Heading into the final days of the third quarter, I am looking forward to more than just a new sheaf of data concerning venture capital flows around the world.

When September wraps, we’ll start a countdown for earnings reports from consumer-serving fintech giants, data that will help us understand present-day market appetite for trading and investing products; given the sheer number of fintech startups that touch at least a part of that operating space, we have our eyes open.

In late 2020 and 2021, companies offering consumers savings, investing and trading products were hot shit. Coinbase, Robinhood, M1 and others grew rapidly; hell, startups were born and scaled that offered other companies the ability to bake services like equity trading into their platforms!

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

We all know what happened next: 2022 brought a change in market conditions and consumer interest — or, perhaps, ability — to save, invest and trade declined. This led to Coinbase, to pick a well-known entity in the consumer fintech market, rapidly flipping from impressive profits to stiff losses in the space of a few quarters. Robinhood saw its market value fall sharply, and M1 laid off staff.

But the fintech market, while prey to changing market conditions, is also a market that never goes away entirely. Despite falling activity at some consumer trading and investing platforms, for example, folks are still using the services we have tracked often from their seed rounds.

Let’s muck around and see what we can turn up regarding consumer fintech activity ahead of Q3 2022 earnings. How healthy does the consumer fintech market look from a trading and investing perspective? Leaning on the most recent trading data from Robinhood, third-party data on crypto trading, and a little bit more, let’s find out.

Let’s muck around and see what we can turn up regarding consumer fintech activity ahead of Q3 2022 earnings. How healthy does the consumer fintech market look from a trading and investing perspective? Leaning on the most recent trading data from Robinhood, third-party data on crypto trading, and a little bit more, let’s find out.

The good and bad news for consumer equity appetite

The stock market has been busy in recent weeks tripping over its own shoelaces, torn between a desire for a strong economy despite the risk of rising rates and low rates despite the risk that high inflation could cause other issues. It’s a damned if it does, damned if it doesn’t market, where every good bit of economic news has the potential to bite back and every bad economic data point brings a silver lining.

All that’s to say that the go-go period of time when stonks went up is behind us. Consumers have noticed, as evidenced by negative growth at Robinhood, a popular consumer equities trading and investing service.

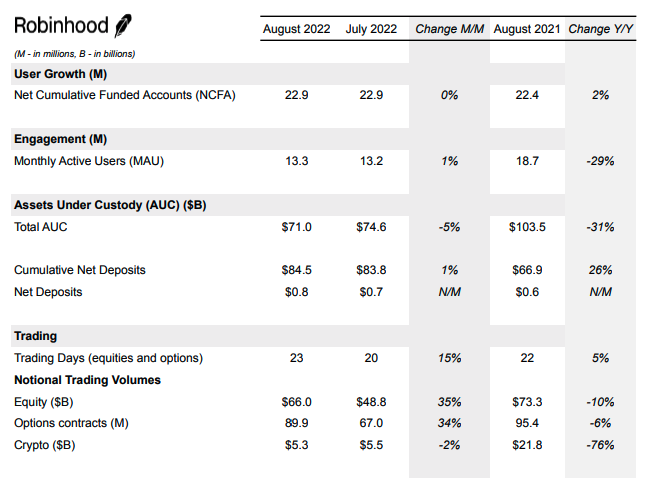

What’s the latest? The following, per Robinhood data concerning August:

Image Credits: Robinhood

- The Bad: Net funded account growth is minute, assets under custody are down and crypto trading continues to fall after sharp declines earlier in the year.

- The Good: Notional trading volumes for equities and equity-related options contracts were up sharply.

Parsing this, it appears that there is life in the equities trading game, and despite Robinhood still being down from year-ago results across all three main trading categories — as measured in notional trading volumes — compared to some of its summer lows, things are coming back up.

For the vast array of fintech companies that added equities trading (SoFi and Block come to mind on the large-cap side) and trading-focused startups (Freetrade, Public, etc.), this is good, welcome news.

What about crypto?

Crypto, decentralized finance, blockchain tech, web3 — call it what you will, but it all lives inside of the fintech world because the new digital economy, at root, is all about value transfer. That’s a crass way of putting it, I know, but a fair one by my estimation, having covered Bitcoin and friends since 2013.

Because crypto is fintech, it fits into our work today. So, what can we learn from crypto data about the health of the consumer?

Recall as groundwork that in its Q2 earnings report, Coinbase shared the following data regarding July and Q3 expectations (emphasis: TechCrunch):

- “July MTUs [monthly transacting users] declined to 8.0 million. Accordingly, we expect MTUs to be lower in Q3 compared to Q2 and for a higher portion of MTUs to be non-investing compared to investing users compared to Q2.”

- “July trading volume of $51 billion [Q2 Coinbase trading volume was $217 billion] reflected a continuation of the trends discussed above. If these trends continue, we believe Q3 will be lower compared to Q2.”

Given that context, we should not be shocked that Robinhood’s above-listed data indicates that it is still seeing soft consumer demand for crypto trading services. We want to know more, however. So what other data can we yank?

Happily, data provider CryptoCompare has a short report out concerning August trading activity, giving us a set of data that corresponds to what we have from Robinhood. Per the company, “[n]etwork activity on the Bitcoin blockchain saw a slight recovery in August, with transaction volume rising 10.5% to $2.39 [trillion,]” while “total number of transactions [on the Ethereum blockchain] fell by 6.23% to 33.5 [million.]”

Call it a wash?

What have we learned?

Frankly, I was curious whether we’d only uncover bad news — that sequential declines in consumer trading and investing activity were continuing. Instead, things appear more positive than anticipated, using August data as a proxy of sorts. Naturally, we’ll be parsing September and full-quarter data as soon as we have it, but what we can see doesn’t look too nasty.

This is good news of a sort! Given the sharp downturn in consumer trading activity we’ve tracked this year, even a soupçon of positivity feels like a breath of fresh oxygen.

The data does look a bit better for equities-related activities than crypto-adjacent action, but as we’ve seen the pair rise and fall in tandem, good news anywhere could eventually be good news everywhere, at least when we consider consumer interest in buying and selling asset classes.

Finally, for fintech startups that eat in part off of consumer activity, perhaps a reprieve is in the offing. That would be welcome for fintech investors, founders and employees alike.