Cloudflare, the internet infrastructure and security company, reported earnings on Thursday, reaching a significant milestone. With almost $254 million in revenue, the company is on a run rate of over $1 billion for the first time.

Revenue, which was up 47% over the previous year, also beat the street’s estimate of $250.6 million. That win was offset by a third-quarter loss of $42.5 million, or 13 cents a share. Still, Cloudflare posted a much smaller loss than in the year-ago quarter when it reported losses of $107.3 million, or 34 cents a share, per MarketWatch.

After earnings, Cloudflare co-founder and CEO Matthew Prince announced that the company set a lofty goal to reach $5 billion in revenue organically within five years. “Even as we achieve $1 billion, we have penetrated less than 1% of our identified market for products we already have available today.”

“That’s why we’re confident we’re on the path to organically achieve $5 billion in annualized revenue over the next five years,” Prince told analysts in the earnings call.

Prince also pointed out how rare it is for a company to reach $1 billion in revenue. “Only 6% of public software companies achieved this milestone, so we’re proud to have crossed it, but nowhere close to finished,” Prince said.

Per usual, the markets treated this news with a kick in the teeth, with the company’s stock down as much as 13% overnight Thursday and down over 18.5% by the close on Friday.

But how realistic is the $5 billion goal, given its current situation and predicted revenue for 2023?

How ambitious is the $5B goal?

With $254 million in Q3 2022 revenue, Cloudflare is on a $1.016 billion run rate. If it grew 35% year over year for the next five years (ending Q3 of each successive year), Cloudflare would reach $4.55 billion at the end of the half-decade. Put another way, Cloudflare will have to grow faster than 35% yearly on a compound basis to reach its revenue target.

However, with 47% growth in the third quarter of this year compared to the year-ago period, Cloudflare is starting from a relatively strong revenue expansion position; if Cloudflare grows 40% in the next 12 months, and 35% for the next four years, it will reach a run rate of $4.72 billion — or very, very close to its goal.

The company’s revenue target for the next half-decade is therefore not too ambitious in the near term. However, Cloudflare is telling investors that it expects its revenue growth to have a relatively high floor, implying a sturdy pace of expansion for the coming years. In theory, investors should cheer this target, as they are anticipating more modest revenue in 2023 than the company is inferring (Yahoo Finance reports that the average analyst estimate for revenue at Cloudflare next year is $1.32 billion, or about 35% growth compared to its midpoint guidance for calendar 2022).

It’s worth noting here how quick the company’s current pace of growth is. Given that we’re now quarters into a macroeconomic slowdown, a changing monetary environment and seeing layoffs around the world of tech, 47% growth is just massive. For comparison, the relatively well-received Amplitude quarter included growth of just 35%, and from a smaller revenue base. Cloudflare is still a rocket.

So why is the stock down? It’s perhaps worth putting its valuation into context at this juncture. Cloudflare is worth $13.45 billion (Yahoo Finance data) as of Friday. At its $1 billion revenue run rate, the company is worth around 13x its present revenues, and say 10x its end-2023 run rate, growth depending. Those multiples are down sharply from 2021 norms, but still rich by today’s prices.

Recent data indicates that the median multiple for the top five most highly valued software companies today is 12.3x, and Cloudflare, per Altimeter investor Jamin Ball, is the second most richly valued software company on the market today (measured on a multiples basis). It isn’t cheap. Even now.

Historical context

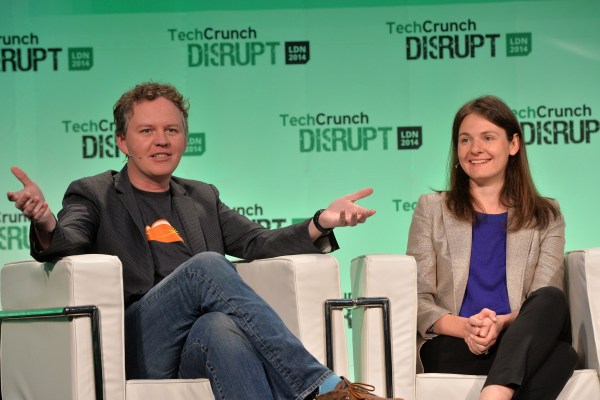

The company’s growth curve to date has been impressive, with Cloudflare growing from zero dollars in top line to a $1 billion run rate in about 12 years after debuting at TechCrunch Disrupt in 2010 as part of the TechCrunch Disrupt Battlefield that year. (It’s not the first $1 billion Battlefield company, by the way. That distinction belongs to Dropbox, which launched in 2008 at what was then known as the TC50.)

Cloudflare operates hundreds of data centers around the world with the goal of helping customers work securely on the internet, while offering faster service with the help of that network of data centers providing delivery at the edge. More recently, the company has gotten into infrastructure with R2 storage, which debuted in 2021, and platform services with a serverless database that launched earlier this year.

The company raised over $330 million. In its final two raises, it brought in $110 million in 2015 and another $150 million in 2019, its final private raise before going public in 2019.

The Cloudflare selloff may seem surprising; How did Wall Street get the value of the company so wrong? Despite targeting 4x the revenue growth that it managed in its first 12 years of life in the next five, the company still had room to lose market cap to get back into a more normal valuation band.

The story with Cloudflare, then, is less about the company performing incrementally better or worse than expected, but more that the market it exists in has shifted so far, so fast, that it still had altitude to lose as it descended to a more normal valuation level.

Being public these days ain’t easy.