There’s no shortage of tools for brainstorming, collaboration and keeping all your knowledge in one place. Still, judging from the number of new tools that come to market on a regular basis, it seems that people are frustrated with the available tools.

Scrintal recently raised $1 million to build its visual collaborative knowledge base tool and shared its deck for us to take a peek under the hood.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

- Cover slide

- Problem slide part 1

- Problem slide part 2

- Solution slide part 1

- Solution slide part 2

- Value proposition slide

- User testimonials slide

- Traction slide

- Revenue slide

- Retention slide

- User profile slide

- Growth projection slide

- Vision slide

- The ask slide

- Contact slide

- Appendices cover slide

- Appendix 1: Why now?

- Appendix 2: Competitive landscape

- Appendix 3: Product and growth model

Three things to love

Scrintal is entering a crowded and chaotic market; without really trying, I can name five or six well-established competitors in that space. The good news is that the company seems to know that and tackles its advantages head-on.

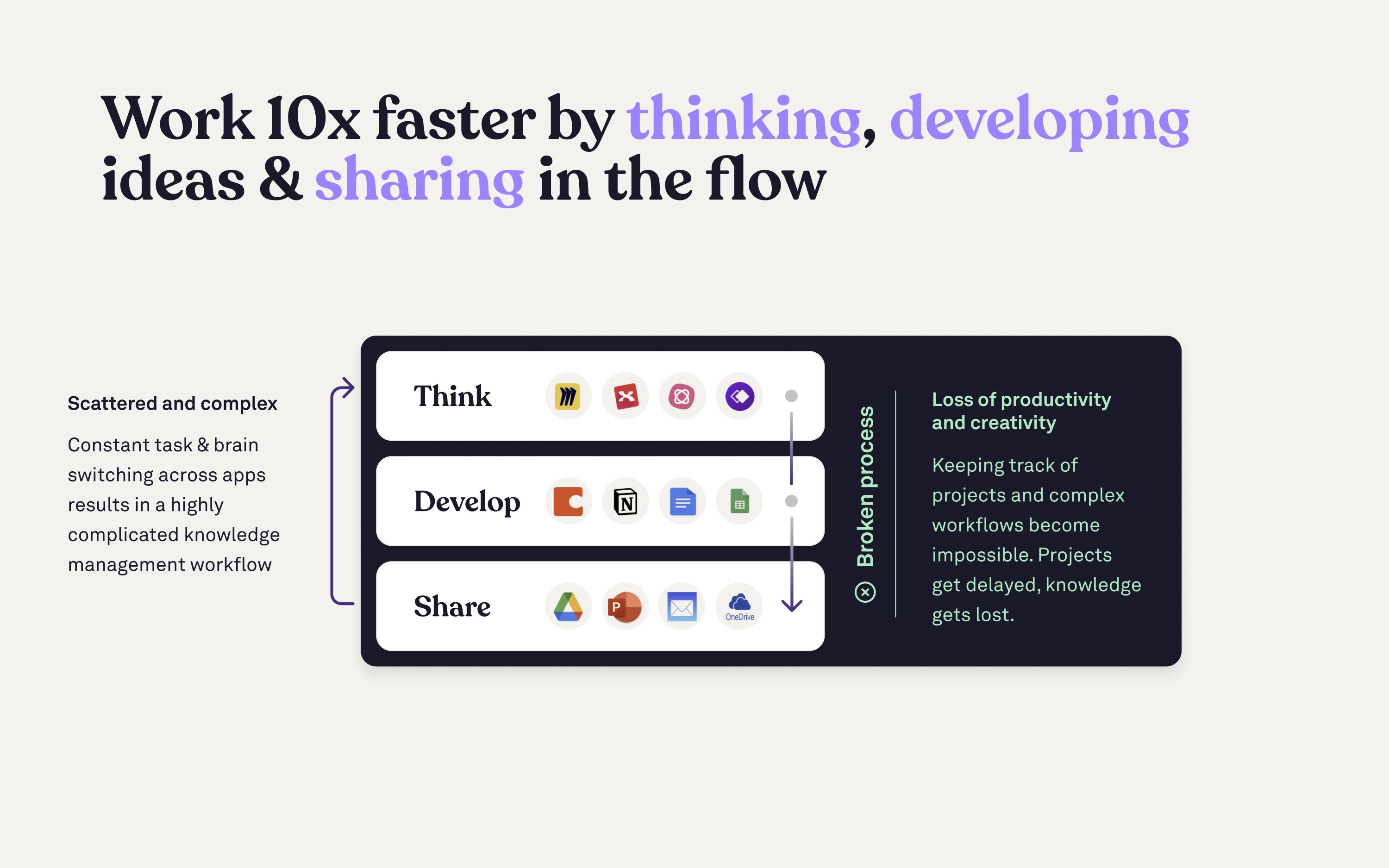

Clarity of value proposition

[Slide 6] Having a clear value prop helps tell the story. Image Credits: Scrintal

Storytelling to explain the benefits

[Slide 7] Scrintal does a great job at making its early customers do the bulk of the storytelling. Image Credits: Scrintal

The stats shown on the slide (66% fewer apps used, 50% less time spent, 30% fewer meetings) tell one part of the story. The headlines tell another. The quotes are helpful for filling out the story even further, and even doing a quick skim of the job titles of the people sharing the testimonials helps give an impression of the breadth of how the companies are able to draw benefits from Scrintal.

I presume that the places it says “user name” are redacted and that the “real” deck shows the names and businesses that are using the product, but even without that, it shows how well you can use testimonials and user interviews to your favor.

For startups, this slide is a lesson in how to think creatively about sharing your journey to date with potential investors.

I’m not in love with how much text there is on this slide — you wouldn’t want to use this for a presentation deck — but it’s a great slide for a send-home deck. It adds a lot of context and does so in a way that is super easy to understand even without a voice-over or additional information.

