There have been many headlines in the past few weeks surrounding the choices of Do Kwon, the founder of Terraform Labs, which created the crypto tokens LUNA and stablecoin TerraUSD (UST).

Kwon previously announced plans to obtain $10 billion in bitcoin for reserves to “open a new monetary era of the Bitcoin standard.” The funds will be used to back UST in a decentralized foreign exchange reserve to keep the value of the stablecoin at a fixed rate.

On Wednesday, a few hours before speaking to TechCrunch, he casually tweeted that he bought $230 million in bitcoin.

Kwon told TechCrunch Terra has purchased $1.6 billion in bitcoin so far and plans to purchase an additional $1.4 billion with capital from Luna Foundation Guard. The Terra protocol will buy the remaining $7 billion of bitcoin through users wanting to mint UST. “Users would put bitcoin into the reserve and then get UST,” he explained.

But what’s more interesting is that these bitcoin purchases are just the beginning of Kwon and Terra’s larger road map to expand and integrate the stablecoin deeper into the crypto ecosystem.

Kwon plans to back UST with other Layer 1 (L1) blockchains like Solana and Avalanche, to name a few, in the short term.

“We’re big believers of Bitcoin, so we’re just going to continue to buy whenever there’s an opportunity to,” Kwon said. “Overtime, Terra is going to be backed by a basket of the top Layer 1 assets.”

He did not clearly note which L1s that would entail, but he said that bitcoin will remain the dominant reserve for UST. “I don’t think we’ll have covers of all the ecosystems within the next few weeks, but we’ll turn on reserves for a few of the popular ones,” Kwon said.

There is a circulating supply of 16.72 billion UST in the market and the current volume of the stablecoin is $672 million, up 9.2% in the past 24 hours, according to data on CoinMarketCap at the time of publication. UST is the 14th largest cryptocurrency by market capitalization.

As the Terra ecosystem begins to grow substantially within other L1s like the Avalanche blockchain, for example, then there’s a possibility that UST will be backed by a lot of Avalanche’s token, AVAX, he said.

“If you’re minting UST on Avalanche, you would trade in AVAX instead of bitcoin and that will in turn improve the size of AVAX reserves,” he said.

By adding other types of collateral, it will expand the potential user base of Terra stablecoins, he said. “For example, if Terra stablecoins were the largest consumer of SOL [Solana] or AVAX and the reserves are that large, then there’s an inherent alignment with the user base from each of those ecosystems.”

Even though the “share of the pie” that Luna takes home gets smaller, the approachable market will get significantly larger, he said.

