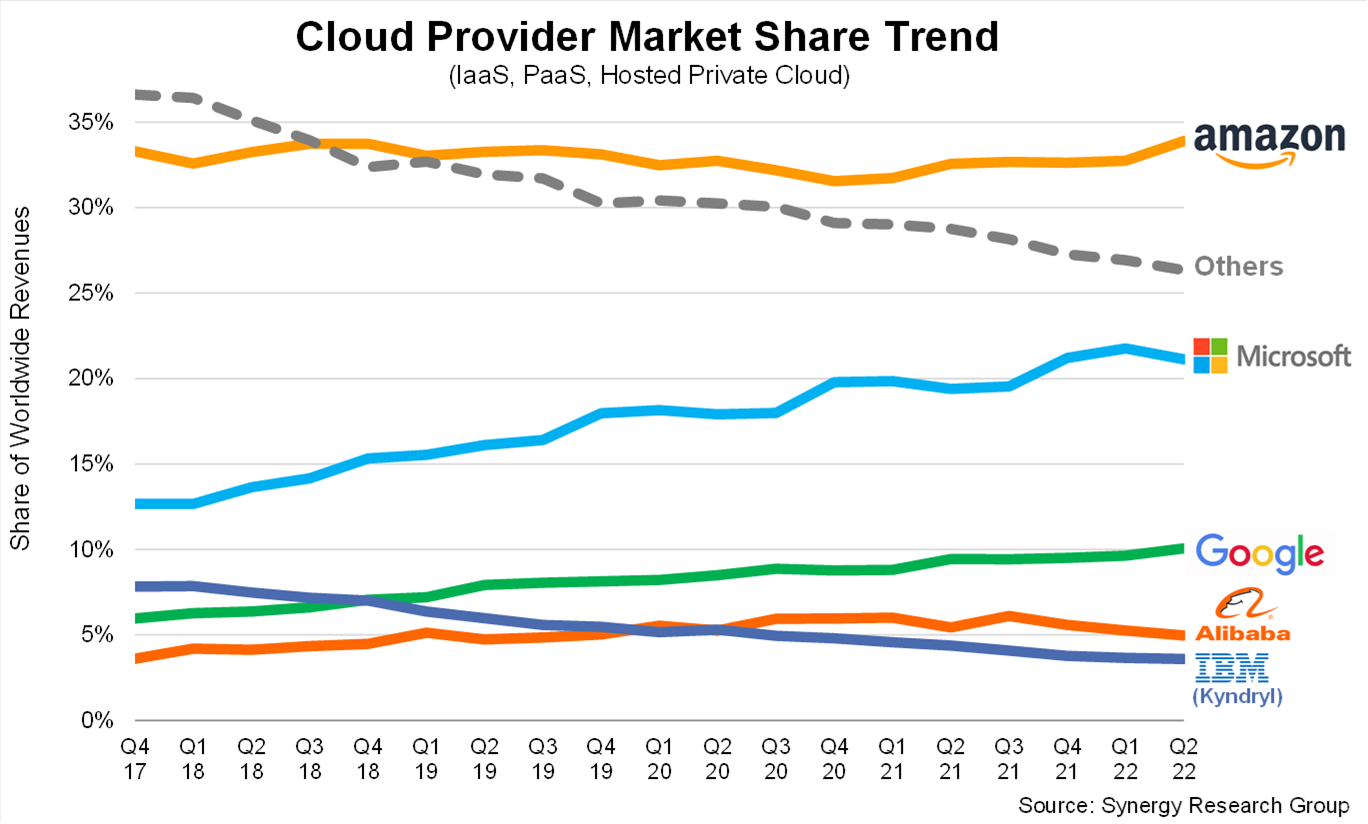

When the Big 3 cloud infrastructure vendors – Amazon, Microsoft and Google – reported their earnings this week, it was clear that the cloud is helping keep their overall numbers up. But perhaps what was most surprising was that after years of sitting at 33% market share, AWS was up a tick to 34% in the second quarter, according to numbers from Synergy Research.

Even more surprising is that after years of steady market share growth, Microsoft was down a notch from 22% last quarter to 21% this quarter. Google came in third, holding steady around 10%.

Synergy chief analyst John Dinsdale said the slight drop in Microsoft’s market share is probably due to the law of large numbers — Microsoft couldn’t sustain its recent growth.

