Once every few months, we take a look at the world of enterprise e-commerce platforms to see how things are panning out, and our last assessment was pretty illuminating.

Here are some stand-out statistics: 2022 is turning out to be a phenomenal year for enterprise e-commerce platforms. The pandemic was a reckoning for big corporations ambivalent about e-commerce, and the result of that ensuing clarity is evident in enterprise e-commerce adoption.

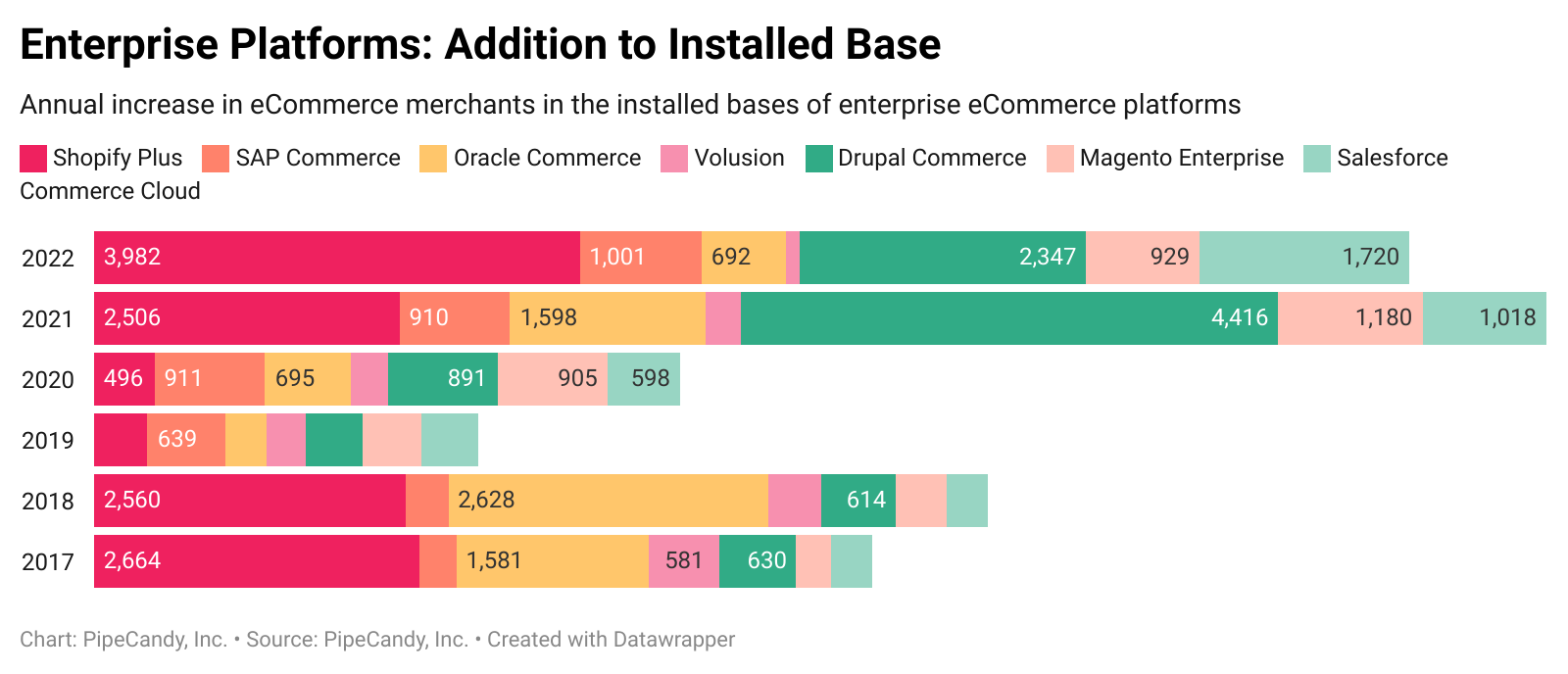

The top enterprise e-commerce platforms have added more than 10,000 merchants. That’s immense, especially as the year is still far from over, and these platforms already have just 1,000 merchants shy of last year. This year promises to be the year of net-new additions for enterprise e-commerce platforms.

Image Credits: PipeCandy

However, such e-commerce companies are quite complex. Multistore setups, multicountry website versions, integrations with heterogenous back-end systems across online stores — it’s all par for the course.

