Recent headlines have been dominated by announcements of large headcount reductions across the tech industry and especially at giants like Meta, Amazon and Twitter. But it’s not just the big names pulling back on headcount — private SaaS companies have similarly been implementing hiring freezes and headcount reductions for almost half a year now.

This isn’t surprising, as VCs started pushing for more focus on capital efficiency and the “Rule of 40” earlier this summer as it became clear that the “growth at all costs” mentality was going out of favor and the goal was to extend runway to weather the storm.

To get a better understanding of headcount fluctuations within the private market, we programmatically tracked the headcount of 150 private Series A to Series C B2B Enterprise SaaS startups across various industries over 24 months.

Here are the highlights of our study:

Companies are reducing headcount growth to extend runway

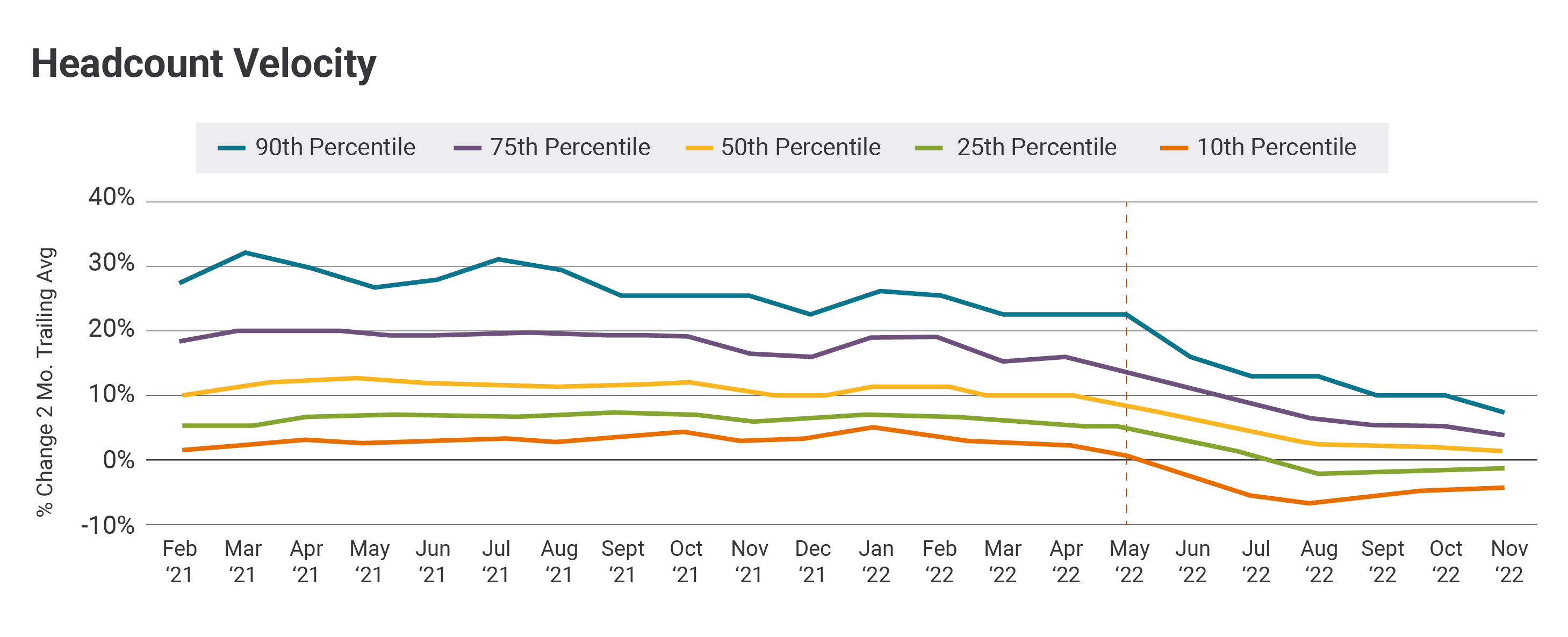

Headcounts rose every month across the last four months at a median rate of around 2% compared to the 10% we saw previously. Additionally, the 25th percentile of startups showed reductions in headcounts, indicating that many companies are taking drastic measures to extend their runway.

