Ethereum’s shift from proof-of-work (PoW) to proof-of-stake (PoS) in September 2022 increased interest in staking across a number of parties — including institutions.

The success of the Merge propelled Ethereum from “a smart contract platform lagging behind” into “something that was doing things right,” Diogo Mónica, co-founder and president of Anchorage Digital, a crypto bank last valued over $3 billion, said to TechCrunch. “Interest from investors grew and the appetite changed dramatically.”

And it’s true: Institutional interest in ETH staking increased after the Merge, Matt Hougan, CIO at Bitwise Asset Management, said to TechCrunch.

“All of a sudden, by holding Ethereum, you went from holding a bet on smart contract platform to holding a bet that holds yield,” Mónica said.

Staking is a way of earning rewards for holding a certain token (in this instance, ETH) for a certain amount of time. In return for staking, people are paid out yield or additional rewards in exchange for holding their coins to secure the network.

In a way, it’s like having cash in your wallet or parking your cash in a bank CD, Hougan said. “You lock your money up in the CD and the bank pays you interest. In this example, you lock your ETH up in a staking pool and earn interest.”

The total reward rate for staking ETH is about 4% currently, according to Staking Rewards data. Prior to the Merge, about 287 ETH were staked per day on average. After the Merge, about 623 ETH were staked per day on average, a 117% increase in about five months, a report by Anchorage Digital stated.

Today, most people participating in staking are either retail investors or crypto-native hedge funds or institutions. But as the market matures, the range of investors participating “will grow substantially,” Hougan said.

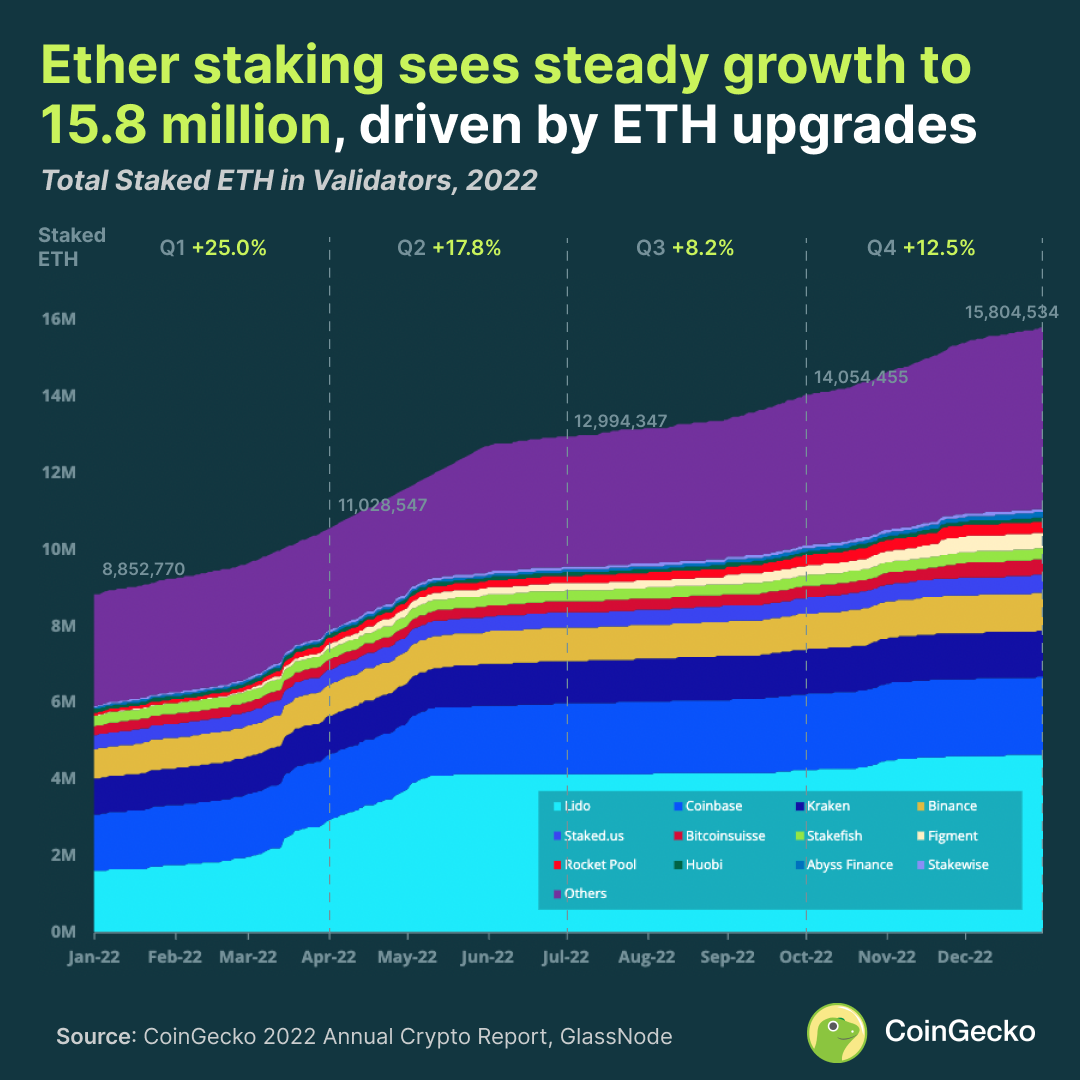

Image Credits: CoinGecko

There’s about 15.8 million staked ETH, up from 8.8 million in January 2022, according to the CoinGecko 2022 Annual Crypto Report. As new Ethereum network upgrades are anticipated in the near future, institutional investors will become increasingly interested in the space, both Hougan and Mónica said.

“There was a big jump in interest [post-Merge], but there’s still a latent appetite,” Mónica said. “People are looking for the March date.”

In March, Ethereum network is supposed to launch its Shanghai upgrade, which will allow people who stake ETH to withdraw it at any time.

“To this point, people who have staked ETH were locking it up indefinitely,” Hougan said. “The Shanghai upgrade will allow you to withdraw staked ETH. Our view is that this will substantially grow the size of the staking market, as more investors will be willing to stake now that withdrawals are enabled.”

The success of the Merge removed some uncertainty around whether and when stakers would be able to withdraw ETH, Hougan said. “That said, staking remains a largely crypto-native market; most traditional investors are still wary of risks in the market.”

Mónica shared that a “large majority” of Anchorage Digital’s clients are staking ETH. While it’s “hard” to pinpoint who, very few clients have ETH unstaked — and those who do usually just want to sell it, he added.

“Anybody that is crypto-native or funds or investments that are long-term are doing ETH staking to basically juice up their returns. A lot of corporations that are using the ETH Network aren’t staking it yet,” Mónica said, “either because they haven’t figured it out from a tax perspective or they don’t care enough about the 4% yield. Then there’s another category of players that are holding on to ETH and are not super sophisticated.”

It’s important to remember that staking isn’t riskless, and many of the service providers in the space are new, Hougan said. “The market will get better and safer over time.”

Institutions and other investors alike are waiting for the next stage of updates to the Ethereum network. “They’re on the sidelines ready to jump in,” Mónica said.

“Staking is an interesting emerging opportunity for long-term crypto investors,” Hougan said. “We expect the space to grow, not just over the next few weeks but over the next few years. For now, it is likely to be dominated by crypto-native providers and investors who can tolerate significant risk, but over time it will be mainstreamed.”