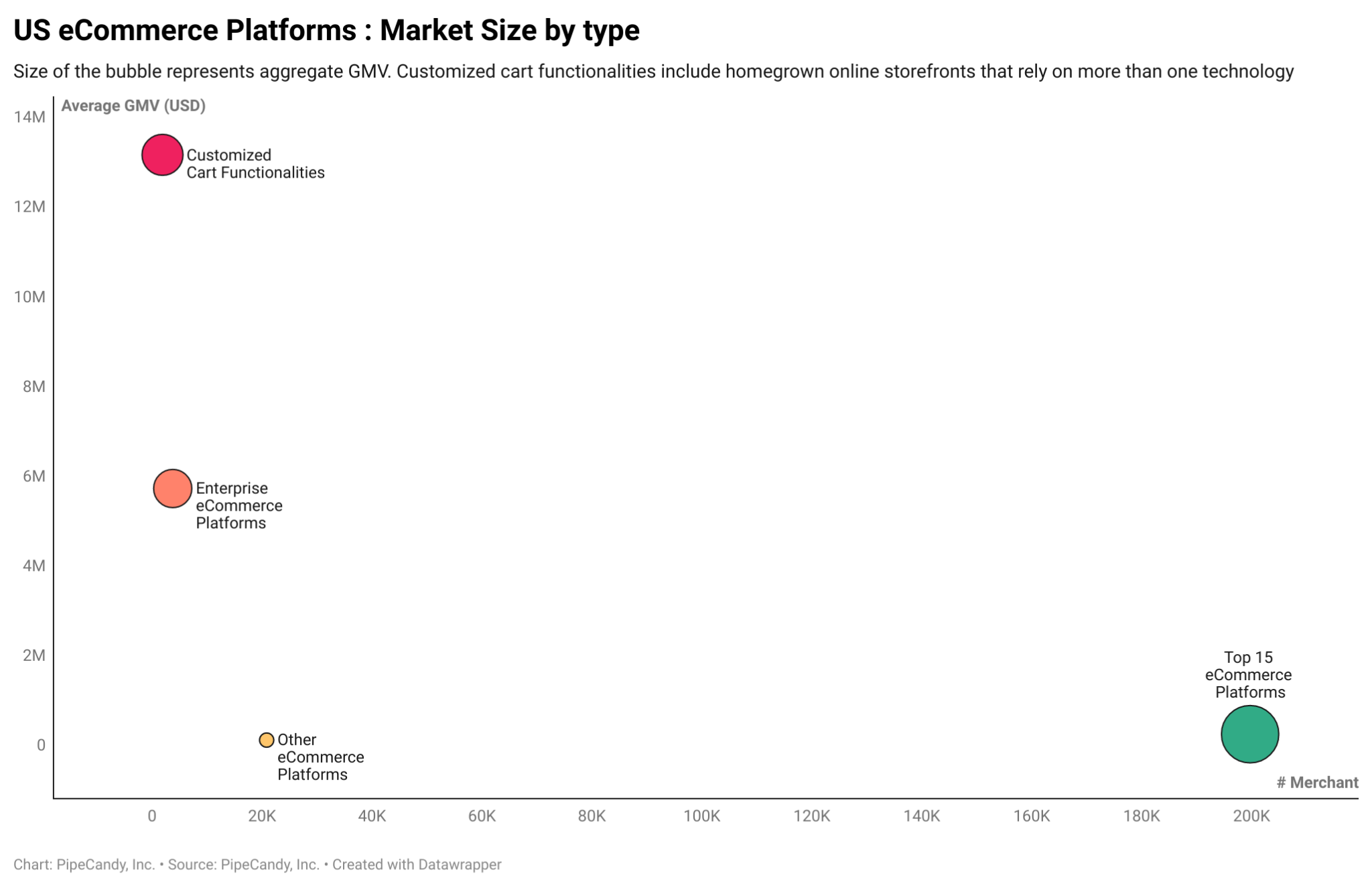

The real prize is at the top, where a flurry of “new to e-commerce” enterprises will expand the TAM at the top unlike ever before.

We have come across several large brands that have multiple e-commerce platforms layered on top — one for the storefront and one for the back end. We have also seen open source CMS platforms serving the catalog for the website, while custom code runs on the back end.

Invariably, such options are preferred by large brands with GMV upward of $10 million per year (on average), while the top 15 e-commerce platforms serve small companies with less than $2 million in GMV.

Image Credits: PipeCandy

We don’t talk much about platform wars in the context of e-commerce tech platforms, because there isn’t one enemy. The long tail of e-commerce is served by platforms like Shopify and WooCommerce, while everyone aspires to serve the midmarket. Shopify Plus currently serves an active customer base of 12,000+ enterprise-ish merchants.

The real prize is at the top, where a flurry of “new to e-commerce” enterprises will expand the TAM at the top unlike ever before. The competition there isn’t another enterprise platform but the need for bespoke solutions. Headless commerce is a starting point for “store front”-first platforms like Shopify in their journey to serve enterprises.

For platforms like Oracle Commerce and Salesforce Commerce Cloud, back-end extendability and enterprise integrations are familiar territories, but modern web/mobile experience and new media formats aren’t. There are also non-technical considerations for an enterprise when they adopt an e-commerce platform. An Oracle shop will be heavily incentivized contractually to adopt Oracle Commerce irrespective of platform merits.

