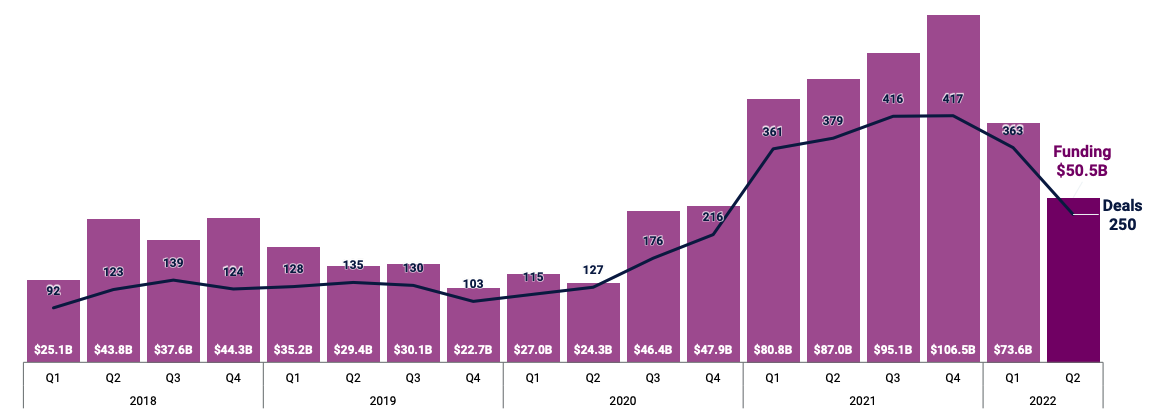

In the final quarter of 2019, startup funding rounds worth $100 million or more reached a local minimum. With 103 such deals, Q4 2019 saw just $22.7 billion disbursed in nine-figure chunks. That dollar figure rose at the start of 2020 only to retreat during the pandemic-impacted second quarter. But from that moment in time, huge rounds for startups rose steadily throughout 2021, CB Insights data indicates.

That boom led to one of the most impressive runs of private-market value creation on record. But since the go-go-go year of 2021 closed, things have changed for the most valuable startups. And the change is not positive.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Data indicates that the pace of unicorn birth — the rate at which new startups clear the $1 billion valuation threshold — has slowed; so-called mega-rounds worth $100 million or more have decelerated; and the larger venture capital market is rebalancing its investments toward earlier-stage companies.

What we saw in 2021 was a natural experiment: What might happen if, during a period of low interest rates, consumer activity is greatly disrupted, leading to an uneven economic environment in which remote work becomes the norm? Well, it turns out that investors hungry for yield will pile into stocks and private-market investment vehicles. That, in turn, will lead to inflated share prices, strong IPOs and a belief among startup backers that the sky is hardly the limit.

Rich in cash and high off paper returns, private investors spent 2021 birthing unicorns at record paces. But now as exits drop, stocks remain stagnant and unprofitable growth is more of a sin than a founder target, the era of startups playing the role of goose to create venture capital foie gras is over.

Rich in cash and high off paper returns, private investors spent 2021 birthing unicorns at record paces. But now as exits drop, stocks remain stagnant and unprofitable growth is more of a sin than a founder target, the era of startups playing the role of goose to create venture capital foie gras is over.

The decline and fall of the mega-round

I cannot improve upon the illustrative power of a singular chart, so, via the CB Insights Q2 report, the following image detailing the number and value of $100 million+ rounds invested into startups on a quarterly basis:

Image Credits: CB Insights

That is a swoon for the ages.

The percentage decline from 417 to 250 is 40%. The fall from $95.1 billion to $50.5 billion is 47%. Yes, 2022 is still outperforming 2020 and 2019 and 2018 in terms of early-year mega-round pace, but we’re clearly on the downswing.

Those declines are impacting venture capital’s overall investment mix. Mega-rounds reached a massive 61% of all invested private-market capital in Q1 2021, a number that nearly repeated with a 60% result in Q4 of the same year. In Q2 2022, however, mega-rounds were worth just 47% of all investment dollars — from six of every 10 dollars to less than half. That’s a marked change.

What impact has the change in investment pattern had on the richest startups?

Unicorn births retreat

Unsurprisingly, the pace of new unicorn births closely tracks the above chart; the more mega-rounds there have been historically, the more startups that clear the $1 billion valuation mark. The rate at which new unicorns were minted rose during 2021, reaching 148 in Q2 2021 and 140 in Q4 of the same year. That fell to 125 in the first quarter of 2022 and then to just 85 in the second quarter.

From 148 to 85 is a 43% decrease, CB Insights notes in its report. Seeing that number land in between the peak-to-Q2 2022 decline in mega-round volume and value is not a surprise; these are highly correlated numbers.

Yeah, but…

If you are a startup founder looking for a big check and a shiny new valuation, all of the above is a bummer. But it’s worth noting that the second quarter is only a poor result for huge funding events if you compare it to 2021. If you look at, say, any other year, we’re still in a very hot period for startup fundraising.

Sure, the 85 new unicorns launched in the second quarter is down sharply from prior highs, but Q2 2019 saw just 27 new unicorns. The second quarter of 2019? Just 45. And the same period of 2018 included just 35 new unicorns. Indeed, 85 is still about one per day, including weekends, in the second quarter. That’s still very strong? Right?

The rebuttal to such sunny thoughts is simple: We’re not done yet with the declines from 2021’s highs. This is likely correct. But it is also worth noting that the descent from last year’s misplaced exuberance will take some time to burn off, and the pace of the correction won’t be instantaneous. So things won’t yet be as bad as they will be, which means that startups are being eased into a new reality. That’s our perspective from today’s data.

Even if the force-feeding era of accelerated unicorn creation is crumbling around us, things could be worse.