A few years ago, I was driving in a rural area on the coast north of San Francisco and found myself low on gas. In fact, the fuel light was flashing urgently.

My cell phone couldn’t get a signal to direct me to the nearest gas station, so I put the engine in economy mode and drove on instinct. I knew the car had a reserve tank, but I had no idea how far it would take me.

Founders who don’t implement proper treasury management practices during a downturn are as foolhardy as I was that day — how far can your company go on fumes?

“Your cash reserves mean nothing if you aren’t able to access them in time to pay for your ongoing expenses,” writes Michael Dombrowski, corporate treasury adviser at Rho.

In a TC+ guest post, he shares the basic steps for creating a cash management plan for startups that have closed an extension or need to make the most out of their precious runway.

Full TechCrunch+ articles are only available to members

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription

TechCrunch+ is hiring for several roles, including a part-time desk editor who will help manage our guest contributor program.

If you’re interested, please don’t contact me — you can find more information about this role and submit an application via LinkedIn.

Thanks very much for reading, and have a great weekend.

Walter Thompson

Editorial Manager, TechCrunch+

@yourprotagonist

Move over, operators — consultants are the new nontraditional VC

Image Credits: Getty Images

In the first half of this year, 30 funds received almost two-thirds of all new venture capital raised, according to PitchBook.

Nevertheless, Rebecca Szkutak found that several consulting firms that help early-stage startups get to the next level are now launching their own VC funds.

“Over the last two to three years we’ve been asked by a lot of founders to join their cap table,” said FNDR founder and CEO James Vincent.

“The founder wants us on the journey. We’ve spent time with them and shown great intimacy. We don’t do it with everybody.”

Strategic warfare: How to hire and retain top analytics talent

Image Credits: designer491 (opens in a new window) / Getty Images

Especially in the early days, non-technical founders are vulnerable when it comes to hiring technical employees. How can you tell if someone can deliver when you don’t have experience doing the job yourself?

Analytics can be as much of a black box as engineering, which is why hiring managers need to look past the skill list on CVs to find more effective ways to sort candidates, writes Chuck Soha, managing director at StoneTurn.

In an article that includes suggested pre-screening techniques and sample questions, he says companies should rely on case studies during the interview process, “which ultimately makes the experience better both for the employee and the employer.”

Proptech in Review: 3 investors explain why they’re bullish on tech that makes buildings greener

Image Credits: Andriy Onufriyenko (opens in a new window) / Getty Images

Investors who work at the intersection of climate tech and proptech seek out potentially profitable startups that can reduce emissions and enhance the built environment.

It’s a high-stakes balancing act with significant risk, but considering the upside for category winners and the health of the planet, “the potential market is enormous,” reports Tim De Chant.

For his second proptech investor survey in a three-part series, he interviewed:

