Last week, I wrote about Ergeon, the fence-building startup founded by a licensed contractor and the co-founder of Upwork. It employs more than 350 people in over 40 countries and raised more than $53 million to shake up the art of building fences, creating driveways and more on its path to “eventually building entire homes.” In a world where homeowners need — but often cannot afford or don’t prioritize — a general contractor even for smaller jobs, Ergeon swoops in, and it’s easy to see how there’s an enormous market for this sort of thing.

Amazed how Ergeon had been able to fly under the radar for so long, only to pop up announcing it had raised an impressive amount of money in a fantastically unsexy market, I asked Jenny He, the company’s founder, if I could pretty please, with a term sheet on top, take a closer look at the pitch deck she used to raise the company’s $40 million Series B. To my joy, and your benefit, she said yes — so let’s dive in and find out what it takes to raise a beefy round in today’s fundraising climate.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Ergeon’s slide deck is dated April 2022 and contained a lot of commercially sensitive data — but the company’s CEO was happy to leave all the slides in the deck. She did remove some of the most sensitive company data from some of the slides, but I think there’s still a lot we can learn from this deck, especially when it comes to showing how a growth-stage company differs from the deck of an earlier-stage company.

- Cover slide

- Name explanation (ERG + EON)

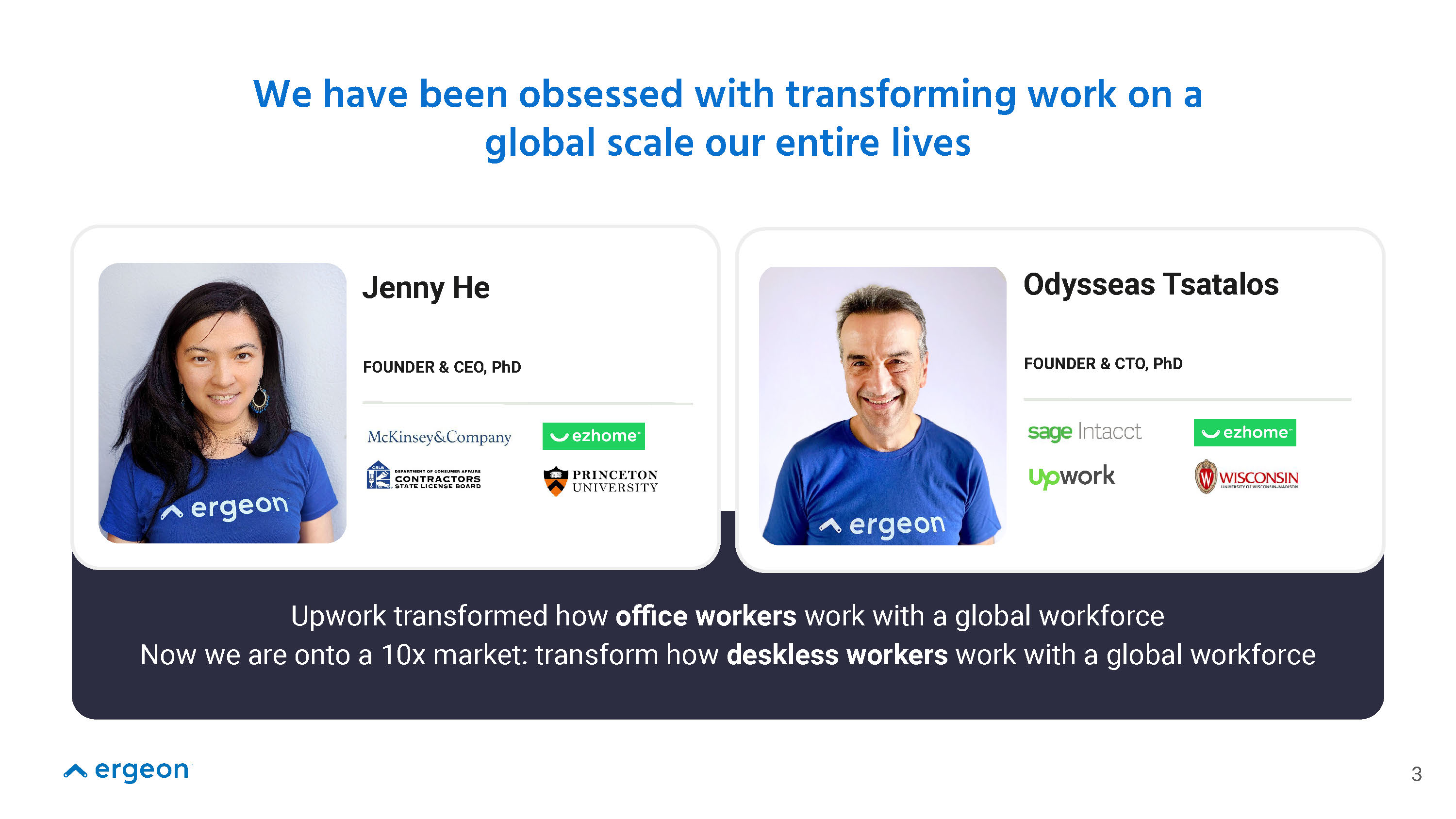

- We have been obsessed with transforming work — team slide

- Reached $XX annualized run rate revenue — traction summary slide [with some redactions]

- Our Approach — value proposition

- Our Flywheel is Working — marketplace dynamics slide

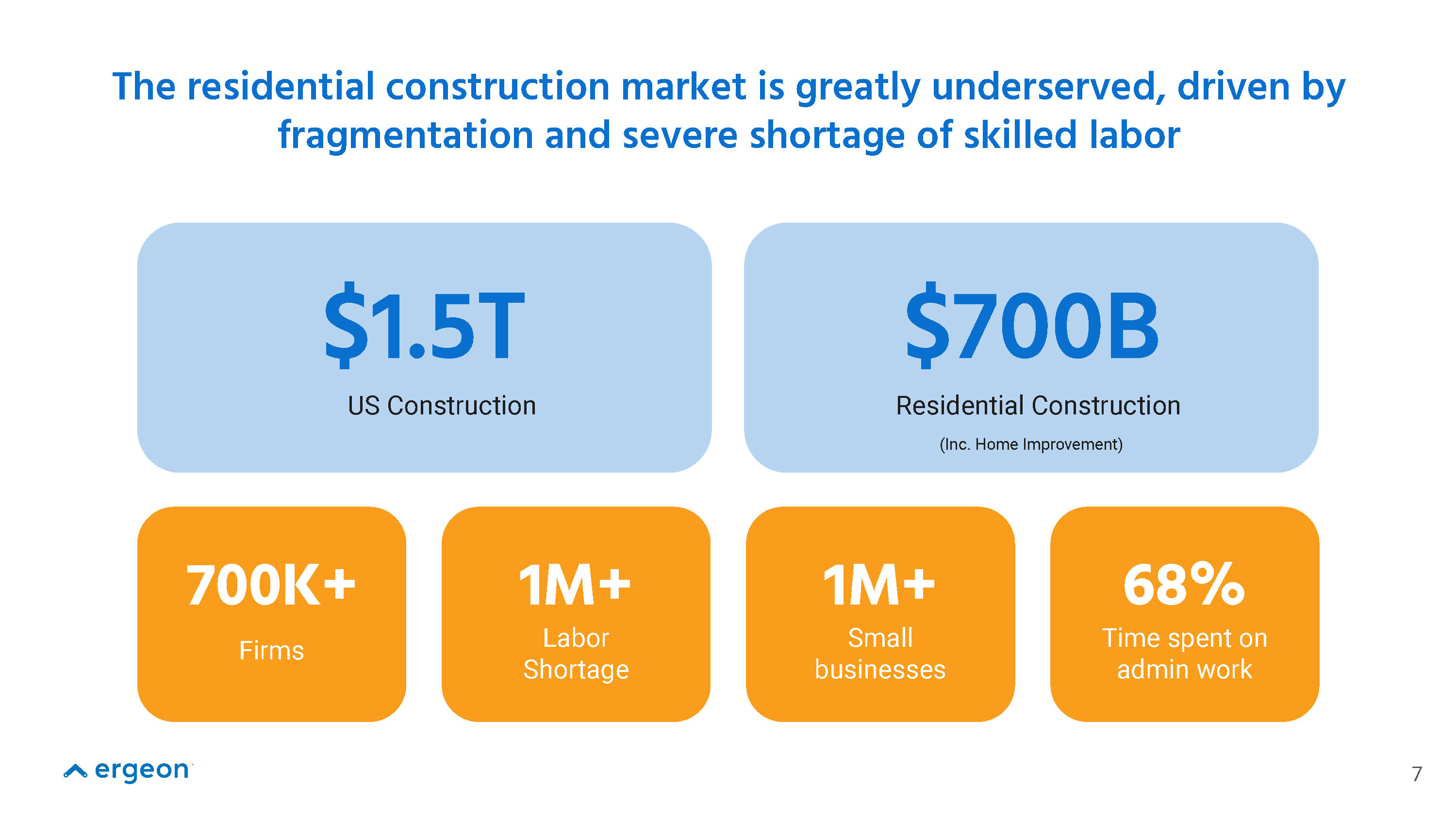

- Residential construction market is greatly underserved — problem slide

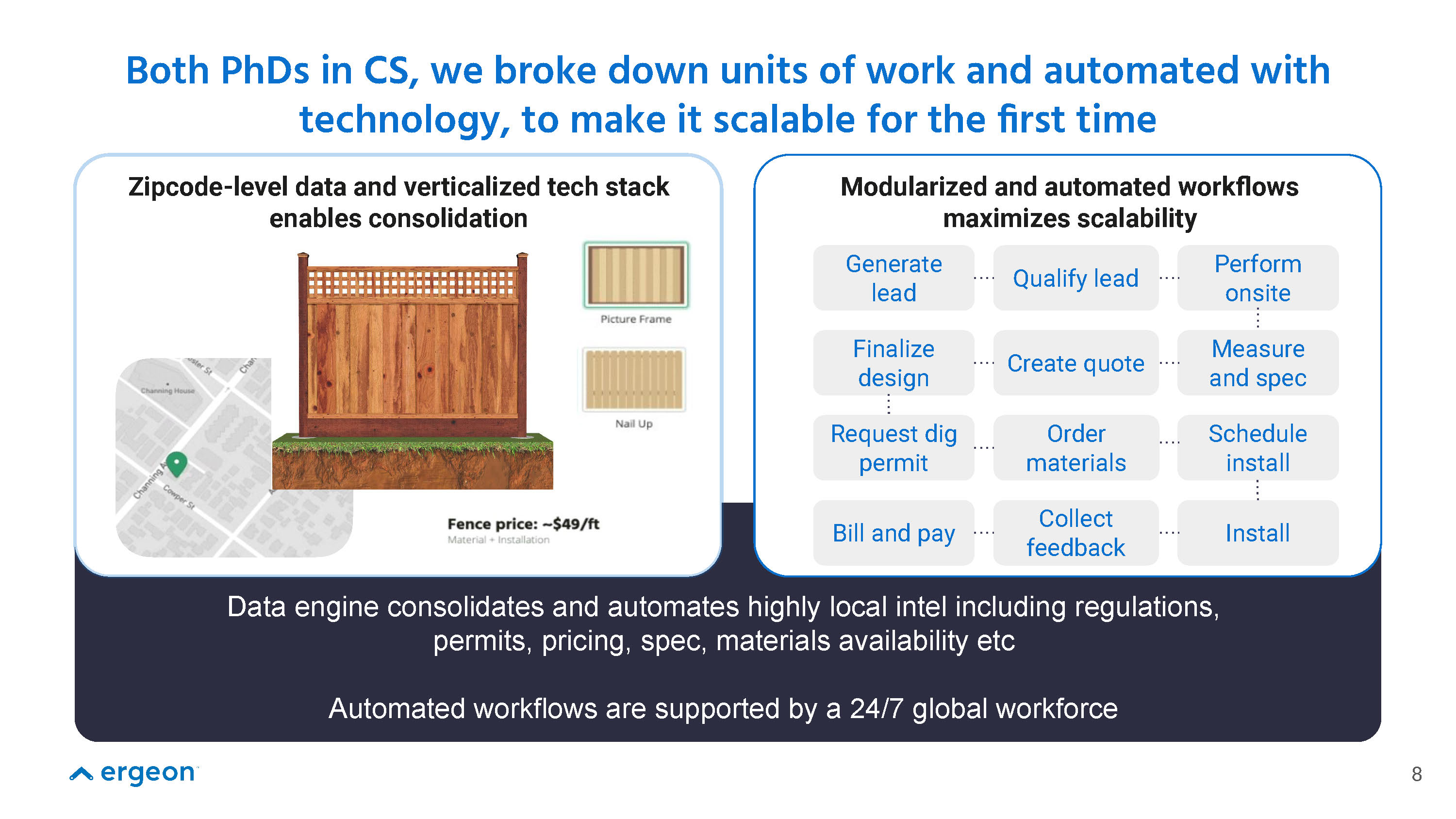

- Scalable for the first time — solution slide

- The #1 California outdoor home construction company in 2.5 years — success story slide [with some redactions]

- Strong localized brand — marketing/growth slide [with some redactions]

- Make XX on first purchase net of CAC — unit economics slide [with some redactions]

- Increase profit to XX per project — unit economics evolution slide [with some redactions]

- $xx million annualized run rate — traction slide [with some redactions]

- Launch anywhere remotely — go-to-market slide

- We are on track to become the largest national outdoor home construction company in 2 years — CAGR and market slide [with some redactions]

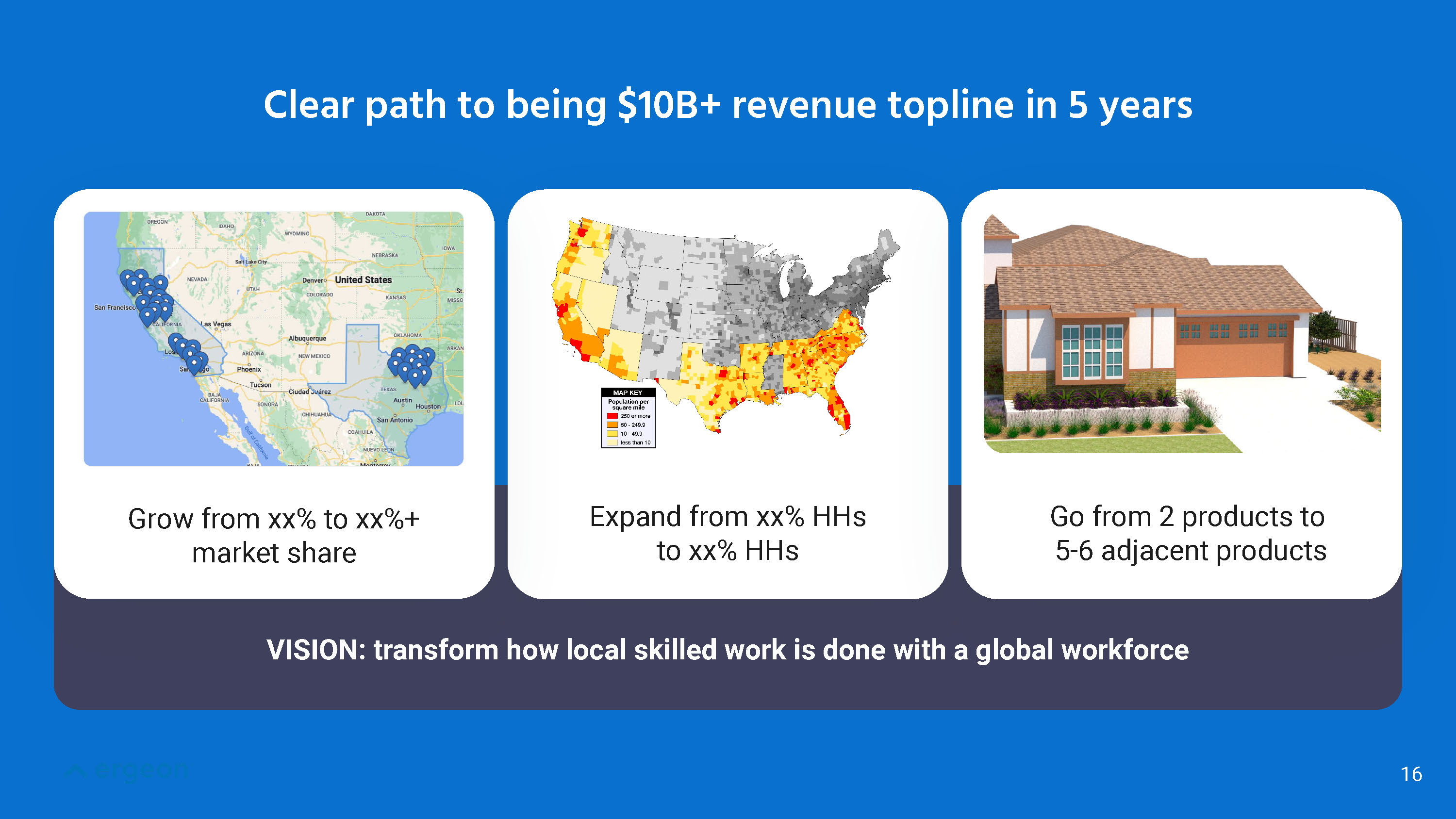

- Clear path to $10 billion revenue top line in 5 years — growth trajectory slide [with some redactions]

Three things to love

Ergeon is in a slightly strange industry — my first impulse when I heard about its funding round was to ignore it. Right now, the company’s homepage says “Fence Installation Service” across the top. In a world where I write about hovercraft, nuclear fusion and weird little robots from Amazon, it is hard to imagine that fence-building rises to a level of interest that makes sense.

But ignoring Ergeon would be a very silly mistake. The team is extraordinary, they have marvelous traction and the company has a path to corner a fantastically valuable market. From the pitch deck, it’s obvious that the company knows what it is doing — and can paint a picture of a future where it is unthinkable that it wouldn’t be wildly successful. As an investor, that’s a page from my favorite hymn book.

Team-ing with fierce possibility

[Slide 3] Let’s talk about this team … Image Credits: Ergeon

Slide 7 is a flippin’ masterpiece … without a single word of voice-over, it tells an extraordinarily good story.

He, in turn, has a hell of a background in her own right: running ezhome, a Ph.D. from Princeton and a number of years at McKinsey, plus being a licensed contractor. That’s in the right direction for an extremely capable technical co-founder and experienced operator combo. The thing this slide doesn’t show is what He is like when she pitches. I didn’t have the privilege of hearing her do that, but I did interview her for the TechCrunch piece about the fundraise a few weeks ago. She’s smart, quick on her feet and understands the market inside out.

As an investor, I would struggle to describe a team that is better suited to take on a company — and even on this relatively simple slide, the founding team tells the most important parts of the story. The narrative draws a parallel between Upwork’s success and how Ergeon is going to take on a huge market that is a lot less served by software startups. It’s masterfully done, and if your team is anywhere near as good as He and Tsatalos, take notes.

