Mudafy, a tech-enabled real estate broker operating in Latin America, has raised $10 million in a Series A round of funding led by San Francisco-based Founders Fund.

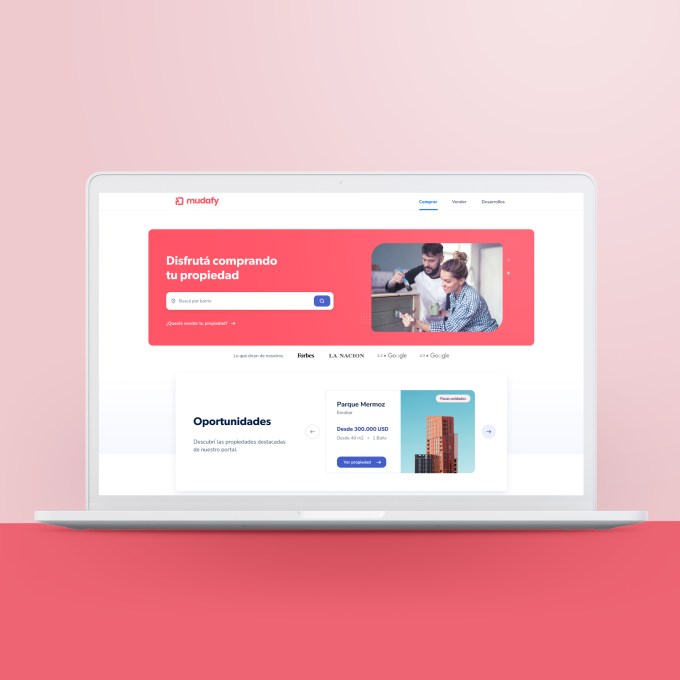

Founded in mid-2019, Mudafy operates with a typical digital brokerage model — aiming to make it easier for people to buy and sell their homes and serve as a “one-stop shop” in the process.

The startup — also backed by Y Combinator — touts that its site features over 50,000 listings and has more than 1 million monthly unique active users in Argentina and Mexico. It claims that it is doing more than 100 real estate transactions per month and is currently originating over 50% of the mortgage loans for its customers.

“This is the beginning of a larger push into fintech and at the same time it improves access to better properties for customers,” said CEO and co-founder Franco Forte.

Mudafy’s ambition with its new capital, among other things, is to generate $500 million in annualized sales by year’s end. Forte says that it ended 2021 with “more than $100 million in sold properties” and maintained a sustained growth of over 20% month-over-month. Overall, he added, the company increased its sales by “10 times” for the second year in a row in 2021.

Today, he says Mudafy is operating at a run rate of “over 2x” of what it did in 2021.

The startup’s revenue model is based on a success fee, or commission. When it sells a property, it charges a fee. It also generates revenue on each mortgage loan that it originates.

With its new capital, Mudafy’s immediate priority is to expand to more cities in Mexico, a market it entered in 2020. Longer term, it is exploring the possibility of moving into other Latin American markets such as Colombia, Perú and Chile.

Forte believes that Mudafy’s product-centric approach makes it stand out in an increasingly crowded space.

“We’ve rebuilt the entire experience by rebuilding the entire service stack,” he told TechCrunch, noting that Mudafy’s team had previously developed products for the real estate industry for more than a decade.

Its customer-facing product includes features that are commonplace in the U.S. but far less so in Latin America, such as 360 degrees virtual tours, online booking for showings and appraisals and pricing data for properties. It also has built an internal product that it says helps agents be 10x more efficient compared to traditional realtors.

Image Credits: Mudafy

Ultimately, Mudafy says, its end goal is to help people close homes faster and for less money.

Certainly, in Latin America, the challenges of buying and selling a home are much more time-consuming and complex than in the United States. With no MLS, consumers lack access to public data and thus, transparency. This is where Mudafy hopes to make a difference with its technology and data analytics.

Today, Mudafy has more than 400 employees — up from 204 at the end of 2021 — and plans to do more hiring with its new capital. The company is not yet profitable as it continues to invest in its technology and products, but Forte says Mudafy has been “super capital efficient” and that its unit economics “are healthy and positive.”

In total, the startup has raised $13 million. IDC Ventures also participated in its latest funding round.

Amin Mirzadegan, principal at Founders Fund, believes that the process for buying and selling homes in LatAm is “broken,” with an average sales cycle of more than six months.

“Since day one, Mudafy has been laser-focused on providing homebuyers a seamless purchase experience, rather than immediately diving into i-buying, rentals, etc.,” he wrote via email. “Agents are a crucial part of the ecosystem. Mudafy is building technology that not only helps buyers but also increases agents’ efficiency and ability to serve potential buyers.”

Interestingly, Keith Rabois is general partner at Founders Fund and also a co-founder of Opendoor, a publicly traded real estate tech company operating in the U.S.

It’s worth noting that other Latin American digital brokerages such as Loft and QuintoAndar have conducted layoffs this year. To this, Forte said: “I believe the Loft and QuintoAndar layoffs are more a reflection of the fundraising environment than the real estate market itself. The market is extremely large, there is space for multiple players, and buyers/sellers want a better experience…If the downturn has an impact on the market, it won’t affect the proptechs. Instead, it will probably affect the traditional real estate brokers.”

My weekly fintech newsletter, The Interchange, launched on May 1! Sign up here to get it in your inbox.