The Ethereum network is nearing its final hours before the Merge, which will move one of the most important global blockchains from a proof-of-work (PoW) system of achieving consensus to proof-of-stake (PoS).

The upgrade to the blockchain has raised concerns in the crypto community that Ethereum could become less decentralized — more centralized — by moving to PoS from PoW, the latter of which powers the Bitcoin blockchain, for example.

Concerns regarding an increase in centralization due to PoS on the Ethereum blockchain post-Merge may have some merit. The current Ethereum staking market — staking is how Ethereum token (ETH) holders could contribute to the Merge before its execution and how consensus and new tokens will be distributed afterward — isn’t as decentralized as some may think.

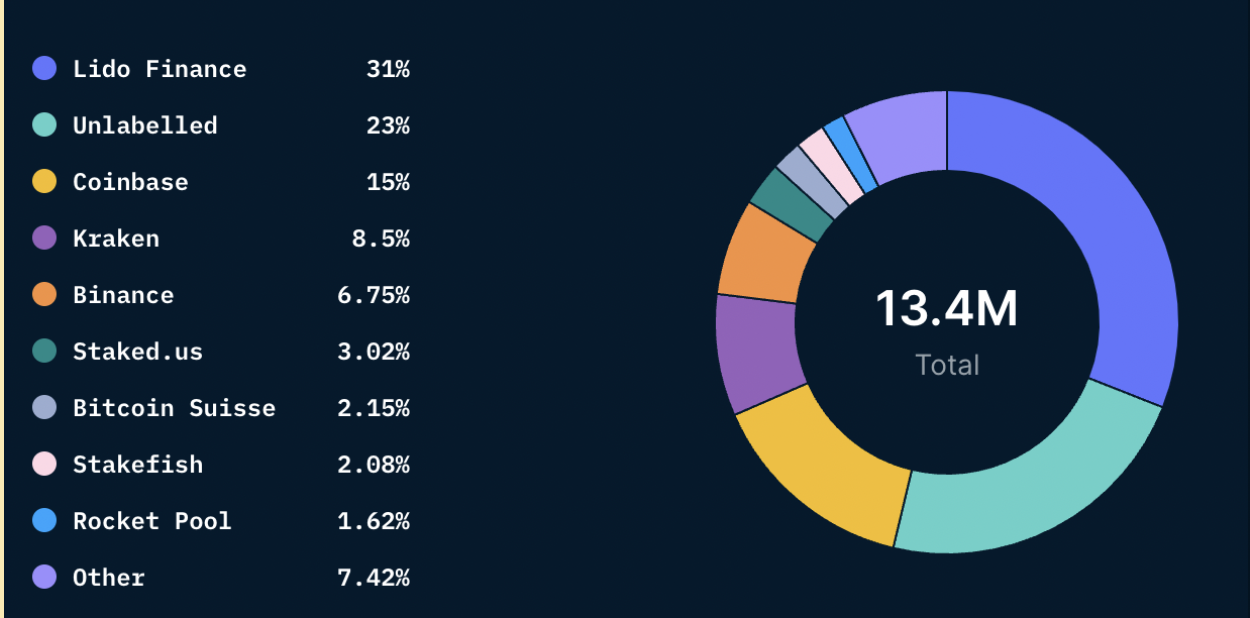

Today, four major crypto entities control over half of all the staked ETH. Lido, a liquid staking service for crypto networks, holds about 31% of staked ETH, while crypto exchanges Coinbase, Kraken and Binance together hold around 30%, according to a report by Nansen.

Query as of September 9, 2022. Image Credits: Nansen

Although about 80,000 unique addresses are participating in Ethereum staking ahead of the Merge, most of the staked ETH and validators are controlled by those four entities, the report notes.

That said, only about 11.3% of the total amount of ETH out there is currently staked, despite there being 426,000 validators who could stake, the report stated. For comparison, 41% of Polygon’s MATIC token and about 77% of Solana’s SOL token are staked (both networks are PoS).

“The staking rewards on ETH pre-Merge were relatively low when compared to other PoS blockchain networks,” Freddy Zwanzger, Ethereum ecosystem lead at BlockDaemon, told TechCrunch. These staking rewards are expected to double to 8% APY post-Merge, which could make it more competitive, he added.

The small amount of staked ETH could be because running a validator node requires 32 ETH, worth around $51,000 today. Furthermore, those funds are generally illiquid, at least until the network undergoes a “Shanghai upgrade,” expected at some point in 2023.

So, for those who aren’t ETH-rich, the opportunity to get a fungible derivative token representing their staked position for less than 32 ETH comes from liquid staking providers like Lido and Binance, which let their users do so.

There are several methods of staking, one of which is called liquid staking. In liquid staking, ETH holders provide tokens to a service (like Lido) that will stake it for the user in a manner that the user won’t lose access to their funds. This means that even if a user stakes ETH, they can still access their tokens while they’re being held, and they aren’t “locked up” or inaccessible as they would be with a traditional proof-of-stake setup.

“Unfortunately, the staking market, especially liquid staking, is likely to produce a few winners,” Beili Baraki, research analyst at Nansen, said to TechCrunch. This isn’t ideal for the cryptocurrency community, as only a few major entities may get the bulk of the benefit.

“It is also important to highlight that if projects such as Lido didn’t exist, a [centralized exchange, or CEX] could easily replace its position and dominate the market,” Baraki said. “This would be a significant risk, as there is no straightforward way to decentralize a CEX, unlike projects such as Lido.”

Ideally, other decentralized staking providers like Rocketpool can grow their share of the market as well, Baraki said. “Ultimately, these few big winners can be decentralized, which should ensure that Ethereum maintains its value proposition as an open and decentralized infrastructure.”

Baraki also said it’s unlikely that the four major crypto entities will “collude,” and regulators haven’t yet stepped in to provide guidelines for existing blockchains. But that doesn’t mean people shouldn’t keep an eye on large staking entities, especially the centralized ones, as more regulatory pressure is expected, Baraki added.

Lido has a governance token (LDO) that allows holders to vote on proposed changes to the service. The top nine addresses, excluding its treasury, hold about 46% of its governance power and a few addresses typically dominate proposal votes, Nansen stated. “The stakes for proper decentralization are very high for an entity with a potential majority share of staked ETH,” the report wrote.

But in the end, staking ETH is an “economic decision for most investors” and doesn’t necessarily bear any meaning toward the general sentiment of PoS, Osgur Murphy O Kane, research analyst at Nansen, told TechCrunch. ETH is one of the most used assets in DeFi and is the primary currency for NFT marketplaces, so there are “opportunity costs” like higher returns or APRs for those staking, O Kane added.

The switch from PoW to PoS is most relevant financially for validators with staked ETH, but it could hold greater implications, Zwanzger said.

“All other participants in the ecosystem will benefit from the transition,” Zwanzger said. “Be it dApps for Defi, NFT projects or L2 scaling solutions, all will benefit not only from the reduced energy consumption, as well as from the increased security and decentralization of the network, as well as the groundwork for future scaling upgrades.”

As for the Merge, in general, Zwanzger believes it’s a critical moment. “It will be looked back in the history books as one of the most important milestones in the early days of blockchain technology.”