For companies with a strong balance sheet, strong backers and low burn/product-market fit, now is the best time to make critical hires.

This is a gloomy indicator as startups brace for additional macro headwinds and repricing events.

Another round of cuts are likely early next year

If the macro environment doesn’t improve, we would expect another wave of job cuts after companies’ fourth-quarter board meetings (usually in January or February).

Many companies will discuss their CY ’23 forecasts, and headcount is always a lever to extend runway since it can account for up to 80% of a startup’s expenses. Given that many companies have maintained their headcounts, we may see them having to lay people off to reduce burn.

Tighter hiring started as early as May 2022

Private companies began tapping the brakes right around May 2022, and more firms started acting in unison, as seen from the tighter headcount velocity interquartile range, which was compressed heavily but has now stabilized.

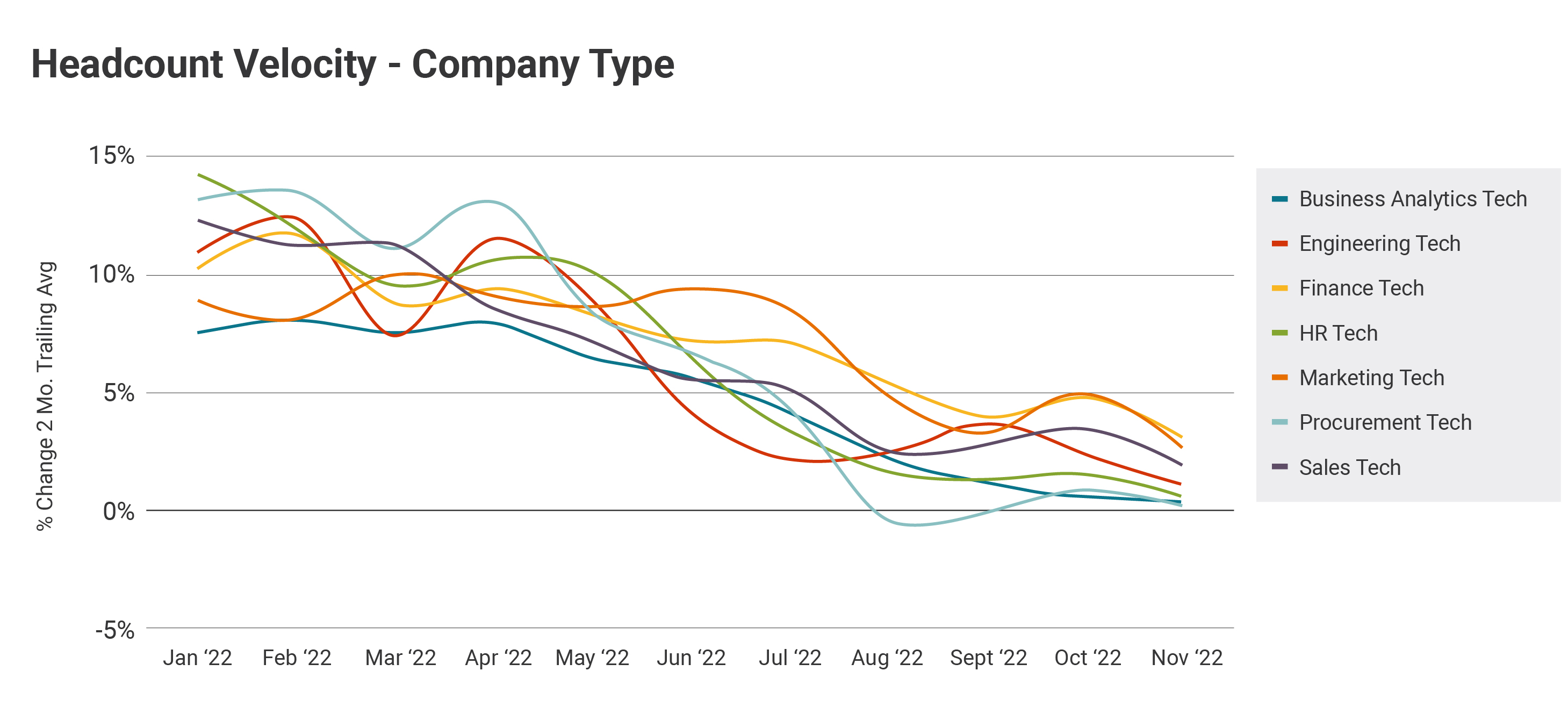

Companies serving HR and procurement saw the steepest drop

As these services have shrunk across the industry, companies providing tech aimed at HR and procurement professionals saw the steepest drop in headcount growth. However, all the tracked customer profiles have trended toward reducing hiring efforts.

There’s lots of available talent

On a positive note, this is an excellent time for companies with product-market fit (and supportive investors) to hire the right talent, as big tech is reducing headcount and the market is flooded with exceptional talent.

From aggressive headcount growth to holding flat

Until April, most companies were hiring aggressively, with headcount rising month over month at over 10%, and the 75th percentile was close to about 20%.

In contrast, the current median is +1% and the 75th percentile is +4%.

This downward trend kicked off in May and continues today. The interquartile range continues to compress, with the median ultimately heading toward flat headcount (i.e., replacing natural attrition but not hiring beyond that). The 25th percentile fell into layoff territory around August, but both the 10th percentile and 25th percentile have since pulled back.

Image Credits: Eddie Ackerman

Now that we have set the stage:

- What trends are we seeing across companies at which headcount velocity is slowing?

- Knowing these trends, what steps do businesses need to take to protect their runway in today’s economy?

