Because no one parties harder than I do, I spent a portion of my week reading through Coinbase’s investor call after its earnings report. The U.S. crypto exchange pulls in some questions from non-analysts during its chats, which makes for a slightly more entertaining set of prompts and responses. You can read it all here.

I bring it up because someone asked Coinbase if the company could spot a “strategic advantage in acquiring or merging with Robinhood.” You might be shocked to learn that Coinbase wasn’t entirely effusive about the idea.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

And then, yesterday, the CEO of Coinbase rival FTX, Sam Bankman-Fried, disclosed that he had purchased 56,273,469 shares in Robinhood, representing around 7.6% of common stock in the company.

Shares of Robinhood are up hugely in pre-market trading, rising nearly 24% in the wake of the news. Why? Because investors are hoping that FTX will scoop up Robinhood for a premium. If FTX was to buy Robinhood, investors would likely expect an exit price far above its depressed share price. Therefore, as the FTX CEO moved into the stock, its potential near-term exit value shot higher, making it a buy.

Per Bankman-Fried’s filing, he thinks that the Robinhood shares “represent an attractive investment.”

Per Bankman-Fried’s filing, he thinks that the Robinhood shares “represent an attractive investment.”

There is an interesting tension between the Coinbase and FTX news that we should unpack. It’s Friday, and we deserve a bit of a think. Let’s have some fun!

If equities go crypto, will crypto go equities?

A running joke at TechCrunch is that all fintech companies, regardless of where they start, wind up looking about the same.

A good example of this is SoFi, best known for its student loan refinancing work, which now offers credit cards, mortgages, business products, checking accounts and more. SoFi even offers crypto investing to a degree, which might seem like a pretty big stretch from its origin point.

The fact that SoFi went broad is not a diss; instead, it’s a reminder that acquiring users in the fintech market is expensive. That high cost makes it good business to try to get every user at your fintech company to use as many products as possible after they are acquired. The logic here is simple: CAC is CAC, so if you want to bolster customer leverage, tack on more LTV. (In venture-speak, CAC means “customer acquisition cost,” while LTV refers to the lifetime value of a customer.)

This is also why we’ve seen Square become Block and spread its wings across the fiat and web3 economies, why you can buy and sell crypto with PayPal, and so forth.

And yet when Coinbase held its earnings call, president and COO Emilie Choi said the following response to the question about possibly buying Robinhood (emphasis TechCrunch):

This is Emilie, thanks for the questions. So we don’t comment on rumors or speculation on any specific M&A transactions. But I think that the question actually was more about the strategic advantage of owning a traditional securities platform. And we are a crypto company. Crypto is in our DNA. Everything we do is in service of building the crypto economy and increasing economic freedom. So we don’t plan to offer traditional securities unless this somehow would help us massively accelerate crypto adoption.

As I wrote earlier in the week, love or hate Coinbase’s recent results, the company is at least clear about its views — both about its business results and its place in the market.

In Choi’s answer, Coinbase sets a high bar for getting into the trad securities game — that doing so would help it advance the crypto economy. Note that this is not the same test that fiat fintechs apply to adding new products; they, instead, are chasing incremental per-user revenues to make their overall business more attractive instead of some larger ideological point.

Coinbase, in contrast, is running a pure-crypto game with unswerving belief in the payout of its long-term wager. This is despite the fact that it just swung to a massive net loss in the first quarter, is expecting even worse results in the second quarter and has lost most of its value as a company in recent months.

Turning back to FTX, what should we make of Bankman-Fried buying a large chunk of Robinhood? There are two obvious options:

- Bankman-Fried is buying some stock for himself and intends to profit from appreciation in the value of Robinhood’s shares.

- Bankman-Fried is giving FTX an option to buy Robinhood, using his personal investments to get in with management ahead of a potential acquisition.

If it’s the latter, we have highlighted a philosophical discrepancy between FTX and Coinbase. Coinbase is sticking to purely crypto, firm in its market perspective, public market investors be damned. FTX, if it did option Robinhood for its future work, would be making a SoFi-style move, but in reverse. We would see a crypto company go equities instead of an equities company going crypto.

Which posture is better? Is purity strength in the crypto game? Or is diversification a way to avoid revenue variance? The cynical part of my mind wants to joke that if diversification worked, Robinhood’s stock would not have fallen as far as it has. On the other hand, while Robinhood’s revenues have declined, its non-crypto incomes have kept it afloat.

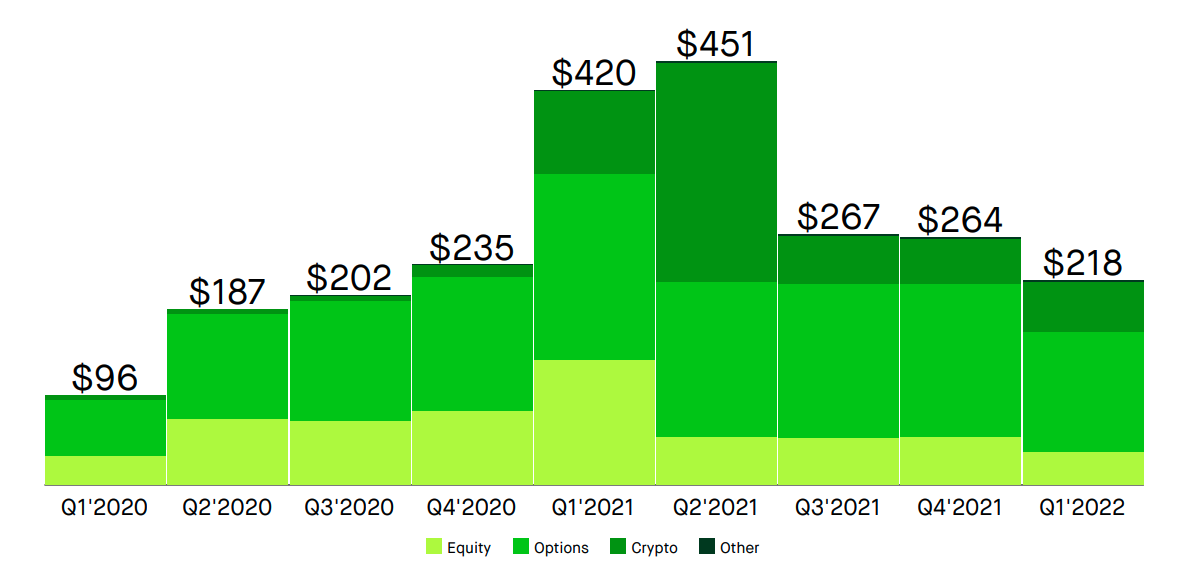

The following chart makes the point, tracking transaction revenues from Robinhood over the past few quarters:

Image Credits: Robinhood Q1 2022 earnings presentation

So would Coinbase be better off with a less fundamentalist stance and more diversified revenue streams? Yes? That would be the standard business advice?

Coinbase likely feels that it was right for a long time when others felt it was wrong. It stuck to its guns even during prior crypto downturns — and then it managed to go public and post some hugely profitable quarters. At issue is the fact that crypto downturns might be harder to survive as a public company, and this is Coinbase’s first downturn as a floating stock. So the confidence that served it so well might now be more liability than benefit.

Diversification might be a decent way to provide some shock absorbers to its top-line profile. Perhaps. But with FTX sniffing around Robinhood already, Coinbase might not even have the chance to buy the equities trading company if it wanted to.

The FTX-Coinbase-Binance race to lead the world’s crypto on-ramps is a fascinating battle, and we look forward to the ideological and business skirmishes to come.