A new report has shone a light on the impact that European and Israeli unicorns have had on the broader technology ecosystem since the global economic crisis 14 years ago.

The report, titled “Europe and Israel’s Startup Founder Factories,” was produced by VC firm Accel with heavy support from startup and VC data platform Dealroom. It reveals that of the 344 VC-backed unicorns since 2008, nearly two-thirds (203) have led to at least one startup being founded by former employees, with 1,018 tech startups emerging in total.

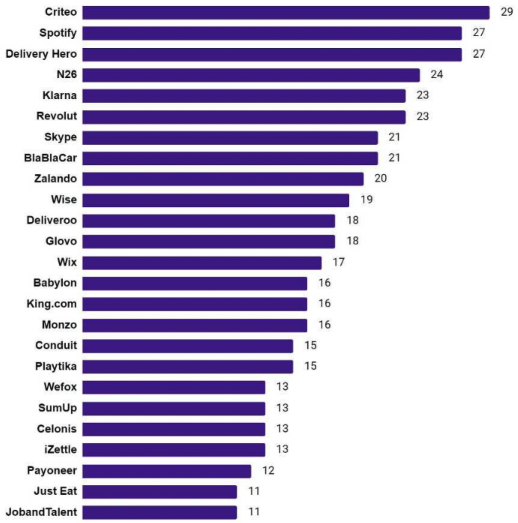

Founded back in 2005, French adtech giant Criteo leads the pack with its alumni going on to create 29 so-called “second generation” startups. This is followed by Spotify (27), Delivery Hero (27), N26 (24), Klarna (23), Revolut (23), Skype (21), BlaBlaCar (21), Zalando (20) and Wise (19).

Number of “second generation startups” spawned from European and Israeli unicorns Image Credits: Dealroom / Accel

While many of the names such as Spotify or Skype are long-established founder factories, what’s perhaps more notable is that some of the more recent entrants to the unicorn brigade, such as Glovo and Wefox, are already leading to a whole bunch of new startups.

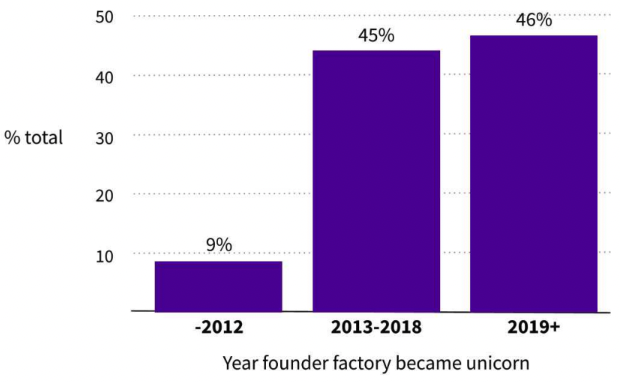

Indeed, a plurality of the unicorns covered in the report only hit unicorn status since 2019.

Unicorn founder factories: Cohort distribution Image Credits: Dealroom / Accel

Experience

This latest report comes as companies from across the industrial spectrum have faced a frosty reckoning with reality this year due to the global economic downturn: valuations at pretty much all stages are down.

However, with the sheer number of tech workers that have been laid of this year, from big tech giants such as Meta and Twitter, to growth-stage startups in just about every vertical, this could create a fertile landscape for a swathe of new startups to emerge. And that, perhaps, is why Accel is producing this report now — it wants to show that some good can come from tough times.

Indeed, the timescale of this report is particularly notable, as its data starts at the time of the last major financial crisis — a point in time that also signalled a major transformation in the technology industry, with smartphones just emerging into the mainstream arena. In the intervening years, countless technology companies have sprung up, some catapulting toward world domination, some disappearing into oblivion and some falling somewhere in the middle. But irrespective of how events transpired, it all served to produce a lot of people with experience of building and scaling complex tech-infused startups. Even failure isn’t necessarily a bad thing.

“While founders and their teams are navigating a tough macroeconomic environment, it’s also true that the community is in a much stronger position than during the 2008/9 financial crisis,” Accel partner Harry Nelis said in a statement. “There’s now a wealth of strong founders and operators building innovative companies that have experienced the start-up journey before and have the knowledge to create global success stories.”

