puts Spinach’s business model at risk. Not a huge risk for Spinach specifically, but my general advice stands: Build a company, not a feature.

In the rest of this teardown, we’ll take a look at three things Spinach could have improved or done differently, along with its full pitch deck.

Three things that could be improved

Where aaaare youuuu? Image Credits: Getty Images/MicroStockHub

There’s a lot of missing information for the deck to be complete, so let’s start there:

Include missing data

While I admire that the company distilled its story to 10 slides, it inevitably means that some important information has been left out. That’s not inherently a disaster, but some of these things are critical for investors to understand fully. It’s a way to confirm that the founders think about certain aspects of the business in a way that is compatible with the investors’ investment thesis.

Here are a few nudges for the company:

- Where’s your competitor slide? A company like this will definitely have competitors. You need to talk about them, especially what they do well and how you are different. And before you ask: Nope, there’s no such thing as “we don’t have competitors.”

- What’s the market and its size? If the market isn’t big enough, the investment isn’t venture-sized. And if that’s true, it doesn’t really matter how good your company is (even incredible traction right now can’t save you if the max market is small). The deal will fail in due diligence if your market isn’t big, well defined and (ideally) growing.

- Why no business model? The deck is missing information about how the company will make money and where it gets its customers. That’s not great, especially for a SaaS business; having good customer acquisition costs and a high LTV should be the goal. You should have these numbers, and if you don’t, get them. If they’re bad, show them anyway, along with a plan for how to improve them.

- What’s your go-to-market strategy? Related to the above, there are a thousand different ways to bring a company to market. Some will be tried-and-true, while others will be more experimental. Show your work: How are you going to get your first 10,000 customers on the platform? What are your marketing channels? Where’s your geographic focus, etc.?

- Why now? There’s usually a reason why a company can exist now when it didn’t three, five or 10 years ago. Scrum product management, as well as SaaS companies, have been around since the 1990s. I suspect that the pandemic has something to do with how Spinach came to be, but that’s all the more reason to mention it: How can Spinach survive in a world where people start to go back to offices?

- Where’s your operating plan? The 18-month plan slide is pretty vague, which means that I wish there were a better “the ask” slide and a more comprehensive operating plan slide.

- How defensible is it? What about the tech can be protected, and how? That doesn’t apply to all companies, but if there are any patents, IP or a moat in some way, remember to shout about it. The absence of a “moat” slide is not a biggie, but it increases the risk of the deal — and funding rounds are all about staged de-risking.

That’s at least seven major and potentially important data points missing from the slide deck. That’s not great, given that the investors will need at least some of that data. If they have to ask for it and you’re caught flat-footed, you could lose control of the conversation.

