A compromise in Congress is forming among Democrats to tinker with the tax code, generate revenue by other means and apply those revenues to climate-change-related investments and deficit reduction. The Inflation Reduction Act of 2022, if it passes, would institute a minimum tax rate for large companies and close the carried interest loophole.

TechCrunch explored the climate-related provisions in the bill separately, giving us space to chat about proposed changes to carried interest, a tweak to our nation’s tax law that could impact venture capitalists and other startup backers. The obvious question is whether the change will have a material impact on how capital is invested into startups; if the tax code change disfavors investors, it could limit investments into startups that were previously tax-advantaged.

So will it? Early public commentary from venture investors indicates that the change isn’t that big of a deal. Let’s talk about what’s changing and what venture investors are saying — out loud, at least.

Closing a loophole

Venture investors make money in two ways. First, they collect fees from their investing funds. A common figure is 2% of assets in the fund, per year. And they make money by collecting a portion of profits from the fund, often 20%. This “2 and 20” model has long been a benchmark in the venture world, even if it is now slightly dated as a rule of thumb.

That 20% cut of fund profits is called carried interest, a concept that also shows up in private equity and hedge funds. So far nothing controversial, yeah? Well, carried interest has long had a special treatment, namely that it was taxed as a long-term capital gain, not ordinary income. Why does that matter? Because long-term capital gains are taxed at a lower rate than most income. The top rate for long-term capital gains is 20%, while federal income tax rates scale to nearly double that amount.

Why do folks who were given lots of money to invest pay a lower rate than folks engaged in traditional labor? In theory, to incentivize investment. If you make it attractive to invest capital, you will get more invested capital, the logic goes. So, if we want more investment, we should incentivize it.

On the other hand, how many investors would slow or stop their investing cadence if they had to pay a normal tax rate for their profits is not clear; if the inflation-themed Senate bill in question passes, we may get something akin to a natural experiment in venture activity viz the tax rate of profits thereof.

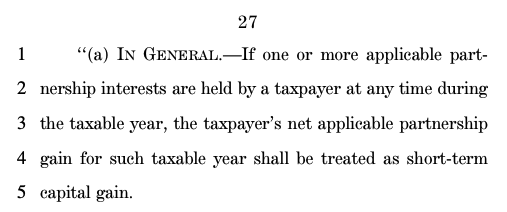

Regardless, what does the bill say? The following:

Image Credits: democrats.senate.gov

Short-term capital gains are taxed like regular income, meaning that the above closes the carried-interest loophole — the taxation of carried interest as a long-term capital gain instead of ordinary income.

Naturally, the bill has more text and nuance that is being unpacked by industry, legal and tax experts. We’ll have more on the details as the language and its potential impact are parsed. For our purposes today, what matters is the general closing of the carried interest loophole and the resulting treatment of carried interest (at least generally) as a short-term capital gain taxed at a higher rate.

How are venture investors responding? Those willing to say something out loud are striking a single note.

Not to worry

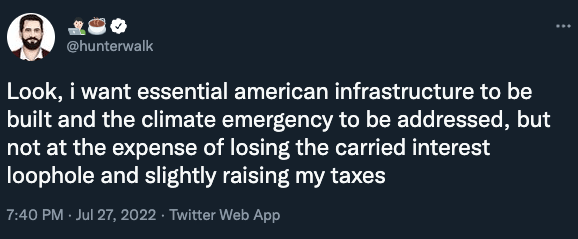

In a fit of sarcasm, Homebrew’s Hunter Walk weighed in:

Adam Nash, an angel investor, former Greylock “executive in residence,” former Dropbox exec and now CEO and co-founder at Daffy, offered a take:

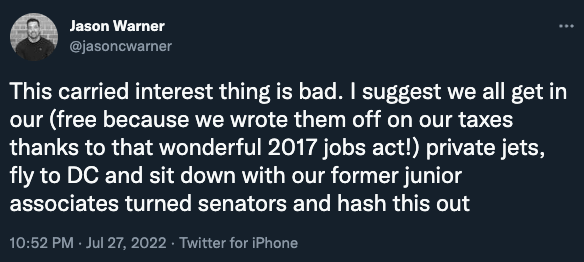

Redpoint’s Jason Warner also had jokes:

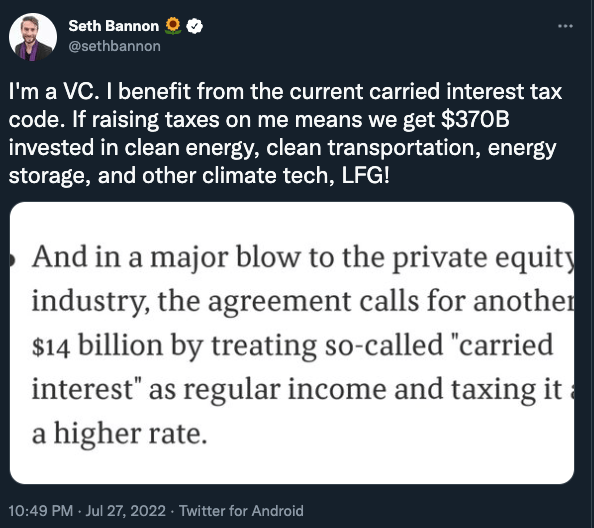

Fifty Years investor Seth Bannon concurred:

The list goes on, but that’s enough for flavor.

I have to admit modest surprise at the lack of outrage from investors, though I suspect that most folks who are incensed at losing a tax benefit have the good sense to be quiet. Why? Who wants to get dragged on Twitter for whining about losing a tax privilege that’s little more than a giveaway to the wealthy?

If any venture investor is willing to go on the record against the provision, we’ll listen. But so far, at least, the tone is one big shrug.