In Novembar last year, Frederic wrote about Lumigo‘s $29 million Series A round led by Redline Capital. The company makes a cloud-native application monitoring and debugging platform and has raised a total of $38 million since its launch in 2019.

In the most recent installment of my Pitch Deck Teardown series, I am beyond excited to share the deck it used when it raised its Series A last year. We’ll take a look at the full deck and break down the three things I love, three things that could be improved and discuss a few other highlights that founders can learn from when they are raising a Series A in the current fundraising climate.

We’re looking for unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

- 1 — Cover slide

- 2 — “In a Nutshell”: summary slide covering the market, problem and solution

- 3 — “Nice to meet you”: team slide

- 4 — “Cloud Native Evolution”: market trends slide

- 5 — “The Year of Cloud Native”: market evolution slide

- 6 — Problem slide

- 7 — Solution slide: solution overview

- 8 — “Lumigo’s Solution”: solution slide (tracing)

- 9 — “Lumigo’s Solution”: solution slide (managed services)

- 10 — “Monitoring and Debugging in the same tool”: product slide

- 11 — “Customer Case Study”: use case slide

- 12 — “Case Study”: typical customer growth overview

- 13 — “Case Study”: how the problem is currently solved

- 14 — “Case Study”: how the problem is solved with Lumigo

- 15 — “Cloud Native Observability market”: market analysis (redacted)

- 16 — “Forecast”: financial forecast interstitial slide

- 17 — “2021 EoY Target”: financial projection graph slide (redacted)

- 18 — “GTM”: go to market slide

- 19 — “Summary & Ask”: summary of the presentation and the ask and use of proceeds slide

- 20 — “Thank you”: final closing slide

Three things to love

Lumigo was gracious enough to let me share its full 20-slide deck, with only two notable redactions: The team told me that its market analysis (slide 15) and financial projections (slide 17) were commercially sensitive. That makes perfect sense. The rest of the deck is a masterclass in storytelling, with a slew of really elegant little details for how to tell the story of a very complex company in a highly competitive market. I loved how Lumigo made the story come to life by using a case study to drive the narrative (slides 11 to 14). Let’s dive in and look at some specific slides:

