Living as we are in an IPO drought, new data points about the financial health of unicorns are annoyingly scarce. Unicorns — private tech companies worth $1 billion or more — have become an asset class of their own. Crunchbase counts 1,386 global unicorns, pegging their value at $4.8 trillion. CB Insights counts 1,180 worth $3.8 billion. Regardless of which number you think is more accurate, it’s clear that unexited unicorns represent one of the largest pools of paper wealth in the world.

A programming note: I am off next week. The excellent Anna Heim, who often helps write The Exchange and recently took over its weekend newsletter, will be filling in next week. She’s the best! I’m back on the 22nd!

That said, there’s a good chance that a portion of that illiquid value isn’t real, in that if every unicorn had to raise capital today, a good number would not be able to defend their most recent private valuation. However, if we ranked the unicorn cohort by quality, the best companies — often also the most valuable — are actually not as overvalued as you might think.

For leading unicorns and their venture capital backers, this is good news. No, not every unicorn that was minted during 2021’s venture torrent will defend its 10-figure valuation when it eventually exits. But more unicorns than you might expect may be able to defend their valuations when the IPO market does, eventually and inevitably, unlock. (More on that topic Monday.)

Let’s peek at a few contrasting data points collated by Bessemer, a venture capital firm with an eye toward sharing information about private and public markets, to make our case. (It’s worth noting here that other venture firms also compile public datasets, something that we welcome.)

Let’s peek at a few contrasting data points collated by Bessemer, a venture capital firm with an eye toward sharing information about private and public markets, to make our case. (It’s worth noting here that other venture firms also compile public datasets, something that we welcome.)

Revenue as valuation firewall

A collection of 1,000 companies or more is going to include a simply huge number of data points; because the unicorn group includes recently minted $1 billion startups and some that are sitting on well-aged valuations, it includes a broad mix of corporate age, maturity and quality.

To narrow somewhat, Bessemer writes up a Cloud 100 list each year, effectively putting together a public leaderboard for private software companies. It’s an exclusive group. Per the venture firm, “the average Cloud 100 valuation [ … ] skyrocketed to $7.4 billion” in 2022.

As you can multiply, yes, the Cloud 100 is worth $738 billion in aggregate, far more than the 2021 Cloud 100 list, which was valued at a paltry $518 billion. (To show how much larger and more expensive late-stage cloud startups have become, the 2016 Cloud 100 was worth $99 billion, meaning that a half-decade ago or so, you could squeak onto the top 100 charts without even reaching unicorn status. Those days are firmly behind us.)

But what fraction of that $738 billion is real, i.e., defensible by current valuation marks? The answer is most.

Surprised? I was. Per Bessemer, here’s how the group’s revenue multiples and growth benchmarks have changed from 2021:

Something notable this year is that as the public markets began to cool, the average Cloud 100 multiple has decreased slightly from 34x in 2021 to 30x ARR, though the average growth rate actually increased to 100% year over year.

If you expected that some companies were overvalued, seeing them post smaller revenue multiples atop faster growth is precisely the corrective you could hope for. Faster growth means that the companies are worth more per dollar of revenue at exit, and a smaller multiple today implies that their valuations are harmonizing with public-market comps over time. (The fact that startup valuations are responsive to changes in the public market is, by now, something we hope we don’t have to defend.)

But 30x still sounds like a lot, yeah? After all, as this column cheekily wrote back in May:

Yes and no — 30x multiples for the entire cohort of unicorns is probably far too much to support; the average unicorn is not growing at 100% year over year, meaning that it should trade at a material discount to that figure.

But if the top 100 unicorns are doubling year over year, and 150 unicorns reached $100 million worth of annual recurring revenue (ARR), we can infer that the top cloud companies are doubling while at IPO scale. That matters because it’s far easier to double from $25 million to $50 million worth of ARR than it is to go from $50 million to $100 million in a single year; growth rates tend to slow as corporate revenue bases expand.