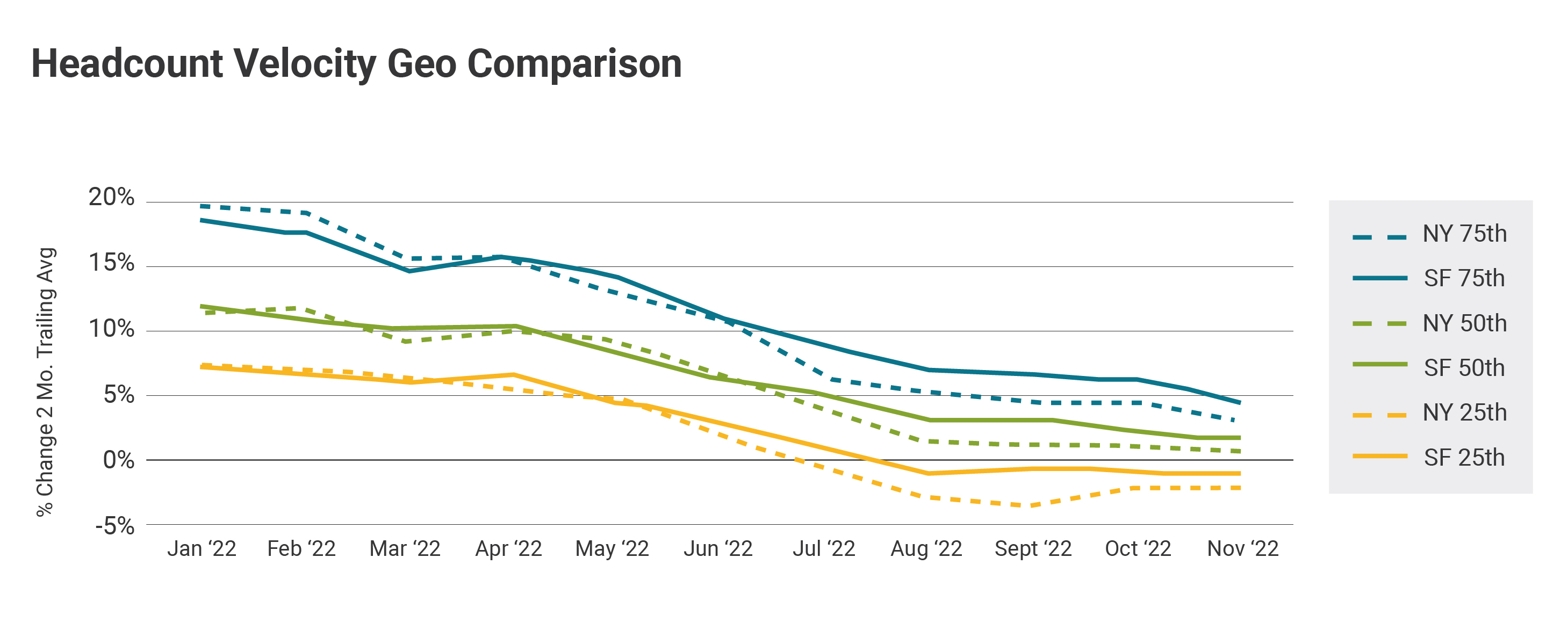

Same impact on both coasts

The macroeconomic trends are impacting the tech industry as a whole and are not isolated to one particular region.

We do see slight nuances in how different regions have reacted. The East Coast shows a steeper initial decline in headcount growth, but both coasts have followed the same trend. However, San Francisco has slightly more aggressive hiring indicators.

