The problem of cash flow reconciliation is an increasingly large one, especially in light of the explosion of digital payments since the onset of the COVID-19 pandemic. As companies that handle customer payments expand to new markets, add new products and handle increasing transaction volume, the more complex the process becomes.

Enter Nilus, a startup which aims to help simplify that process with a no-code financial operations platform. Founded out of a basement last year by Daniel Kalish and Danielle Shaul, Nilus has raised $8.5 million in a seed funding round led by Bessemer Venture Partners.

As in the case of many startup origins, both Kalish and Shaul said they experienced the problem they’re trying to solve in their previous roles. Kalish spent more than five years at PayPal, most recently serving as head of market development and GTM for Central Eastern Europe, Russia and Israel. Shaul spent more than five years at Fundbox — most recently as a software architect and before that as an R&D manager that led risk and underwriting engineering efforts for both credit and fraud and building cutting-edge products using ML and big data.

“The payments industry actually has a huge data problem today,” Kalish told TechCrunch in an interview. “On the surface level, it looks really easy to start collecting payments — by working with Stripe, PayPal or banks, for example. But behind the scenes, the data is so messy and finance teams are struggling to understand what’s happening, what’s their financial position or making sure there’s no risk involved in accepting and sending payments to their customers.”

The biggest challenge, he added, is the fact that payment financial data basically sits between multiple locations within an organization.

“You have payment data with your payment processor or with your bank or with your ERP and your finance team is often trying to match those data points either manually or by running some funky Excel or SQL scripts just so they can get the clarity they need around their financial and their activity,” Kalish said.

In building financial infrastructure over the past decade, Shaul said she saw finance teams “going back and forth” to identify incoming payments.

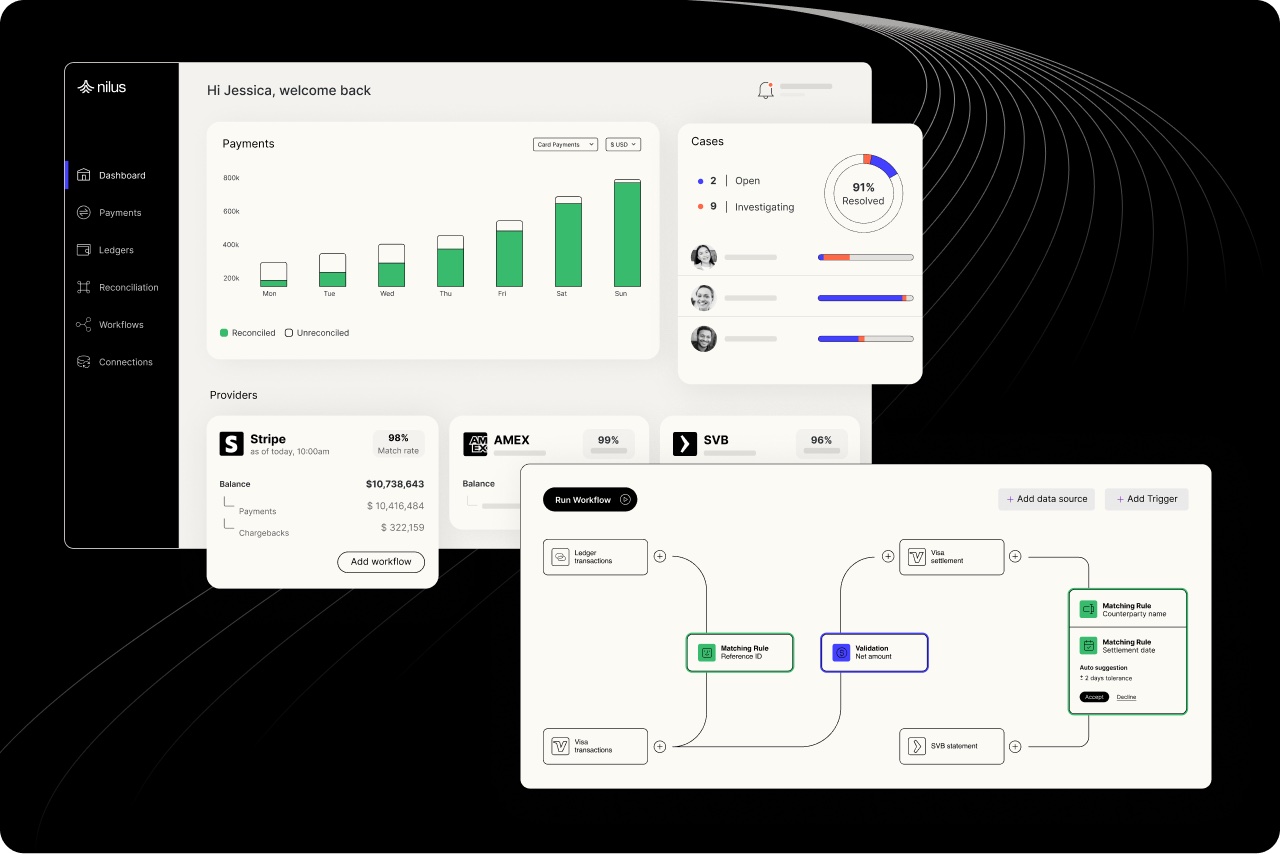

So the pair teamed up to build Nilus, a company they say offers a “plug and play” payments operations platform for finance teams that move significant volumes of dollars. Their goal is to help these teams understand all that underlying data behind the payment activity so they can have “a real-time view of cash, mitigate risk and always be audit-ready,” said Kalish, who serves as Nilus’s CEO.

Kalish and Shaul say the tech includes “pre-built data connectors” and algorithms that allow finance teams to analyze that data and ultimately automate reconciliation, reporting and payment workflows.

“We see reconciliation as kind of like the building blocks on which you can build a lot of capabilities,” Shaul, the startup’s CTO, told TechCrunch. “Once you can move the money with confidence and have visibility, you can manage things, you can predict things, you can forecast — you can do so many great things on top of that.”

Image Credits: Nilus

Nilus’ target customers are fintechs, financial service companies, marketplaces and vertical SaaS outfits — or basically any company with embedded fintech products that are already moving customer money. While it would not disclose specific customers, Nilus says it is working with companies processing “hundreds of millions of dollars.”

The startup’s headquarters and go-to-market team is based out of New York, and its technical team out of Tel Aviv. Presently, the company has 18 employees.

Also participating in the startup’s seed funding round are Better Tomorrow Ventures, Symbol and the CEOs and founders of fintech companies including Unit, Alloy, Melio and Lithic.

“We’ve seen so many companies working with out-of-date financial workflows, the space is desperately in need of innovation,” said Adam Fisher, a partner at Bessemer Venture Partners, in a written statement.

Sheel Mohnot of Better Tomorrow Ventures agrees, noting that his firm was “stunned” at how many companies still used Excel for financial reconciliation.

“Financial teams are really underserved,” Shaul said. “Most reconciliation platforms out there are for banks.”

TechCrunch’s weekly fintech newsletter, The Interchange, launched on May 1! Sign up here to get it in your inbox.

Got a news tip or inside information about a topic we covered? We’d love to hear from you. You can reach me at maryann@techcrunch.com. Or you can drop us a note at tips@techcrunch.com. If you prefer to remain anonymous, click here to contact us, which includes SecureDrop (instructions here) and various encrypted messaging apps.