Doubling yearly at scale is impressive and is something that even smaller companies often struggle to do. Public cloud companies generally grow at far slower rates, even if some do post growth numbers around the 100% mark. However, the most valuable public cloud companies — ranked by their present-day revenue multiple — are generally growing slower than the yearly doubling benchmark that the best unicorns are managing today. Therefore, when considering them in the context of their public peers, I tend to slot the best private cloud companies into the upper echelon of the public cloud company valuation matrix — their growth rates simply rank them highly.

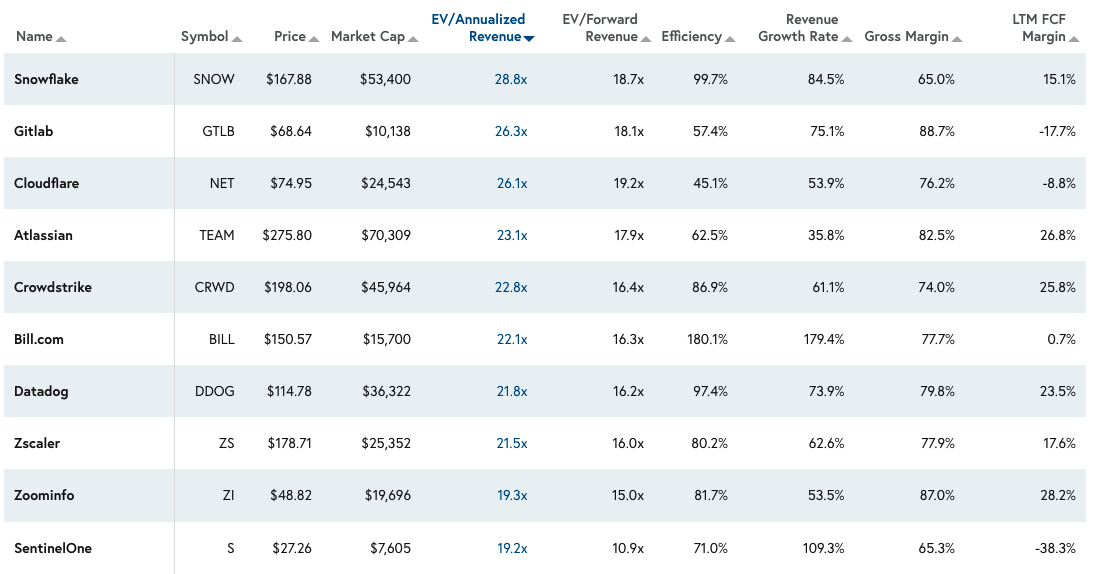

Here are the top 10 public cloud companies, per the Bessemer Cloud Index, ranked by their current revenue multiples:

Image Credits: Bessemer Cloud Index

I apologize for the wall of data, but check each company’s present-day revenue multiple, and then contrast it with its underlying growth rate. The correlation is not perfect, as investors weigh more than mere top-line expansion rates when they value companies, but we can see that most public cloud companies that feature a multiple over 20x are not growing at 100% per year.

Given that the top private cloud companies are growing at that pace, we can infer that many will be able to go public at 20x or more, provided that their other metrics aren’t hot garbage.

Why do we care about that particular data point when the companies in question are worth 30x today? Because at 100% growth, it isn’t that long of a journey from 30x revenue to 20x revenue. Indeed, in a single year of growth, the top private cloud companies would grow into multiples that would make them appear cheap stacked up against the most expensive public cloud companies. (As we’re comparing only the best private cloud companies, we’re contrasting them with the cohort that they will hope to join — their most valuable public comps.)

By our relatively blunt analysis, leading private cloud startups are mere quarters away from reaching a price/revenue mix that would allow them to go public. That’s great news for investors and employees alike, frankly.

When are those IPOs going to come? That’s the, er, $100 billion question, I suppose. In time. But at least we aren’t now expecting a train wreck.