For consumers, the holiday season means indulging in gifts, family traditions and festive celebrations. But for retail businesses, it’s the most critical time of the year.

We’re seeing a gathering storm of economic conditions — inflation, inventory and supply chain issues, and an elongated holiday season — that has companies scrambling to determine the right e-commerce strategy for the holiday season. Retail e-commerce channels such as Amazon, Walmart and Instacart, where a majority of all e-commerce happens, will be the real holiday battlefront. The key to succeed this year will be flexibility, responsiveness and endurance: Companies will have to be ready to respond to the market and the consumer throughout the season.

Following two years when e-commerce enjoyed pandemic tailwinds, consumers are now living with inflation and an unofficial recession, and we can expect more selective and price-conscious shopping behavior. While prices across major retail e-commerce marketplaces like Amazon, Walmart and Target have mostly kept pace with inflation, consumers are feeling the squeeze on their everyday essential purchases.

According to CommerceIQ data based on thousands of products across 450+ online retailers, grocery and home and kitchen prices have risen about 20% on average over last year, far outpacing inflation. The average shopper has to focus more of their budget on essentials, leaving them less to spend on gifts and other discretionary purchases.

Place as many inventory orders as possible early so that you have inventory before the holiday season begins.

However, unemployment has remained low so far, and consumer spending has been resilient, which we can see in the continued strength of online shopping. For instance, in Q2 2022, e-commerce growth has already rebounded to 9% at Target, 12% at Walmart and 10% at Amazon in North America.

On top of this shift in value, the holiday shopping season is kicking off earlier this year, spurred by the second Amazon Prime Day in October. Other retailers will follow suit in an attempt to capture the spending of price-conscious consumers as they plan ahead for the holidays.

What does this mean for brands? The focus must be on endurance and companies will need to be ready to shift their strategy for discounting, inventory planning and ad and marketing spend as the environment changes, all while fending off potential consumer fatigue.

Increase discounts while balancing profitability

Discounting has taken a back seat over the past couple of years, largely thanks to consumers’ lockdown savings and stimulus checks, but that is set to change this year. Promotions and discounts have been on the rise throughout 2022, and Amazon Prime Day was a great indicator of what could come in the holiday season. According to CommerceIQ data, during Prime Day 2022, discount levels for items on sale rose 10% to 12% compared to Prime Day 2021. The trend will likely continue at other major retailers as we head into the holidays.

While companies and retailers will look to increase promotions and discounts throughout the season, the majority of promotions will still occur during specific sales like Black Friday and Cyber Monday rather than broadly across the season as consumers hold out for the best deals.

There is an opportunity to further eventize promotional events like Cyber Week to capture greater volume, but getting discount levels wrong could lead to big hits to profitability. Companies that go into the season with excess inventory could face a perfect storm that eats into the bottom line.

Prices continue to rise leading into 2022 holidays, but discounts have yet to pick up. Image Credits: CommerceIQ

Here are some principles companies should keep in mind when planning e-commerce promotional strategies for the holiday season:

Balance growth and profitability

Companies will have to balance discounts during this highly competitive period. As consumers focus on value, companies can be tempted to race to the bottom and that can negatively affect profitability.

Use discounts to clear out excess inventory early in the season

Take advantage of customer appetites for discounts driven by Prime Day 2 to clear out excess or non-seasonal inventory you may have on hand.

Maximize Cyber Week

With more consumers looking to buy during sales, critical periods like Cyber Week may see an outsized portion of the season’s spending. As more companies compete for customers’ clicks during this period, brands will have to be smart with their ad strategies as well.

Look outside of Cyber Week

Companies should consider differentiated promotional events and discounting throughout the season to reach consumers when there is less noise from competitors, as well as to keep them engaged throughout the elongated shopping season.