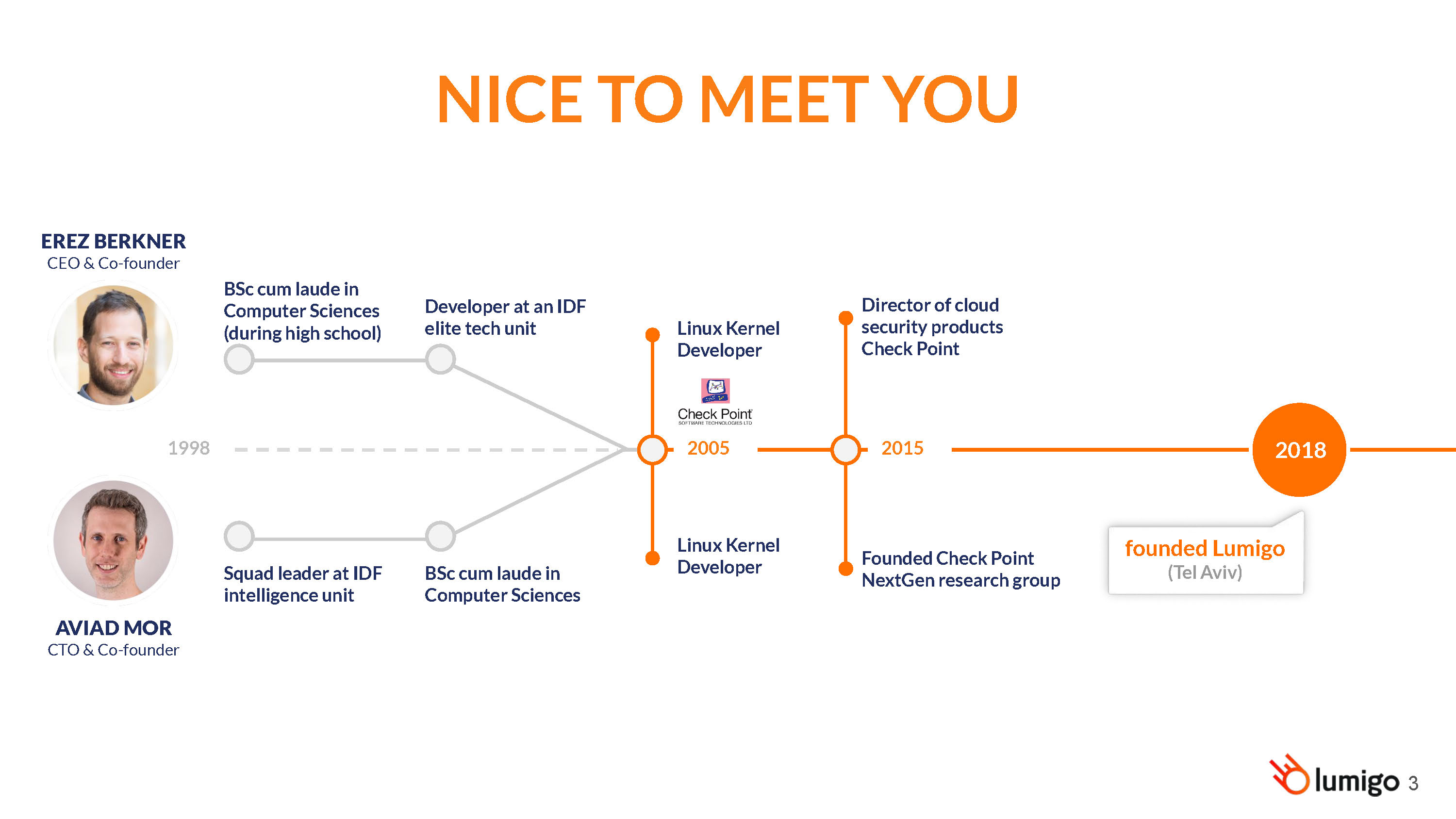

One of the best team slides I’ve seen

[Slide 3] The story of Lumigo’s founders meeting and working together is very well done. Image Credits: Lumigo

“What have you done to date?” helps ascertain whether the founding team has the prerequisite experience to build a company in general, and in this space specifically. “Have you worked together before?” combines all of this, and whether the founders have started companies — together or separately — can help add extra context to the mix. This slide does something rare: It answers all of those questions in an easy-to-read timeline format that I haven’t seen in a pitch deck before. It works fantastically well, and for the right founding teams, I can imagine that this model will work really well.

The fact that the founders have been working on the Linux kernel together since 2005, after both being part of the tech units in the Israeli military and gaining degrees in computer science, helps tell part of the story. It’s ludicrously well done. As an investor, my next few questions would be: “Tell me about a time you guys disagreed on something and how that was resolved,” and “If someone came and offered you $100 million for Lumigo tomorrow, what is the decision-making process around whether you’d take the offer? What if they offered $5 billion?” Again, because the slide lays the groundwork for the narrative, it makes it really easy to double-click on the relevant parts of the story.

A masterclass in simplicity

[Slide 7] I love the brevity and clarity of this slide. Image Credits: Lumigo

When you hit a slide like this, it’s super obvious what you want your investors to remember: When the customer uses Lumigo, they get an early warning system when issues come up and a massive head start in resolving them. That’s it; that’s the whole story — the entire company distilled down into a very short phrase. Yes, there’s more nuance. Yes, the product no doubt does more than that — but by boiling it right down, you make the information very easy to digest. And best of all, the investor doesn’t have to understand every nuance of the product anyway; that’s not what they are there to do. They’re there to figure out whether this company can turn a $29 million investment into a $290 million fund-returning investment. That’s where the founders should be focusing their attention, not on the minutia of what the product does and doesn’t do.