On the long-tail side, platforms win based on ease of getting started and the presence of a vibrant app/developer ecosystem. The midmarket is won based on how robust, extendable and flexible the platforms are. The enterprise market is won by how easy it is to integrate into the existing enterprise architecture and not necessarily what gives the best e-commerce experience.

By sheer numbers, Shopify’s GMV is bigger than that of Salesforce, Magento and BigCommerce. Among the vendors, it has the best “land and grow” opportunity as companies graduate from Shopify to Shopify Plus.

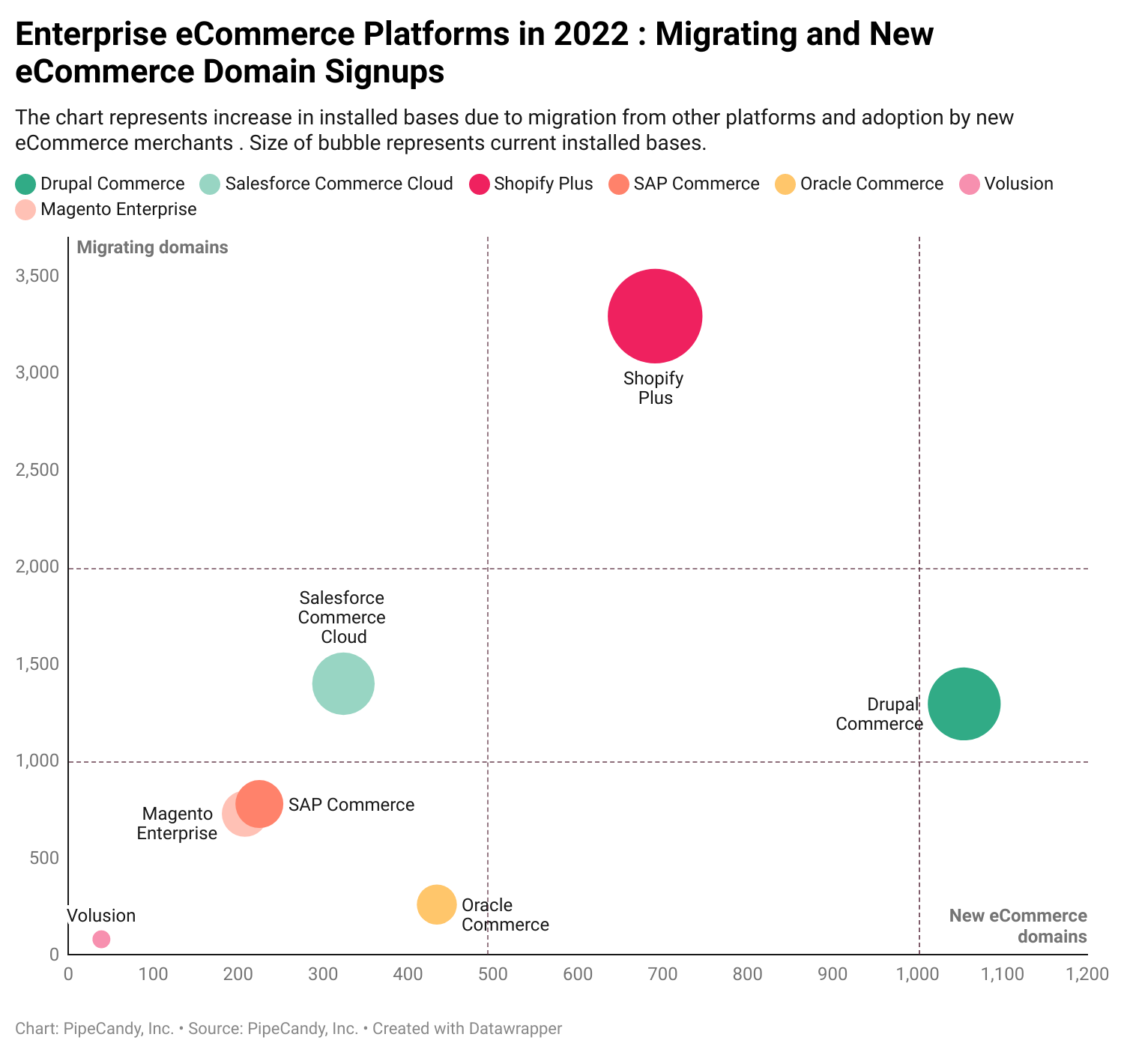

Image Credits: PipeCandy

Shopify Plus demonstrated its strength by being the leading platform both in terms of adoption by new e-commerce websites as well as migrations. Yet, Shopify is hardly enterprise-grade and is not seen as the platform to compete against. It’s not what SAP is to ERP or Salesforce is to CRM.

The slow-turning ship of enterprise e-commerce adoption is showing momentum. Should this have been the bet for Shopify instead of simply e-commerce growth?