When my co-founders and I started Equi, we each committed to putting 80% of our liquid net worth into the investment platform we were building.

It made sense because we had initially built the product for ourselves. We knew what investment strategies would yield the best returns on our savings, but without $100 million in the bank and a family office to manage the funds, leveraging these strategies was impossible.

We also quickly learned that the major banks and private wealth advisers really didn’t have much when it came to great alternative investments. They all had the same big brand names, but they didn’t deliver the performance to back it up.

Our current target customers are “accredited investors,” who represent about 10% of households in the U.S. These investors also represented 100% of the institutional and angel investors we were in conversations with when we went out to raise our seed round earlier this year.

Since our future business partners also fit in our target customer demographic, we asked ourselves: What if we required our investors to take the same bet on our product that we did?

We were inspired by Vanguard, which pioneered the model of collective ownership to drive lower expenses for their funds. They chose to raise money from their customers so they could be owned by their founders, employees and customers rather than taking capital from passive investors.

Vanguard successfully aligned incentives between their shareholders and customers, and we decided to do the same. Our “Customer Pledge” is a commitment to invest personal capital on the platform now or within the next two years.

Our $10 million seed round closed with hundreds of investors on the cap table. Partners at funds like Foundation Capital, Hustle Fund, Montage Ventures, F7 Ventures, Gaingels and Calm Ventures, as well as over 100 angel investors, took our Customer Pledge.

While we could’ve closed the round with a fraction of these many investors, we decided to take smaller checks from a greater number of people to gather as much feedback and input as possible. We also reserved 25% of our fundraise for groups underrepresented in VC, so that input would be diverse and varied.

This paid off. Our shareholders showed an unparalleled level of engagement. They’ve been through the onboarding experience, they’ve used our product dashboards, they’ve received our marketing emails, and they’ve interacted with our customer support.

Because they’re technology leaders — and many previously built or ran successful companies of their own — their feedback has been even more invaluable than I anticipated. Not only can they identify and clearly articulate issues, but they can also use their expertise to proactively brainstorm solutions and solve problems.

We completely transformed our dashboard and reporting process after we got feedback from an investor. They told us that they wanted a better understanding of when to expect official performance reporting because it is somewhat unpredictable. This feedback led to the creation of a dynamic timeline feature in the app to keep investors in the loop on performance report production and delivery.

The process wasn’t easy. In fact, it was definitely the harder path because it required an additional 60 to 80 hours of conversations and extra legwork. But it was worth it.

If you’d like to do something similar at your company, here are a few crucial things that we found helped make our endeavor a success:

Ask the right questions as soon as you can

After an investor grew familiar with the product and company, we’d ask them a series of questions before they could write a check. In addition to basic information (like their address), we’d ask them questions like, “What are two specific ways you’d be able to help our company?” and “When are you planning on becoming a customer?”

Questions like these help hold both sides accountable and establish a tangible path for the future. That said, we couldn’t do this over email. We had to formalize the process, which brings me to our next tip.