I also like how the company used its cover slide (you can see it as the cover image in this story) to foreshadow the “team” slide. Sticking a pair of founders on the cover of a Series B deck shows that the company knows what it’s got: founders as the moat.

Why this market? Well, lemme tell ya

[Slide 7] The company tells the story of the market it serves in numbers. Image Credits: Ergeon

Well, the seventh slide rams that point home with gusto and elegance. It’d be a very unambitious investor indeed that’s willing to ignore a TAM/SAM of $1.5 trillion and $700 billion, respectively. The next row of numbers pulls on a variety of other important strands of this conversation: It’s a very crowded market without a clear leader (700,000+ firms), there’s a desperate shortage of skilled labor (1 million+ labor shortage), there are a ton of small independent contractors out there that are overwhelmed and cannot operate efficiently, and the industry as a whole spends more than two-thirds of its time on admin.

This slide is a flippin’ masterpiece of convincing an investor through numbers: Without a single word of voice-over, it tells an extraordinarily good story, and these numbers ram home the point the founders are trying to make: that this market is huge, fragmented and theirs for the taking.

Easy-to-understand solution

[Slide 8] Software, eating the world, as predicted. Image Credits: Ergeon

The company’s claim that building fences has never been scalable before is a bold one, but it’s not unreasonable — a software tool that has ambitions of being nationally applicable, including local ordinances, regulations, permitting processes, specs, pricing, material and worker availability, makes that believable. It seems like an almost insurmountable big software development challenge, and as someone who has had to do permitting for small projects from time to time, I can only start to imagine the multivariable nightmare Ergeon has to tackle. And — even as I am imagining that nightmare — I can see how this tool, and the dataset that powers it, becomes a huge and powerful moat; once Ergeon has a good enough grasp on the market, finds the contracting partners it likes to work with, and spools up the word of mouth flywheel, good luck catching up with them.

