Recent economic headlines have been dominated by the declining stock market, rampant inflation and widespread talk of recession. At Armanino, we use the term “VUCA” to describe such broadly adverse market conditions. Standing for volatility, uncertainty, complexity and ambiguity, VUCA illustrates the many challenges currently facing business owners and operators.

Times like these can separate well-run companies from those with directional or operational flaws. Forward-looking owners and C-suite executives who provide strong direction are more likely to steer their companies through the storm. Facing a sea of challenges, leaders have clear opportunities to implement critical changes and prepare for better times ahead.

As a business owner and CEO, anticipating and managing through VUCA is a constant focus for me. We have helped thousands of companies — ranging from seed-round startups and late-stage unicorns to mature public companies — navigate it by implementing practices that can allow them to survive and thrive. Having helped build a startup and gone under the hood with many unicorns over the past few decades, I’ve seen how some of the best founders and executives position their companies in times of stress to flourish on the other side, whether through a successful IPO, SPAC exit or just stable growth.

It might seem counterintuitive, but the ability of AI to assess the quality of client relationships can actually help companies become more “human.”

As I look back on what these businesses have done to succeed, my best tips for company leaders encountering VUCA now are to empower their operations, invest in digital transformation and seek M&A opportunities.

Empower operations to capitalize on better market conditions in the future

Companies are increasingly focused on running their businesses better during adverse market conditions so they can come out stronger when the economic environment improves. In some cases, companies that had been targeting IPOs or funding transactions for 2022 are now postponing until Q1 or Q2 of 2023, if not later.

Empowering operations includes understanding and communicating relevant metrics. First, does your team grasp the metrics on which success is based for your company? Second, do your employees understand those numbers and how to impact them? When times are tough, everyone in the organization should understand the most important metrics and how to potentially improve them so they can better recognize what to do and why their roles matter.

We’ve also noticed companies increasingly emphasizing the idea of reaching a cash-flow-positive state. In the past, a “revenue at all costs” approach often took precedence. But now it’s more about identifying the best revenue and focusing on how to manage costs to achieve some level of cash-flow positivity or at least a clear trajectory toward it.

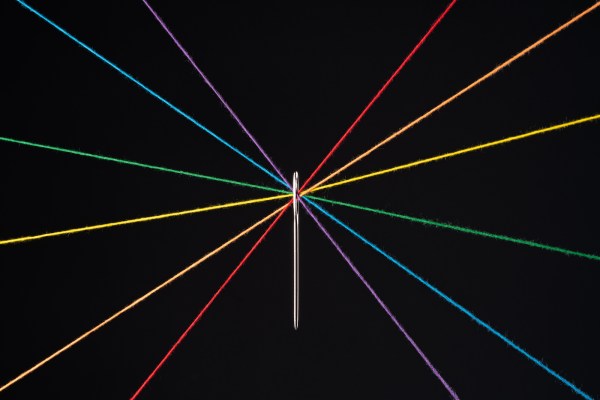

During lucrative times, companies have historically focused on growing top-line revenue by aggressively adding new accounts. During a downturn, it’s critical to be laser-focused on your most engaged customers and invest in building deeper relationships with less steady clients. Businesses should take a closer look at key accounts to analyze relationship strength and work to bolster these relationships. In fact, many companies are now hiring more account managers instead of salespeople to improve client relations and promote additional services to paying customers.

Invest in digital transformation to make your data actionable

If becoming cash-flow positive and developing deeper client relationships are important goals, then focusing on technology and digital transformation is vital. Businesses need to assess how they can become more efficient with their infrastructure and leverage more valuable information from their data collection.

Most companies collect data about their operations, but that data is essentially meaningless unless it’s actionable. As a result, AI-driven efficiency is rapidly gaining prominence. AI can make your data more actionable by providing insights into your clients or customers, as well as identifying areas where you might expand, reduce investments or even look to divest.

Some companies are using AI to reduce customer churn and help determine the exact profile of a client that is most likely to leave. This enables them to be more proactive about engaging with those clients before they find the door or to invest more time and energy into those they expect to be longer-term customers.

It might seem counterintuitive, but the ability of AI to assess the quality of client relationships can actually help companies become more “human.” As your perspective changes to expanding within existing client bases from adding new clients, AI offers great potential thanks to its connection with data.

Many organizations are increasingly leveraging their AI investments by taking tasks off the plates of employees to enhance efficiency. The smartest companies are both investing in AI to help maintain business success today and evaluating how to further leverage AI-driven technologies to stand out from competitors in the future. The ROI provided by an efficient workforce is invaluable.

Seek M&A opportunities for talent and alternative investment

Another vital focus in the current environment is actively seeking M&A possibilities. The slumping economy has led to lower valuations, allowing companies to make strategic acquisitions at more reasonable prices. The buy-versus-build question has changed from a few years ago. Many organizations are reevaluating the cost of developing a road map versus accelerating it through technology acquisition.

Additionally, opportunities to bolt on smaller companies will become more prevalent. At our September “Unicorn Roundtable,” we heard from multiple companies about successful “acqui-hire” strategies in 2022.

If your business is a well-funded unicorn, you might be able to make deals now that wouldn’t be possible in a booming economy. A down market allows you to buy low and capitalize on the growth of those investments when conditions improve. In the current environment, not only could you identify some distressed companies potential acquisition, you could also pick up good businesses that simply lack the experience and wherewithal to weather the storm.

Just as a large company could be thinking now is a good time to tuck in a smaller business, smaller companies might feel the time is right to become part of a larger organization rather than shrinking their operations in a down market. With many investors increasingly hesitant to write checks, strategic buyers could find great opportunities to jump in.

Maximizing value

Successful leaders know that hoping and waiting for economic certainty isn’t a viable strategy. Instead of sitting on the sidelines, they’re taking proactive measures to come out ahead in the long run. Well-run companies see opportunity in adverse conditions to set themselves up for success when the environment becomes more favorable. Pivotal strategies include utilizing strong and clear metrics, working toward cash-flow positivity, making substantial investments in technology and actively evaluating M&A opportunities.

One of the best things any leader can do right now is to be straightforward and communicate directly with employees. Many organizations have leaders who are disconnected from their teams. Stronger connections enable companies to weather economic downturns.

With all the elements of forward-thinking, candid leadership during hard times, companies can potentially earn a higher valuation or enjoy a more successful IPO or exit event in the future. In the end, it’s about maximizing value. As long as leaders do that by practicing concepts like these, an economic downturn can become an opportunity rather than an obstacle.