- Jake Fingert, managing partner, and Lionel Foster, investor, Camber Creek

- Anja Rath, managing partner, PropTech1 Ventures

- Othmane Zrikem, chief data officer, A/O Proptech

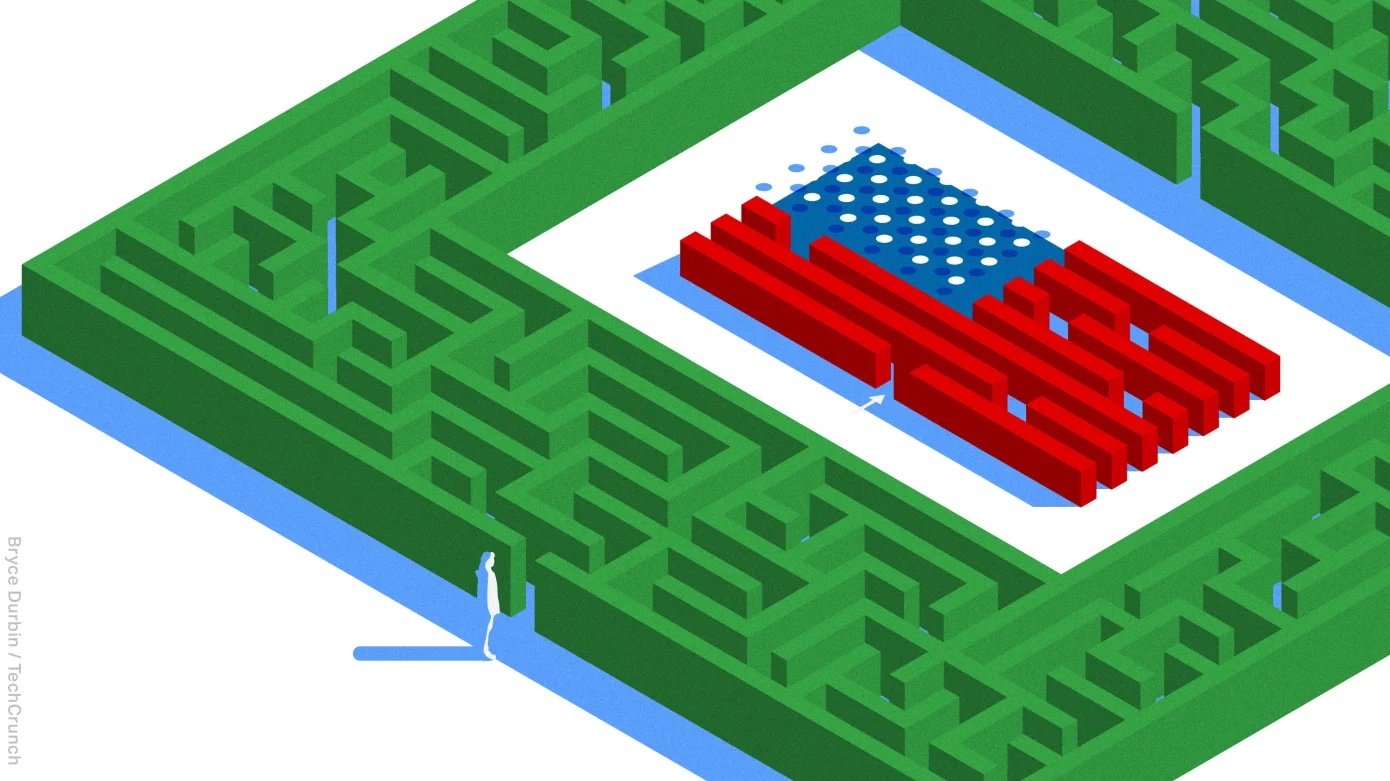

Dear Sophie: How should I prepare for my visa interview?

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie,

Our startup was just accepted into the winter batch of a top accelerator!

My co-founder with an H-1B just got laid off from Big Tech, but he’s OK because his immigration lawyer is filing a change of status to B-1 within the 60-day grace period. I’m nervous though, because I’m outside the U.S. and I don’t yet have a B-1/B-2 visitor visa.

How can I ace the visa interview? What type of questions will I be asked? How should I prepare?

— Tenacious in Tobago

5 methods for leveraging digital advertising during a downturn

Image Credits: Richard Drury (opens in a new window) / Getty Images

When Apple offered its customers greater privacy control, it upended mobile advertising. According to a survey by data science company Proxima, 40% of respondents said the iOS privacy policy change negatively impacted their business.

To stay flexible, Proxima CEO Alex Song says marketers should experiment with shifting their campaigns to platforms like TikTok, Snapchat and Instagram.

“For the remainder of 2022 and beyond, the decision is not whether to advertise, but where, how much and how to augment performance.”

Pitch Deck Teardown: Hour One’s $20M Series A deck

Image Credits: TechCrunch

Startups are approaching language learning from every angle: Hour One uses AI to deploy avatars that turn text into video.

In 2020, its founders raised a $5 million seed round, but earlier this year, it raised $20 million more via a Series A. Here’s a complete breakdown of the company’s unredacted 11-slide deck:

- Cover slide

- “At a glance” summary slide

- Solution slide

- Market size slide

- Value proposition slide

- Product slide 1

- Product slide 2

- Target audience slide

- Case study slide

- Team slide

- Closing slide