It’s obvious that periods of enormous growth won’t continue forever, but it’s still somewhat startling when they end. Edtech hasn’t been immune to the ongoing downturn, but at least the turn came at the end of a period that saw robust investment activity. Indeed, it’s very easy to forget just how far edtech has come in the past 2.5 years.

Per Dealroom and Brighteye Ventures’ paper, “The evolution of Edtech: activity in private and public markets,” there’s still hope for the sector, and edtech remains an enormous, underinvested opportunity. However, the momentum that has been building in recent years has slowed significantly as investors tighten their belts to better understand the more robust parts of the sector.

The public market pullback can largely be explained by the overall macro environment affecting tech and high-growth companies. Assessing individual cases, there is clear variation in the extent to which market caps have evolved, and there is some correlation with subsectors. Companies that appear to have more robust caps appear to be B2B SaaS companies, while MOOC-providers like Coursera and 2U have suffered significant declines. Of course, these changes are not only associated with overall macro trends and the subsector, they are inextricably linked to performance.

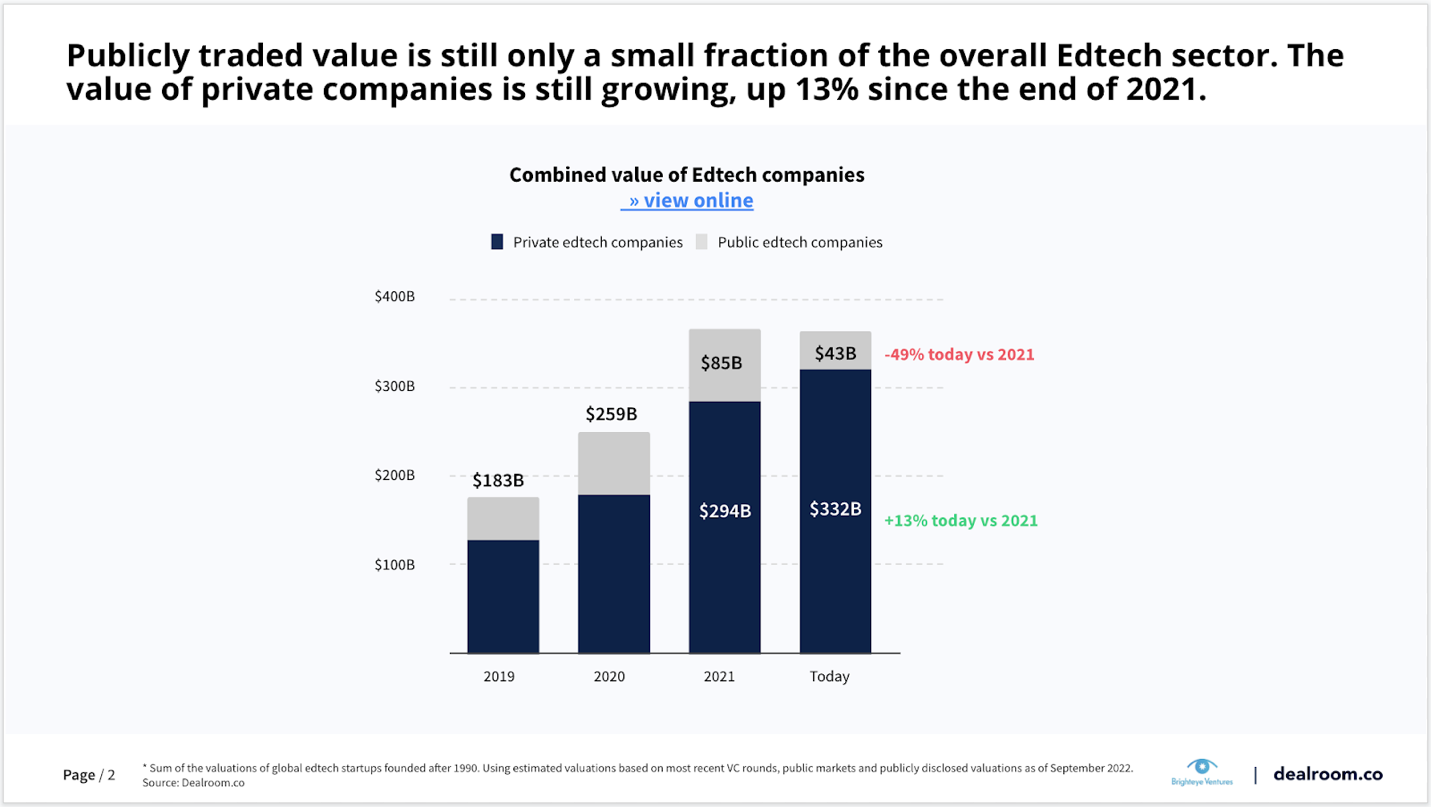

That said, it’s important to remember that publicly traded value represents a fraction of the overall edtech sector. The value of private companies is still growing, although at a slower pace than previous years.

Image Credits: Brighteye Ventures, Dealroom

Market consolidation continues, and IPOs are few and far between

After last year’s IPO fever, public exits have been rare thus far in 2022. Big public exits aren’t necessarily an appealing exit strategy in this climate, but M&A activity has already surpassed 2020 levels.

Bolstered by pandemic tailwinds and significant rounds raised in good times, edtech has begun to show signs of maturity in the form of major M&A activity led by the sector’s biggest names. Notably, Byju’s, edtech’s most valuable company, has bought 11 edtech startups since 2020 in an acquisition spree.

Consolidation suggests that bigger companies are opting to buy instead of building their own capabilities to expand geographically and launch new products. To some extent, the popularity of this approach to growth highlights the transferability of edtech problems and solutions across markets.

