We often hear companies claim: “We will grow into our valuation from 2021.”

That statement is in reference to their expectations of when they’ll price their IPO, or with regards to a future private round. They are implying that they will wait to go public until they can price an IPO higher than or at least at the same valuation as their last funding round. This further implies that the company is opposed to down rounds or publicizing a decrease in their valuation.

Interestingly, these companies claim they can do that — as if growing into one’s 2021 valuation is easy and can happen in the near term.

We always attempt to do the math every time we hear a company make this statement (again, we hear it frequently). In most cases, pricing an IPO at a company’s 2021 valuation is more than a few years away (assuming perfect execution), and in some cases, we don’t think it will ever happen.

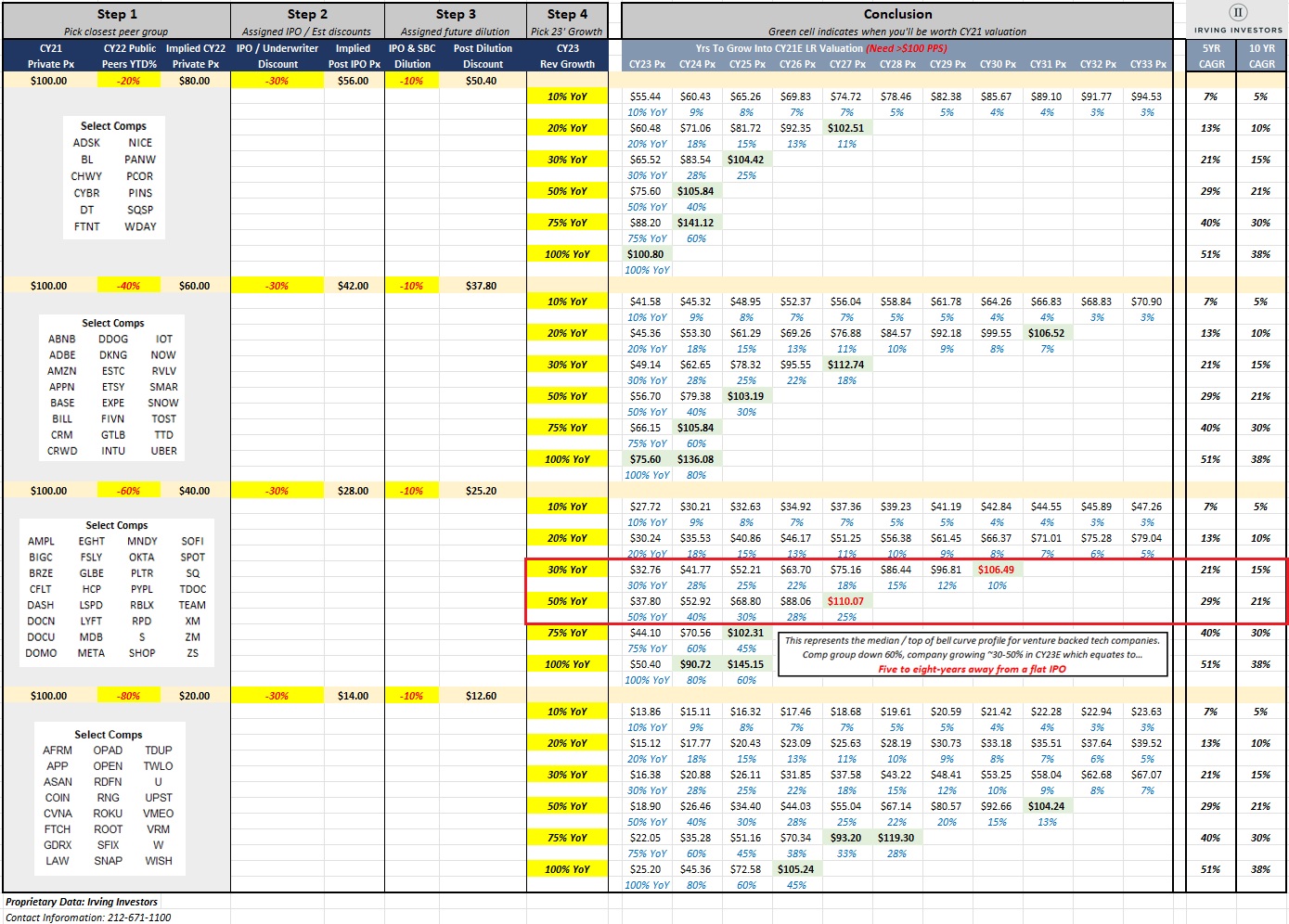

Our chart of the quarter depicts the math behind how long it will take companies to price their IPO so they can match their previous valuations:

Image Credits: Irving Investors

Using the chart

If you are growing slower than 30%, there is a strong chance that you will never be able to match your 2021 valuation.