“The days of Azure growing by 50% to 80% year on year are over. Once you get to a certain scale, it is virtually impossible to organically grow at such high rates. So its growth rates have trended down, as they had to. AWS experienced the same phenomenon a long time before Azure got there. Despite the Q2 changes in market share that you saw in our article, Azure’s rolling annualized growth rate does remain quite a bit higher than AWS,” Dinsdale told TechCrunch.

But he said that AWS’ ability to continue to grow at the rate it has is nothing short of remarkable.

“I do have to say that given its immense scale, AWS’ ability to continue growing at a rate of 30% to 40% really is rather impressive. Its year-on-year growth rate has stayed within that band for the last 13 quarters. As the total market size increased by $1.9 billion from Q1 to Q2, AWS accounted for over 60% of that sequential increase. That is a great quarter by any standards,” he said.

The overall market reached almost $55 billion for the quarter, up 29% from the previous year, according to Synergy. But Dinsdale said when you discount changes in currency exchange rates over that time period, growth would actually have been six percentage points higher.

Dinsdale sees a cloud market that remains strong and growing in spite of the economic malaise.

“While there has been a lot of hand-wringing in some circles over the impact of global economic and political issues on company performance, the fact is that the cloud market remains in rude good health,” Dinsdale said in the report.

When you break down the numbers by percentage, Amazon had around $18 billion, Microsoft around $11.5 billion and Google came in at around $5.5 billion. If these numbers don’t quite line up with publicly reported numbers, it’s worth noting that Synergy is only counting public platform, infrastructure and hosted private cloud services in its figures. The companies may include other revenues from other categories in their publicly reported numbers.

Image Credits: Synergy Research Group

As we’ve pointed out before, Amazon continues to benefit greatly from its first-to-market advantage. While market share percentages may fluctuate very little from quarter to quarter, the market itself continues to grow at a steady clip, so the size of the pie is increasing on a yearly basis.

What’s more, cloud infrastructure usage estimates suggest that there is plenty of room for additional growth. Most analysts believe that somewhere between 20% and 25% of workloads have moved to the cloud at this point, and the workloads themselves are also not a fixed number. All of that suggests there is still room for substantial growth moving forward.

As we enter an economic downturn, the cloud market appears to be propping up these companies. GDP numbers reported yesterday showed the U.S. economy contracted 0.9% in the second quarter, the second consecutive down quarter, which is usually a signal we are in a recession.

Cloud power

The movement from on-prem computing power to the cloud is pushing the public cloud market itself forward. And with many computing workloads yet to make the jump to the cloud, there is a good chance that we continue to see strong aggregate cloud growth for years to come.

For Amazon, Microsoft and Alphabet, that’s welcome news, as their cloud businesses are key drivers of growth and profit.

This is perhaps most obvious in the case of Amazon. The e-commerce giant saw its international sales dip in Q2 2022 compared to the year-ago period. And while North American e-commerce revenues did grow — 10% to $74.4 billion — the sales category slipped to negative operating income in the most recent quarter.

But AWS forms a distinct revenue growth and profit center at Amazon, helping its collected results mightily. AWS revenue growth of a little more than 33% helped the company’s overall growth rate, and with operating income of $5.7 billion in Q2 2022, Amazon’s public cloud division accounted for 172% of its operating profit for the period.

With Google and Microsoft, the story is a little bit different. While we can infer that both companies are leaning on their cloud divisions for growth, the profit picture is more opaque.

Revenue at Alphabet expanded 16% in Q2, compared to the company’s year-ago results. But Google Cloud grew at a nearly 36% rate. Sadly for the search giant, operating profit at its public cloud group worsened from -$591 million in Q2 2021 to -$858 million in its most recent three-month period.

Microsoft is a similar story, posting 12% growth in the second calendar quarter (the fourth of its fiscal 2022), powered in part by Azure growth of 40%. Unfortunately, we can’t see the actual operating profit result of the Azure division in Microsoft’s numbers, so we cannot delve more deeply.

The market share competition among the Big 3 cloud vendors is showing minor variations as the players compete for business. But with the larger public cloud migration continuing, it appears that there will be room for at least three major players. That’s good news for Amazon, Alphabet and Microsoft, companies that are seeing macroeconomic impacts elsewhere in their businesses. Public cloud as megatech growth driver? It’s the present-day reality as it props up less profitable parts of the business.

More in a quarter’s time, but it’s still good days in the cloud, recession or not.