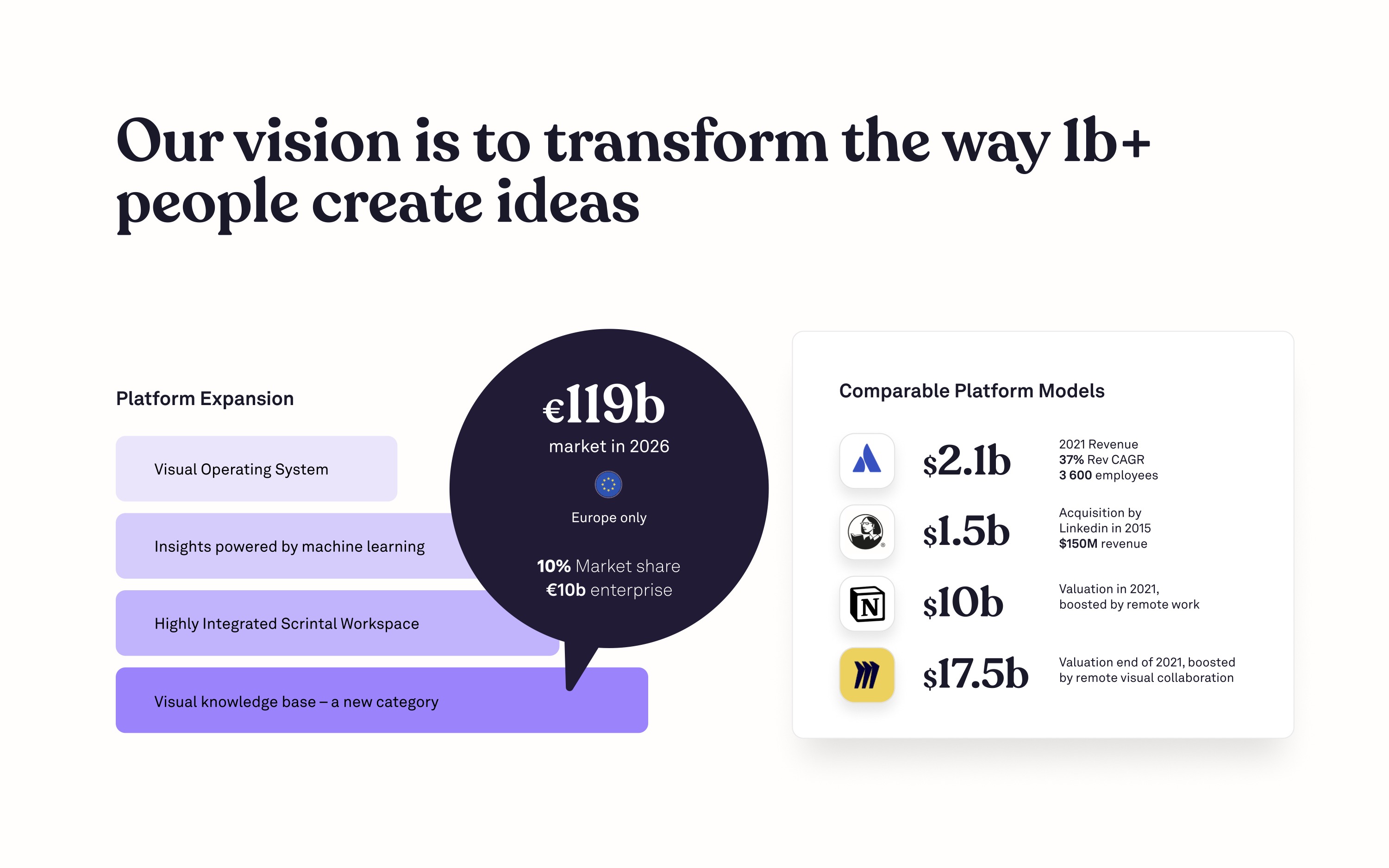

A bold vision

[Slide 13] Including a clear vision for the near future is helpful. Image Credits: Scrintal

(opens in a new window)

This slide isn’t a complete slam dunk, however, and there are a few things that could be improved. I wish the vision was clearer: “transform the way 1B+ people create ideas” is pretty fluffy. Yes, the company wants to transform it, but from what to what, and why? It’s also a little confusing to me why the company is talking about the European market only — it’s a big world out there, and the company’s pricing is in U.S. dollars, so seeing the “platform expansion” limit itself is confusing.

In the rest of this teardown, we’ll take a look at three things Scrintal could have improved or done differently, along with its full pitch deck!