Optimize inventory for flexibility

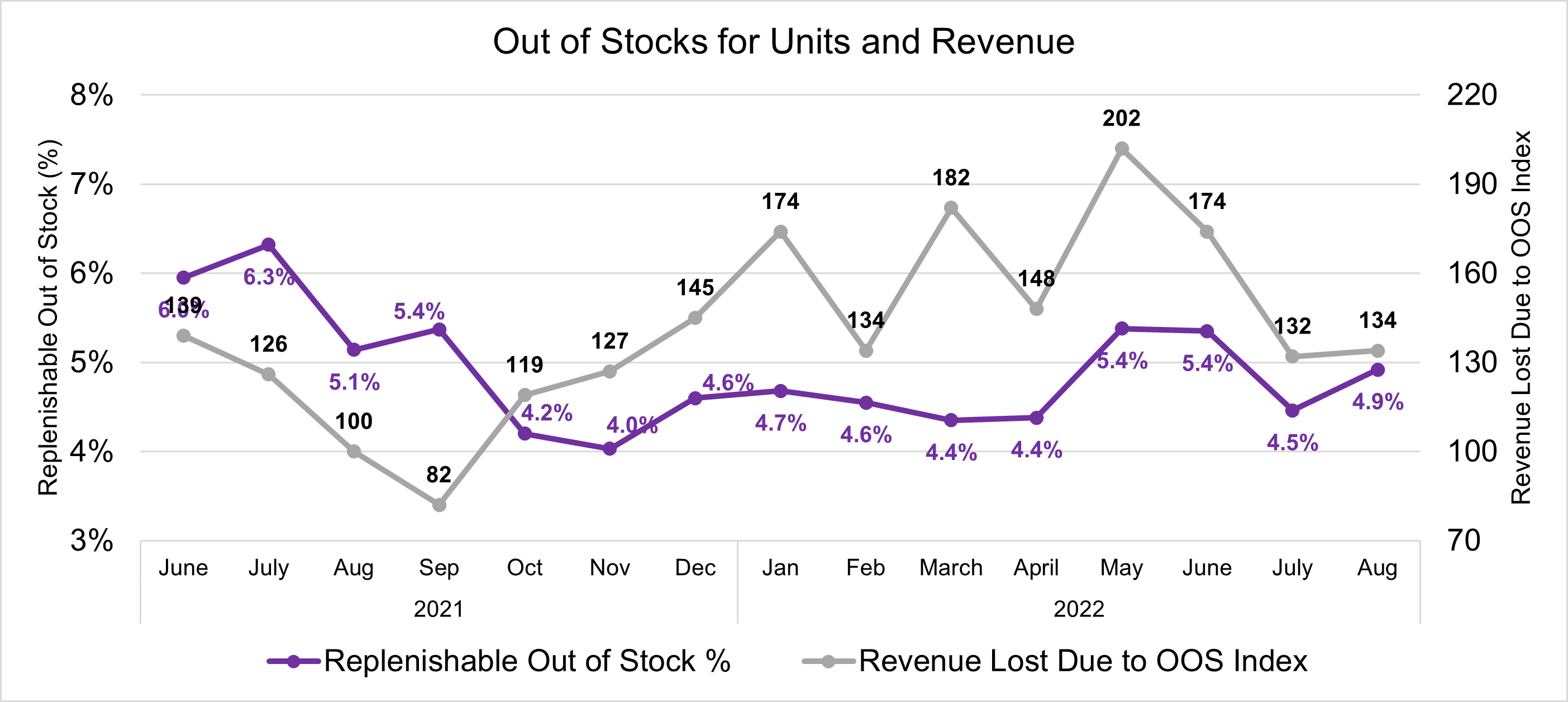

The good news for companies (and shoppers) is that CommerceIQ data shows out-of-stock issues improved in 2021 from 2020 and will likely continue to improve as supply chain issues clear up.

But, while the major production and shipping delays due to COVID-19 have abated, the supply chain crisis has evolved, and there are even more complications for brands and retailers to juggle. Many companies overcorrected and planned higher inventory levels in anticipation of potential production or shipping disruptions and now have surplus inventory that they need to offload before the holidays.

Even Walmart and Target have admitted they are struggling with inventory pile-ups. Additionally, the war in Ukraine is having second- and third-order effects on the supply chain, causing outsized food demand in Europe, which could cause a domino effect as well as an energy crisis.

Out of stocks show more stability ahead of 2022 holidays than in early 2022. Image Credits: CommerceIQ

Brands will have to play both offense and defense to prepare for these challenges as well as consumer appetites. They must plan their allocation and assortment for this environment while being nimble and responsive.

Here are a few strategies companies should keep in mind to optimize inventory this season:

Ensure availability of inventory

Companies must ensure SKUs have plenty of stock and their listings are optimized on retail e-commerce platforms. Beauty, alcohol, gourmet food, toys and tech products will be sought after in the run up to the holidays, so guaranteeing availability will be key.

Perform daily monitoring and maintenance

Ensure product availability and protect your brand on platforms like Amazon by monitoring for and removing third-party seller variants, eliminating duplicate listings and ensuring you win the buy box.

Also monitor product display pages for any content variations that might keep the product from reaching customers. These can be highly manual and time-intensive tasks for already stretched teams, so companies should consider automation for these critical responsibilities.

Front-load inventory as much as possible

Place as many inventory orders as possible early so that you have inventory before the holiday season begins. If you can’t frontload, tighten allocation and plan to match where you can.

Incorporate variation into your assortment

Make sure your new items vary and include current best sellers. Companies should check frequently on variations leading up to and during the Cyber Week.

Create a dynamic and responsive retail media ad strategy

As consumers become more selective with their spending, companies will have to compete hard to capture their attention. A solid ad strategy will play an even more important role in e-commerce brands’ success this holiday season.