Magnificent storytelling

[Slide 11] This is the first of four slides that tell the story of why Lumigo makes sense as a business, as told through a case study. Very cleverly done. Image Credits: Lumigo

Through a series of slides, the Lumigo team takes us through the customer journey from its perspective. It tells the story of a two-month sales cycle that results in 10x growth in annual recurring revenue once the company has deployed Lumigo on a proof-of-concept install. It shows how its customers previously solved the problem of monitoring and the pain points inherent in those solutions, and then reveals how Lumigo replaces a wall of impenetrable log files with a snazzy, clickable system map that can be interrogated to figure out which part of the infrastructure is working — and what is about to keel over.

Together, the four slides make it really easy to understand how the product is valuable to its customers and how Lumigo can grow its revenue with a customer once it proves its value.

In the rest of this teardown, we’ll take a look at three things Lumigo could have improved or done differently, along with its full pitch deck!

Three things that could be improved

I think Lumigo’s Series A deck is one of the best I’ve seen in recent memory, and so it feels like I’m digging pretty deep here to find points of improvement — but nothing is ever so good that it cannot be better, so let’s get into it.

Where are the metrics?

As a SaaS platform in the monitoring space, I expected some slides that tell the story of the company through graphs covering the type of data that SaaS companies care about. I’m talking about monthly or annually recurring revenue metrics (MRR/ARR), negative churn metrics (when a customer upgrades to a bigger plan or potentially adds more services and instances to the platform), churn metrics (when it loses customers), etc. The company hints in slides 11 to 14 that this is an important growth dynamic; it would have been logical to double-click on this a bit more. Some of this may show up on the redacted financial targets slide (slide 17), but a simple ARR graph seems too minimalist compared to the depth and breadth of data I suspect Lumigo has available.