Image Credits: Brighteye Ventures, Dealroom

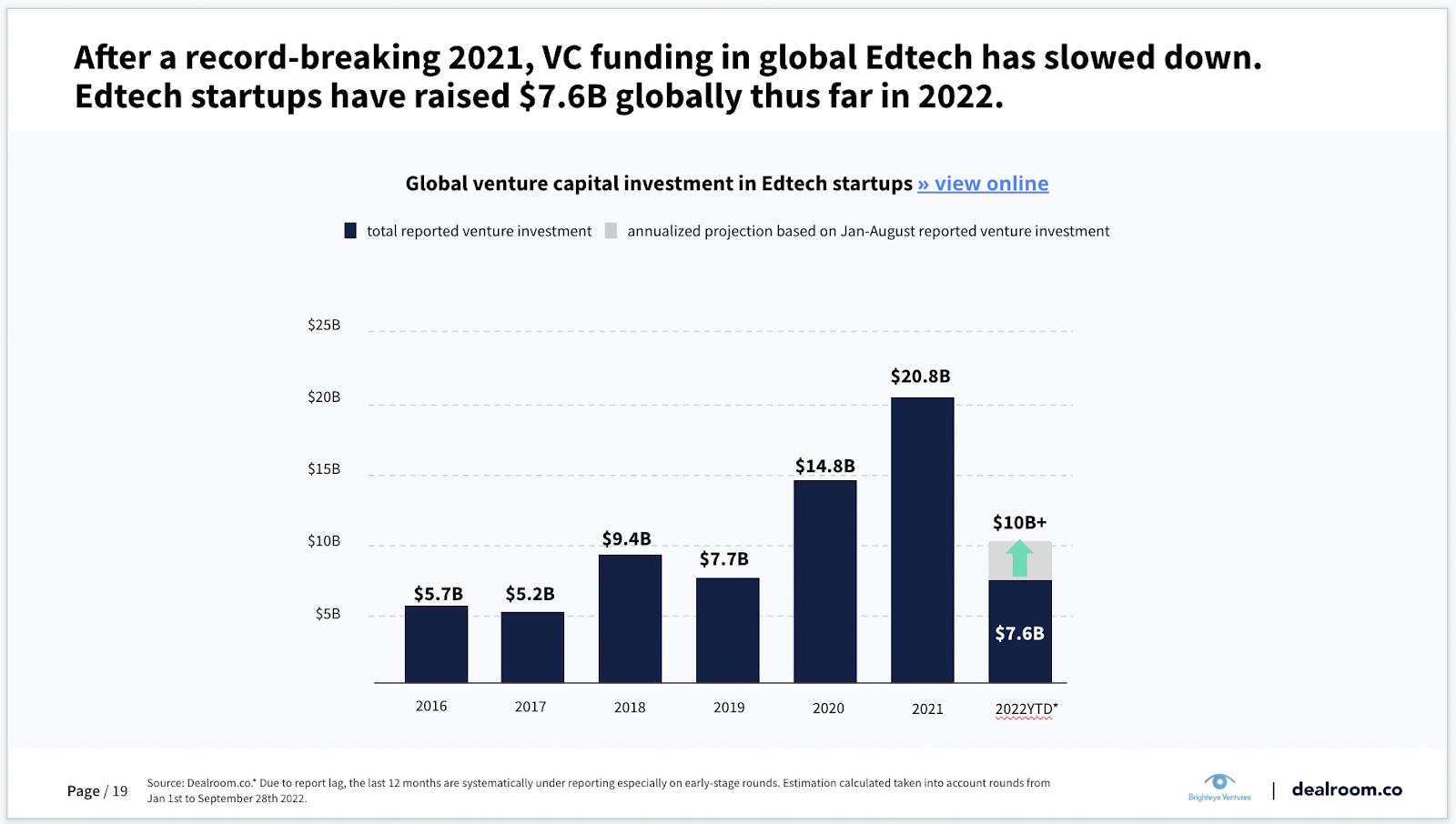

VC funding has cooled, but the early stage remains resilient

Global VC funding into edtech startups totaled $7.6 billion in the year to September 2022, down from a year earlier. The pullback has been largely due to a drop in late-stage rounds. Late-stage edtech companies appear to be postponing their fundraising plans, instead prioritizing paths to breaking even and greater financial independence. This may be partially because the current conditions necessitate lower revenue multiples, and therefore, lower valuations.

Globally, early-stage investment has been resilient and was up 33% in the first half of 2022 compared to the first half of 2020.

Image Credits: Brighteye Ventures, Dealroom

As previously reported, the European edtech ecosystem saw the most investment in the first half of 2022, attracting a larger share of global edtech funding (21% in the first half 2022 compared to 12% in all of 2021). However, some correction might be underway, as Q3 results show a considerable decline.

Edtech innovation across different subsectors

Several trends within the user verticals (K-12, corporate learning, lifelong and consumer learning) are particularly exciting.

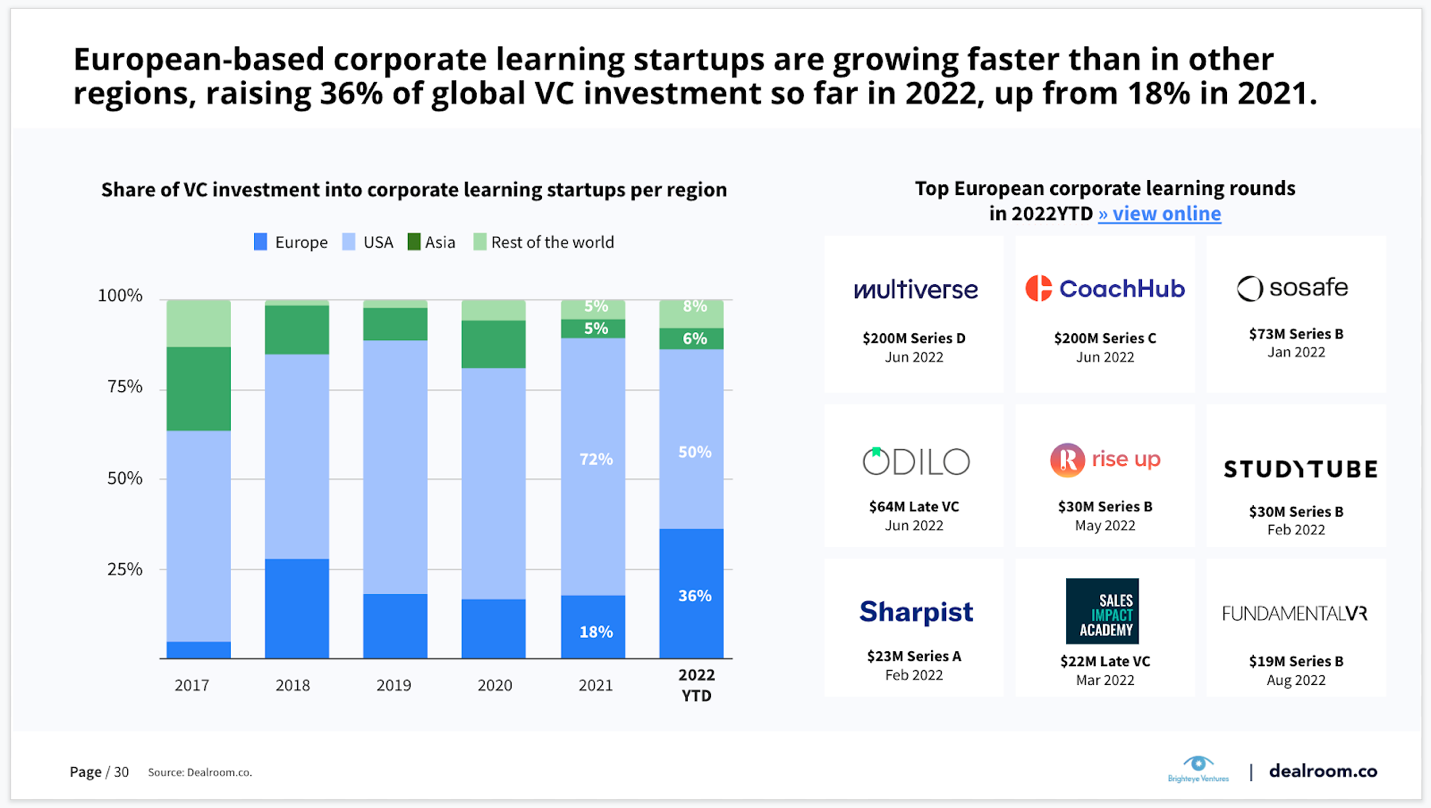

While K-12 remains the dominant edtech segment, raising over $2.6 billion in the first half of 2022, companies offering corporate learning programs are gaining a greater share of VC investment. Notably, European companies are among those growing the fastest in the corporate learning funding landscape — four of the top 10 largest corporate learning rounds were raised by European startups. Multiverse and CoachHub are now global names in their respective fields.

Image Credits: Brighteye Ventures, Dealroom

The cost of higher education for consumers has been rising for decades, which has resulted in skyrocketing demand for accessible and affordable education financing. University fees have been climbing, but the incomes of those who attend and graduate have not kept pace. Higher tuition fees, combined with pandemic-related disruptions mean that an entire generation is now weighing the value of higher education and its costs, questioning whether a university degree is the fast track to professional success it once was. An increasing number of startups are tackling the student debt problem to make higher education more affordable and ensure students have a sustainable path to paying off their debts.

Another emerging subsector is learning for older adults. Today, around 30% of the European population (90 million) is over 55, and by 2050, it will increase to 42% of the total population (140 million). The new generation of people over 65 is digitally connected and willing to engage in and pay for online activities. Senior learning is still a niche, but represents a huge untapped opportunity in Europe. Companies like Vilma, Mirthy and The Joy Club, among others, are tackling these issues and have seen some early success. We expect to see considerably more activity and success in this area in the short and medium term. You can read our analysis of this here.

Edtech still has deep and untapped opportunities. You just need to look at the mega-funds raised by edtech specialist investors like Owl Ventures to know that it won’t be long until activity bounces back. Indeed, the unraveling of education’s digital age remains in its infancy, particularly in Europe.

Learning is something we all do from our earliest days to our final years, and the breadth of the sector is beginning to reflect this truth, and so is the startup and investment landscape. The markets may have slowed, but it won’t be long until the momentum returns.

You can read the report here.