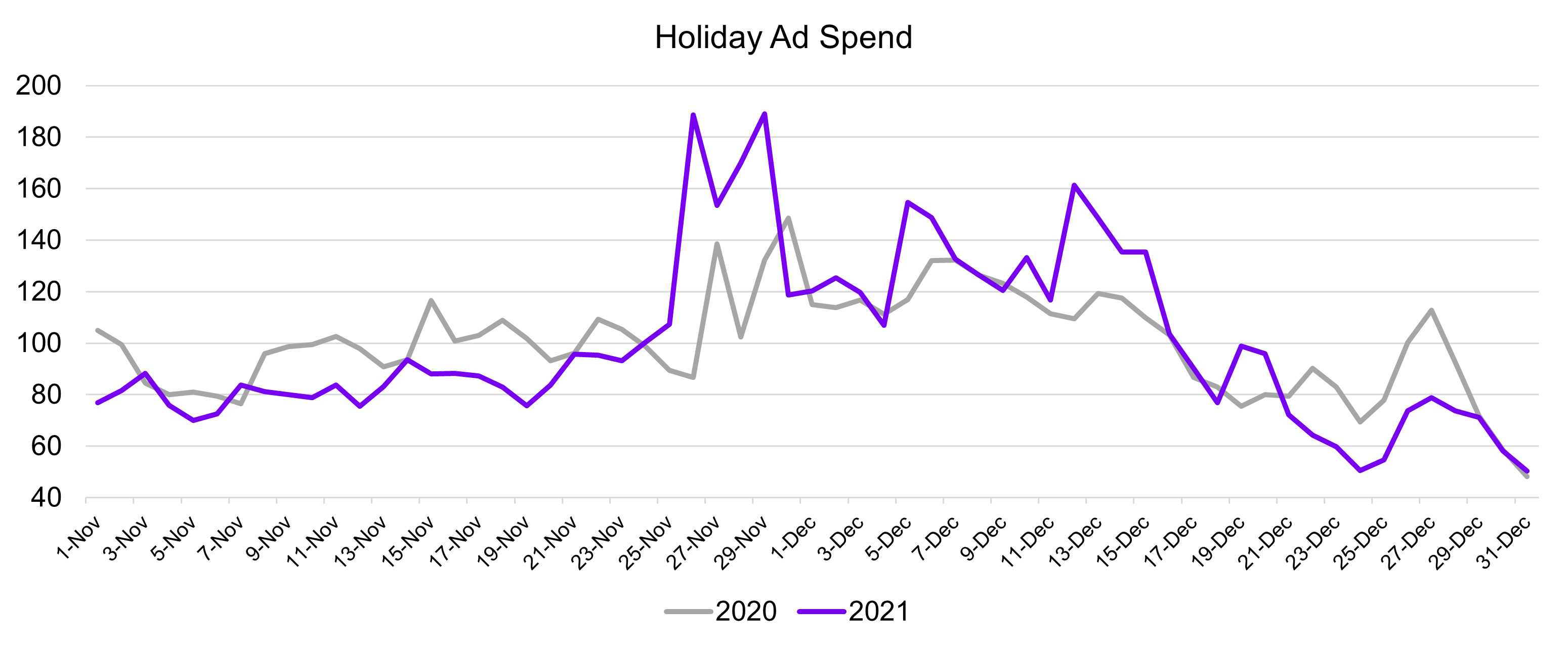

During Cyber Week 2021, retail media ad spend was more impactful, and vendors raised their investment in ad spend across the board. According to CommerceIQ data, shoppers clicked on fewer pages, but conversion increased, demonstrating the effectiveness of targeted ad spend on retail e-commerce platforms. Some categories saw greater spend than usual, with ad spend for beauty products soaring 300% on Black Friday last year. Given the higher competition this year, we could see similar or even greater spend.

Ad spend has risen rapidly year over year for the holidays. Image Credits: CommerceIQ

Companies should keep the below recommendations in mind to make the most of their ad strategies:

Make big bets, but leave flexibility in your trade dollars

Companies should bump up retail media ad spend across e-commerce platforms and make sure to pick the search terms that see high volume and relate to their products.

Sponsor premium products that boost profitability, and apply ad spend to relevant categories, as shoppers may attempt to get ambient product purchases done early “just in case” availability degrades. That said, be agile and leave yourself enough space to respond to the market as it evolves.

Leverage retail media incrementality to win new shoppers

Track share of voice (SOV) to reach the right customers through both organic and sponsored search. Return on ad spend (ROAS) may perform well as a backward-looking indicator of ad-spend efficiency, but SOV can better determine where dollars should be spent to drive incremental sales.

Harvest new keywords by tracking the competition as well as which keywords are rising or falling to uncover opportunities to boost SOV and grow sales.

Balance retail media with contribution profit

Search results are a function not just of keyword relevance, but also of contribution profit, which is profit-per-product for a retailer over the past 1,000 product page impressions. Companies can improve profitability by lowering costs, raising prices or improving conversion. Improve conversion by optimizing the product content or by altering the offering itself to boost visibility.

Any retail media advertising should be inventory aware

Don’t lose sales to competitors by inadvertently putting your ad dollars behind a product that is out of stock. Marry your inventory and your advertising strategy to increase ROAS.

Increase spend around Black Friday/Cyber Monday

With more price-conscious consumers looking to buy on sale, critical periods like Cyber Week may see an outsized portion of the season’s spending. With more brands competing for customers’ clicks during this period, brands can’t afford to miss out, especially if they are in a hypercompetitive category like beauty.