New data from Carta indicates that valuations for very early-stage startups are holding up better than we might have expected in the current slowdown.

But while it appears that the price at which investors are willing to put capital into various startup sectors is at times becoming more expensive, the pace at which deals are happening is slowing enough that the changing value of seed deals actually makes sense.

Call it the glass half-full/glass half-empty seed market. If you are bullish, there’s good news aplenty. And if you are bearish, well, we have enough data to make that argument as well.

The good

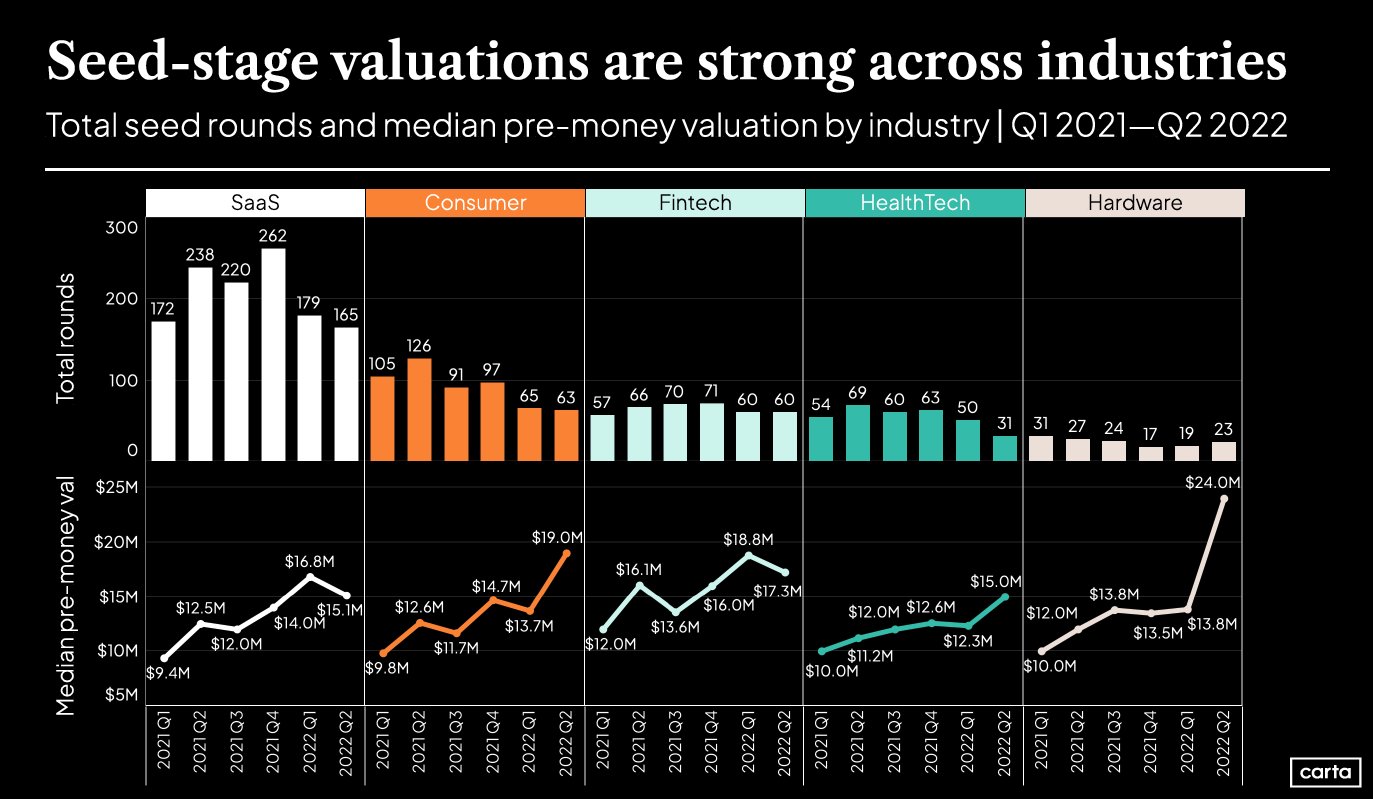

Data from Carta indicates that through the second quarter of 2022, seed valuations in consumer, health tech and hardware startups actually ticked higher. At the same time, valuations for software (SaaS) and fintech companies fell, but not as much as we might have anticipated.

An expectation that startup valuations at all stages should be depressed today is predicated on weaker public markets and revaluations of particular tech sectors that rode high during the first years of the pandemic. However, while those concerns have been on display in late-stage startup deal-making, they appear to be far more modest — or even inverted — in the earliest stages.

For example, the median pre-money valuation of consumer-focused startups in the Carta dataset rose from $13.7 million in Q1 2022 to $19.0 million in the second quarter, cresting the prior record of $14.7 million set in Q4 2021. It’s a similar story in health tech, where seed valuations (again pre-money, median) rose from $12.3 million in Q1 2022 to $15.0 million in the most recent quarter, again besting a prior record in Q4 2021 of $12.6 million.

Hardware had the best result, rising from three quarters of pre-money valuations of around $13 million to $14 million to $24.0 million in the second quarter of 2022.

Median pre-money SaaS valuations fell from a record of $16.8 million in Q1 2022 to $15.1 million in the second quarter, while fintech prices dipped from $18.8 million to $17.3 million over the same time frame. Both declines represent modest haircuts more than deep valuation downturns. Not bad!

The bad

If you observe the following table that Carta shared, you will be able to spot the other side of today’s coin:

Image Credits: Carta

As we see the valuations of certain categories rise, we are also seeing a generally negative pace of deal-making; quarterly SaaS deals are down by 100 from their peak, while consumer and health tech deals halved. Fintech deals are mostly flat, while hardware, notably, is perking up.

It is easy at this juncture to simply argue that fewer deals are getting done, meaning that only the Very Best startups are attracting capital. In that context, is it at all surprising that valuations are rising? Not really.

So what?

Does it matter that we’re seeing higher prices at the cost of rounds? Yes: If true, as it implies that the bar is rising for the median startup to raise capital. This could lead to more startups than in prior years dying on the vine, effectively starved for liquid capital (cash) in a more arid climate (tight investing market). In turn, that could lead to more startup deaths in the back half of 2022 than we saw over a similar time interval in any preceding recent years.

We wanted to verify Carta’s assessment that it is seeing the pace of deal-making slow. So, we turned to PitchBook data and ran a very broad query, simply asking for the number of seed and earlier deals around the world; at that age, what counts as “seed” is more spin than science, making “seed and earlier” the correct net to cast.

Per PitchBook, such deals around the world peaked in Q4 2021 and Q1 2022 at around 3,600 apiece. That figure fell to just over 3,100 in Q2 2022 and is currently at around 1,550 for Q3, though that number will fill in some during the last weeks of the quarter. Still, it’s possible that the pace of the earliest-stage deal-making has effectively halved in a few quarters’ time.

That’s a massive deceleration. And it makes the good news above, in my view, cold comfort for many startups. Why? Rising medians are likely more influenced by fewer lower-priced deals than more higher-priced deals. How can we be confident in that analysis? If deal volume is in retreat, do we expect stronger or weaker startups to be able to capture falling deal velocity? The former, which means that we are likely seeing less frequent deals involving borderline startups, which would limit the number of lower-priced deals and, therefore, boosted median valuations.

Call it glass half-empty.