Stablecoin’s growth is anything but stable

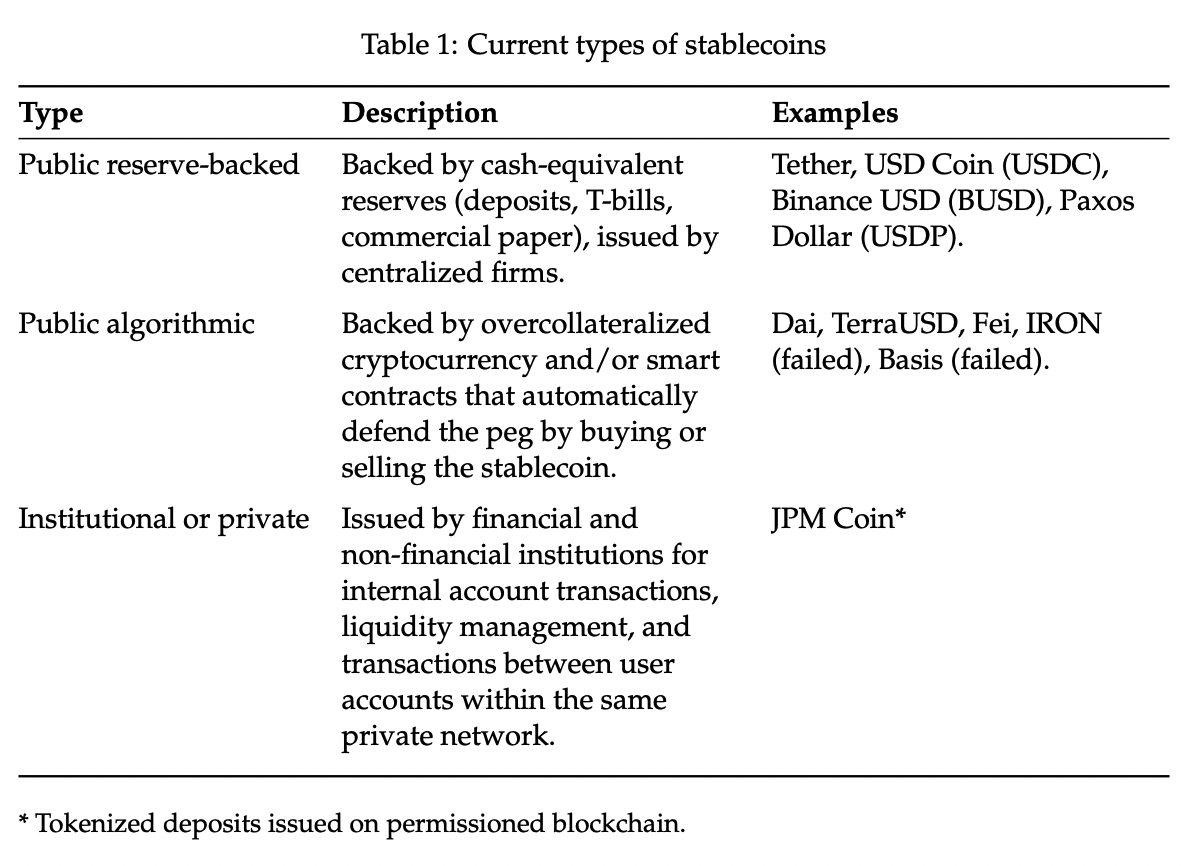

Stablecoins get their name from the fact that they are “stable” through a 1:1 ratio that pegs their value to an external reserve, typically U.S. dollars, but can also be tied to other assets, like UST is with bitcoin. This means every stablecoin in circulation is backed up by $1 held in its relative reserve, whether it be U.S. dollars or another asset.

The stablecoin ecosystem has expanded dramatically over the past year, and even the U.S. Federal Reserve took note by saying in a January 2022 report on the crypto assets that they “experienced tremendous growth in the past year” and that “stablecoins hold the potential to support next-generation innovations.”

Image Credits: Screenshot of U.S. Federal Reserve report

Tether (USDT) is the biggest stablecoin by market capitalization and the third-largest cryptocurrency behind Bitcoin and Ethereum. USDT has a circulating supply of 82.4 billion, which is about five times the circulating supply of UST and mirrors the value of the U.S. dollar through Hong Kong-based blockchain platform Tether.

Another major stablecoin, USD Coin (USDC), has a circulating supply of 51.4 billion and is the fifth-largest cryptocurrency, according to CoinMarketCap data. The token has grown over 400% in the past year from around 10 billion tokens circulating to the current supply.

Similar to USDT, USDC is pegged to the U.S. dollar on a 1:1 basis. The stablecoin was founded by peer-to-peer payments service firm Circle and the cryptocurrency exchange Coinbase.

Stablecoins allow crypto users to facilitate trades from stablecoin to cryptocurrencies and vice versa on crypto exchanges without the need for fiat currency, like the U.S. dollar. Other common use cases currently consist of using stablecoins to make financial transactions through peer-to-peer payments, internal transfers, or across decentralized finance (DeFi) protocols.

“Stablecoins are like the utility side and basically the money of crypto,” Kwon said. “Possibly aside from Bitcoin, stablecoins are crypto’s holy grail use case.”