Three things that could be improved

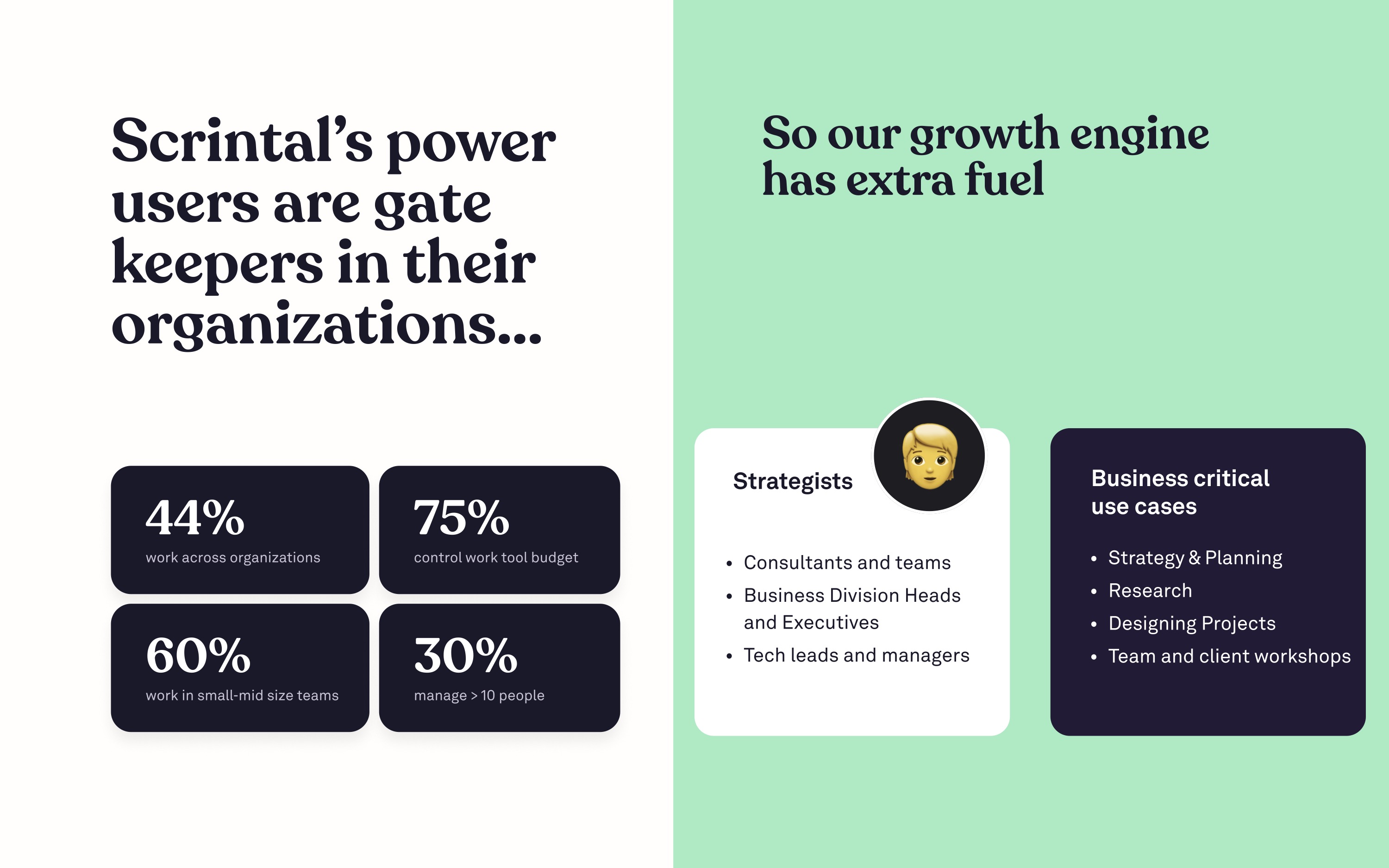

One of the big things investors are looking for when evaluating a startup is whether it is able to gradually de-risk what it is doing, stage by stage. A million dollars isn’t a huge fundraising round by most standards, and the company is likely at the earliest stages of its value-creation journey. That means that the deck needs to make something pretty clear: What is it doing in the current stage to prove some of its hypotheses? Sadly, the Scrintal deck is a little lacking on that front.

The company’s metrics are weaker than they should be

Here’s a challenge: Look at Scrintal’s full pitch deck below, and see which metrics might make you go “Yes! This is a great investment opportunity!”

[Slide 11] Makes sure your numbers actually matter. Image Credits: Scrintal

On Slide 8, it talks about how many people are on the waitlist, the percentage of which came from referrals and how many shares they have on social media. On Slide 12, the company mentions how much ARR it aims to reach by a certain date — but doesn’t list how it has grown to date. There are more examples, and I’ll leave it as an exercise for you to find them, but this does deserve a reminder: If you’re going to list numbers, make sure they actually matter, at the very least as a proxy for the success of the company, and ideally as an indicator for what the investor can expect. In other words: It’s time to banish vanity metrics; they’re worse than worthless.

As a startup, the thing you can learn here is the importance of getting a really deep understanding of why you are reporting what you’re reporting.

Where is your team slide?

Sorry about the stock image, but you illustrate the absence of a slide! Image Credits: benjaminec (opens in a new window) / Getty Images

As I wrote in my article about why the majority of VC deals fall apart in due diligence, at the early stages, investors are looking for three things: the right founders, in the right market, with the potential for a VC-scale exit. Moreover, data from Dropbox DocSend shows that 100% of successful decks include a team slide.

Your team is, by far, the single most important thing about a VC pitch. Having a bad team slide is almost a guarantee you won’t raise money. Having no team slide at all? Well, I don’t know what to tell you. Don’t make this mistake.

