The big news of the morning is that Amazon is buying One Medical, a previously venture-backed consumer healthcare company with a technology twist, in an all-cash deal worth $3.9 billion inclusive of debt. The announcement follows recent reporting that One Medical was in play.

Seeing One Medical taken off the table, then, is not a surprise, but Amazon being the acquiring entity is a bit more of a shock. What is the company getting for its billions, how does the buy fit into its overall business, and what does the deal mean for startups?

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Recall that Amazon has been making moves in the healthcare space for some time. Back in 2018, the AWS parent company bought PillPack, a consumer-focused online pharmacy, and it previously worked with Berkshire Hathaway and JPMorgan to revamp American healthcare, though that effort fizzled.

This morning, let’s peek at One Medical’s latest financial results to both understand the deal and what Amazon is really buying. And then, we’ll see what we can shake loose about why the deal is happening now and what it could mean for startups more generally. To work!

This morning, let’s peek at One Medical’s latest financial results to both understand the deal and what Amazon is really buying. And then, we’ll see what we can shake loose about why the deal is happening now and what it could mean for startups more generally. To work!

Inside One Medical

Back in 2020 when One Medical went public, it priced its equity at $18 per share. Shares of the American healthcare company raced to the high $50s in early 2021 around a year after its IPO. But the company’s value has fallen since then, only reversing the trend when news of it considering a sale came out earlier this month. Today’s news has sent the company’s stock up around 67% as of the time of writing.

One Medical, then, is another example of a company that saw its valuation skyrocket during the early quarters of the COVID-19 pandemic in the United States, only to see its worth come back to Earth as caution waned and most folks went back to their regular lives. Other entities that have seen similar gains and losses include Coinbase, Robinhood and Zoom.

Looking at One Medical’s Q1 2022 financial results, the comedown in value is not entirely surprising. Condensing its year-over-year results, we can see a company that is growing but at the same time losing more money over time and burning more cash:

- Good: Revenue of $254.1 million, up 109%.

- Bad: Nearly all of that revenue growth is Medicare-derived revenue stemming from One Medical’s mid-2021 purchase of Iora Health.

- Good: “Total Membership Count” rose 28% year over year to 767,000.

- Bad: Net loss widened to $90.9 million (Q1 2022) from $39.3 million (Q1 2021).

- Bad: Operating cash flow flipped from $22.1 million (Q1 2021) to -$55.1 million (Q1 2022).

- Bad: About $102 million worth of negative free cash flow in Q1 2022 (year-ago period heavily impacted share sales, making the comparison moot).

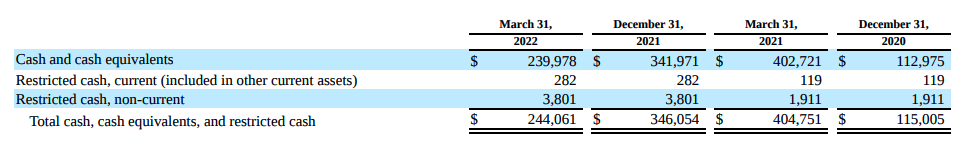

That final number shows up in One Medical’s cash and equivalent history:

Image Credits: One Medical

As you can see, the company’s cash burn from Q4 2021 to Q1 2022 harmed its aggregate cash position and put One Medical in a position where its senior notes liability ($310.3 million) is more than the cash it has on hand.

At its Q1 2022 burn rate, One Medical only had a few quarters of cash left, though it could have pulled back on spending in the second quarter that we cannot see yet, providing it with more runway. Regardless, the company is unprofitable and cash consumptive — you can see why its share price suffered given the uncertain path to profitability. Amazon, then, is at once an acquirer and a lifeline of sorts, if we are reading the numbers correctly.

It is not hard to see why One Medical is taking the deal: It no longer has to worry about viability from a cash perspective and can provide a $4-per-share return to investors over its IPO price. Done and done.

The Amazon side of things is a bit more interesting.

Why, though?

Amazon talks about the deal as a way to attack a broken sector in its release:

We think healthcare is high on the list of experiences that need reinvention. [ … ] we want to be one of the companies that helps dramatically improve the healthcare experience over the next several years. [With the One Medical deal Amazon believes it] can and will help more people get better care, when and how they need it.

The American medical care system is far from great and medical care in the United States is a simply massive market. From a high level, that’s a reasonable explanation of the Amazon-One Medical deal.

Recall that Amazon started life as a bookseller, wound up building an endless online mall and paired its product expansion with investments into logistics, hardware, robots and transit. Building healthcare services into its product mix is not strange for Amazon, prima facie, which also sells e-book hardware, powers your favorite social network’s back end and makes basketballs.

More importantly for Amazon, it needs to keep growing. The e-commerce market’s isn’t growing as fast anymore, which means that the company needs more TAM. Why not healthcare?

But it’s not easy or inexpensive to get deep into the health space. Amazon could start from scratch and build a new brand. Or, it could lever some of its tectonic wealth into buying a company that has consumer, enterprise and government-sponsored healthcare incomes already.

The pace at which One Medical consumes cash is largely immaterial to Amazon, given their discrepant relative scales. Amazon solves One Medical’s largest issue — unprofitability — while resolving the cold-start problem its healthcare ambitions face.

A jump-start for the big company, then, on a long-term growth initiative and a welcome repricing for One Medical. That’s the deal as we can see it this morning.

The last question we have concerns startups. Does the sale imply that private startups could also find themselves in play? Frankly, it doesn’t seem so. How many other Big Tech companies are going to push into consumer healthcare in this manner? It’s hard to come up with another name that might, which makes the One Medical transaction feel unique.

Sure, it does help that some startups in the healthcare space have some stronger comps to use when fundraising, but past that datapoint, this deal is one between public companies and likely won’t bring the M&A cavalry to the health tech startup market.