If you told me that a company that’s charging $70 per month for multivitamins would be able to raise a $10 million round, I’d demand to see the receipts, and I’d be very curious indeed to see its pitch deck. It looks like today is my lucky day!

Rootine is the company, and the founders were gracious enough to share their pitch deck with me. Let’s figure out what the investors saw in this startup.

The company first turned up in TechCrunch’s coverage as part of the Techstars accelerator back in 2018. Anthony Ha reported that the company had 1,500 paying customers in Europe and was gunning for a U.S. expansion. It looks like that was a long journey that ultimately worked out.

Rootine’s deck is my 30th teardown — time flies! You can see the rest of them here, in case today’s read isn’t quite enough pitch decking for you.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

The Rootine deck consists of 29 slides, and the team tells me there have been no omissions or redactions — this is what the investors saw when they were getting pitched!

- Cover slide

- Summary slide

- Traction summary slide

- Team slide

- “Why” slide

- Market context slide

- Market size and market trajectory slide

- Problem slide

- Solution slide

- “Community enhances member experience” — community slide

- Business model slide

- “The Precision Multivitamin”— product slide

- “Supported by a variety of at-home lab tests”— product slide

- “Innovative form factor for nutrition products”— product slide

- Technology slide

- “Feedback loop”— product slide

- “How it works” slide — tracking member outcomes

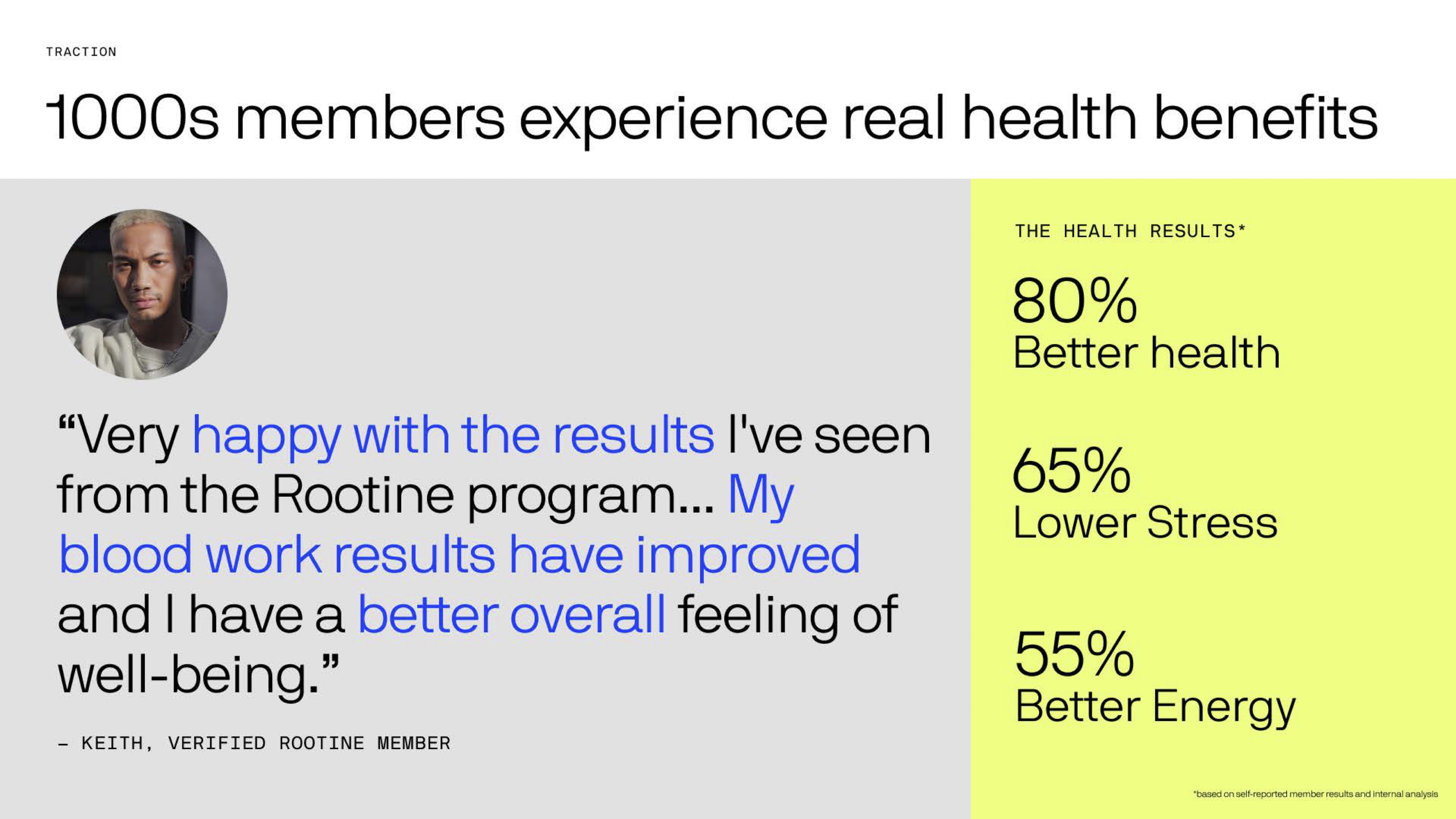

- Customer (“member”) results slide

- Product traction slide

- Customer traction slide

- Partnership traction slide

- Competitive landscape slide

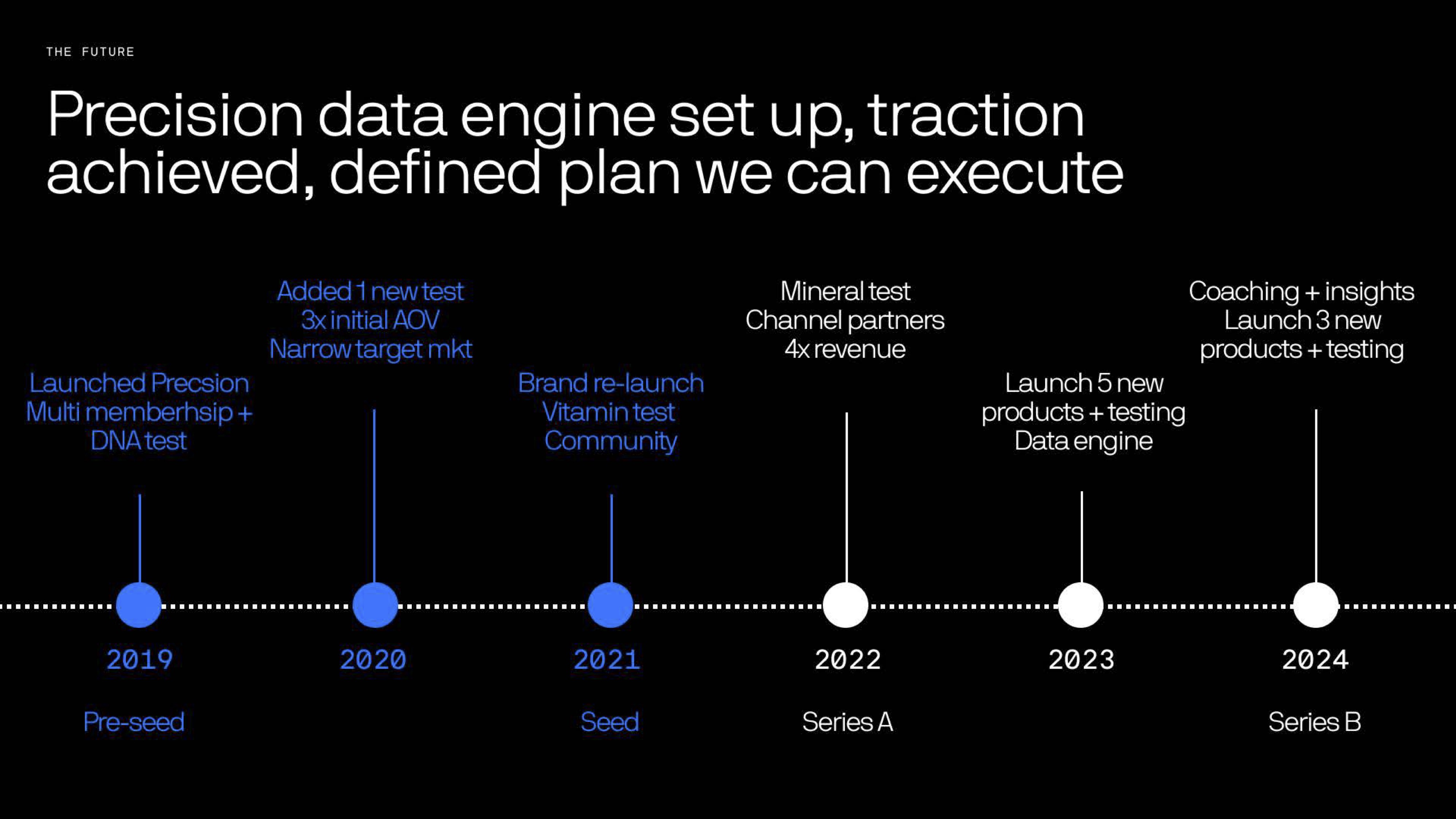

- Vision slide

- Product road map slide

- Revenue projection slide

- Go-to-market evolution slide

- Advisors slide

- The ask and use of funds slide

- Contact info slide

Three things to love

Rootine’s slide deck is a masterclass; it covers everything I would expect in a deck. It does go deeper than I would have liked into the product, but when I looked through it again, there’s not a lot I can remove from this deck to make it much better. Incidentally, there’s also not a lot I would add. That’s a great sign. Let’s check out some of the highlights.

An “ask” slide

By quite some considerable margin, the “ask and use of funds” slide is the most frequently screwed-up slide in pitch decks, in my experience. This one isn’t perfect, but I’m so glad it’s there, because it helps lead the conversation for what happens next.

[Slide 28] Great use of funds slide. Image Credits: Rootine

One little detail, though: 30% growth, 40% tech, 20% community, 20% ops. Oops. I love the realism that everything in startups can run over budget, and I believe in the wisdom of raising more than you think you’ll need, but I’m pretty sure most investors would prefer the use of funds to add up to 100%.

As a startup, the lesson here is to show that you have clarity around why you are raising money, as well as what you’re going to accomplish with the money. It’s embarrassingly rare to see either of these things clearly outlined — and it’s literally the whole purpose of a pitch deck. Rootine’s example above is a good jumping-off point. Make it your own; make it good.