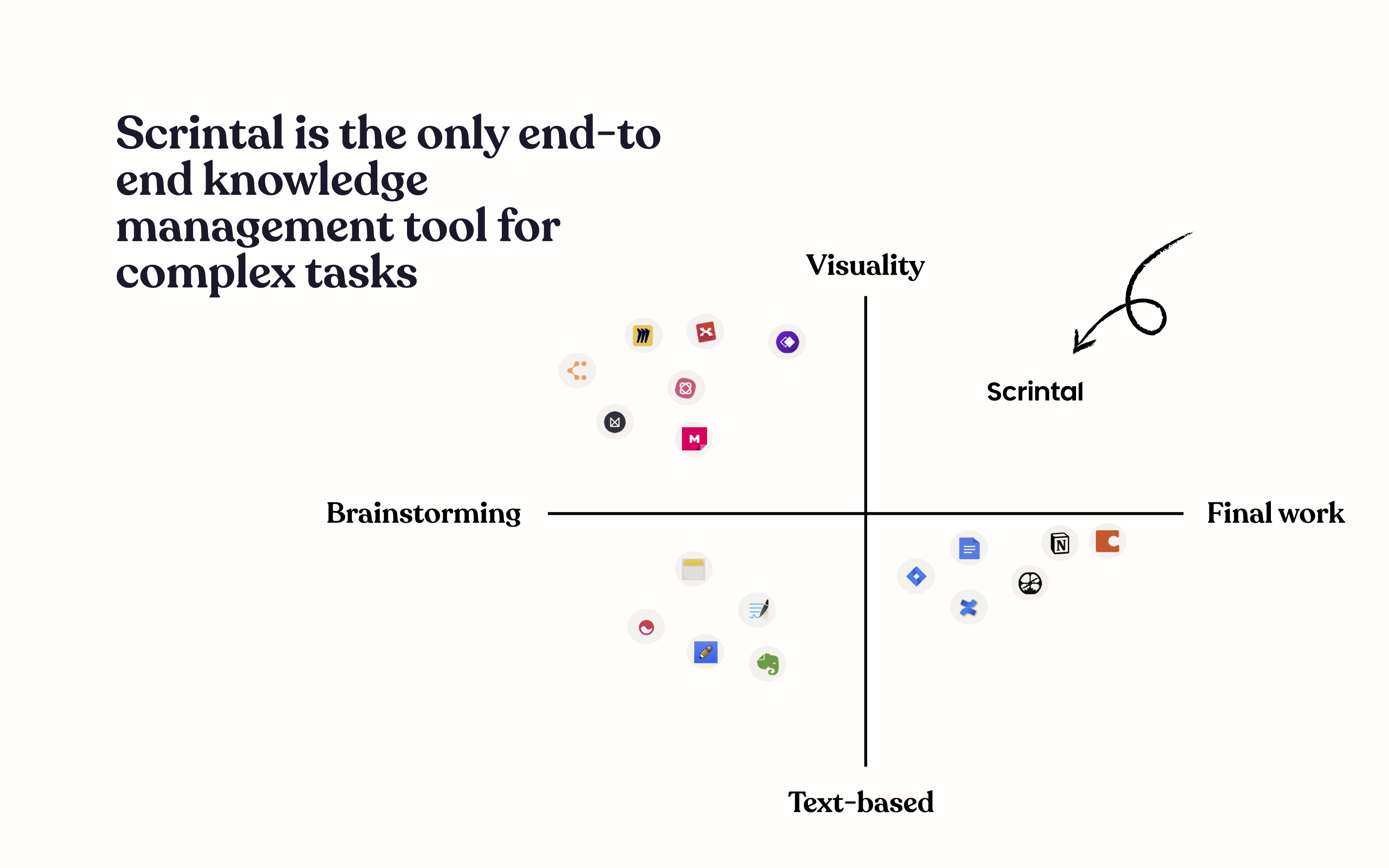

More work is needed on the competitive landscape

[Slide 18] This isn’t good enough. Image Credits: Scrintal

That, to an investor, is scary. Sure, perhaps it is a one-stop shop, but the truth remains that millions of companies are already using existing solutions to manage their data and workflows through a project. Without really going into what the competitive advantages are to switching to Scrintal, what this slide tells me is that there is probably already a solution out there, and it isn’t immediately clear to me why someone would switch.

If the switching cost is high enough, it means that the ability for Scrintal to grow is significantly hampered. That, in turn, limits how attractive the company is to an investor. If you’ve been floating around startup land (or in the corporate world) for long enough, you’ve been forced to use inferior tools, probably. I have a few I have a personal, passionate hatred for, but that doesn’t matter: Switching from one piece of software to another is extremely hard, risky and expensive.

If all of this is true, then the real question an investor is going to ask is this: “How will you convince the 40,000 people you have on your waiting list to switch to Scrintal?” A good answer here is important; it’s very likely that even if every single one of those waitlisted would-be customers wanted to use Scrintal over its current solution, chances are that they don’t have the final say in tool selection, meaning that a not insignificant number of those 40,000 people are essentially worthless to Scrintal as a business. Having a very deep understanding of both the competitor products and the business models they operate under is going to be crucial to success here, and from the pitch deck, I’m not seeing enough attention focused here.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!