There’s such a thing as too sparse

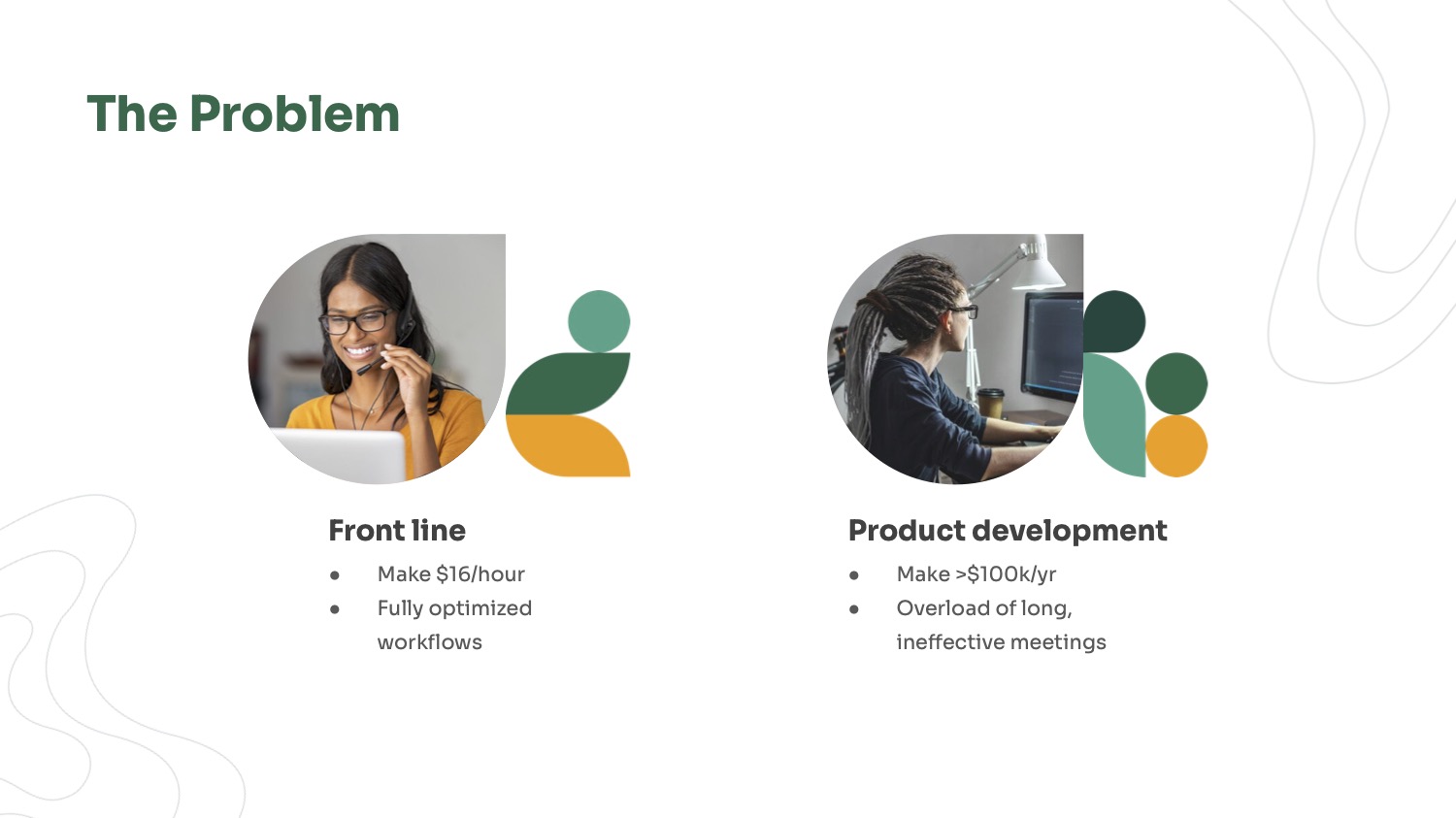

[Slide 3] The problem with the problem … Image Credits: Spinach.io

A slide has to work on its own, without a voiceover, because the audience may not have the benefit of you being there to talk about it and answer questions. If you can’t make one deck do all the heavy lifting for some reason, you may need a couple of decks to get through the fundraising process.