Image Credits: Eddie Ackerman

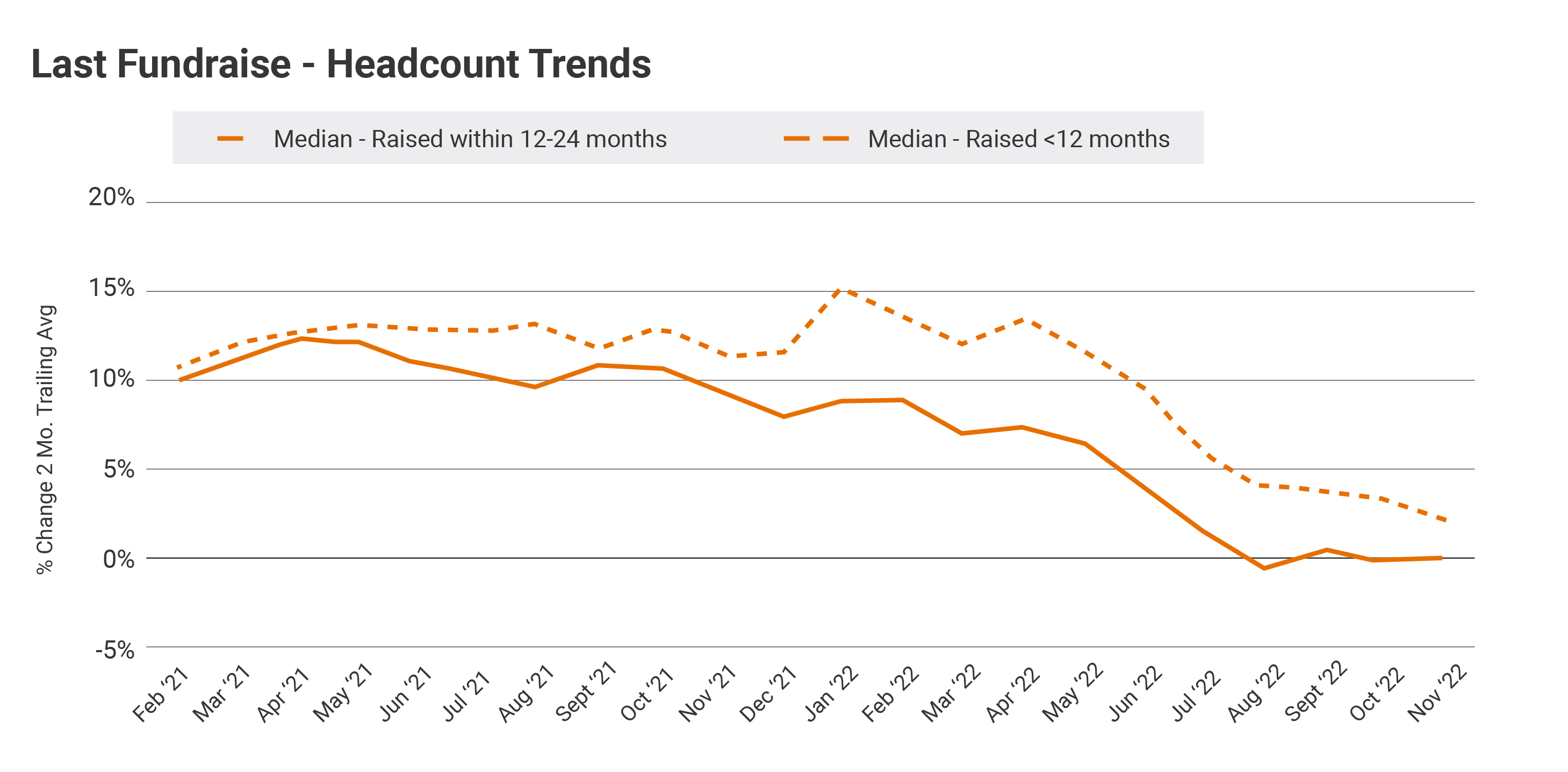

Companies are remaining cautious

Companies that received funding within the last year have higher sustained headcount growth, but both groups acted in unison and reduced headcounts. The 25th percentile for startups that raised over one year ago is down 2.4% whereas startups that raised less than 12 months ago are down 0.5%.

Startups that have a bit of a cushion can pull back hiring while leaving room for essential hires, especially given the talent available. This indicates many startups, regardless of recent funding, are now more cautious with hiring and are either instituting freezes or laying people off.

Image Credits: Eddie Ackerman

Regardless of the end buyer, all startups are being cautious

For this part of our analysis, we examined the target group startups sell to within an enterprise (e.g., HR, sales or engineering teams). As expected, technology for HR and procurement took the biggest hit as companies began shrinking hiring teams and reducing spend.

The two surprises in the charts were the slowdown in technology geared toward engineers and business analytics. Additionally, it was surprising to see that there was a slight resilience in technology aimed at finance professionals.

Overall, the message remains the same: Regardless of the customer, headcount growth has slowed down drastically.

Image Credits: Eddie Ackerman

Now what?

Access top talent

For companies with a strong balance sheet, strong backers, product-market fit or low burn, now is the best time to make critical hires. As many of the top companies in tech begin layoffs, many startups now have access to talent that would have otherwise been unattainable.

Reevaluate customer spending power

The macro environment has changed rapidly, and startups must now determine how their potential customers’ budgets and timing have changed.