Traction galore

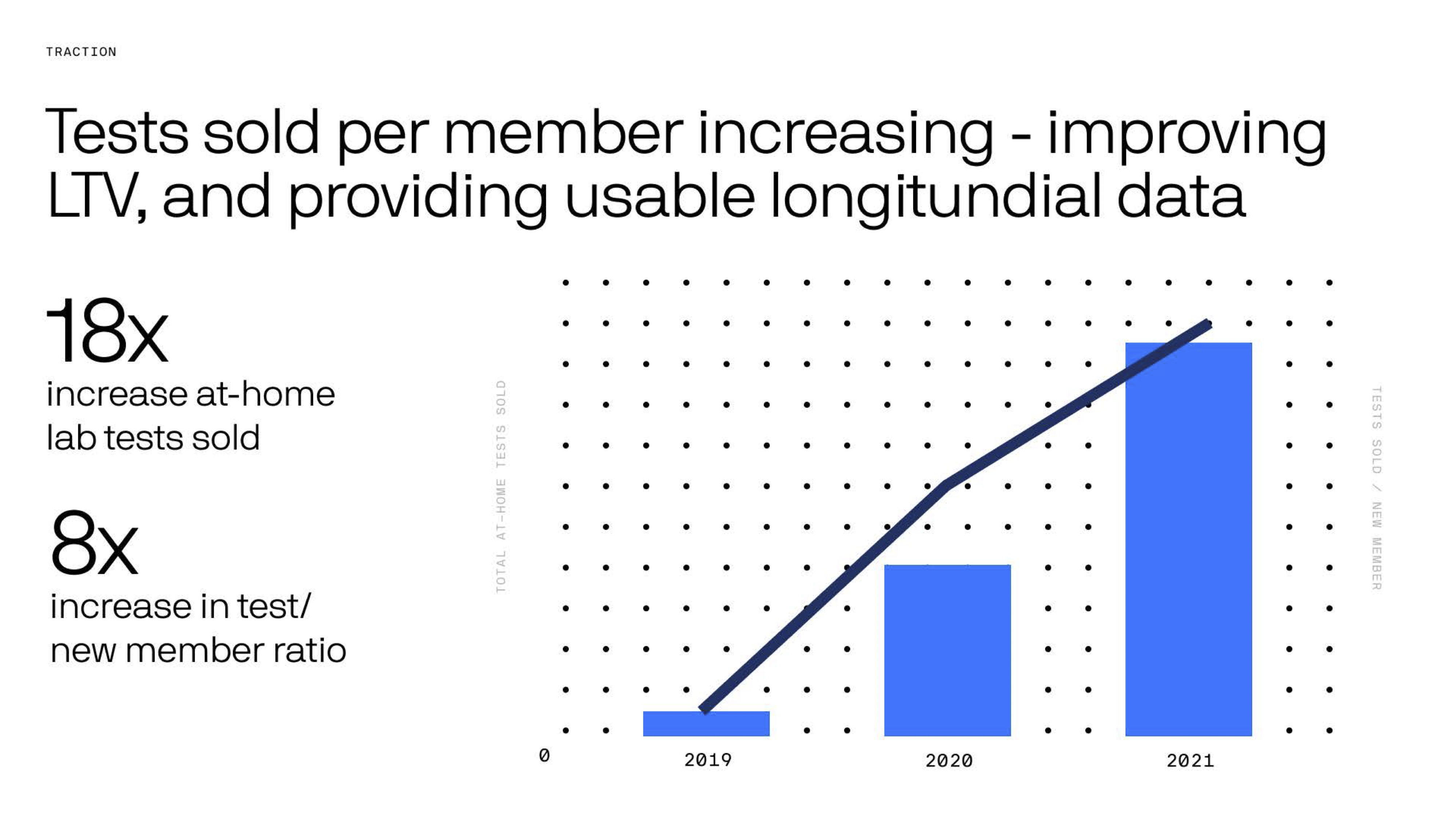

Rootine has a few traction slides in its deck (one that makes me unhappy, but we’ll get to that one), but I love how it flexes its numbers in various ways to show how well the company is doing. Slide 19 showcases some really cool traction:

[Slide 19] Holy traction, Batman. Image Credits: Rootine

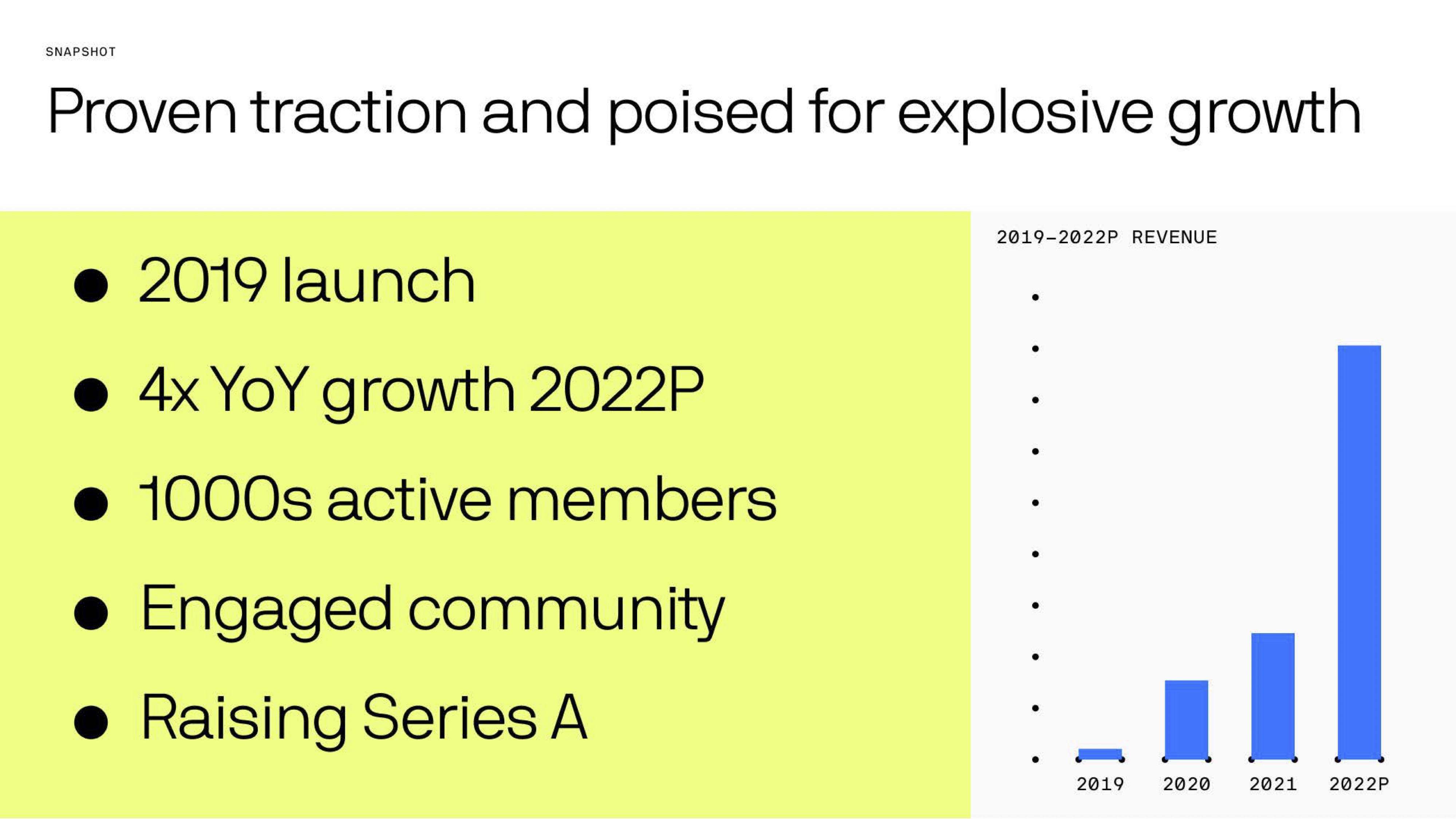

[Slide 3] Kicking off the story with a summary of the metrics. Image Credits: Rootine

I’d also have liked to see more detail about the numbers behind the numbers. Acquisition costs, margins and all the numbers that drive a business forward. Especially at a Series A, where a company is explicitly setting itself up for growth, it would be good to have more detailed breakdowns of how the various key metrics have evolved over time.

How has the customer acquisition cost (CAC) evolved over time? How has the initial spend per customer and assumed lifetime value per customer shifted? What about the costs of goods sold (COGS), etc.? As an investor, this is where I would spend a lot of my due diligence time, so it makes sense to include most — if not all — of that as part of the presentation. If you’re positioning yourself as being ready for growth, show that the numbers support that!

As a startup, consider how you can use the numbers driving your company to tell the story, both of what you have done and what you are about to do. If you have meaningful numbers that truly show the growth of your company — use ’em to ram that point home. What you are doing is hard; brag, brag, brag!

