I love meeting startups that are making a tangible impact on the factory floor. While Shein applies a data-driven approach to improve efficiency for clothing manufacturing, Pacdora is doing something similar for packaging, from design all the way to production.

Packaging sounds archaic and pretty removed from tech — and it is, which is why there aren’t many competitors for Pacdora — yet. But the opportunity is enormous. In 2019, McKinsey estimated the global packaging industry had exceeded $1 trillion, thanks to a combination of factors like the e-commerce boom and changing consumer expectations. Most important, it’s an industry primed for technological upgrade.

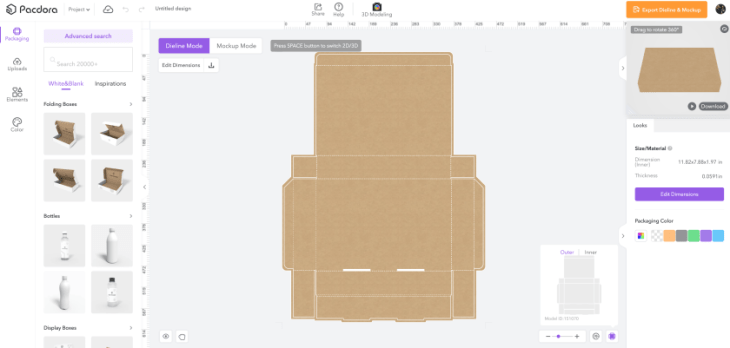

The traditional lifecycle of packaging is highly inefficient. The illustrator might take a few days to draw up the design and spend another few days to discuss with their client before they can finalize the dieline — the 2D diagram marking the folds and cuts for a 3D box — only to be told later by the factory that the measurement doesn’t add up and the colors and materials requested aren’t available. This back-and-forth can take weeks before the prototype goes into production.

“That’s because most designers don’t have real-life manufacturing experience and they are drawing things that aren’t useable by the factory,” Xianfeng Wang, founder and CEO of Pacdora, tells TechCrunch.

To bridge the gap between designers and manufacturers, Wang’s team developed Pacdora, which is like Canva plus Figma for packaging. The platform offers thousands of packaging templates for all kinds of products, from shipping boxes and coffee bags to lotion bottles and yogurt pouches. With a click, designers can switch between the 2D dieline and 3D-rendered mockup. Any tweaks to the look apply to both modes automatically, freeing designers from spatial visualization challenges.

Powering the automatic 2D-3D conversion is Pacdora’s proprietary algorithm, which took the team six months to develop, according to Wang.

The Figma aspect of the platform allows a client to view and comment on the design in real time, further speeding up the project cycle. The collaboration feature is available on Pacdora’s Chinese version and will later debut on its international platform powered by AWS.

Packaging is also notoriously polluting. Look around and you’d be uneasy with how much packaging there is, from bubble wrappers for your Amazon order to the plastic container holding cupcakes. That is just the visible portion of the waste generated by the industry. Traditionally, factories are only willing to take large orders — that is, at least tens of thousands of units — due to the overhead of starting up a printing machine. If the production volume is too low, the machine ends up idle for most of the time and the factory operates at a loss.

“Therefore many clients are forced to order tens of thousands of packaging units even though they know they can’t sell that many products,” observes Wang.

The inflexibility in traditional manufacturing fails to meet the growing need for product customization. Instead of sticking to the same classic bottle look, beverage makers, for example, are increasingly introducing brand collaboration or seasonal packaging. Brands now want to order 500 customized wrappers instead of 10,000 standardized ones. Pacdora’s other main service is to solve this mismatch.

“The beauty of an internet platform is that we can group the same kinds of low-volume orders and place one batch order with a factory,” says Wang. Factories get to keep production costs low while brands pay the price for mass production and avoid inventory waste.

Pacdora has launched the printing service in China by connecting designers to third-party manufacturers, and it’s getting its hands dirty by setting up its own production line to make prototypes. “We want to ensure quality control. Only after our client approves a sample will we place the order with factories,” says Wang.

The firm’s freemium, Canva-like design platform enjoys an 80% profit margin; its supply chain side of the business, which works to consolidate orders, also has a comfortable 40% margin compared to 10% for traditional manufacturers. Pacdora has accumulated some 1.5 million registered users with revenues expected to exceed 10 million yuan ($1.37 million) this year. In August, the company raised $8 million from investors including Hearst Ventures, GGV Capital and Sequoia Capital China at a valuation of $110 million. It has around 110 employees, mostly based in China.

Like many other SaaS startups that originate from China, Pacdora is excited about expanding to more mature markets like the U.S. Businesses in China are increasingly willing to pay for software that can help cut costs and boost income, but the SaaS market is still years behind that of the U.S. SaaS penetration in China was just 28%, compared to 58% in the U.S., according to a November 2021 report by Deloitte.

The startup’s growth outside China is telling. Several months after launching the international version of its design platform, Pacdora is generating $200,000 to $300,000 in revenues a month, with the U.S., the U.K. and Australia being its largest markets. It took the firm three years to reach that revenue level in China.

While it doesn’t currently provide a manufacturing service for overseas customers, Wang is bullish about a future of connecting Chinese factories to global designers because of the country’s obvious price advantage: The same box that costs one yuan to make in China can easily cost seven times more, or one dollar, to make in America.