It seems that this trend isn’t lost on unicorns themselves. Just last week, Spanish delivery company Glovo, which was acquired by Delivery Hero back in January and which has laid off a number of employees this year, announced a new program called Glovo House, designed specifically to support Glovo alumni founders via mentorship, networking and support for raising money.

Methodology

For the purpose of Accel and Dealroom’s report, the term “unicorn” describes any VC-backed company that achieved a valuation of $1 billion or more while it was a private company, though it excludes pharmaceutical or biotech companies. And “startup” refers to any technology company that was founded by someone formerly employed by a unicorn on a full-time basis for at least five months, and who started their new company within six years of leaving the unicorn.

Digging into the data does reveal some potential flaws, insofar as less than half (44%) of the second-generation startups have confirmed raising more than $1 million in funding. While venture capital funding isn’t the only bellwether of what constitutes a successful startup launch, it’s certainly a strong indicator — thus, it’s difficult to know how many of the startups gained any meaningful traction.

Indeed, when pushed on the data, Accel said that just 48% of the startups had revealed raising $100,000 or more. However, it caveated this by noting that 54% of the startups had only been founded since 2020, meaning that many of them are still very early-stage and either haven’t raised any outside funding yet, or have yet to announce it.

Second-generation unicorns

Digging even deeper into the numbers reveals some other notable nuggets. Delivery Hero, for example, has birthed Flink, Gorillas and Jokr, while Skype led to Wise, Bolt and Pipedrive — each of these companies have gone on to hit unicorn status themselves.

Also, there is at least one third-generation unicorn out there. Israel-founded payments company Payoneer has spawned some 12 startups, one of which is IronSource, which recently merged with Unity in a $4.4 billion deal. And it was IronSource employees who launched Noname Security, which hit a $1 billion valuation last December just a year after it was founded out of Israel.

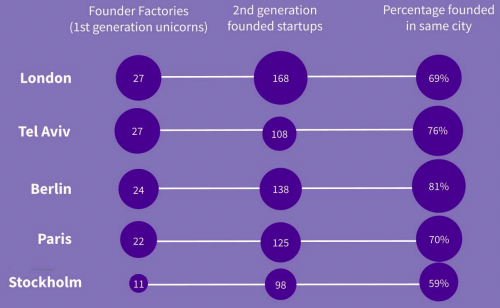

In total, there are 23 examples of unicorns birthing unicorns, though not all of those secondary unicorns are necessarily based in Europe themselves. The report did state, though, that 56% of second-generation companies were founded in the same city as the original unicorn.

On top of all that, with layoffs and scalebacks rife, it’s not clear whether all these companies’ respective valuations are still at a “unicorn” level today — some of these valuation needles may spin backwards in a future funding round.

On location

The report also delved into founder factories by city, with the data suggesting that London remains a bedrock in the European technology sphere — the U.K. capital is top of the list in terms of overall number of startups spawned by unicorns. Indeed, 27 unicorns founded out of London created 168 startups over the past 14 years, 69% of which are also based in the city. Berlin was second with 24 local unicorns creating 138 startups, 70% of which were founded in the German capital. Rounding out the top five were Paris (125 startups from 22 unicorns) Tel Aviv (108 startups from 27 unicorns) and Stockholm (98 startups from 11 unicorns).

Founder factories by city Image Credits: Dealroom / Accel

However, it can be difficult pinning a startup to a specific region, as companies may move their headquarters to the U.S. early on to secure funding or be closer to customers. GitLab, whose former VP of Product launched Remote, which recently hit a $3 billion valuation, is perhaps a good example of this — while its foundations are certainly rooted in Europe, the company is formally incorporated in the U.S. with a fully distributed workforce spread across dozens of markets globally. Similarly, Payoneer has been headquartered in New York almost since its inception.

The report did note that the location of the companies in the dataset was based on where they were initially created, irrespective of where they may have later relocated. Put simply, in a world of remote work and founders with itchy feet, it’s perhaps not as easy to pigeonhole a startup as “European” or “Israeli” in 2022 as it was 14 years ago.

But despite all those grey areas, Dealroom’s data still gives some interesting insights into founder factories and the flow of technology talent over the past 14 years.