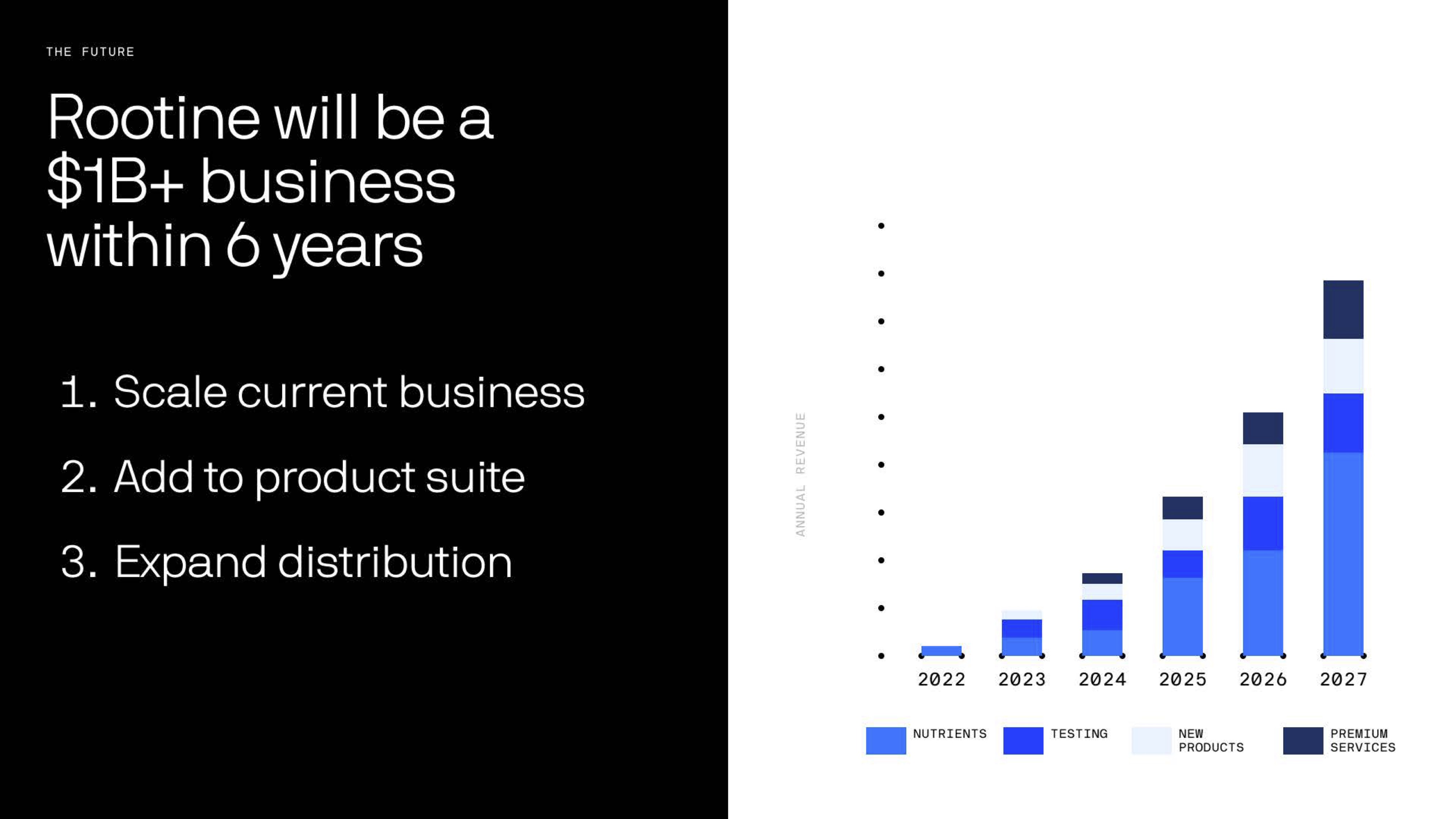

The path to $1 billion

[Slide 25] That’s a bold claim. Image Credits: Rootine

I hinted at that above; I’d want to see the numbers that drive this aggressive curve. Doubts aside; if you’re playing the VC game and you’re raising growth capital, this is precisely the sort of claim you need to be able to make, backed with some confidence and the numbers to back it up.

