Few startups launch with a coherent content strategy.

In the early days, every project is a sprint, and there are times when putting on a show for investors can feel more important than actually serving your customers.

Blogs are a great example: Because they’re a cheap way to drive SEO, companies crank them out, then use KPIs like time on site, pages per session and social media likes to demonstrate how successful they’ve been.

“The truth is: vanity metrics don’t measure how engaged potential customers are,” writes Christopher P. Willis, chief marketing and pipeline officer at Acrolinx.

Full TechCrunch+ articles are only available to members.

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription.

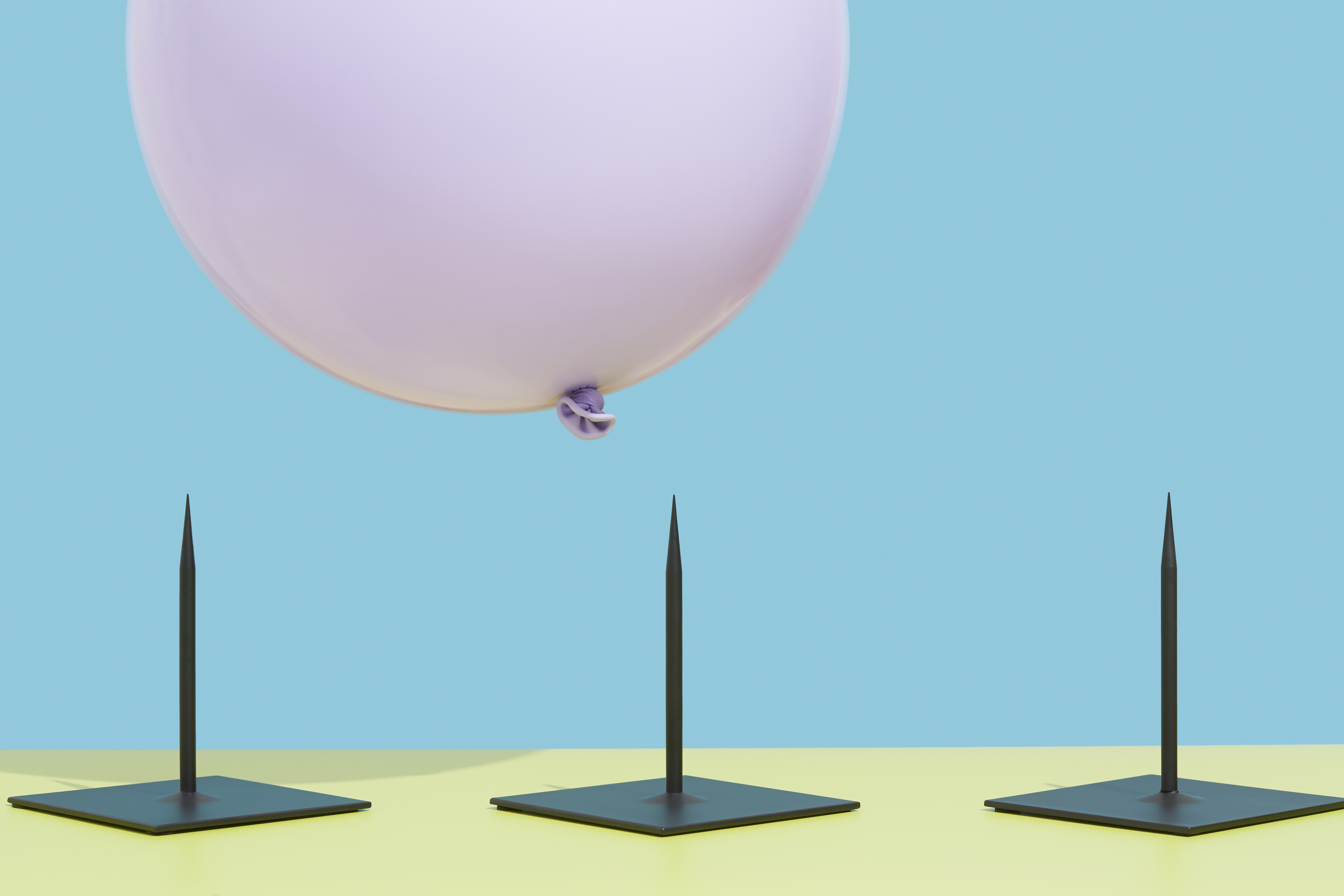

Relying on vanity metrics is like attending a Little League awards dinner: Everyone goes home a winner!

“They simply gauge the relative popularity of your business. This makes measuring ROI tricky.”

Creating a consistent brand strategy isn’t a major investment and creating a shared style guide for marketing, design and sales generates positive ROI. With a content governance plan, any startup can track which offers are most likely to convert new customers.

“The biggest benefit of this is content that establishes trust,” writes Willis.

Thanks very much for reading TC+!

Walter Thompson

Editorial Manager, TechCrunch+

@yourprotagonist

Banish vanity metrics from your startup’s pitch deck

Image Credits: We Are (opens in a new window) / Getty Images

It’s legitimately nice to give your hard-working team targets they can work toward, but vanity metrics (e.g., X email signups in Y days, 20% more retweets) are like a Little League awards dinner: Everyone goes home a winner!

“The truth is, investors know what traction looks like,” writes Haje Jan Kamps, which means feel-good stats have no place in a pitch deck.

“Don’t confuse fluffy numbers and vanity metrics with your go-to-market strategy.”

3 Black founders predict little will change in VC in 2023

Image Credits: tifonimages (opens in a new window) / Getty Images

A rising tide lifts all boats, but when free-flowing venture capital starts to recede, underrepresented founders are the first to find themselves on dry ground.

Dominic-Madori Davis spoke to three Black founders to get their thoughts on the current funding landscape and the issues that are top of mind for them as we head into the new year:

- Vernon Coleman, founder and CEO, Realtime

- Sevetri Wilson, founder and CEO, Resilia

- Abimbola Adebayo, founder and CEO, Pinnu Analytics

The fundraising stages are not about dollar values — they’re about risk

Image Credits: Richard Drury (opens in a new window) / Getty Images

Before a founding team approaches any investor, they’ll need a clear idea of how their planned company will make money.

And also: how it will lose money.

Investors are open to ideas, but because they view everything through a lens of risk, entrepreneurs must develop a holistic understanding of where it exists in their company.

“‘For our company to be successful, these three things have to be true’ is a potent phrase in the earliest stages of starting a company,” writes Haje Jan Kamps.

With IT spending forecast to rise in 2023, what does it mean for startups?

Image Credits: We Are / Getty Images

The fact that so many CIOs and analysts believe IT spending will increase in 2023 is potentially good news for new SaaS companies hoping to weather this downturn, but “it’s not all rosy,” writes Ron Miller.

To bring these predictions down to earth, he interviewed several investors, industry watchers and CIOs to get their thoughts on “what’s coming for enterprise startups in 2023.”