What this slide tells me is that the company is tapping into the powerful network effect of, er, network effects; the more jobs it completes, the better the quotation tool becomes because it can make more accurate and faster quotes, replacing huge amounts of manual labor that the carpenters don’t really want to be doing in the first place. It leaves the workers to do what they do best (build fences), taking the two-thirds of admin work they don’t really want to do and turning it into functions of a software platform.

As an investor, it becomes crystal clear what the startup is trying to do here.

Trac-to-the-tion

It would be very, very tempting to talk about traction in the “what the company did well” section here, but I’m not going to. The traction story the company is telling is truly incredible — it suggests it went from nothing to the number one ranked outdoor home construction company.

On Slide 9, it claims that it is already twice as big as its largest local competitor and that it caught up with Home Depot in just two years. It also reminds us that Home Depot’s market cap is $300 billion — larger than Airbnb, Uber and Doordash combined. The company, through its market sizing and incredible growth trajectory, is painting a phenomenal picture. Unfortunately, the numbers themselves are redacted — understandably so. You can see how the company is growing exponentially, but it’s hard to tell exactly how much.

When you look at the full pitch deck, though, even with redacted numbers, you’ll get another masterclass — in how to tell a story of traction in a way that makes Ergeon seem completely unbeatable. It’s beautifully done and well worth checking out.

In the rest of this teardown, we’ll take a look at three things Ergeon could have improved or done differently, along with its full pitch deck!

Three things that could be improved

I wish I could have seen an unredacted slide deck; my suspicion is that the company largely raised off the back of its traction. That would explain why it spends a lot of time talking about traction. However, I’m not going to talk about that; there are a couple of other things that could have been handled a little differently.

Explaining the company’s name?

[Slide 2] Having to explain your name is not a good sign. Image Credits: Ergeon

No “use of funds” slide

[Slide 16] Ergeon leaves us curious and wanting more. Image Credits: Ergeon

Those numbers are staggeringly big. Wearing my pitch-coaching hat, I am torn between shouting “Yes, but how?!” and “Show me the plan!” Even though the deck includes a bunch of traction metrics, it’s missing a summary operating plan slide (here’s the example I use in my own pitch deck template) or any financials. Granted, it’s likely that the investors would have done a deep dive into the company’s operating and financial plans as part of the pitching and due diligence process, but if you have incredible traction, you may as well throw some spreadsheet-y goodness (or at least a financial overview) into your slide deck as well.

Usually, I would recommend having a closing slide with the standard “any questions” language and contact information, but in this case, I think Ergeon did the right thing: Leave that $10 billion figure up on the screen as the questions start. It’s a BFHAG — big, fat, hairy, audacious goal — that bold investors love. If you can back it up (and from the rest of the deck, it looks as if the company can), you’re off to the races.

Nobody gives a CAC?

It’s possible that the company has customer acquisition costs elsewhere on its slide deck (Slide 15 does mention profit on first purchase net of CAC, and Slide 12 has unit economics, so it may be part of that), but when you are talking about an industry where your potential market is literally every homeowner in the United States of America, the cost of acquisition is important enough to warrant its own slide.

If I were advising Ergeon, I’d push them into naming blended customer acquisition cost (CAC — i.e., all customer acquisition spend divided by the number of customers) and channel-specific CAC (i.e., how much does it cost to acquire a customer via Facebook ads? Via partner channels? Via supplier partnerships? Direct mail campaigns? Postering campaigns? Door-to-door sales?), along with a part of the story indicating which of these customer lead sources are tapped out and which of them are still showing a lot of promise for growth.

Now, Ergeon is showing explosive growth, so perhaps investors are willing to take it at face value that the company has that side of things figured out, but trust me: Finding companies that have enormous customer acquisition needs, investors are going to want to know what the secret sauce is, not least because experienced investors will be sitting on a number of boards where “How do we get more customers?” is a recurring topic of conversation. It’s one of the big things growth investors get very curious about, so if you can, spell it out!

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our pitch deck teardowns and other pitching advice.