In the rest of this teardown, we’ll take a look at three things Rootine could have improved or done differently, along with its full pitch deck!

Three things that could be improved

Rootine’s pitch deck is very good indeed — perhaps the best overall deck I’ve seen so far in this series. The company did stumble a couple of times along the way, though.

Yeah, but does it deserve to exist, tho?

[Slide 12] Is this actually necessary? Image Credits: Rootine

I’m not a doctor, and I can barely identify a protein from a fat. Clearly I’m not the target audience, but I’d have thought that if you take more vitamins than you need, your body will just absorb whatever it needs and ditch the rest. There was that article circulating a while back that wonders whether the vitamin thing is a myth. I’m an ignorant-ass cynic, but I can’t help but wonder if the economy takes a nosedive, whether $69-per-month vitamin sachets with my name on them would survive the first round of belt tightening. There’s nothing in the company’s deck about how sticky its customers are. How often do they churn? Why?

Maybe it’s a moot point that doesn’t matter, but as a potential investor, I’d want to know. Seeing nothing in the deck about churn rates (or references to scientific studies about the efficacy of Rootine) scares the bejesus out of me. If I were working with Rootine as a pitch coach, I’d encourage them to find a way to tell the story to make skeptics like myself relax a little.

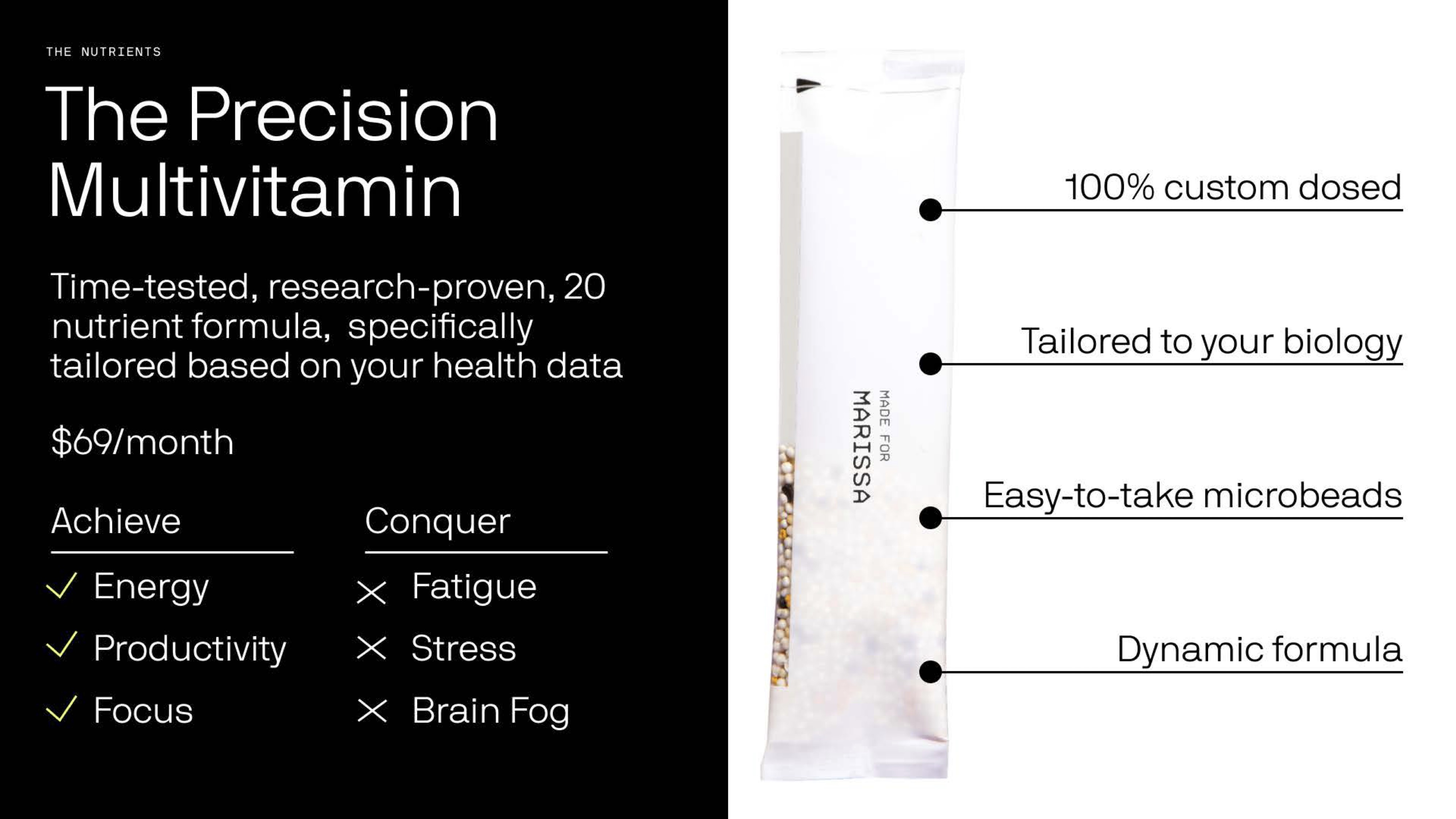

This is the slide that gets closest to answering some of the questions, but it doesn’t address why customized is necessarily better. For most people, clothes don’t need to be custom tailored. Cars for the masses aren’t custom built. And the vast majority of drugs prescribed are the same drugs for everyone, with slightly different dosing. This deck leaves me unconvinced that vitamins and supplements need to be different.

The microbeads thing is clever, though. Rootine is right about one thing: Nobody wants to swallow pills, ever.

That’s not traction.

[Slide 18] That’s not traction. Image Credits: Rootine