Help me understand why this is the perfect team

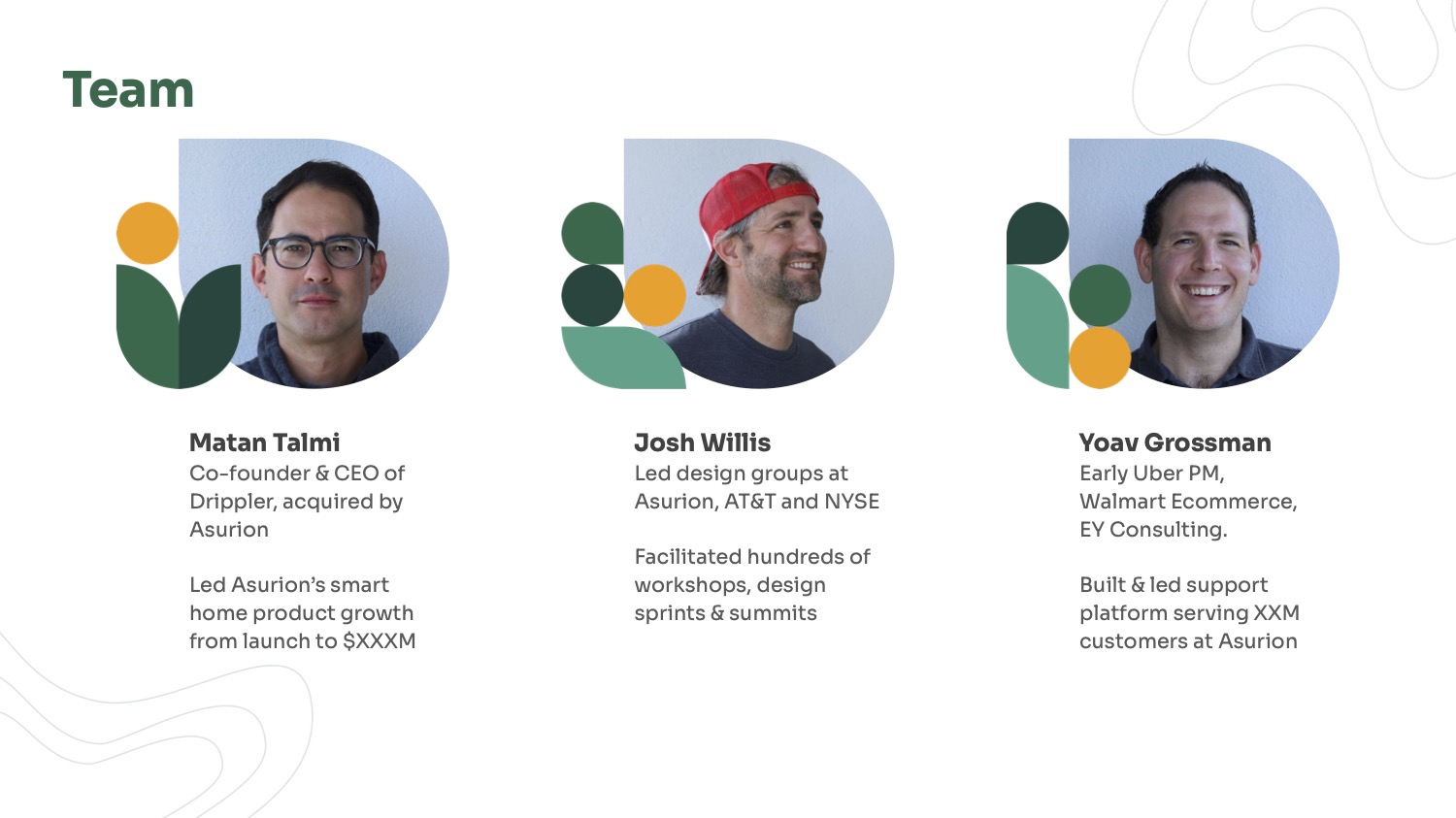

[Slide 2] Why are these the perfect humans to build this company? Image Credits: Spinach.io

The first thing I notice is that there aren’t any job titles. Not great; titles help investors map skill sets with job roles.

Matan Talmi founded Drippler, which was acquired for an undisclosed amount, My mind immediately jumps to “acquihire,” which is where a bigger company buys a smaller one to get its team. In the VC world, those are typically not great outcomes. He then led growth of a smart home product, which doesn’t immediately seem related to what Spinach is doing here. Before that, he had a number of tech jobs. In other words: Talmi has experience as an engineer and probably understands the problem well and has some startup experience. But there’s nothing about him that makes me go, “OMG, I have to invest.”

Josh Willis is listed as leading design groups for some big-name companies and facilitating workshops and summits. Neat, but it doesn’t make me jump up and down with excitement. His LinkedIn, however, shows that he was the co-founder of a virtual events platform. Given that Spinach has a video calling and collaboration component, it would seem that there’s a lot of overlap and potentially relevant knowledge. It seems curious that this isn’t reflected on the pitch deck.

Yoav Grossman’s description and LinkedIn profile suggest that he’s the getting-shit-done guy, but the mini-bio on this slide doesn’t really highlight that.

Overall, I’m left confused: Yes, these are three experienced people, but why this startup? Why not literally anything else? In terms of fundraising, it means that there’s no clear founder-market fit.

I’d have loved to see a founding team with deeper experience in selling SaaS products, perhaps, or building meeting tools, developer support products, or perhaps even scrum coaching training. I’m just spitballing here, but the risk I see as a potential investor is that if there’s nothing defendable about this company, and the inherent risk is that it wouldn’t be that hard to assemble a far-better-connected team with massive growth experience, hand them $10 million and out-compete this team.

As a startup, your team needs to be exceptional; investors see thousands of pitches per month, and a lot of the companies they talk to are truly extraordinary. If that’s true of your team, then highlight that on your team slide. And if your team isn’t the best you could possibly imagine, then throw the team slide somewhere in the back of the deck and let your traction do the talking.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!