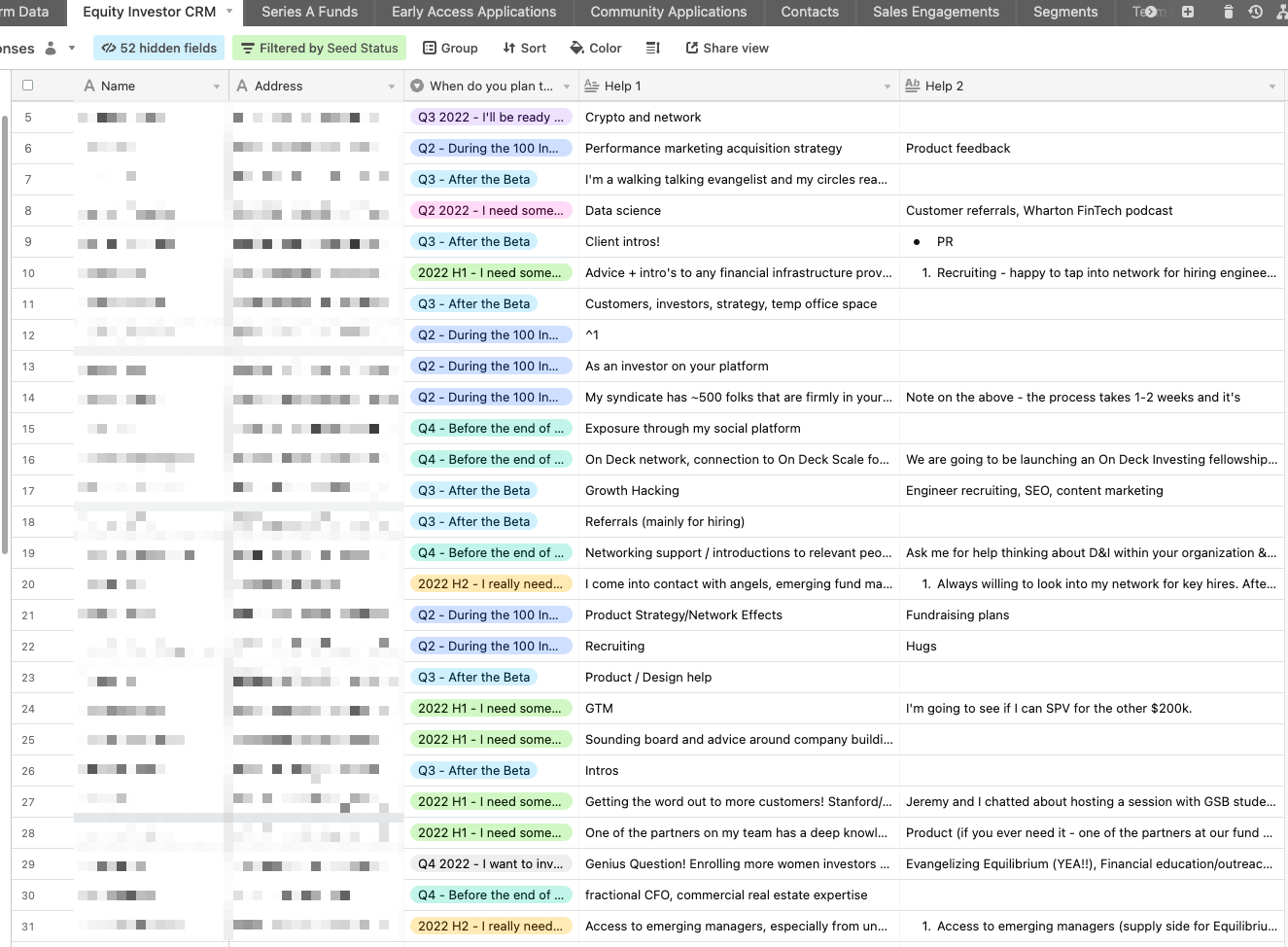

Create a searchable investor database

It’s impossible to keep track of hundreds of investors without a scalable process in place. We ask every new investor to fill out a form that populates an Airtable spreadsheet, which organizes and lets us uncover relevant information.

Image Credits: Equi

This allows us to maximize our relationships with our investors in an easy and simple way. When I’m visiting another city, I can see which investors are in the area so we can meet in person. When we need help with recruiting, I can easily find which investors offered to help us with that part of the business.

Be loud and proactive about building a diverse cap table

To attract investors from outside of our somewhat homogeneous network, I hosted a series of Clubhouses to attract investors from underrepresented backgrounds. I also held “virtual demo days” to get the word out to larger groups of investors and reached out on Twitter to leaders of funds and angel investors who would bring diversity to our cap table.

All of this advice won’t apply to every startup, especially when your target audience does not fit the same profile as your investors. But for the hundreds of founders raising money right now, I recommend giving it a go.

While we went all-in, depending on the business and product, you can experiment with different levels of engagement. Do you want your investors to try the product once or be loyal users? Think about what you’re hoping to get out of the arrangement and structure it in a way that achieves that outcome.

Next time an investor asks, “How can I be helpful?” give this approach some consideration.