In this case, remember that “traction” shows forward momentum in the market. It is something that’s measurable, that shows that your company is working as a company. Your company’s product working as a product is not traction: That’s efficacy. You might even argue that a product working causes customer validation. In this case, it’s based on self-reported member results and internal analysis. In itself, that isn’t a problem: Happy customers stay and recommend a product to their friends.

The problem is that the metrics are so fuzzy. What does “better health” mean? How do you measure “better energy”? The scientist in me gets really suspicious about this whole slide; anecdotes aren’t evidence, and as far as I am aware, “better health” and “better energy” are not universally accepted standardized measurements. “Lower stress,” is encouraging, but there are accepted scientific ways of measuring that. Heart rate variability or cortisol levels, perhaps? If that’s what’s being measured, then report that.

Overall, I wish the company had left this slide out. It feels like vanity metrics at best and potentially subjective and deceptive at worst. In any case, it signals that the founders at Rootine have some soul-searching to do about what its core metrics are. In any case, Rootine has a lot going for it. It doesn’t have to resort to cheap tricks; investors see dozens of decks per day and see through that sort of thing easily.

Be specific!

[Slide 24] Vague info is worse than no info. Image Credits: Rootine

It feels a little unfair to single out Rootine here; many startups are too fuzzy about their plans. That’s not a good thing. In the investment process, investors will want to know whether the founding team knows what it is doing. It’s a combination of showing that you can be a believable operator and a good strategist.

A hand-wavy “I will get this company to $1 billion in six years” and “we will launch five new products” makes me worried. The plans should be a lot more detailed than that; if they are, you may as well tell that part of the story in the pitch. The goal of a pitch is to explain to your investors why you are a solid bet. This slide doesn’t do that. Improve the slide to be more specific or get rid of it. The way it stands is worse than not having a slide at all.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!