Companies need three inputs to use the chart:

- Their own public company comparables group (guidance given below);

- How much that comparable group has sold off this year / CY2022 (guidance given below);

- Projection of your growth rate.

Step 1

- Start with your last round valuation (we mark it at “$100.00”);

- Select the comparable group stock performance discount that is closest to your comparable group’s 2022 sell-off:

- Define your own public comparable group;

- Calculate the value decline (%) within that group from January 1, 2022 to today;

- Determine which sell-off range applies to you.

- See the impact of the discount on your valuation.

Step 2

- Apply an additional 30% discount for:

- IPO discount;

- Conservative sell-side projections at time of IPO.

- See the impact of discount on your valuation.

Step 3

- Apply an additional 10% discount, given:

- Dilution from IPO primary capital raise;

- Dilution from additional stock-based compensation issued.

- See the impact of discount on your valuation

Step 4

- Apply your projected revenue growth trajectory:

- Select the growth rate that most closely resembles CY23 actual revenue growth;

- The chart then applies traditional deceleration trends;

- If the outyears seem too high or too low, change buckets.

Conclusion

- Look to the outyears to see when your growth rate relative to the discounted current fair value gets you back to your 2021 valuation ($100.00);

- Target level boxes shaded in green.

Last round valuation compared with IPO pricing

IPO pricing is not the same as the fair value when you go public.

There is significant precedent here. Top-tier companies didn’t price their IPOs at the highest end of their fair value calculations based on aggressive outward projections. They priced at a discount to fair value based on very conservative forward guidance, and then beat that forward guidance by 30% in the first 12 months after the IPO, and by an aggregate 50% by the end of the second full year. Companies that followed this predictable cadence include Datadog, ZScaler and Crowdstrike Holdings

We include two strategic factors as a combined 30% discount: IPO discount, and beat and raise cadence / conservative guidance. Note that this 30% discount is very conservative for the combination of these two factors.

Takeaways:

- A lot of companies say they’ll grow into their valuations, but few grow fast enough to accomplish it within the next few years;

- If you are growing faster than 75%, you can entertain the discussion;

- If you are growing slower than 30%, there is a strong chance that you will never be able to match your 2021 valuation;

- If you’re at the top of the bell curve: The median company profile has a comparable group that has sold off about 60%, and has a top-line CAGR of about 20% to 30%. For those companies, it will take six to nine years (from 2021) to grow into their old valuations.

- The comparable group discount is conservative: Correction data is not peak to trough, and we used CY2022 whereas many companies began their correction well into 2021

- Sustained growth is hard: Many companies will look at the chart’s outyear deceleration numbers compared with their 2023 starting point, and assume they will do better — history would disagree.

- Only the highest-quality software (very rare) can grow by 30% at scale for five years. Companies that have done that include: Snowflake, ServiceNow, Datadog and Mongodb.

What the data won’t tell you

Public market investors don’t care if you do a down round. At all. Unless you have guaranteed return/dilutive instruments in your cap table.

Conclusion

The most surprising thing about 2022 was late-stage companies’ steadfast refusal to acknowledge the actual decrease in their valuations. It’s time to wake up, because bad decisions are being made based on that stance, especially as it relates to spending cash that was once cheap to raise.

To us, it seems simple and unthreatening.

If we were a pre-IPO company, the easy conclusion would be: “My high-quality public comps have lost 60% of their market cap / enterprise value, so my market cap is probably off by something similar to that. If I was a $10 billion company, I am probably worth around $4 billion now. That discount has nothing to do with the quality of my business — it only has to do with the current valuation landscape. I’m worth less, and if I want to raise money now, it will be at a much lower valuation with more dilution.”

Few companies are willing to take the medicine now. If you have aspirations of going public, the market will price you when you IPO. Why not start operating within that new valuation context as soon as possible?

So many companies continue to burn cash and fight the decrease in valuation through delays, debt, ratchets, and punitive convertible notes that will all inevitably result in significant desperation in the future.