Customers who previously had access or control of the budget may no longer have that power. It is time to throw out previous forecasts and reevaluate the pipeline, close rates and upsell potential. This top-line analysis will dictate your growth and headcount needs.

Set clear KPI targets tied to headcount decisions

Many startups begin hiring aggressively after a fundraise to ensure they can hit ARR targets and scale the company.

During volatile periods, management must ensure that the company does not get ahead of its skis. One creative solution is to create “unlock” targets for your business units, meaning headcount can be unlocked if certain KPIs are hit, but not until that happens.

Tough decisions are coming

An unfortunate part of a bear market is having to right-size a business to match the macro environment.

Previous private market valuations were relatively aggressive, which will result in many companies extending runway to allow growth to catch up to contracting multiples. As such, founders and CEOs need to continually evaluate headcount, contributions and burn, and make the tough decisions.

Don’t move slowly when making a hiring freeze decision

CEOs are sensitive to saying, “We are freezing hiring,” but that is much better than the alternative of sending the “we made a mistake and hired too aggressively” email to employees and investors. The tough decision to freeze hiring should be made early, even if your balance sheet is in a good position.

While it is not uncommon for companies to reduce headcount in response to economic downturns, the extent of the hiring slowdown in the startup world is noteworthy. Given the high amount of dry powder in the VC world, it is uncertain what fundraising for startups will look like next year, but one thing is clear: Startups are preparing for the worst-case scenario.