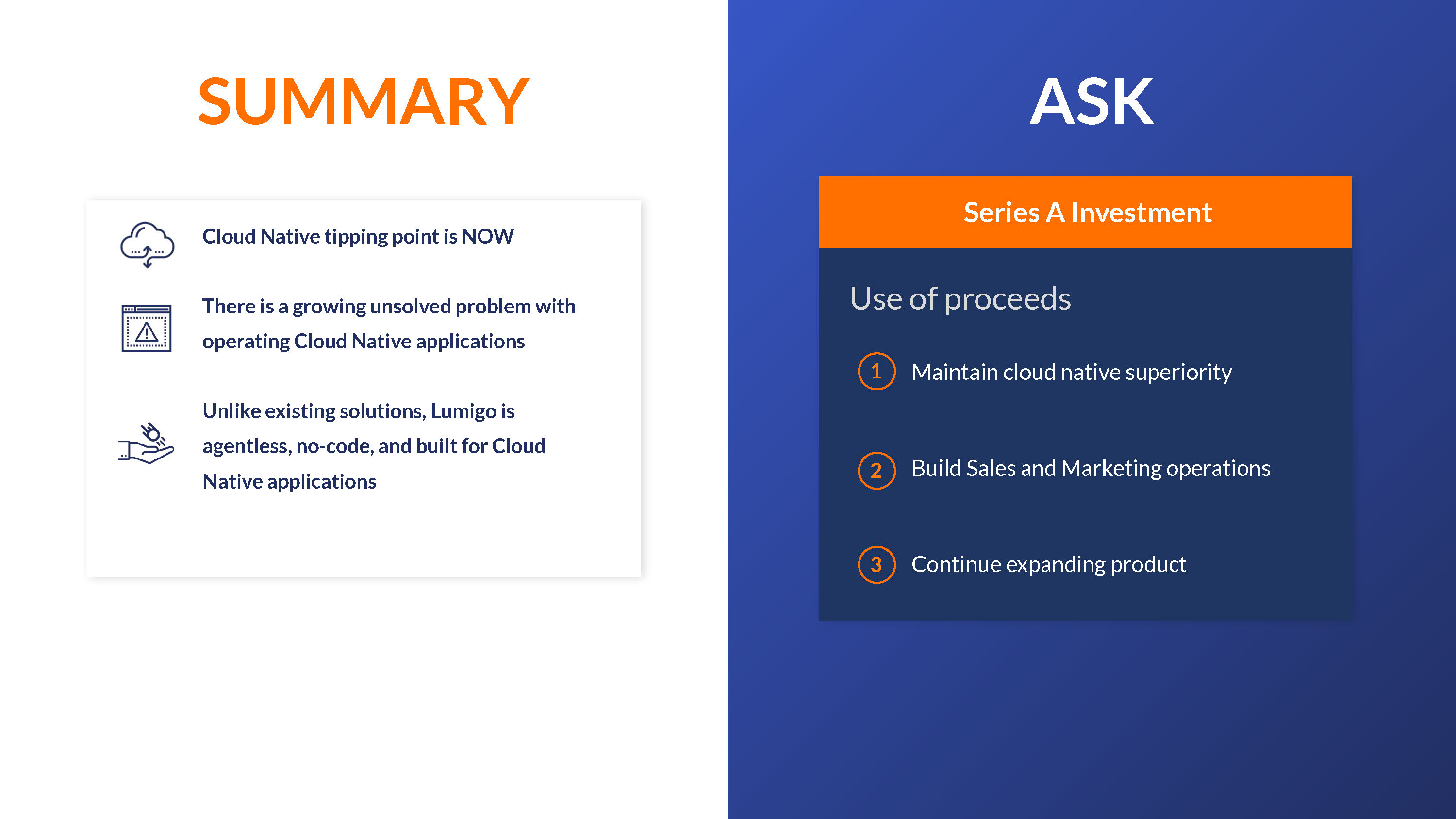

Weak ask slide

[Slide 19] This slide isn’t great. Image Credits: Lumigo

It’s curious to have an ask without listing the actual ask — i.e., if you’re raising $20 million, then put that as the actual ask. If you don’t know how much you are raising, then find that out first, and if you don’t want to tell your investors on the slide deck? Well, that subterfuge won’t last, because it’ll be one of the first questions they’ll ask.

The “use of the proceeds” section is also pretty weak because it doesn’t hold the founders accountable. “Continue expanding,” “build sales and marketing” and “maintain superiority” are a little wanting, not least because they are so very, very easy to fudge. Hire one salesperson and the second point is successful. Ship one sprint of development milestones and point three is successful. And “maintain superiority” means nothing unless you dip into how that is measured and how you maintain that.

I encourage founders to use SMART goals (specific, measurable, achievable, relevant and time-bound). So instead of “build sales and marketing ops,” you could turn that into a smart goal by saying “by the end of the year (time-bound), we will hire 20 new marketing people (specific, measurable) to increase our inbound inquiries by 30% (specific, measurable, relevant, achievable), which will result in a 40% increase in ARR from new customers in the next 12 months.”

Yes, it’s scary to get that specific on a slide, because you’re setting goals that might not be reached, but at least it shows that the founders have a specific set of goals in mind with this fundraise.

Possibly weak go-to-market slide

[Slide 18] I personally love the GTM slide, but I have some questions. Image Credits: Lumigo

The problem with this slide is that none of it scales, and that’s a challenge when you’re raising close to $30 million from VCs. They will want to see a graph that curves up with accelerating revenues coming in. Content marketing, self-serve solutions and freemium plans only work if you have a way of driving traffic to those pages. If this slide also included “paid acquisition of traffic to our content” or “customer acquisition cost of $300 per freemium customer,” it would be more believable as a rapidly scaling business. Of course, this is never linear — if it costs you $200 to acquire a customer today, that doesn’t mean you can spend $200 million to acquire a million customers, but at least there’s a mechanism for rapidly growing the business.

In my experience, organic growth alone is not positive in the eyes of the VC community, so I would be really curious what questions Lumigo got on this slide and whether there’s an aspect to the company’s go-to-market strategy that isn’t visible on this slide.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice.