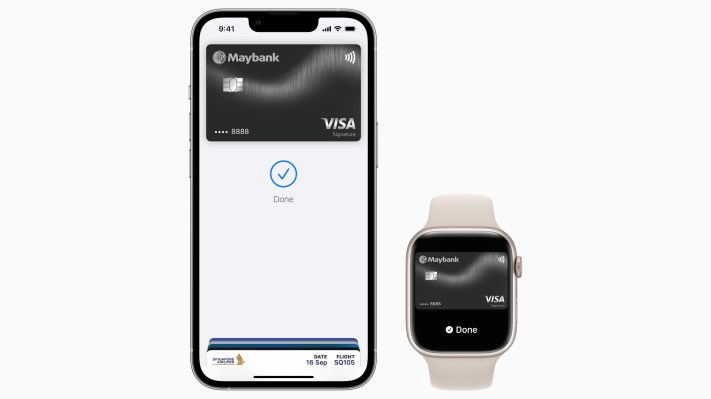

Apple launched Apple Pay, which lets customers make payments in stores and online through iPhone, iPad, Apple Watch or Mac, in Malaysia on Tuesday. Currently, Apple Pay is supported for Malaysian customers using Visa and Mastercard cards from banks including AmBank, Maybank and Standard Chartered Bank with support for American Express cards coming later this year.

The Cupertino-based firm has partnered with retail outlets like KFC, Maxis, Machines, McDonald’s, Mydin, Pizza Hut, Starbucks, U Mobile, Uniqlo, Village Grocer and Watsons, and online marketplaces like Shopee, Sephora, Atome and Adidas on the merchant side.

The official announcement comes days after AmBank, a local bank, prematurely published details about the Apple Pay launch in the country.

A report from local media suggests that other contactless payment services such as Samsung Pay, Visa PayWave or Mastercard PayPass require customers to enter a PIN for transactions above RM250 ($56.1); Apple Pay users can simply authenticate these transactions through Face ID, Touch ID or passcode. Apple Pay follows limits set by customers’ banks.

Malaysia is only the second country to get Apple Pay in Southeast Asia after the service was launched in Singapore in 2016.

Reports from various banks suggest that customers are rapidly adopting digital payments in Malaysia. In 2021, digital transactions reached the 7.2 billion mark, registering a 30% year-on-year growth. A report from Bank Negara Malaysia noted that last year an average person made 221 digital transactions, up from 170 in 2020. A study by the Malaysia Digital Economy Corporation (MDEC) and IDC suggested that the gross transaction value of e-commerce in the country would reach RM25.2 billion ($6 billion) in 2022.

Apple has been facing an antitrust case in the EU over restrictions that companies can’t use iPhone’s NFC stack to build Apple Pay competitors.